Clinical Laboratory Services Market Overview:

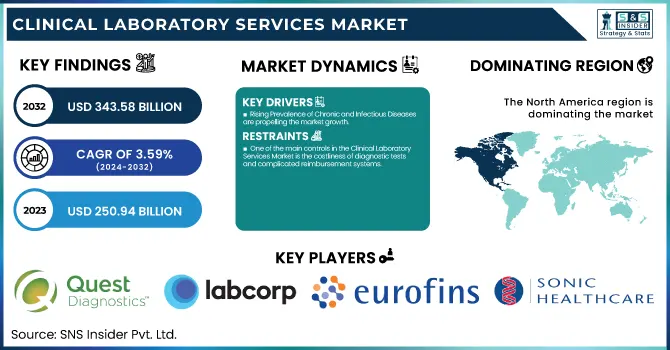

The Clinical Laboratory Services Market was valued at USD 250.94 billion in 2023 and is expected to reach USD 343.58 billion by 2032, growing at a CAGR of 3.59% from 2024-2032.

To Get more information on Clinical Laboratory Services Market - Request Free Sample Report

The Clinical Laboratory Services Market report offers insights into changing trends in laboratory service models, including the shift between in-house and outsourcing diagnostic operations. It analyzes the growing investments in laboratory automation and digital pathology, focusing on AI-based diagnostics and robotic lab workflows. The report also addresses reimbursement and insurance coverage trends, evaluating the financial effect of policy changes on laboratory services. In addition, it explores R&D spend among top-performing laboratory service providers, highlighting improvements in precision diagnostics, biomarker investigation, and next-generation testing solutions, presenting an overview of how the market is changing in terms of efficiency and innovation.

U.S. Clinical Laboratory Services Market Size

The U.S. Clinical Laboratory Services Market was valued at USD 69.16 billion in 2023 and is expected to reach USD 95.15 billion by 2032, growing at a CAGR of 3.65% from 2024-2032. The United States is the leader in North America's Clinical Laboratory Services Market with its highly developed healthcare infrastructure, excessive healthcare expenditure, and extensive availability of leading market players such as Quest Diagnostics, Labcorp, and Mayo Clinic Laboratories. The nation holds a high percentage of diagnostic testing stimulated by an increasing need for customized medicine, prevention care, and sophisticated laboratory automation. Moreover, positive reimbursement policies and growing investments in digital pathology and AI-based diagnostics further cement the U.S.'s position of strength in the region.

Clinical Laboratory Services Market Dynamics

Drivers

-

Rising Prevalence of Chronic and Infectious Diseases are propelling the market growth.

The growing number of chronic conditions like diabetes, cardiovascular diseases, and cancer is fueling the demand for sophisticated diagnostic procedures. The Centers for Disease Control and Prevention (CDC) states that almost 6 out of every 10 adults in the U.S. have a chronic disease, requiring repeated laboratory testing to monitor and manage the disease. Moreover, the escalating prevalence of infectious diseases such as COVID-19, influenza, and tuberculosis has tremendously boosted demand for PCR tests, blood examination, and microbiological testing. Recent advancements also involve the application of liquid biopsy tests for oncology diagnosis and the growing usage of next-generation sequencing (NGS) for clinical diagnostics. The increasing growth of geriatric populations worldwide, which needs regular health monitoring, also accelerates market growth. As a result, laboratories are enriching their performance with automated testing platforms and artificial intelligence-based pathology solutions.

-

Increasing Adoption of Laboratory Automation and Digital Pathology accelerating the market growth.

Implementation of automation and digital pathology within clinical laboratories is revolutionizing diagnostic service efficiency and accuracy. Automated technologies, such as robotic handling of samples, AI-based imaging, and high-throughput analyzers, hugely decrease turnaround time and human mistakes. As per a 2023 report by the College of American Pathologists (CAP), more than 65% of North American laboratories have incorporated at least some level of automation to deal with rising sample volumes. Some of the recent innovations involve AI-enabled diagnostic algorithms, cloud-based laboratory information management systems (LIMS), and remote digital pathology solutions, which enable real-time consultation among pathologists across the globe. In addition, firms such as Quest Diagnostics and Labcorp are spending extensively on AI-enabled workflows to maximize test accuracy and reduce complexity. This technological advancement is enhancing the efficiency, scalability, and reach of clinical lab services globally.

Restraint

-

One of the main controls in the Clinical Laboratory Services Market is the costliness of diagnostic tests and complicated reimbursement systems.

Sophisticated diagnostic methods, including next-generation sequencing (NGS), molecular diagnostics, and personalized medicine testing, involve huge investments in cutting-edge equipment, highly trained staff, and quality assurance measures. These are usually transferred to patients, rendering tests inaccessible to many, particularly in areas where insurance coverage is minimal. Furthermore, slow reimbursements and repeated alterations in insurance policies cause laboratories financial stress. For instance, in the United States, Medicare reimbursement reductions under the Protecting Access to Medicare Act (PAMA) have cut deeply into payments for numerous standard tests. These economic burdens slow down market growth and uptake of innovative diagnostics, especially in small and mid-sized labs with fewer resources.

Opportunities

-

The increased need for genomic testing and personalized medicine represents a large opportunity within the Clinical Laboratory Services Market.

Developments in genomics, proteomics, and biomarker discovery are propelling the use of targeted therapies that demand thorough laboratory testing. The incorporation of next-generation sequencing (NGS), liquid biopsy, and pharmacogenomic testing is transforming disease diagnosis and treatment planning. For example, genetic tests focused on oncology, including BRCA mutations in breast cancer and EGFR mutations in lung cancer, are becoming routine in clinical settings. Moreover, regulatory bodies such as the FDA are promoting the use of companion diagnostics, further stimulating market growth. With growing healthcare investments and collaboration among biopharma and diagnostic firms, the market is observing a rise in genomic testing services, which generates new revenue streams for laboratory service providers.

Challenges

-

One of the biggest issues in the Clinical Laboratory Services Market is compliance with regulations and data privacy.

Laboratories are required to follow strict rules, such as the Clinical Laboratory Improvement Amendments (CLIA), HIPAA (Health Insurance Portability and Accountability Act), and GDPR (General Data Protection Regulation) for protection of patient data. Following fluctuating guidelines, accreditation criteria, and quality control practices creates operational challenges, particularly for independent and small laboratories. Moreover, the growing reliance on digital pathology, artificial intelligence, and cloud-based lab systems invites potential cybersecurity threats and unauthorized access to sensitive patient information. Data breaches can result in legal consequences, financial penalties, and erosion of patients' and providers' trust. Managing such intricate regulatory environments along with keeping testing accuracy and efficiency high is a major hindrance to market growth.

Clinical Laboratory Services Market Segmentation Analysis

By Test Type

The Clinical Chemistry segment dominated the Clinical Laboratory Services Market with 55.46% market share because it has broad usage in routine diagnostic testing, management of chronic diseases, and preventive healthcare programs. Clinical chemistry tests such as blood glucose, lipid panels, liver function tests, and kidney function tests are necessary for diagnosing and monitoring diseases like diabetes, cardiovascular diseases, and renal diseases. The increasing incidence of chronic diseases worldwide, combined with a growing population and greater focus on early disease detection, has greatly increased demand for these tests. Moreover, the incorporation of automated analyzers and point-of-care testing (POCT) solutions has improved testing efficiency, lowering turnaround time and facilitating high-throughput analysis. The common availability of clinical chemistry tests at hospitals, diagnostic centers, and independent labs also solidified its market leading position.

By Service Provider

The Hospital-Based Laboratories segment dominated the Clinical Laboratory Services Market with a 54.12% market share in 2023 because it is part of healthcare facilities, allowing for smooth diagnostics and treatment planning. These labs are critical to performing urgent and complex testing that supports real-time clinical decision-making, especially in emergency care, surgical interventions, and inpatient monitoring. High patient traffic in hospitals, combined with the necessity of specialized test services, has fueled demand for in-house laboratory facilities. Moreover, the growth in laboratory automation and central hospital networks has improved efficiency, accuracy, and accessibility of test services. Favorable reimbursement policies and government funding of hospital labs support the dominance of the segment by enabling affordability and mass adoption of clinical test services in hospitals.

The Stand-Alone Laboratories segment will see the fastest growth in the forecast year with 4.06% CAGR throughout the forecast year on account of increasing demand for independent diagnosis services, spurred by cost-savings, ease of access, and focus on high-tech testing. As more patients opt for outpatient-focused, convenient diagnosis services, stand-alone laboratories are increasing their array of tests, such as genetic testing, molecular diagnostic testing, and personalized medicine. In addition, strategic partnerships with healthcare networks, payers, and telehealth companies are expanding their reach. Digital pathology adoption, AI-based diagnostics, and home sample collection services are also fueling growth further. Further, growing healthcare consumerism and pressure for quicker turnaround times are making stand-alone laboratories an attractive alternative to hospital-based testing, driving them to expand across the developed as well as emerging economies.

By Application

The Bioanalytical & Lab Chemistry Services segment dominated the Clinical Laboratory Services Market with 51.68% market share in 2023 because it plays a central role in pharmaceutical research, clinical diagnostics, and therapeutic drug monitoring. These services are crucial for the analysis of biological samples, the detection of biomarkers, and the measurement of drug efficacy and safety, making them indispensable for drug development, personalized medicine, and disease diagnosis. The increasing incidence of chronic diseases, such as cardiovascular diseases, diabetes, and cancer, has fueled the need for accurate bioanalytical testing. Moreover, strict regulatory needs from organizations like the FDA and EMA demand thorough bioanalytical studies to ensure compliance. The increasing use of high-throughput screening, mass spectrometry, and chromatography technologies has further increased the dominance of this segment, providing accurate and efficient laboratory-based chemical and biological analysis.

The Toxicology Testing Services segment is experience to register the fastest growth in the forecast years ahead, led by the growing prevalence of drug abuse, boosting workplace drug testing, and concerns regarding environmental pollutants and food safety. With the liberalization of cannabis and the stringent regulation of drug testing, toxicology testing has emerged as a prerequisite for employment screening, forensic analysis, and clinical diagnosis. Also, growth in pharmaceuticals and biotechnology R&D has amplified demand for toxicological tests for new drug products to certify safety and compliance with regulations. Technical advances in liquid chromatography-mass spectrometry (LC-MS) and new-generation toxicology tests have enhanced test sensitivity and specificity, further enhancing adoption. Further, increased government efforts to stem opioid abuse and track exposure to harmful chemicals are driving growth in this segment worldwide.

Clinical Laboratory Services Market Regional Insights

North America dominated the clinical laboratory services market with a 38.11% market share in 2023 mainly because of its highly developed healthcare infrastructure, high rate of adoption of sophisticated diagnostic technologies, and the availability of leading market players such as Quest Diagnostics, Labcorp, and Mayo Clinic Laboratories. The region is assisted by robust government support, positive reimbursement policies, and high healthcare expenditure, which fuels demand for routine and specialized diagnostic testing. In addition, the rise in chronic disease, cancer, and infectious disease prevalence requires sophisticated laboratory services. The expanding use of artificial intelligence (AI), digital pathology, and automation in the laboratory further asserts the region's leadership by enhancing efficiency and accuracy in diagnostics.

Asia Pacific is experiencing the fastest expansion in the clinical laboratory services market with 4.21% CAGR throughout the forecast period due to the rapid urbanization, growing healthcare expenditure, and developing awareness of early disease detection. China, India, and Japan are considerably developing diagnostic testing infrastructure with the rising burden of infectious and chronic diseases. Moreover, initiatives by governments to enhance healthcare infrastructure and growth in private diagnostic labs are driving the market. Rising emphasis on precision medicine, genetic testing, and digital healthcare solutions in the region is further driving demand for lab services. Lower labor cost, high number of patients, and increasing outsource trend in laboratory services are also making the Asia Pacific market a good expansion place for clinical laboratories.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Companies the Clinical Laboratory Services Market

-

Quest Diagnostics (Comprehensive Health Profiles, Blueprint for Wellness)

-

Labcorp (Pixel by Labcorp, Women's Health Blood Test)

-

Mayo Clinic Laboratories (Neurology Testing, Cardiovascular Diagnostics)

-

BioReference Laboratories (OncoReveal Dx, Scarlet Health)

-

Sonic Healthcare (Clinical Pathology Services, Genetic Testing)

-

ARUP Laboratories (Pediatric Testing, Infectious Disease Diagnostics)

-

Eurofins Scientific (Clinical Diagnostics, Genomic Services)

-

Synlab Group (Specialty Testing, Preventive Check-Ups)

-

Unilabs (Radiology Services, Pathology Testing)

-

Cerba Healthcare (Clinical Trials Services, Veterinary Diagnostics)

-

ACM Global Laboratories (Central Laboratory Services, Toxicology Testing)

-

Medicover (Preventive Health Packages, Diagnostic Imaging)

-

Genova Diagnostics (GI Effects Comprehensive Profile, NutrEval FMV)

-

Healius Limited (Pathology Services, Imaging Services)

-

Australian Clinical Labs (COVID-19 Testing, Women's Health Diagnostics)

-

Bio-Rad Laboratories (Quality Control Products, Immunohematology Testing)

-

Thermo Fisher Scientific (Clinical Chemistry Analyzers, Molecular Diagnostic Assays)

-

Agilent Technologies (Pathology Solutions, Genomics Services)

-

Tecan Group Ltd. (Automated Liquid Handling Systems, Microplate Readers)

-

DiaSorin (LIAISON XL Analyzer, Molecular Diagnostic Kits)

Suppliers (These suppliers provide essential laboratory equipment, reagents, and consumables, including diagnostic kits, assay reagents, analytical instruments, and automation solutions, enabling clinical laboratories to perform high-quality diagnostic testing and research efficiently.) in Clinical Laboratory Services Market

-

Merck KGaA

-

Thermo Fisher Scientific

-

Danaher Corporation

-

Agilent Technologies

-

Bio-Rad Laboratories

-

Siemens Healthineers

-

PerkinElmer, Inc.

-

Roche Diagnostics

-

Beckman Coulter (Danaher Corporation)

-

BD (Becton, Dickinson and Company)

Recent Developments in Clinical Laboratory Services Industry

-

January, 2025 – Quest Diagnostics, a preeminent diagnostic information services provider, has officially closed the acquisition of certain University Hospitals assets, a respected nonprofit health system and academic medical center in the United States. The transaction's financial terms are not disclosed.

-

March, 2024 – Labcorp, a world leader in laboratory testing, has signed an agreement with OPKO Health, Inc. to buy certain assets of BioReference Health, an OPKO Health subsidiary. The deal is expected to improve Labcorp's diagnostic capability and service offering.

-

January, 2023 – Helix, the leader in population genomics and viral surveillance, and Mayo Clinic Laboratories have established a strategic alliance. The joint effort will give biopharma customers an expansive combined laboratory portfolio to assist research and development teams across the lifecycle of drug development.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 250.94 Billion |

| Market Size by 2032 | US$ 343.58 Billion |

| CAGR | CAGR of 3.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Genetic Testing, Clinical Chemistry, Medical Microbiology Testing, Hematology Testing, Immunology Testing, Cytology Testing, Drug of Abuse Testing, Other Esoteric Tests) • By Service Provider (Hospital-Based Laboratories, Stand-Alone Laboratories, Clinic-Based Laboratories) • By Application (Bioanalytical & Lab Chemistry Services, Toxicology Testing Services, Cell & Gene Therapy Related Services, Preclinical & Clinical Trial Related Services, Drug Discovery & Development Related Services, Other Clinical Laboratory Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Quest Diagnostics, Labcorp, Mayo Clinic Laboratories, BioReference Laboratories, Sonic Healthcare, ARUP Laboratories, Eurofins Scientific, Synlab Group, Unilabs, Cerba Healthcare, ACM Global Laboratories, Medicover, Genova Diagnostics, Healius Limited, Australian Clinical Labs, Bio-Rad Laboratories, Thermo Fisher Scientific, Agilent Technologies, Tecan Group Ltd., DiaSorin, and other players. |