Artificial Intelligence in Drug Discovery Market Report Scope & Overview

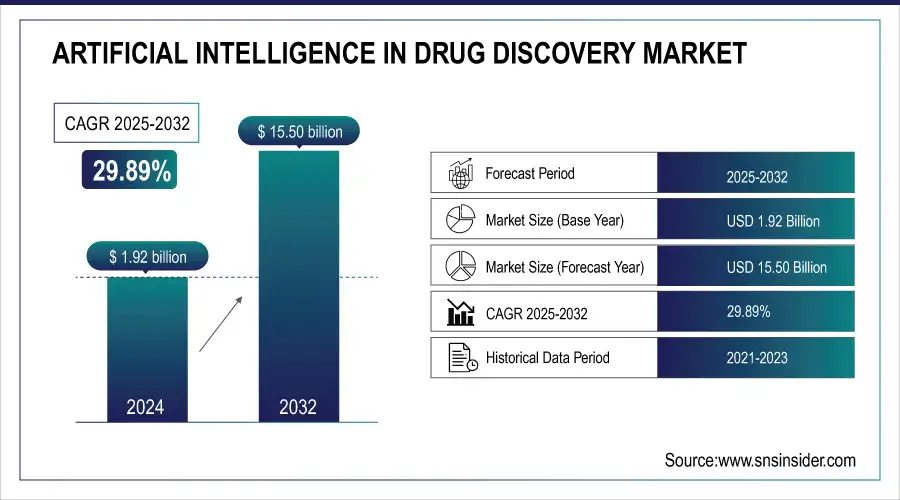

The Artificial Intelligence in Drug Discovery Market was valued at USD 1.92 billion in 2024 and is expected to reach USD 15.50 billion by 2032, growing at a CAGR of 29.89% from 2025-2032.

To get more information on Artificial Intelligence In Drug Discovery Market - Request Sample Report

The AI in Drug Discovery Market is rapidly growing, driven by the need for faster, cost-effective drug development. AI technologies machine learning, deep learning, and natural language processing accelerate discovery by predicting molecular interactions, simulating trials, and analyzing complex datasets. Companies like Insilico Medicine and Atomwise have demonstrated rapid drug design and compound screening, while Tempus uses AI to personalize cancer treatments. Increasing regulatory support and collaborations between AI startups, pharmaceutical firms, and academia are further boosting innovation, efficiency, and the transformation of drug discovery processes globally.

Artificial Intelligence in Drug Discovery Market Trends

-

Increasing R&D costs and demand for faster drug development are driving AI adoption in drug discovery.

-

Integration of machine learning, predictive analytics, and big data is enhancing target identification and lead optimization.

-

AI-powered platforms are accelerating preclinical testing and clinical trial design.

-

Growing focus on personalized medicine and precision therapies is boosting market growth.

-

Collaborations between pharmaceutical companies, biotech firms, and AI startups are fostering innovation.

-

Cloud computing and high-performance computing are enabling scalable AI-driven drug discovery solutions.

-

Regulatory support and successful case studies are encouraging wider adoption across the industry.

Growth Drivers of the AI in Drug Discovery Market

-

Reducing Costs and Accelerating Drug Discovery

The growing pressure to minimize the time and cost associated with traditional drug discovery is one of the key drivers for AI adoption in the industry. Conventional drug development can take 10-15 years and cost over USD 2.6 billion. AI technologies offer the capability to streamline this process by automating tedious tasks such as data analysis and compound screening. Machine learning and deep learning algorithms can analyze vast datasets, predict molecular interactions, and optimize the selection of drug candidates. This automation not only accelerates drug discovery but also minimizes human error, ensuring more accurate results. AI tools can identify promising drug candidates in a fraction of the time compared to traditional methods, ultimately reducing the cost of bringing a drug to market and increasing the efficiency of the development pipeline.

-

Addressing Complex Diseases and Enhancing Precision Medicine

The increasing complexity of diseases such as cancer, Alzheimer's, and rare genetic disorders is prompting the adoption of AI to identify novel therapeutic targets and design effective treatments. AI’s ability to process vast amounts of genetic, clinical, and biochemical data enables a deeper understanding of disease mechanisms. By leveraging these insights, AI models can help researchers identify biomarkers and predict how drugs will interact with specific disease pathways. This precision approach is key to developing personalized therapies tailored to individual patients' genetic profiles. The use of AI in this way is crucial for addressing diseases that require more targeted, effective, and personalized treatment strategies, as it accelerates the identification of the most promising therapeutic options.

-

Leveraging Big Data and Enhancing Drug Discovery Outcomes

The ever-expanding volume of healthcare data, including patient records, clinical trials, and research studies, is another significant factor driving the AI in drug discovery market. With the ability to process and extract meaningful insights from these large datasets, AI technologies are transforming the drug discovery process. Machine learning models can quickly sift through massive amounts of data to identify patterns and correlations that might be missed by traditional methods. This helps researchers make informed decisions about drug candidates, reducing trial and error. Moreover, AI enhances the process of drug repurposing, enabling the identification of existing drugs that could be effective for new indications, further speeding up the discovery process and improving overall outcomes.

Challenges and Restraints in the AI Drug Discovery Market

-

Data Privacy Concerns and Regulatory Challenges

One of the primary restraints of AI in the Drug Discovery market is the ongoing challenge of data privacy and security, especially when dealing with sensitive patient data. The use of AI in healthcare requires access to large volumes of clinical, genetic, and patient data, raising concerns about the protection of personal health information. Regulatory bodies, including the FDA and EMA, are working on frameworks to ensure AI models meet stringent standards for data protection and privacy. However, these regulations often vary by region, adding complexity to the adoption of AI technologies across global markets. Additionally, the lack of standardized guidelines and ethical considerations regarding the use of AI in drug discovery makes it difficult for companies to navigate the approval processes. These barriers can slow down AI adoption, especially for smaller companies and startups that may face challenges in complying with diverse regulations and ensuring the security of sensitive data in their AI-driven drug development processes.

Artificial Intelligence in Drug Discovery Market Segment Analysis

-

By Application Drug Optimization & Repurposing dominated while Preclinical Testing is expected to grow fastest

In 2024, Drug Optimization and Repurposing was the dominant application segment in the AI in Drug Discovery market which held significant share of 40%. Drug repurposing has become a key focus, especially in response to urgent healthcare needs, as it allows for faster identification of treatments. AI models can quickly analyze existing drug libraries to find new uses for approved medications, dramatically cutting development time and costs. A prime example is BenevolentAI, which used AI to repurpose Baricitinib for COVID-19 treatment. The ability of AI to rapidly identify viable drug candidates for new indications is one of the primary reasons this application remains the dominant force in AI-driven drug discovery.

The Preclinical Testing segment is experiencing the fastest growth within the AI in drug discovery landscape. AI is transforming the preclinical phase by providing innovative tools to predict drug toxicity, side effects, and efficacy earlier in the process. These advancements are minimizing the need for animal testing and enabling more precise preclinical evaluations, speeding up the transition to human clinical trials. This growing demand for faster, cost-effective, and more accurate testing methods is contributing significantly to the rapid growth of this segment.

-

By Therapeutic Area Oncology led while Neurodegenerative Diseases are projected to grow fastest

In 2024, Oncology accounted for the largest share of the AI-driven drug discovery market, holding 45% of the market. The complexity of cancer treatment, combined with the increasing global burden of cancer cases, has made oncology a primary focus area for AI technologies. AI helps in identifying new therapeutic targets, optimizing clinical trials, and personalizing treatment options based on patients' genetic data. Platforms like Tempus are using AI to integrate genomic data for more effective cancer treatments, which is a driving factor behind oncology's dominance. As the demand for more effective and personalized cancer therapies grows, oncology will continue to be a key area of focus.

The Neurodegenerative Diseases segment is the fastest-growing therapeutic area in AI-driven drug discovery. The increasing global prevalence of diseases like Alzheimer's and Parkinson's has spurred the need for more targeted and effective treatments. AI is enabling more efficient identification of biomarkers and potential drug candidates that can alter the course of these debilitating diseases. By analyzing complex neurological data, AI is helping researchers better understand the underlying mechanisms of these conditions, leading to new therapeutic possibilities. With a greater focus on personalized medicine and early intervention, this segment is rapidly expanding as researchers strive to find solutions for these complex diseases.

Artificial Intelligence in Drug Discovery Market Regional Analysis

North America Artificial Intelligence in Drug Discovery Market Insights

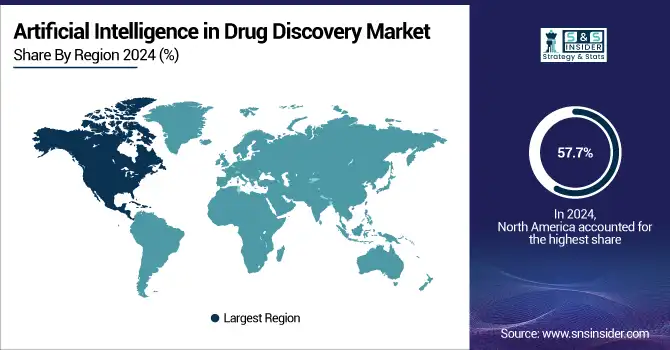

In 2023, North America dominated the global AI in Drug Discovery market, accounting for a 57.7% share due to the region's robust healthcare infrastructure, advanced technological landscape, and high levels of investment in pharmaceutical research and development. The United States, in particular, stands out with numerous AI-driven initiatives in drug discovery, led by major companies like IBM Watson Health and Tempus. Government support, including funding for AI research and regulatory efforts to streamline AI adoption in drug discovery, further contributes to North America's dominance. The high concentration of biotech and pharmaceutical companies and academic institutions positions the region at the forefront of AI innovation in drug development.

Need any customization research on Artificial Intelligence In Drug Discovery Market - Enquiry Now

Asia Pacific Artificial Intelligence in Drug Discovery Market Insights

Asia-Pacific, particularly countries like China and India, is witnessing the fastest AI Drug Discovery market growth. China’s government is heavily investing in AI and biotechnology, aiming to become a global leader in AI-driven healthcare innovation. The region also benefits from a large pool of data and increasing partnerships between technology companies and pharmaceutical firms, driving the rapid adoption of AI technologies in drug discovery.

Europe Artificial Intelligence in Drug Discovery Market Insights

Europe is a key region in the AI in Drug Discovery Market, driven by strong pharmaceutical infrastructure, advanced research facilities, and supportive regulatory frameworks. Countries like the UK, Germany, and Switzerland are leading AI adoption, with collaborations between biotech startups, academic institutions, and pharmaceutical companies accelerating innovation. Increasing investments in AI technologies for drug design, personalized medicine, and compound screening are enhancing efficiency, reducing development timelines, and strengthening Europe’s position in the global market.

Middle East & Africa and Latin America Market Insights

The Middle East & Africa and Latin America are emerging markets in AI-driven drug discovery, supported by growing healthcare investments and increasing adoption of advanced technologies. Countries such as the UAE, Saudi Arabia, Brazil, and Mexico are fostering collaborations between local pharmaceutical firms, AI startups, and research institutions. Focus on personalized medicine, efficient drug development, and digital health initiatives is driving AI integration, creating opportunities for market expansion and innovation in these regions.

Artificial Intelligence in Drug Discovery Market Competitive Landscape

IBM

IBM is a leading player in the AI in Drug Discovery market through its IBM Watson for Drug Discovery platform. Leveraging advanced AI technologies such as machine learning and natural language processing, IBM Watson accelerates drug development by analyzing complex biological and chemical datasets. The platform aids in predicting molecular interactions, identifying potential drug candidates, and simulating clinical trials, enabling pharmaceutical companies to reduce research timelines, enhance efficiency, and drive innovation in personalized medicine and targeted therapies.

-

2024: IBM Research launched an AI Alliance with Boston University, Red Hat, and Cleveland Clinic, open-sourcing biomedical foundation models to accelerate collaborative AI-driven drug discovery across institutions.

-

2024: IBM unveiled multi-view foundation models combining diverse molecular representations (SMILES, graphs, 3D structures) to outperform single-input models in small molecule drug discovery tasks.

-

2023: IBM partnered with Boehringer Ingelheim to enhance generative AI and foundation models for therapeutic antibody development, integrating in silico design with lab validation to accelerate biologic discovery.

Atomwise

Atomwise is a prominent company in the AI in Drug Discovery market, known for its AtomNet platform. Utilizing deep learning and advanced algorithms, AtomNet enables rapid virtual screening of millions of chemical compounds to identify potential drug candidates. The platform has been instrumental in discovering treatments for diseases like Ebola and Malaria. By significantly reducing screening time and enhancing accuracy, Atomwise accelerates drug development, optimizes research efficiency, and supports the creation of innovative therapeutics.

-

2025: Atomwise released the NGT generative AI, capable of discovering MC2R inhibitors through a tera-scale virtual screen, uncovering a cryptic PPM1D phosphatase binding site and enhancing synthetic drug design capabilities.

-

2024: Atomwise showcased AtomNet’s capabilities via the AIMS project, virtually screening 318 targets with global collaborators, validating AI as an efficient and credible alternative to traditional high-throughput screening (HTS).

Insilico Medicine

Insilico Medicine is a leading AI-driven company in the drug discovery market, leveraging deep learning, generative models, and advanced analytics to accelerate therapeutic development. The company designs novel drug candidates, predicts molecular interactions, and simulates clinical outcomes, significantly reducing development timelines. Notably, Insilico Medicine developed a fibrosis drug candidate in just 46 days, demonstrating the efficiency of AI in identifying viable treatments, optimizing research processes, and advancing precision medicine.

-

2024: Insilico Medicine reported positive Phase IIa topline results for ISM001-055, a first-in-class, AI-designed antifibrotic targeting idiopathic pulmonary fibrosis (IPF), demonstrating favorable safety and dose-dependent efficacy.

-

2023: The company became the first to advance a generative AI-designed drug (INS018_055) into Phase II trials, marking a milestone for end-to-end AI-led drug discovery and design.

Leading Companies in the AI Drug Discovery Market

-

Insilico Medicin

-

PandaOmics

-

ChemICo

-

GNS Healthcare

-

Google (DeepMind)

-

BioSymetrics, Inc.

-

Berg Health

-

Atomwise Inc.

-

Insitro

-

CYCLICA (Acquired by Recursion)

-

NVIDIA Corporation

-

Schrödinger, Inc.

-

Microsoft

-

Illumina, Inc.

-

Numedii, Inc.

-

Xtalpi Inc.

-

Iktos

| Report Attributes | Details |

| Market Size in 2024 | USD 1.92 Billion |

| Market Size by 2032 | USD 15.50 Billion |

| CAGR | CAGR of 29.89% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application [Drug optimization and repurposing, Preclinical testing, Others] • By Therapeutic Area [Oncology, Neurodegenerative Diseases, Cardiovascular Disease, Metabolic Diseases, Infectious Disease, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Exscientia, Insilico Medicine, PandaOmics, ChemICo, GNS Healthcare, Google (DeepMind), BenevolentAI, BioSymetrics, Inc., Berg Health, Atomwise Inc., Insitro, CYCLICA (Acquired by Recursion), NVIDIA Corporation, Schrödinger, Inc., Microsoft, Illumina, Inc., Numedii, Inc., Xtalpi Inc., Iktos |