Corn Grit Market Report Scope & Overview:

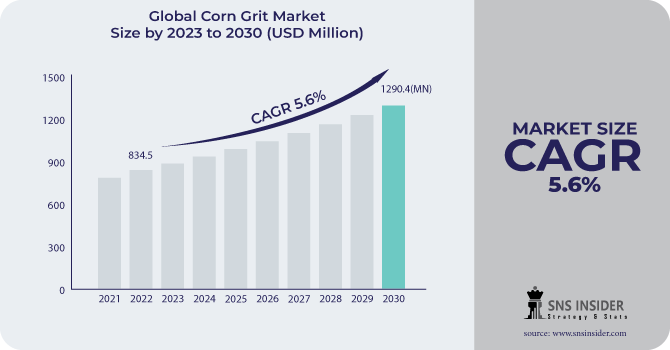

The Corn Grit Market size was USD 881.23 million in 2023, is expected to Reach USD 1439.01 million by 2032, and grow at a CAGR of 5.6% over the forecast period of 2024-2032.

The rise in demand for corn grit in the food and beverage sector is what is fueling the market's expansion. Many different food items, including grits, cornbread, tortillas, and snacks, include corn grit. The market for corn grit is predicted to expand as a result of the rising demand for gluten-free food items. Based on type, the corn grit is segmented as Yellow Corn Grits, purple Corn Grits, and White Corn Grits. By application, the food industry holds a largest segment in 2022.

The market is also anticipated to expand as a result of the rising demand for corn grit from the animal feed industry. Animals can get plenty of protein and energy from corn grit. It is also anticipated that increased disposable income among consumers in developing nations will accelerate market expansion.

MARKET DYNAMICS

KEY DRIVERS

-

Rising awareness of the potential health benefits of corn

Grits made from corn are high in complex carbs, fiber, vitamins, and minerals. They are also gluten-free, making them a popular option for persons suffering from celiac disease or gluten intolerance. Reduced risk of heart disease is one of the specific health benefits of corn grits because corn grits are a good source of dietary fiber, which can help to lower cholesterol levels. It Reduces the risk of cancer, Improves digestion, and many other benefits. Corn grit producers can profit from the increased awareness of corn's health benefits by promoting their goods' health benefits and producing new products that are targeted to the needs of health-conscious consumers.

RESTRAIN

-

Competition from other grains

Quinoa is a complete protein, which means it includes all nine essential amino acids that the body cannot synthesize. It is also high in dietary fiber, iron, and magnesium. Millet is high in protein and fiber, as well as iron and calcium. Chia seeds contain protein, fiber, omega-3 fatty acids, and calcium. These grains are frequently regarded as more nutritious and healthier than corn grits. They are also frequently more expensive, making them a less appealing option for consumers on a tight budget. Overall, the popularity of other grains such as quinoa, millet, and chia is posing a challenge to the corn grit business.

OPPORTUNITY

-

Increasing demand for corn grit in ethnic cuisines

Corn grits are a versatile ingredient that can be used in a variety of dishes, from breakfast cereals to snacks to main courses. They are also gluten-free, making them a popular choice for people with celiac disease or gluten intolerance. There are a number of ways to promote corn grits in various culinary applications around the world. One way is to develop new recipes that incorporate corn grits into traditional dishes from other cultures. For example, corn grits could be used to make a gluten-free version of tamales or a corn grit risotto. corn grits can be introduced into Asian cuisine, Mediterranean cuisine, Indian cuisine, and Mexican cuisine beyond traditional ones. With the globalization of cuisines, there is an opportunity to promote corn grits in various culinary applications around the world, introducing them to dishes beyond traditional ones.

CHALLENGES

-

Fluctuation in prices of corn

When the price of corn rises, the price of corn grits may rise as well. This may make corn grits more expensive for customers. Furthermore, when corn prices are variable, it might be difficult for corn grit manufacturers to manage their production and pricing.

IMPACT OF RUSSIA UKRAINE WAR

The Russian invasion of Ukraine has caused major food commodity prices to rise. Corn prices grew by 17.8% in the mid-2022 period. Furthermore, Ukraine and Russia are major producers of wheat, corn, barley, and sunflower oil. maize production and exports from both countries have been hampered by the war, resulting in increased maize prices and a decrease in corn supplies. Corn exports have also suffered as a result of the war. Global corn shipments are predicted to fall 5.7% in 2022 compared to the previous year, according to the USDA. The war in Ukraine has also contributed significantly to this reduction.

IMPACT OF ONGOING RECESSION

Disruptions in supply chains caused by the Russia-Ukraine war, followed by the recession have had an impact on the market for corn grit. The cost of almost every agricultural product, including corn, might increase. The average price of grain in the US has increased by more than 30% since the start of the war in Ukraine. The USDA projects that global corn production will decrease by 1.7% from 2022. This disruption of corn grit production and exports is likely to increase in prices of corn. This will continue to have a negative impact on the corn grit market, as corn grit producers will continue to face higher costs and difficulty obtaining the corn grit they need.

MARKET SEGMENTATION

By Type

-

Yellow Corn Grits

-

Purple corn Grits

-

White Corn Grits

By Distribution Channel

-

Direct Sales

-

Distributor

-

Online Retailers

-

Supermarkets/Hypermarkets

-

Specialty Stores

By Application

-

Food Industry

-

Breakfast Cereals

-

Baking

-

Snacks

-

Beverage Industry

-

Animal Feed

-

Other

.png)

REGIONAL ANALYSIS

North America dominates the market for corn grit with a market share of more than 30% in 2022. This growth is attributed to the rising demand for gluten-free goods and the strong demand for corn grit in the food and beverage industry. The largest market in this area is the United States. In industrialized economies like the United States and Canada, the demand for corn grits is being driven by the rising awareness of the health advantages of corn.

Asia Pacific is the fastest-growing market for corn grit with a CAGR of more than 5% in the upcoming period. This expansion is being driven by rising demand for corn grit in the food and beverage industries, as well as the region's growing population. This region's primary markets are China and India. It is also driving corn grit demand in emerging economies such as India and China.

Europe has a significant market for corn grit with a CAGR of more than 4% during the forecast period. The demand for corn grit in the food and beverage business is rising, and consumer health consciousness is rising, both of which are driving this rise. The three biggest markets in this area are France, Germany, and the United Kingdom.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Corn Grit Market are Cargill Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Bunge Limited, Tate & Lyle PLC, Semo Milling, Didion Milling, The Andersons, Inc., Agrana Beteiligungs-AG, LifeLine Foods, Hodgson Mill, and other key players.

Cargill Incorporated-Company Financial Analysis

RECENT DEVELOPMENTS

In 2023, Hodgson Mill, a top producer of corn grits and other whole grain goods, was purchased by Bob's Red Mill Natural Foods. With this transaction, Bob's Red Mill's retail presence significantly increased.

In 2022, Archer Daniels Midland purchased AGT Food & Ingredients, a Canadian producer of corn grits along with other agricultural commodities. ADM became the world's largest maize processor as a result of this transaction.

In 2021, Honeyville Products, a top producer of corn grits and other culinary components, was purchased by Cargill. With this transaction, Cargill gained a significant footing in the expanding gluten-free sector.

| Report Attributes | Details |

| Market Size in 2023 | USD 881.23 Million |

| Market Size by 2032 | USD 1439.01 Million |

| CAGR | CAGR of 5.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Yellow Corn Grits, purple Corn Grits, White Corn Grits) • By Distribution Channel (Distributor, Direct Sales, Online Retailers, Supermarkets/Hypermarkets, Specialty Stores) • By Application (Food, Beverage, Breakfast Cereals, Baking, Snacks, Animal Feed, Other Industrial Uses) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cargill Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Bunge Limited, Tate & Lyle PLC, Semo Milling, Didion Milling, The Andersons, Inc., Agrana Beteiligungs-AG, LifeLine Foods, Hodgson Mill |

| Key Drivers | • Rising awareness of the potential health benefits of corn |

| Market Restrain | • Competition from other grains |