Food Packaging Films Market Key Insights:

Get PDF Sample Copy of Food Packaging Films Market - Request Sample Report

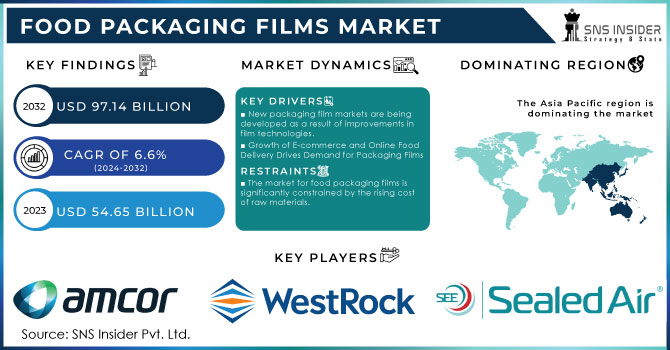

The Food Packaging Films Market size was valued at USD 54.65 billion in 2023 and is expected to Reach USD 97.14 billion by 2032 and grow at a CAGR of 6.6 % over the forecast period of 2024-2032.

The food packaging film market thrives on convenience. Consumers love ready-to-eat meals, and this fuels the demand for flexible pouches and stand-up bags that rely heavily on these films. Novolex's easy-open produce bags, launched in 2022, are a perfect example. But safety remains key. These films prevent spoilage and extend shelf life, a priority for both consumers and manufacturers. Technological advancements are creating films with even better barriers against contaminants and microbes.

Sustainability is also a major player. Governments are cracking down on plastic waste, with the EU aiming for zero landfill plastic by 2025. This is pushing companies towards eco-friendly packaging. "Green packaging" is on the rise, following the "3 R's" of reduce, reuse, recycle. Developing countries are even promoting natural biopolymers, a more flexible alternative to traditional plastic. The future of food packaging films is bright, with eco-friendly options like bioplastics, recycled paper, and even palm leaves taking center stage.

MARKET DYNAMICS

KEY DRIVERS:

-

New packaging film markets are being developed as a result of improvements in film technologies.

The food packaging films market is benefited by advancements in materials, film structures, protective coatings, and printing methods. As a result of these developments, it is now possible to produce films with enhanced barrier qualities, improved printing quality, and novel functionalities to satisfy the changing needs of the food industry.

-

Packaging films are now required due to the growth of e-commerce and online food delivery services.

RESTRAIN:

-

The market for food packaging films is significantly constrained by the rising cost of raw materials.

Resins, additives, and coatings are some of the primary raw materials whose prices have been rising recently and are used to make packaging films. These price hikes can be attributed to a variety of factors, including supply chain disruptions, changes in oil prices, and increased demand from various industries.

OPPORTUNITY:

-

Innovation and the creation of new products are made possible by the shift to returnable packaging.

Packaging films are required that not only adhere to environmental standards but also offer practical advantages like increased shelf life, improved product protection, and enhanced usability. Companies can gain market share and maintain an advantage over rivals by creating cutting-edge sustainable packaging solutions.

-

E-commerce and direct-to-consumer channels are expanding, which gives packaging films a chance.

CHALLENGES:

-

It can be difficult to inform consumers of the advantages and proper disposal of sustainable packaging.

The adoption of sustainable packaging solutions can be hampered by misconceptions or a lack of knowledge about composting, recycling, and the environmental effects of various packaging options. It is essential to explain to consumers the worth and sustainability of packaging films.

IMPACT OF RUSSIA-UKRAINE WAR

Russia, the world's second-largest oil producer, has the ability to significantly alter the petroleum market, which could have an indirect impact on the manufacturing of packaging.

Gas prices are expected to continue rising as long as the conflict lasts due to the disruption their sudden invasion of Ukraine caused. Logistics and shipping will face additional challenges as the price of gasoline rises significantly.

As manufacturers and distributors alike scramble to adjust their pricing as the price of gas continues to soar, these cost increases will likely be felt throughout the supply chain for various packaging products. Experts in the plastics industry are predicting potentially significant price increases for consumer goods made of plastic, which should come as no surprise given the rising costs in the global oil market.

Industry's worry that the cost of plastics will keep rising because the majority of flexible plastics packaging are made from resins derived from petroleum. The Ukrainian crisis may also lead to significant price increases for a variety of plastic packaging materials made from formulations derived from resin, such as polyethylene.

IMPACT OF ONGOING RECESSION

The food packaging film market may be impacted in a variety of ways while the recession is still going strong. Lower demand for packaged foods can indirectly affect demand for food packaging films due to decreased consumer spending and increased price sensitivity. The demand for specific kinds of packaging films may be impacted if consumer preferences change in favor of less expensive alternatives. Manufacturers may implement cost-cutting strategies to address economic challenges, which may include looking for more affordable packaging options or lowering overall packaging spending. The precise effect on the food packaging film market will depend on the depth and length of the recession, the state of the local economy, and the nature of the industry.

KEY MARKET SEGMENTATION

By Raw Material

-

PET

-

Polyamide

-

Polypropylene

-

Others

Polypropylene offers a selective barrier, allowing some gas exchange while excelling at blocking water vapor to keep food fresh. This versatility makes it ideal for diverse packaging, from salad dressing bottles to yogurt containers. It strikes a balance between slight stiffness and flexibility, reducing the risk of cracking. Finally, its lightweight nature minimizes storage space and simplifies transportation, making it a logistical winner.

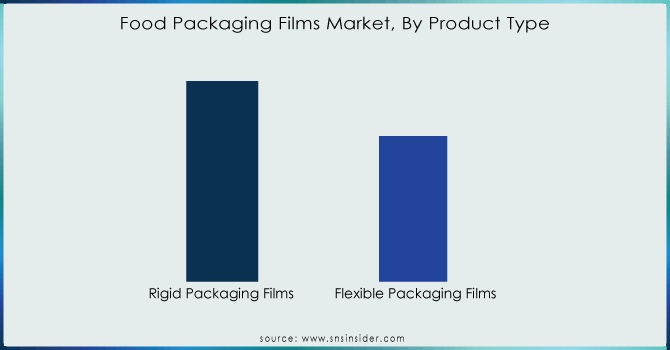

By Product Type

-

Rigid Packaging Films

-

Flexible Packaging Films

Get Customized Report as per Your Business Requiremrnt - Enquiry Now

By End Use

-

Food & Beverages

-

Healthcare

-

Homecare Products

-

Industrial Goods

-

Others

REGIONAL ANALYSIS

With over 35% of the market's revenue expected to come from Asia Pacific in 2023, it is predicted that this region will be the largest market, followed by Europe and North America. The rising per capita income, expanding population, and rising demand for packaged foods in developing nations like China, Japan, and India are predicted to be major drivers of the food packaging industry.

Because of its large population and expanding economy, China is the biggest consumer. Because of China's growing middle class and increasing purchasing power, the country's food packaging market is predicted to expand significantly. As a result of the product's expanding use in retail chains, India has the fastest-growing market.

Demand for packaging solutions in North America is anticipated to be driven by the region's thriving retail market and consumers' high consumption of packaged food. In addition, the presence of numerous manufacturers is anticipated to be advantageous for the area.

Though there is a high level of saturation, Europe is anticipated to have a promising future. The single market policy of Europe permits free trade within the area, which is anticipated to promote exports and subsequently fuel industry growth.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Food Packaging Films market are Amcor Plc, Coveris, Sealed Air Corporation, Mondi Group, WestRock, DS Smith, Graphic Packaging Holding Company, DuPont Tejin Films, Charter Next Generation, Berry Global, and other players.

RECENT DEVELOPMENTS

-

ProAmpac, The ProActive Recyclable R-2200D Easy-Peel Open for food film, manufactured by ProAmpac, based on PE.

-

Thailand and Malaysia, Using the leftover pineapple stems, researchers produce a biodegradable film.

| Report Attributes | Details |

| Market Size in 2023 | US$ 54.65 Bn |

| Market Size by 2032 | US$ 97.14 Bn |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Raw Material (PET, Polyethylene, Polyamide, Polypropylene, Others) • by Product Type (Rigid Packaging Films, Flexible Packaging Films) • by End Use (Food & Beverages, Healthcare, Homecare Products, Industrial Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Plc, Coveris, Sealed Air Corporation, Mondi Group, WestRock, DS Smith, Graphic Packaging Holding Company, DuPont Tejin Films, Charter Next Generation, Berry Global |

| Key Drivers | • New packaging film markets are being developed as a result of improvements in film technologies. • Packaging films are now required due to the growth of e-commerce and online food delivery services. |

| Market Opportunities | • Innovation and the creation of new products are made possible by the shift to sustainable packaging. • E-commerce and direct-to-consumer channels are expanding, which gives packaging films a chance. |