Wireless Home Security Camera Market Size Analysis:

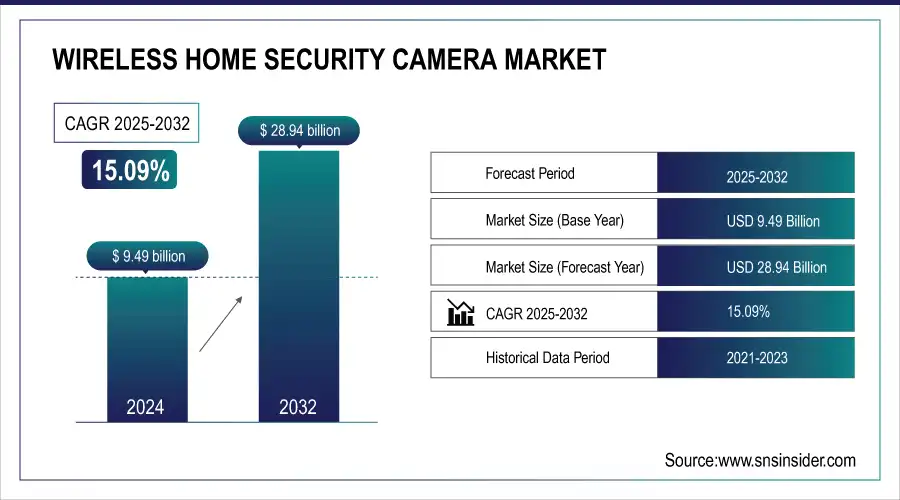

The Wireless Home Security Camera Market Size was valued at USD 9.49 billion in 2024, and is expected to reach USD 28.94 billion by 2032, and grow at a CAGR of 15.09% over the forecast period 2025-2032. Wireless security cameras directly address this gap by providing crucial video evidence to identify and prosecute perpetrators. According to Federal Bureau of Investigation a significant decrease in burglaries (1.2 million fewer incidents) was reported in 2021. However, the 2022 numbers show a rise, with 847,522 incidents. While the percentage of residential burglaries dropped to 57% in 2022, residences remain the most frequent target (386,489 incidents). These statistics paint a clear picture: burglaries remain a serious concern in the U.S.

For Instance, the rise of wireless home security cameras directly addresses a significant pain point in the U.S. With an average of 3,062 burglaries happening daily, and 72% occurring in unoccupied homes, the need for robust security solutions is clear. Furthermore, homes without security systems are 3 times more likely to be targeted. Despite this alarming reality, only 25% of Americans currently utilize home security systems, and only 28% of those systems include cameras. This lack of evidence collection thwarts crime-solving efforts.

Get More Information on Wireless Home Security Camera Market - Request Sample Report

The increasing popularity of wireless security cameras signifies a growing national awareness of this issue and a proactive approach to home security. With their ease of use, affordability, and ability to deter crime and provide valuable evidence, wireless security cameras are poised for continued market expansion. Wired systems are complex and expensive to install. Wireless cameras offer a user-friendly, affordable solution to deter criminals, capture evidence, and gain peace of mind.

Wireless Home Security Camera Market Highlights:

-

Rising adoption of wireless cameras enhances smart home security and integrates with smart devices like voice assistants, locks, and lighting systems.

-

AI and analytics transform cameras into smart protectors with facial recognition, motion detection, behavior analysis, and predictive security capabilities.

-

Cybersecurity vulnerabilities remain a concern, requiring strong encryption, regular updates, and higher manufacturing costs.

-

Unreliable wireless connections can cause signal interference, low-quality video, or security blind spots, particularly in large or complex properties.

Wireless Home Security Camera Market Drivers:

-

The increase in popularity of wireless cameras has led to improved security in smart homes.

Incorporation into smart home systems. Consumers are more looking for cameras that can easily link with other smart devices in their houses, like voice assistants, smart locks, and lighting systems. This connectivity provides a significant benefit-enhanced automation and control, all easily accessible via one user-friendly interface. As smart homes become more common, the market for wireless home security cameras is growing rapidly. For Instance, In the United States surveillance camera installations are expected to grow from 70 million in 2018 to about 85 million cameras in the United States by 2021, an increase of about 21%.

-

AI and analytics are transforming security cameras.

The wireless home security cameras market is experiencing a significant change due to the integration of Artificial Intelligence (AI) and advanced analytics. These innovations are changing security cameras from passive watchers to smart protectors. Facial recognition, improved motion detection, and behavior analysis capabilities enable cameras to differentiate between actual dangers and routine events. This greatly decreases incorrect alerts, reducing interruptions and optimizing security efficiency. AI-driven analysis goes further than just spotting things, providing useful information and the ability to predict future outcomes. Based on the camera's analysis, users can take proactive steps to address potential security issues. In January 2024, Nest introduced a state-of-the-art wireless home security camera featuring advanced AI facial recognition technology. This camera gets better with time, identifying familiar faces and telling them apart from strangers. It reduces false alarms by recognizing usual visitors and disregarding inconsequential activities such as pets.

Wireless Home Security Camera Market Restraints:

-

Vulnerabilities in the cyber security of the wireless home security market.

These devices connected to the internet, despite providing surveillance, are vulnerable to cyber-attacks from hackers. Hacked cameras pose higher security risks. Thieves may use the cameras to scope out a property before breaking in, changing the intended use of the camera and causing concern for potential buyers. Expensive and intricate solutions are needed to tackle these vulnerabilities, necessitating strong cyber security measures. Manufacturers must prioritize strong encryption protocols, regularly update security measures, and implement consistent practices across all devices. These treatments may become intricate and costly, potentially increasing manufacturing expenses and affecting affordability.

-

Unreliable Connections in Wireless Security Cameras market

Issues and disruptions may arise in wireless connections because of interference from electronic devices or neighboring Wi-Fi networks, leading to lost connections, low-quality video, or malfunctions in cameras at critical moments. Imagine a scenario in which a burglary occurs with a poor signal, leading to no documentation of the incident. Users' trust in the system may be greatly affected by its unreliability, leading to a reduction in user confidence. The effectiveness of wireless cameras is often limited by the range and strength of their Wi-Fi signal. Areas of lacking signal or weak signal within a property can lead to security blind spots. This means that larger homes or properties with intricate layouts might require additional cameras or signal boosters to ensure complete coverage, thereby raising both the overall cost and complexity of the system.

Wireless Home Security Camera Market Segment Analysis:

By Type

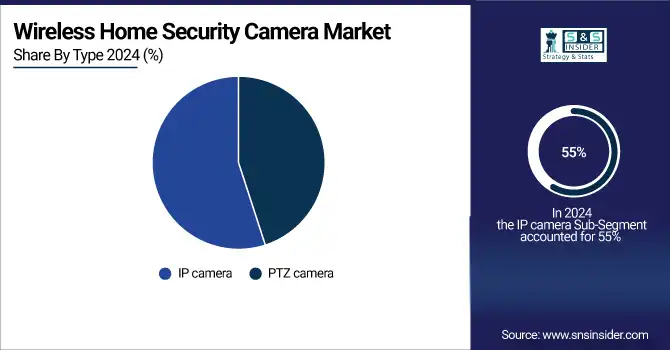

The IP camera category dominates the wireless home security camera market in 2024, holding a majority share of 55%. IP cameras, unlike traditional analog models, send video over the internet, allowing for remote monitoring on mobile devices or computers from anywhere. Moreover, they offer advanced capabilities like detecting motion, higher resolution, and easier expandability for bigger security systems. Moreover, they easily link with smart home devices, providing immediate notifications and online storage to boost security. The dependability, versatility, and sophisticated surveillance features of IP cameras have made them a popular choice for modern homes. Contrary to old-fashioned analog cameras, IP cameras send video footage digitally over the internet. IP cameras offer the convenience of remote monitoring from any location with internet access, giving reassurance and the option to keep an eye on your belongings at all times. IP cameras come with advanced features that outperform analog models. Increased resolutions provide clear video quality, enabling an effortless identification of individuals or objects. Alerts and recording are activated by motion detection, so you are only notified for significant occurrences. Moreover, IP cameras can be expanded effortlessly, enabling you to incorporate additional cameras to your setup as your security requirements change. Cloud storage and ease of use have replaced the need for large VHS tapes. IP cameras frequently provide cloud storage options, enabling you to safely store and retrieve recorded videos from any location. This removes the necessity of having storage devices in the local area and offers simple playback features for revisiting previous occurrences.

By Resolution

Based on Resolution, in 2024, the 4k segment dominates the wireless home security camera market with a majority share of 50%. 4K technology represents the newest innovation in wireless security camera systems. These cameras provide excellent clarity by offering a resolution of 3840 x 2160 pixels, producing high-quality ultra-high-definition video. The great video quality makes it easy to identify faces, license plates, and important details, significantly enhancing security. 4K cameras are particularly beneficial in large, poorly lit areas where small details are often hard to see in lower resolutions. The reason for their growing appeal to homeowners seeking top-notch security options is their exceptional transparency and dependability. Their excellent clarity enables you to easily distinguish faces, license plates, and other important details in a security situation. The additional resolution guarantees clear and sharp images in spacious outdoor areas such as driveways or backyards, as well as in dimly lit spaces like hallways or garages. This is perfect for homeowners with large properties or who want excellent nighttime safety. Prominent security camera companies are adopting 4K technology in their newest product offerings. With its exceptional image quality and top-notch performance, 4K technology is quickly becoming the prevailing standard in the wireless home security camera sector.

Wireless Home Security Camera Market Regional Analysis:

North America Wireless Home Security Camera Market Trends

North America dominated the global wireless home security camera market with share of 38% in 2024. The US is a key player in this dominance, with a high level of smart home technology adoption and robust consumer interest in advanced security options. The increase in demand is fueled by growing concerns about protecting property, a rise in theft, and an increasing necessity for remote monitoring. In the competitive business industry, major companies are constantly looking for innovative ways to offer services like cloud storage, AI-driven analytics, and seamless integration with smart home systems. Developments in AI and IoT technologies, alongside government efforts to enhance home security, are also contributing to this innovation. The steady rise of wireless home security cameras in the US market indicates that consumers are willing to invest in reliable and effective methods to safeguard their homes. Cloud storage options, provided by businesses such as Nest and Ring, enable homeowners to securely save and retrieve recorded video from any location with an internet connection. Wireless security cameras blend effortlessly with smart home systems to form a cohesive and smart security network. Companies such as Ring, which integrates with Alexa smart devices, showcase this trend.

Need any customization research on Wireless Home Security Camera Market - Enquiry Now

Asia-Pacific Wireless Home Security Camera Market Trends

The Asia Pacific region is experiencing the most rapid growth in the worldwide market for wireless home security cameras, capturing a 25% market share by 2024. China's quick urban growth and increasing security-aware middle class are driving its growth. Affordability and advanced features are crucial in meeting various needs, as companies operate in that space. In Japan, a population knowledgeable about technology values dependable, AI-driven cameras that can be connected to smart homes. The market is expanding because of video analytics and enhanced connectivity. South Korea's market flourishes thanks to the extensive use of the internet and a culture that prioritizes technology. In this situation, customers are looking for high-quality characteristics such as facial recognition and cloud storage, while government backing for intelligent households and security policies continue to drive progress.

Europe Wireless Home Security Camera Market Trends

Europe holds a significant share in the wireless home security camera market, driven by countries like the UK, Germany, and France. Rising urbanization, smart home adoption, and an emphasis on residential safety are key growth factors. Consumers increasingly prefer AI-enabled cameras with features like motion detection, cloud storage, and smartphone connectivity. Government regulations promoting home safety and technological innovation in IoT devices further support market expansion. Companies such as Bosch and Arlo are leveraging advanced analytics and seamless smart home integration to capture consumer interest.

Latin America Wireless Home Security Camera Market Trends

Latin America is witnessing steady growth in wireless home security cameras, with Brazil and Mexico leading the market. Rising urbanization, increasing theft concerns, and growing awareness of smart home technologies are driving adoption. Consumers prefer affordable yet feature-rich solutions such as AI-enabled cameras, cloud storage, and smartphone integration. Local governments and security agencies promoting home safety initiatives further boost market potential. Companies are focusing on cost-effective products with robust performance to cater to a diverse consumer base. advanced low-voltage circuit breakers to ensure grid reliability and operational safety.

Middle East & Africa Wireless Home Security Camera Market Trends

The Middle East & Africa region is showing moderate growth in wireless home security cameras, primarily due to heightened security concerns and increasing disposable income in countries such as the UAE and Saudi Arabia. The adoption of smart home technology is accelerating, with consumers seeking solutions offering remote monitoring, cloud storage, and AI-enabled analytics. Government initiatives and partnerships with technology providers support market expansion. Cultural emphasis on property protection and modern housing developments are further fueling demand for reliable, connected security solutions.

Key Wireless Home Security Camera Companies are:

-

D-Link Corporation

-

Google LLC

-

Ring (Amazon)

-

Xiaomi Corporation

-

Vivint, Inc.

-

Dahua Technology Co., Ltd

-

Panasonic Life Solutions India Pvt. Ltd

-

CP Plus.

-

SAMSUNG

-

Wyze Labs, Inc.

-

EZVIZ Inc.

-

Hikvision Digital Technology Co., Ltd.

-

Bosch Security Systems (Robert Bosch GmbH)

-

Honeywell International Inc.

-

TP-Link Technologies Co., Ltd. (Tapo)

-

Netgear, Inc.

-

Logitech (Logitech Circle)

-

Reolink Technology Co., Ltd.

Wireless Home Security Camera Market Competitive Landscape:

Google Nest, a brand under Google LLC (Alphabet Inc.), was founded in 2010 and acquired by Google in 2014 for $3.2 billion. Headquartered in California, it specializes in smart home solutions, including wireless security cameras, video doorbells, and smart devices integrated with Google Home. Nest emphasizes AI-driven features, seamless ecosystem integration, and strong privacy commitments for enhanced home security.

-

In June 2024, Google Nest introduced a new doorbell camera that uses AI and has updated facial recognition features. This camera enhances both home security and convenience through the recognition of familiar faces and the delivery of customized notifications. Google's commitment to integrating artificial intelligence (AI) into home security systems to offer smarter and more effective monitoring capabilities is showcased through the introduction of this revolutionary advancement.

Ring, an Amazon-owned company founded in 2013 and based in California, specializes in smart home security solutions, including wireless security cameras, video doorbells, and alarm systems. Acquired by Amazon in 2018, Ring focuses on user-friendly, app-integrated devices with motion detection, real-time alerts, and smart home compatibility, enhancing residential safety and convenience through its connected ecosystem.

-

In May 2024, Ring, a company owned by Amazon, revealed the release of a cutting-edge battery-operated home security camera. The extended battery life and improved motion detection features of the camera address the growing demand for flexible and easy-to-set-up home security systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.49 Billion |

| Market Size by 2032 | USD 28.94 Billion |

| CAGR | CAGR of 15.09% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (PTZ camera, IP camera) • By Resolution (HD (720p & 1080p), 2K, 4K) • By Application (Doorbell Camera, Indoor Camera, Outdoor Camera) • By Distribution Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Arlo Technologies, D-Link Corporation, Google Nest, Ring (Amazon), SimpliSafe, Xiaomi, Vivint, Dahua Technology, Panasonic Life Solutions India, CP PLUS, Samsung, Wyze Labs, EZVIZ, Hikvision, Bosch Security Systems, Honeywell International, TP-Link (Tapo), Netgear, Logitech (Circle), and Reolink Technology are leading players in the wireless home security camera market. |