Container Liner Market Report Scope And Overview:

Get More Information on Container Liner Market - Request Sample Report

The Container Liner Market Size was valued at USD 892 million in 2023 and is expected to reach USD 1360.24 million by 2032 and grow at a CAGR of 4.8 % over the forecast period 2024-2032.

The surge in global transportation activities, particularly in seaborne transportation, is driving the demand for bulk packaging solutions like container liners. These liners help shipping companies save costs associated with cleaning and preparing containers for reuse, thereby increasing operational revenue. With the rise in manufacturing industries worldwide, there's a growing need for protective packaging solutions such as container liners, preferred by shippers and manufacturers globally. Additionally, the increase in international trade and demand for goods exported from one region to another contributes to the growth of container liners. They provide a protective layer for commodities during transit, safeguarding them from rough conditions and temperature fluctuations. Overall, container liners offer a cost-effective and efficient solution for transporting bulk cargo across regions, making them increasingly popular in the market.

The global rise in manufacturing industries has driven international trade, increasing the demand for protective packaging solutions like container liners among shippers and manufacturers worldwide. Growing demand for goods manufactured in one region and exported to another, such as chemicals and cattle feed from India to European countries, further boosts the container liner market. Additionally, the cost advantages of production in developing countries contribute to market growth. Container liners, known for their temperature resistance, safeguard cargo from harsh conditions and temperature fluctuations during transit, making them indispensable in global trade.

MARKET DYNAMICS

KEY DRIVERS:

-

The continuous growth of global trade and commerce is a primary driver for the container liner market.

-

Container liners provide a cost-effective bulk packaging solution for various industries.

Container liners, used in bulk material shipping, are flexible packaging materials that function within a closed-loop system. Within this system, container liners are cleaned and prepared for reuse in their original application. Typically, container liners have a lifespan of five to eight years, making them highly reusable. The increasing adoption of container liner reuse is attributed to their cost-effectiveness and ease of transportation, requiring minimal space.

RESTRAIN:

-

Unpredictable fluctuations in rates, impacting the profitability of container liner operations due to geopolitical tensions.

-

The container liners market growth is being impeded by fluctuations in transportation and inventory costs.

OPPORTUNITY:

-

Exploring and expanding operations in emerging markets with growing industrialization.

-

Innovations in pharmaceutical products and materials by top companies drive market growth opportunities.

The pharmaceutical industry relies heavily on air freight, trucking, and non-maritime transportation services for 90% of their transportation needs, which are costly and cut into their revenue. Consequently, many pharmaceutical companies are now exploring ocean freight as a feasible alternative.

CHALLENGES:

-

Fluctuations in fuel prices can significantly impact operational costs for container liners, making it challenging to manage and predict overall expenses.

-

Rising raw material costs pose a challenge to market expansion.

Impact of Russia Ukraine War

The Russia-Ukraine war has significantly impacted the Container Liner Market in several ways. Disruptions in key trade routes, especially in the Black Sea region, due to port closures have forced container liners to reroute, leading to longer transit times and higher fuel costs, affecting operational efficiency. The designation of the Black Sea as a conflict zone has resulted in increased insurance premiums for vessels in the area, further raising operational expenses. Uncertainty caused by the conflict has led to fluctuations in container capacity and freight rates, causing shortages and price spikes in various regions.

Additionally, Western sanctions on Russia and retaliatory measures have disrupted trade flows, necessitating container liners to navigate complex regulatory environments, impacting operational efficiency. The Russia-Ukraine war has created challenges for the Container Liner Market worldwide. Europe faces port congestion and seeks alternative routes, while Asian exporters encounter longer transit times and higher costs for European markets. North American markets also feel the effects through global price adjustments and shifts in trade flows. Overall, the conflict has led to a complex and challenging landscape for the Container Liner Market.

Impact of Economic Slowdown

The economic crisis has significantly impacted the Container Liner Market in several ways. One notable consequence is the decline in demand for goods, stemming from reduced consumer and industrial activity during economic downturns. This directly affects the volume of goods transported by container liners, impacting the industry's overall performance.

Another repercussion is the increased volatility in freight rates. Economic crises often trigger fluctuations in rates due to shifts in supply and demand dynamics. Rates may experience a decline due to decreased demand or surge unpredictably as a result of disruptions in the supply chain. Cash flow challenges emerge as a significant concern for shipping companies during economic downturns. Customers may delay payments or seek contract renegotiations, placing financial strains on container liner operators and affecting their liquidity.

KEY MARKET SEGMENTS

By Material

-

Polypropylene

-

Poly Vinyl Chloride

-

Metallized Film

-

Polyethylene

-

Others

Polyethylene container liners are projected to lead the segment, being the most prevalent choice. These liners serve to protect cargo and goods from moisture and contamination, ensuring safety and hygiene. Primarily utilized for sugar, cement, chemicals, fish meal, and other commodities, they are also suitable for boxed goods.

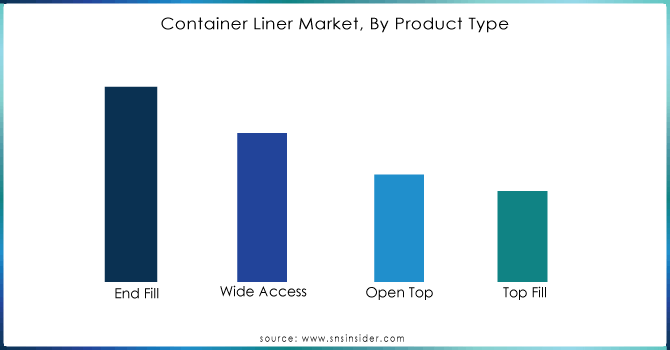

By Product Type

-

Open Top

-

End Fill

-

Top Fill

-

Wide Access

End fill and wide access container liners are anticipated to capture a market share of 37.5% and 26.8%, respectively. Their demand is projected to escalate owing to expanding applications across the chemical, food & beverage, agriculture, and pharmaceutical sectors. The innovation of end fill and wide access container liners has addressed the long-term logistical challenges encountered by end-users in transporting bulk cargo, ensuring protection from harsh weather, corrosion, and contamination risks.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Capacity

-

20 foot

-

30 foot

-

40 foot

By End Use

-

Building & Construction

-

Agriculture

-

Pharmaceutical

-

Food & Beverage

-

Chemical

-

Mining

-

Others

The agriculture and food and beverage industries are projected to capture market shares of 16.5% and 27.2%, respectively. These sectors are prominent end-users experiencing growing exports and transportation of finished goods. As these industries expand, there is an anticipated increase in demand for packaging solutions to facilitate the shipment of bulk cargo. This trend is expected to drive growth in the container liner market.

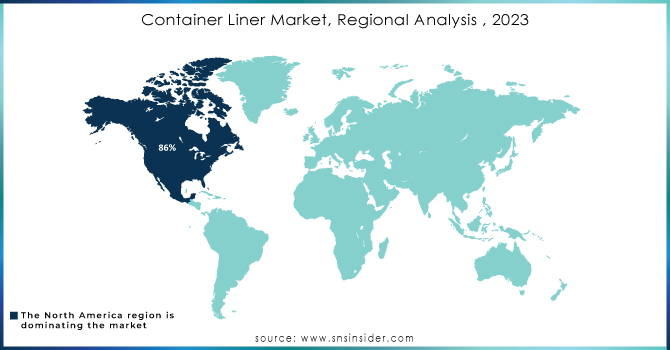

REGIONAL ANALYSIS

North America, led by the United States, anticipates an 86% market share by 2033, driven by FDA regulations ensuring safe food transportation and the U.S.'s significant role in pharmaceutical exports. Meanwhile, the UK's container liner market is expected to grow at a 4.2% CAGR, supported by robust construction sector growth and rapid infrastructural developments.

Germany, renowned as a pharmaceutical powerhouse, is projected to attain a 15% market share in the European container liner market by 2032. Demand is primarily propelled by leading pharmaceutical firms in Germany, necessitating container liners as contamination-proof bulk packaging for cutting-edge medicines. India is expected to command more than 14% of the South Asia container liner market by 2031, fuelled by the expanding chemical industry, which offers favourable prospects for container liner sales.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the Container Liner Market are Berry Global, Inc, CDF Corporation, Nier Systems Inc, Bulk Corp International, United Bags Inc, Display Pack, Inc, Composite Containers LLC, Emmbi, Inc, Greif, Inc, Ven Pack and other players.

RECENT TRENDS

-

In July 2020, Grief, Inc., an American provider of industrial packaging solutions, introduced an innovative container liner called Grief Seal Guard. This solution addresses longstanding challenges encountered by end-use industries utilizing container liners.

-

In June 2019, Amcor Plc completed the acquisition of Bemis Company, Inc., which now operates solely under the Amcor Plc name. This acquisition has enhanced Amcor's operational excellence and bolstered its capabilities. Amcor Plc aims to further expand its global container liner business.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 892 Million |

| Market Size by 2032 | US$ 1360.24 Million |

| CAGR | CAGR of 4.8 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polypropylene, Poly Vinyl Chloride, Metallized Film, Polyethylene, Others) • By Product Type (Open Top, End Fill, Top Fill, Wide Access) • By Capacity (20 Foot, 30 Foot, 40 Foot) • By End Use (Building & Construction, Agriculture, Pharmaceutical, Food & Beverage, Chemical, Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Berry Global, Inc, CDF Corporation, Nier Systems Inc, Bulk Corp International, United Bags Inc, Display Pack, Inc, Composite Containers LLC, Emmbi, Inc, Greif, Inc, Ven Pack |

| Key Drivers | • The continuous growth of global trade and commerce is a primary driver for the container liner market. • Container liners provide a cost-effective bulk packaging solution for various industries. |

| Challenges | • Fluctuations in fuel prices can significantly impact operational costs for container liners, making it challenging to manage and predict overall expenses. • Rising raw material costs pose a challenge to market expansion. |