Digital Pathology Market Report Scope & Overview:

Get more information on Digital Pathology Market - Request Sample Report

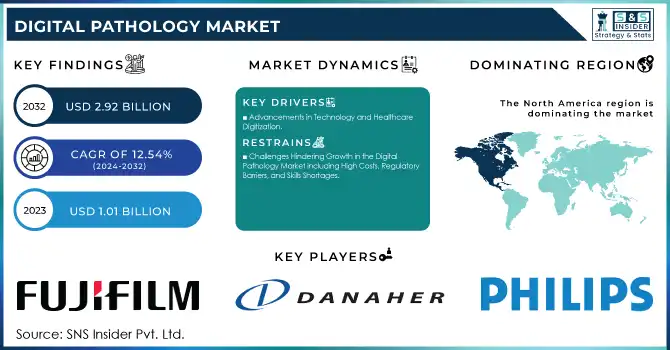

The Digital Pathology Market size is expected to reach USD 2.92 billion by 2032 from USD 1.01 billion in 2023, and grow at CAGR of 12.54% over the forecast period 2024-2032.

The Digital Pathology Market is revolutionizing diagnostic processes by digitizing traditional pathology workflows, enabling enhanced precision, efficiency, and collaboration. This innovation has been critical in addressing the increasing burden of chronic diseases such as cancer and cardiovascular disorders, which require accurate and timely diagnostics. Studies indicate that digital pathology systems can reduce diagnostic turnaround times by up to 50%, significantly improving patient outcomes.

Technological advancements, particularly in artificial intelligence (AI) and machine learning (ML), are major contributors to this transformation. AI-powered algorithms are now capable of automating the detection of abnormalities in histopathology slides with remarkable accuracy. For example, a 2023 study published in Modern Pathology highlighted an AI-based tool that achieved a sensitivity rate of over 92% in identifying lymph node metastases in breast cancer. Similarly, digital pathology has enabled the early detection of prostate cancer, with AI systems demonstrating consistent diagnostic performance comparable to expert pathologists.

The adoption of digital pathology has also been accelerated by the COVID-19 pandemic, which highlighted the need for remote diagnostics and telemedicine. Research published in Diagnostic Pathology showed that remote digital pathology reduced the time for second-opinion consultations by 40%, ensuring timely and effective patient management during global lockdowns. The technology also supported continuity in pathology education and training, allowing students and professionals to access high-quality digital slides remotely. However, the path toward widespread adoption is not without challenges. Regulatory frameworks, such as compliance with the Health Insurance Portability and Accountability Act (HIPAA) and General Data Protection Regulation (GDPR), require robust data security measures to safeguard patient information. Additionally, the high initial costs of implementing digital pathology systems pose a barrier, particularly for smaller healthcare providers.

Despite these hurdles, digital pathology continues to gain traction due to its proven benefits. With advancements in imaging technologies, AI integration, and supportive regulatory initiatives, the field is set to redefine diagnostic accuracy and efficiency, transforming healthcare delivery worldwide.

Digital Pathology Market Dynamics

Drivers

-

Advancements in Technology and Healthcare Digitization

A key factor is the rising demand for high-throughput diagnostic solutions to address the global increase in chronic and lifestyle-related diseases. Pathologists face increasing pressure to process large volumes of samples quickly and accurately, and digital pathology systems, with their automated workflows, significantly enhance productivity. Another critical driver is the ongoing digitization of healthcare. As hospitals and laboratories implement electronic health records (EHRs) and other digital systems, integrating digital pathology becomes vital for seamless data sharing and collaboration. This interoperability encourages multidisciplinary teamwork, allowing pathologists, oncologists, and other specialists to provide efficient and comprehensive care.

Advances in digital imaging technologies have also played a significant role, improving the resolution and quality of virtual slides for more reliable diagnostics. These innovations, combined with artificial intelligence (AI) integration for automated image analysis, are reshaping pathology by reducing errors and standardizing diagnostic results. For example, digital pathology is becoming essential in personalized medicine research, where molecular insights rely on accurate histopathological data. Additionally, regulatory support and strategic partnerships between healthcare organizations, technology providers, and research institutions are further driving market expansion. Government initiatives that promote telemedicine and remote diagnostics, particularly during public health crises like the COVID-19 pandemic, have highlighted the crucial role of digital pathology in ensuring continuous and effective diagnostics.

Restraints

-

Challenges Hindering Growth in the Digital Pathology Market including High Costs, Regulatory Barriers, and Skills Shortages

A significant challenge in the digital pathology market is the high upfront cost associated with the systems, which include advanced imaging equipment, software, and storage solutions. This substantial initial investment may discourage smaller healthcare providers and laboratories from adopting the technology, limiting its broader implementation. Additionally, regulatory obstacles pose a considerable barrier to market growth. Strict data privacy regulations, such as HIPAA in the U.S. and GDPR in Europe, make it difficult to integrate digital pathology systems into clinical environments. Meeting these compliance requirements can cause delays in adoption as organizations strive to ensure data security and storage standards are met. Moreover, the lack of standardized protocols across different regions and healthcare systems results in interoperability challenges, hindering the seamless integration of digital pathology systems with existing medical infrastructure. Lastly, the shortage of trained professionals capable of operating digital pathology systems and analyzing digital slides remains a key issue, especially in areas with limited healthcare resources, impeding the widespread adoption and effective use of digital pathology technologies.

Digital Pathology Market Segmentation Analysis

By Product

In 2023, the Software segment dominated the digital pathology market, accounting for 45% of the total market share. This dominance is driven by the increasing demand for advanced image analysis and management solutions in pathology. Software plays a critical role in processing, managing, and analyzing digital pathology images, enabling pathologists to interpret large volumes of data more efficiently and accurately. The integration of artificial intelligence (AI) and machine learning into pathology software has further enhanced diagnostic precision and workflow efficiency, making it indispensable in modern healthcare settings. The growing focus on automating pathology workflows and improving diagnostic accuracy has fueled the dominance of this segment.

The Storage Systems segment is emerging as the fastest-growing in the digital pathology market. With the continuous generation of large volumes of digital data through high-resolution imaging, the demand for efficient, scalable, and secure storage solutions is rapidly increasing. Cloud-based storage, in particular, has gained significant traction due to its ability to provide remote access, data sharing, and seamless integration into digital workflows. As more healthcare organizations adopt digital pathology systems, the need for robust storage systems to manage vast amounts of image data is expected to rise, driving growth in this segment.

By Application

In 2023, the Drug Discovery & Development segment led the market, representing 55% of the share. Digital pathology has become an essential tool in drug discovery by providing high-resolution imaging and detailed analysis of tissue samples. It supports the identification of biomarkers, understanding of disease mechanisms, and evaluating therapeutic efficacy. The growing use of digital pathology to accelerate research and reduce the time and costs associated with drug development has driven this dominance, particularly in pharmaceutical and biotech companies.

The Disease Diagnosis segment is the fastest-growing area in the digital pathology market. The increasing global burden of chronic diseases, such as cancer, along with advancements in diagnostic technologies, has led to a surge in the adoption of digital pathology systems for clinical diagnostics. These systems enhance diagnostic accuracy, enable remote consultations, and facilitate collaboration among medical professionals. The integration of AI-powered tools to assist with diagnostics further fuels this growth, positioning disease diagnosis as a key driver for the expansion of digital pathology applications in the coming years.

Digital Pathology Market Regional Overview

North America held the largest market share, primarily due to the early adoption of digital pathology technologies and the presence of leading healthcare providers and research institutions. The U.S., in particular, is at the forefront of integrating digital pathology systems into clinical settings, fueled by strong government initiatives, investments in healthcare digitization, and a growing emphasis on precision medicine. Furthermore, the high incidence of chronic diseases like cancer is driving the adoption of digital pathology in diagnostic and research applications.

Europe is another key region, with substantial growth in countries like Germany, the UK, and France. The European market benefits from supportive regulatory frameworks, increased healthcare digitization, and a strong focus on medical research and drug discovery. In particular, the growing need for personalized medicine and advancements in AI-based diagnostics are contributing to the rapid adoption of digital pathology solutions.

The Asia-Pacific region is expected to see the fastest growth in the coming years, driven by expanding healthcare infrastructure, rising healthcare awareness, and increasing investments in technological innovation. Countries like China, Japan, and India are witnessing a surge in digital pathology adoption in both clinical and research sectors. The growing healthcare burden due to an aging population and increasing incidence of chronic diseases is also propelling the market in this region.

Need any customization research on Digital Pathology Market - Enquiry Now

Key Digital Pathology Market Companies

1. Fujifilm Holdings Corporation

-

-

Fujifilm Virtual Slide System

-

2. Danaher Corporation

-

-

Aperio Digital Pathology Systems (Leica Biosystems)

-

-

-

Philips IntelliSite Pathology Solution

-

4. Mikroscan Technologies, Inc.

-

-

Mikroscan Digital Slide Scanners

-

5. PathAI

-

-

PathAI Diagnostic Solutions

-

6. Hamamatsu Photonics K.K.

-

-

NanoZoomer Digital Slide Scanners

-

7. F. Hoffmann-La Roche Ltd.

-

-

Ventana Digital Pathology Systems

-

8. 3DHISTECH

-

-

Pannoramic Digital Slide Scanners

-

CaseViewer Software

-

9. Apollo Enterprise Imaging

-

-

Apollo Enterprise Imaging Platform

-

10. XIFIN, Inc.

-

-

XIFIN Pathology Solutions

-

11. Proscia Inc.

-

-

Proscia Concentriq Digital Pathology Platform

-

12. KONFOONG BIOTECH INTERNATIONAL

-

-

KONFOONG Digital Pathology Solutions

-

13. Sectra AB

-

-

Sectra Digital Pathology Solution

-

14. Hamamatsu Photonics, Inc.

-

-

NanoZoomer Digital Slide Scanners

-

15. Olympus Corporation

-

-

Olympus Digital Pathology Systems

-

16. Inspirata, Inc.

-

-

Inspirata Digital Pathology Solutions

-

17. Epredia (3DHISTECH Ltd.)

-

-

Pannoramic Digital Slide Scanners

-

18. Visiopharm A/S

-

-

Visiopharm Digital Pathology Solutions

-

19. Huron Technologies International Inc.

-

-

Huron Digital Pathology Solutions

-

20. ContextVision AB

-

-

ContextVision Pathology Imaging Software

-

21. CellaVision

-

-

CellaVision Digital Pathology Solutions

-

22. HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO)

-

-

Morphogo Digital Pathology Systems

-

23. West Medica Produktions- und Handels-GmbH (West Medica)

-

-

West Medica Digital Pathology Solutions

-

24. aetherAI

-

-

aetherAI Digital Pathology Solutions

-

25. IBEX (IBEX MEDICAL ANALYTICS)

-

-

IBEX AI Pathology Solutions

-

26. SigTuple Technologies Private Limited

-

-

SigTuple AI-based Pathology Solutions

-

27. Morphle Labs, Inc.

-

-

Morphle Labs Digital Pathology Solutions

-

28. Bionovation Biotech, Inc.

-

-

Bionovation Digital Pathology Solutions

-

Recent Development

In Dec 2024, OptraSCAN raised USD 30 million in Series B funding to advance its mission of democratizing digital pathology and improving diagnostic accuracy worldwide. The funding round, led by Molbio Diagnostics, highlights the increasing significance of digital pathology in transforming healthcare and patient outcomes.

In Oct 2024, Central Maine Healthcare (CMH) partnered with Spectrum Healthcare Partners (SHCP) to enhance its pathology services by adopting Pramana's AI-enabled autonomous scanners. This collaboration aims to improve operational efficiency and provide pathologists with a more detailed view, boosting diagnostic confidence.

In Sept 2024, Roche expanded its digital pathology open environment by integrating over 20 advanced AI algorithms from eight new collaborators. This initiative aims to enhance cancer research and diagnostics, supporting pathologists and scientists with innovative AI technology.

In Sept 2024, Mindpeak raised USD 15.3M in Series A funding to accelerate the development of its AI-driven digital pathology solutions. This investment will enhance its AI-powered histopathological assessments, benefiting clinical labs and biopharma companies globally.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.01 billion |

| Market Size by 2032 | USD 2.92 billion |

| CAGR | CAGR of 12.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Software, Device (Scanners, Slide Management System), Storage System] • By Application [Drug Discovery & Development, Academic Research, Disease Diagnosis (Cancer Cell Detection, Others)] • By End-use [Hospitals, Biotech & Pharma Companies, Diagnostic Labs, Academic & Research Institutes] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fujifilm Holdings Corporation, Danaher Corporation, Koninklijke Philips N.V., Mikroscan Technologies, Inc., PathAI, Hamamatsu Photonics K.K., F. Hoffmann-La Roche Ltd., 3DHISTECH, Apollo Enterprise Imaging, XIFIN, Inc., Proscia Inc., KONFOONG BIOTECH INTERNATIONAL, Sectra AB, Leica Biosystems Nussloch GmbH (Danaher), Olympus Corporation, Inspirata, Inc., Epredia (3DHISTECH Ltd.), Visiopharm A/S, Huron Technologies International Inc., ContextVision AB, CellaVision, HANGZHOU ZHIWEI INFORMATION TECHNOLOGY CO. LTD. (MORPHOGO), West Medica Produktions- und Handels-GmbH (West Medica), aetherAI, IBEX (IBEX MEDICAL ANALYTICS), SigTuple Technologies Private Limited, Morphle Labs, Inc., Bionovation Biotech, Inc. |

| Key Drivers | • Advancements in Technology and Healthcare Digitization |

| Restraints | • Challenges Hindering Growth in the Digital Pathology Market including High Costs, Regulatory Barriers, and Skills Shortages |