Consumer Electronics Market Report Scope & Overview:

Get More Information on Consumer Electronics Market - Request Sample Report

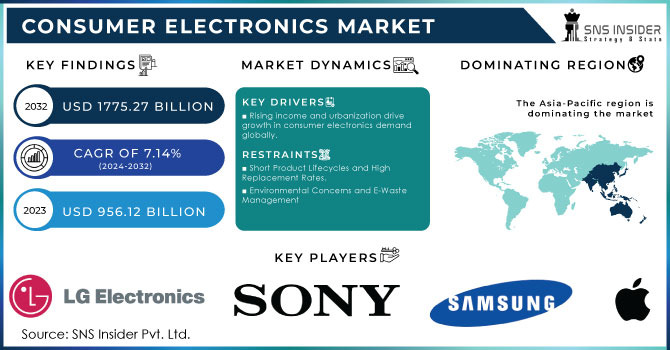

The Consumer Electronics Market size was valued at USD 956.12 Billion in 2023. It is estimated to reach USD 1775.27 Billion by 2032, growing at a CAGR of 7.14% during 2024-2032.

The consumer electronics market is a fast-growing and ever-changing sector that includes a variety of devices and technologies created for personal and home usage. Due to technological advancements and shifting consumer preferences, the consumer electronics industry has seen substantial growth in recent years, emphasizing connectivity, convenience, and smart technology. The increasing desire for smart devices is a crucial factor in driving the consumer electronics industry. Consumers are looking for devices that provide improved functionality and convenience as the Internet of Things (IoT) and artificial intelligence (AI) become more integrated. For example, the growing trend of smart home gadgets like voice-controlled speakers, thermostats, and security systems enables users to manage different settings in their houses from a distance. At present, 65% of Americans possess a minimum of one smart home gadget, marking a rise from 51% in 2023. Furthermore, 37% of Americans are planning to buy smart home technology this year, indicating a 68% rise compared to 2023. Within certain groups, 82% of people who rent are interested in having at least one smart device at home, with a large number stating that these devices are either important or very important to them. Moreover, around 70% of potential home buyers are actively seeking homes that come with smart technologies. The trend towards smart devices has led to an increased need for products that blend easily into daily life, encouraging a connected way of living.

The expansion of 5G technology is also a significant factor impacting the consumer electronics market. The arrival of 5G networks has transformed the way users engage with their devices by providing quicker and more dependable internet connection. This advancement has sped up the acceptance of high-bandwidth Sales Channels like augmented reality (AR) and virtual reality (VR), which need fast data transfer and low latency. Due to this, manufacturers are concentrating on creating devices that can maximize the potential of 5G, contributing to the market's expansion. Key players in the industry, including Apple, Samsung, Sony, and LG, are regularly releasing innovative products with cutting-edge capabilities to keep up with changing consumer demands. Some of the advancements influencing the market include foldable smartphones, home appliances powered by AI, and ultra-high-definition televisions. Businesses are additionally putting money into research and development to launch products that improve user experiences and provide smooth integration with different platforms and ecosystems.

Consumer Electronics Market Dynamics

Drivers

-

Rising income and urbanization drive growth in consumer electronics demand globally.

The increase in available income, particularly in developing countries, has played a major role in the expansion of the consumer electronics industry. As people in areas like Asia-Pacific, Latin America, and Africa see their income rise, they are more likely to buy luxury items such as the newest consumer electronics. Urbanization is also important because people who move to cities tend to embrace modern ways of living that heavily depend on technology such as smartphones, tablets, smart home gadgets, and entertainment systems.

Consumers with higher disposable income can more often upgrade their devices, opting for premium models with advanced features. For instance, individuals are increasingly inclined to invest in premium smartphones, smartwatches, and gaming consoles. Moreover, the presence of financing choices and payment plans in installments increases the affordability of electronic devices for consumers, allowing those with moderate incomes to buy costly gadgets. With the rise of urbanization, smart cities are being developed with infrastructure aimed at incorporating consumer electronics seamlessly into daily routines. This consists of intelligent appliances, linked gadgets, and security systems, all of which improve consumer convenience and lifestyle quality. This change is pushing manufacturers to constantly come up with new products to meet the growing demand for various consumer electronics.

-

The rise of smart homes, transforming consumer electronics through IoT integration.

The idea of a smart home has grown to become a top trend in the consumer electronics industry. The rise of IoT has led to a surge in the popularity of smart homes, which feature devices that can be controlled, automated, and monitored from a distance. The demand for devices like smart thermostats, lighting systems, security cameras, and voice-activated assistants has risen due to their ability to make homes more efficient and secure.

Tech giants such as Google, Amazon, and Apple are at the forefront of smart home ecosystems, offering devices that enable users to manage various household devices through one centralized platform. The ease of use provided by these systems is a significant factor in driving market expansion. Consumers can customize their home settings according to their preferences, keep tabs on energy consumption, and remotely oversee their homes using their smartphones. Additionally, the compatibility of devices between various platforms guarantees that consumers are purchasing complete sets of products, leading to multiple repeat buys. Integrating a security camera with a smart doorbell or connecting a thermostat to a home assistant enhances the attractiveness of smart home devices. This increasing pattern promotes the expansion of smart gadgets, turning the smart home sector into a major influencer for consumer electronics overall.

Restraints

-

Short Product Lifecycles and High Replacement Rates.

Consumer electronics are defined by remarkably short product lifecycles. This is because companies are constantly trying to outdo their competitors by releasing new models with improved characteristics, which renders already-produced devices obsolete. This reality creates a huge imperative for constant consumption among customers. However, it is also a serious burden for original equipment manufacturers, as they are forced to innovate continuously and pay attention to effective cost management. Given these circumstances, consumers might become irritated by the frequency of obsolescence, which could lead to decreasing satisfaction and, in turn, the reluctance to upgrade their devices to newer models.

-

Environmental Concerns and E-Waste Management

The consumer electronics segment produces considerable e-waste, which negatively impacts global ecology. Smartphones, tablets, laptops, TVs, and other gadgets alike are disposed of after only a few years of usage. While manufacturers lose on those potential extra sales, the devices’ batteries, electronic components, wires, and other parts eventually accumulate to form tons of dangerous waste. Governments and ecology protection bodies introduce new regulations regarding proper e-waste management, and the manufacturers have to comply by recycling the waste at their own expense. Moreover, clients themselves become more concerned about ecology and challenge the companies to design environmentally-friendly gadgets and implement recycling initiatives, as well as decrease their carbon footprint.

Consumer Electronics Market Segmentation Overview

By Product

Smartphones led the market in 2023 with a 49% market share because of their widespread use and versatility. The widespread global use of these devices is due to their capability to offer communication, entertainment, productivity, and digital services all in one. The rise of internet usage, improvements in 5G technology, and enhancements in smartphone capabilities like AI-powered cameras and facial recognition have boosted the demand even more. Key players in the industry, such as Apple with their iPhone, Samsung with their Galaxy series, and Xiaomi with their Redmi series, are consistently introducing state-of-the-art products.

Tablets are rapidly expanding and expected to register the fastest CAGR during 2024-2032 in the consumer electronics market due to their portability and versatility in filling the gap between smartphones and laptops. The rising popularity of remote learning and working has greatly increased the sales of tablets. Tablets are favored for personal and professional use due to their larger screens for productivity and entertainment, all while still being mobile. Big names like Apple, Samsung, and Microsoft are increasing the variety of tablet uses in fields like education, graphic design, and business.

By Sales Channel

The offline dominated the market segment in 2023 with 58% market share, representing a large share of sales. This classic distribution method includes brick-and-mortar retail stores, tech stores, and display rooms, giving customers the chance to engage with products in person before buying them. The physical interaction with products, as well as the chance for tailored assistance and instant satisfaction from immediate transactions, enhances the attractiveness of the brick-and-mortar channel. Best Buy and Walmart utilize their large physical presence to provide a diverse selection of consumer electronics, guaranteeing customers access to the newest devices and technology.

The online is to experience a rapid growth rate during 2024-2032 due to rising internet usage and consumer desire for ease of shopping. E-commerce platforms offer a wide range of products, competitive prices, and the convenience of home delivery, attracting technology-savvy shoppers who enjoy shopping from their own homes. Amazon and Newegg demonstrate successful internet tactics with easy-to-use designs, comprehensive product details, and customer feedback, improving the overall shopping journey.

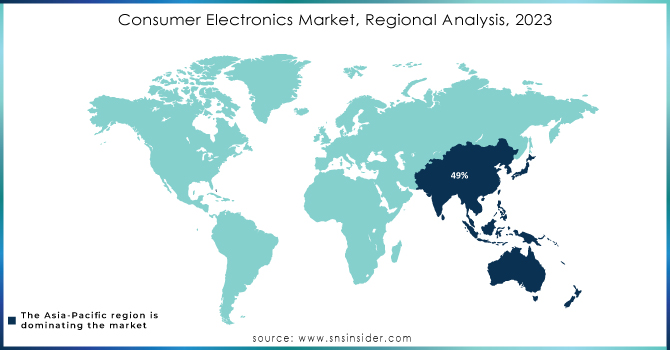

Consumer Electronics Market Regional Analysis

The Asia-Pacific region held a market share of 49% in 2023 and led the market. China, Japan, and South Korea are at the forefront of technology innovation, manufacturing, and the consumption of electronic goods. The region experiences high demand due to fast urbanization, rising disposable incomes, and a growing interest in smart devices. Furthermore, leading companies like Samsung and Sony have developed significant manufacturing and research skills in the APAC region, launching advanced products such as smartphones, smart TVs, and wearable technology.

Latin America is accounted to become the fastest-growing region with a CAGR of 7.59% in the consumer electronics market during 2024-2032, fueled by a growing middle class and increasing use of digital technology. Brazil and Mexico are experiencing an increase in the need for electronic items, especially smartphones and smart home devices. The young population in the area is eager to embrace technology, along with the rise of e-commerce platforms that enhance the accessibility of these products. LG and Motorola are increasing their footprint in Latin America by introducing products tailored to consumer preferences, like budget-friendly smartphones and energy-saving appliances.

Need any customization research on Consumer Electronics Market - Enquiry Now

Key Players

The key players in the Consumer Electronics market are:

-

Apple Inc. (iPhone, MacBook)

-

Samsung Electronics (Galaxy Smartphones, QLED TVs)

-

Sony Corporation (PlayStation, Bravia TVs)

-

LG Electronics (OLED TVs, InstaView Refrigerators)

-

Panasonic Corporation (Lumix Cameras, Viera TVs)

-

Microsoft Corporation (Xbox, Surface Laptops)

-

Huawei Technologies (MateBook, P Series Smartphones)

-

Xiaomi Corporation (Mi Smartphones, Mi Smart Bands)

-

Dell Technologies (XPS Laptops, Alienware Gaming PCs)

-

Lenovo Group (ThinkPad Laptops, Yoga Tablets)

-

HP Inc. (Spectre Laptops, DeskJet Printers)

-

ASUS (ROG Gaming Laptops, ZenFone Smartphones)

-

Acer Inc. (Predator Gaming PCs, Aspire Laptops)

-

Philips Electronics (Hue Smart Lighting, Sonicare Electric Toothbrushes)

-

Toshiba Corporation (Canvio External Hard Drives, Satellite Laptops)

-

Nikon Corporation (D850 Cameras, Z Series Mirrorless Cameras)

-

Canon Inc. (EOS Cameras, PIXMA Printers)

-

Bose Corporation (QuietComfort Headphones, SoundLink Speakers)

-

Sharp Corporation (Aquos TVs, Healsio Superheated Steam Oven)

-

Vizio Inc. (SmartCast TVs, V-Series Sound Bars)

Recent Development

-

In September 2024: Apple launched the iPhone 16 series, featuring significant upgrades in camera technology, processing power, and battery life, aimed at enhancing user experience and productivity.

-

In August 2024: Samsung introduced the Galaxy Z Fold 5, the latest in its foldable smartphone lineup, with improved durability, enhanced multitasking capabilities, and a refined design to appeal to tech enthusiasts and professionals.

-

In March 2023: Sony launched the PlayStation VR2, a next-generation virtual reality headset for the PlayStation 5 console, offering enhanced graphics, improved ergonomics, and a wider field of view to elevate gaming experiences.

-

In November 2023: Amazon unveiled the 5th generation of its Echo smart speaker lineup, featuring improved sound quality, integrated smart home controls, and enhanced compatibility with third-party Sales Channels, aiming to strengthen its position in the smart home market.

-

In October 2023: GoPro introduced the Hero 12 Black action camera, featuring improved stabilization, higher resolution recording capabilities, and advanced shooting modes tailored for outdoor adventurers and content creators.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 956.12 Billion |

| Market Size by 2032 | USD 1775.27 Billion |

| CAGR | CAGR of 7.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Smartphones, Tablets, Desktops, Laptops/Notebooks, Digital Cameras, Hard Disk Drives, E-readers) • By Sales Channel (Offline, Online) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Samsung Electronics, Sony Corporation, LG Electronics, Panasonic Corporation, Microsoft Corporation, Huawei Technologies, Xiaomi Corporation, Dell Technologies, Lenovo Group, HP Inc., ASUS, Acer Inc., Philips Electronics, Toshiba Corporation, Nikon Corporation, Canon Inc., Bose Corporation, Sharp Corporation, Vizio Inc. |

| Key Drivers | • Rising income and urbanization drive growth in consumer electronics demand globally. • The rise of smart homes, transforming consumer electronics through IoT integration. |

| RESTRAINTS | • Short Product Lifecycles and High Replacement Rates. • Environmental Concerns and E-Waste Management |