Gin Market Report Scope & Overview:

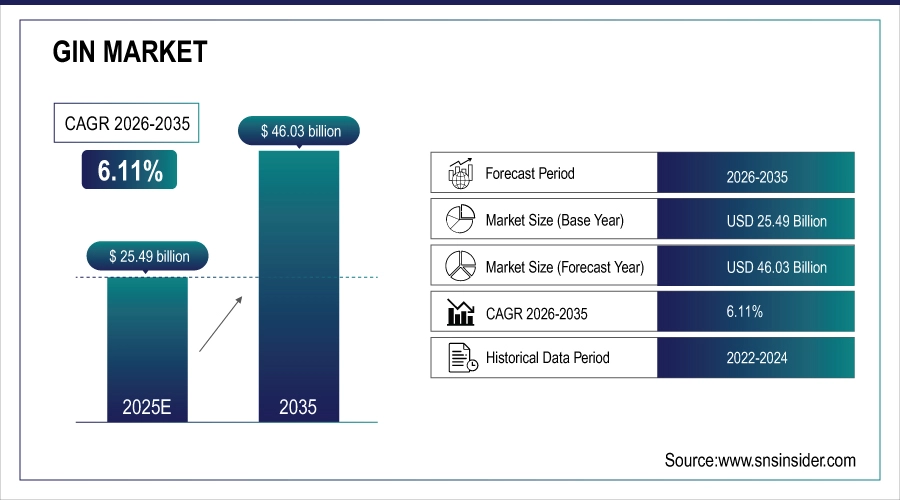

The Gin Market size is valued at USD 25.49 Billion in 2025 and is projected to reach USD 46.03 Billion by 2035, growing at a CAGR of 6.11% during the forecast period 2026–2035.

The Gin Market analysis report provides a comprehensive assessment of market dynamics, product innovations, and consumer trends. Rising premiumization, growing demand for craft and flavored gins, expanding urban nightlife culture, and increasing on-trade and off-trade consumption are driving steady market growth during 2026–2035.

Gin consumption exceeded 4.8 billion liters in 2025, driven by strong demand for premium and craft gins, rising cocktail culture, and expanding on-trade and off-trade retail penetration.

Market Size and Forecast:

-

Market Size in 2025: USD 25.49 Billion

-

Market Size by 2035: USD 46.03 Billion

-

CAGR: 6.11% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Gin Market - Request Free Sample Report

Gin Market Trends:

-

Premiumization and trading-up behavior are driving higher demand for super-premium, craft, and small-batch gin varieties across developed and emerging markets.

-

Rapid expansion of flavored, botanical-infused, and contemporary gins is attracting younger consumers and fueling product experimentation and brand differentiation.

-

Growing cocktail culture and mixology innovation in bars, restaurants, and hospitality venues is strengthening on-premise gin consumption.

-

Rising urbanization and lifestyle shifts are increasing at-home gin consumption through premium retail and experiential packaging formats.

-

Craft distillery proliferation and local sourcing of botanicals are enhancing authenticity, sustainability appeal, and regional brand loyalty.

-

Strategic collaborations between gin producers, hospitality brands, and influencers are accelerating brand visibility, new product launches, and market penetration.

U.S. Gin Market Insights:

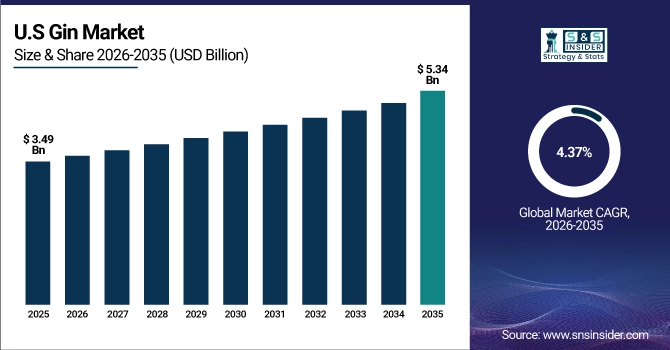

The U.S. Gin Market is projected to grow from USD 3.49 Billion in 2025 to USD 5.34 Billion by 2035, at a CAGR of 4.37%. Growth is driven by rising premium and craft gin demand, expanding cocktail culture, urban nightlife, flavored gin innovations, and increasing adoption across bars, restaurants, and at-home consumption.

Gin Market Growth Drivers:

-

Rapid premiumization and cocktail culture expansion driving demand for high-quality and craft gin varieties.

Rapid premiumization and the expansion of cocktail culture are major drivers of Gin Market growth. Consumers are increasingly trading up to premium, super-premium, and craft gin offerings, driven by evolving taste preferences and experiential drinking trends. Bars, restaurants, and hospitality venues are expanding curated gin menus and signature cocktails, boosting on-premise demand. Simultaneously, at-home cocktail consumption and innovative botanical infusions are enhancing product appeal, brand differentiation, and consumer engagement, supporting sustained market expansion across regions.

Over 52% of gin sales in 2025 were generated from premium, super-premium, and craft variants, driven by cocktail culture and premiumization trends.

Gin Market Restraints:

-

High excise duties and strict alcohol regulations are limiting gin affordability and market penetration in emerging economies.

High excise duties and stringent alcohol regulations represent major restraints for the Gin Market. Elevated taxation significantly increases retail prices, limiting affordability and restricting consumer access, particularly in emerging and price-sensitive markets. Complex licensing requirements, advertising restrictions, and varying state-level regulations further challenge market expansion for producers and distributors. Additionally, frequent policy changes, import duties, and compliance costs increase operational burdens, discouraging new entrants and slowing distribution expansion despite growing consumer interest and premiumization trends.

Gin Market Opportunities:

-

Rising demand for craft, flavored, and premium gins presents significant market expansion opportunities.

Rising demand for craft, flavored, and premium gins presents significant opportunities for the Gin Market. Distilleries and beverage companies can capitalize on evolving consumer preferences for unique botanicals, artisanal production, and innovative flavor profiles. Bars, restaurants, and e-commerce platforms are increasingly promoting premium and craft offerings, expanding market reach. Continued innovation in packaging, limited-edition releases, and experiential marketing further enhances brand differentiation, consumer engagement, and loyalty, supporting sustained growth and broader adoption across both on-trade and off-trade channels.

Over 38% of gin sales in 2025 came from craft, flavored, and premium variants, driven by evolving consumer preferences.

Gin Market Segmentation Analysis:

-

By Product Type, London Dry Gin held the largest market share of 38.72% in 2025, while Contemporary / New Western Gin is expected to grow at the fastest CAGR of 8.21% during 2026–2035.

-

By Botanical Base, Juniper-Dominant dominated with 41.56% market share in 2025, whereas Herbal & Spiced variants are projected to record the fastest CAGR of 7.95% through 2026–2035.

-

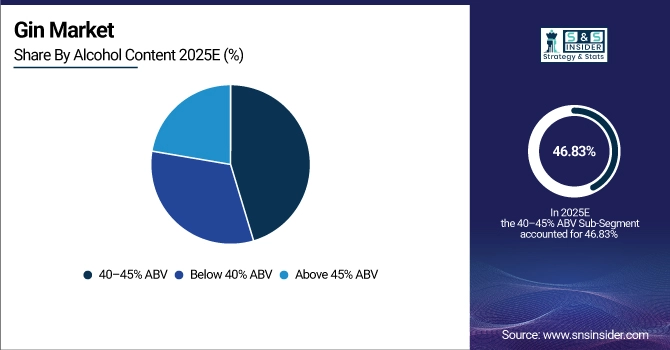

By Alcohol Content, 40–45% ABV accounted for the highest market share of 46.83% in 2025, while Above 45% ABV is expected to grow at the fastest CAGR of 7.12% during the forecast period.

-

By Quality Grade, Premium gin dominated with a 42.19% share in 2025, while Craft gin is anticipated to expand at the fastest CAGR of 8.45% through 2026–2035.

-

By End User, Household / Individual Consumers held the largest share of 53.46% in 2025, while Bars & Restaurants are expected to grow at the fastest CAGR of 7.88% during the forecast period.

By Alcohol Content, 40–45% ABV Dominates While Above 45% ABV Grows Rapidly:

40–45% ABV segment dominated the market due to balanced flavor, versatility in cocktails, and wide availability in retail and on-trade channels. In 2025, consumption exceeded 1.5 billion liters, reflecting broad consumer acceptance across multiple regions and strong preference among both traditional and modern gin enthusiasts.

Above 45% ABV are the fastest-growing segment, driven by craft distilleries, premium launches, and cocktail enthusiasts seeking stronger and bolder flavor profiles. Over 610 million liters were sold in 2025, with notable growth in Europe, North America, and emerging Asian markets embracing high-ABV artisanal gins.

By Product Type, London Dry Gin Dominates While Contemporary / New Western Gin Grows Rapidly:

London Dry Gin segment dominated the market due to its established heritage, broad consumer recognition, and widespread use in classic cocktails. In 2025, sales exceeded 980 million liters, reflecting strong preference among traditional gin consumers and premium bar establishments.

Contemporary / New Western Gin is the fastest-growing segment, driven by innovative botanical blends, flavored infusions, and younger consumers seeking unique tasting experiences. In 2025, over 360 million liters were sold, particularly in urban bars and specialty stores, highlighting rising adoption of craft and experimental gin varieties.

By Botanical Base, Juniper-Dominant Dominates While Herbal & Spiced Gins Grow Rapidly:

Juniper-Dominant segment dominated the market due to their classic flavor profile, versatility in cocktails, and strong brand recognition. In 2025, consumption exceeded 1.2 billion liters, establishing them as the preferred choice in traditional gin markets and driving sustained growth across premium and on-trade channels.

Herbal & Spiced are the fastest-growing segment, fueled by consumer interest in unique botanicals, craft distilleries, and mixology trends. Sales surpassed 320 million liters in 2025, with strong growth observed in premium bars, specialty stores, and online platforms offering experiential and seasonal gin varieties.

By Quality Grade, Premium Gin Dominates While Craft Gin Grows Rapidly:

Premium segment dominated the market due to consumer willingness to pay for quality, brand reputation, and mixology suitability. In 2025, over 1.1 billion liters were sold, particularly in bars, restaurants, and urban households, supporting steady market leadership and driving innovation in flavored and limited-edition gin offerings.

Craft is the fastest-growing segment, propelled by small-batch production, innovative botanicals, and storytelling around heritage and sustainability. Sales exceeded 310 million liters in 2025, with strong adoption in specialty bars, online retail, and premium gifting segments, reflecting rising consumer demand for artisanal and exclusive gin offerings.

By End User, Household / Individual Consumers Dominate While Bars & Restaurants Grow Rapidly:

Household / Individual Consumers segment dominated the market due to increasing at-home cocktail consumption, retail availability, and growing interest in premium and flavored gins. In 2025, over 1.8 billion liters were consumed, highlighting the strong preference for personal consumption and gifting occasions.

Bars & Restaurants are the fastest-growing segment, driven by mixology trends, cocktail menu expansion, and experiential drinking. Over 780 million liters were served in 2025, particularly in urban nightlife hubs and premium hospitality venues, reflecting accelerating adoption of high-quality and craft gins in on-trade channels.

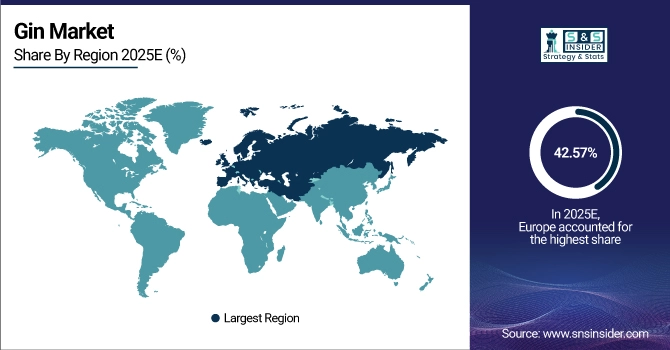

Gin Market Regional Analysis:

Europe Gin Market Insights:

The Europe Gin Market is dominated, holding a 42.57% share in 2025, driven by strong premiumization, growing cocktail culture, and high consumer awareness across the U.K., Germany, France, and Italy. Widespread adoption of London Dry, flavored, and craft gins in bars, restaurants, and retail channels fuels growth. Expanding mixology trends, innovative botanical infusions, limited-edition releases, e-commerce expansion, and experiential marketing reinforce Europe’s leadership, supporting sustained market development and robust regional consumption through 2035.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.K. Gin Market Insights:

The U.K. is a key market in the European Gin landscape, driven by strong premiumization, established cocktail culture, and high consumer awareness. Growth is supported by widespread adoption of London Dry, flavored, and craft gins, expanding bar and restaurant networks, innovative botanical infusions, and increasing e-commerce and retail penetration.

Asia-Pacific Gin Market Insights:

The Asia-Pacific Gin Market is the fastest-growing region, projected to expand at a CAGR of 7.81% during 2026–2035. Growth is driven by rising urbanization, increasing disposable incomes, and expanding cocktail culture across China, India, Japan, and Southeast Asia. Strong demand for premium, craft, and flavored gins, along with growing bar, restaurant, and e-commerce channels, innovative botanical infusions, and experiential marketing, are accelerating consumption and fueling robust market expansion in the region.

China Gin Market Insights:

The China Gin Market is driven by rising disposable incomes, urbanization, and growing cocktail culture. Increasing demand for premium, craft, and flavored gins, expanding bar and restaurant networks, and rapid growth of e-commerce and retail channels are accelerating consumption, positioning China as a key contributor to Asia-Pacific market expansion.

North America Gin Market Insights:

The North America Gin Market is driven by growing premiumization, cocktail culture, and expanding urban nightlife. Countries such as the U.S. and Canada are shaping regional demand through widespread adoption of London Dry, flavored, and craft gins. Rising at-home cocktail consumption, bar and restaurant expansions, and e-commerce retail growth are boosting sales. Continuous innovations in botanical infusions, limited-edition releases, and experiential marketing strategies reinforce North America’s significance in the gin market.

U.S. Gin Market Insights:

The U.S. Gin Market is driven by strong premiumization trends, growing cocktail culture, and increasing consumer preference for craft and flavored gins. Expanding bar and restaurant networks, e-commerce retail growth, innovative botanical infusions, limited-edition releases, and experiential marketing reinforce the U.S. as the dominant gin market in North America.

Latin America Gin Market Insights:

The Latin America Gin Market is growing due to rising disposable incomes, urbanization, and expanding cocktail culture. Adoption is supported by increasing demand for premium, craft, and flavored gins across Brazil, Mexico, and Argentina, with bar and restaurant expansions, retail growth, and innovative marketing strategies driving regional market development and strengthening consumer engagement.

Middle East and Africa Gin Market Insights:

The Middle East & Africa Gin Market is expanding due to rising urbanization, increasing disposable incomes, and growing cocktail culture. Demand for premium, craft, and flavored gins is rising across Saudi Arabia, the UAE, and South Africa. Expanding bar networks, retail availability, and e-commerce channels are driving regional market growth and consumer adoption.

Gin Market Competitive Landscape:

Diageo plc is a British multinational alcoholic beverages leader, dominating the gin market with iconic brands such as Tanqueray and Gordon’s. The company leverages heritage, innovation in flavor variants, limited-edition releases, and premiumization to attract diverse consumers. Its vast distribution network spans bars, restaurants, retail, and e-commerce, enhancing reach. Strategic acquisitions, sustainability initiatives, and strong marketing campaigns reinforce brand visibility. Diageo’s continuous investment in emerging markets, mixology trends, and digital engagement solidifies its leading position in the gin sector.

-

In September 2025, Diageo plc launched Gordon’s Spritz Edition, featuring Strawberry Passionfruit and Lime Elderflower variants, aiming to capture rising at-home cocktail trends, simplify drink preparation, and expand appeal among casual and social gin consumers in the UK, with plans for rollout.

Pernod Ricard SA, a French multinational spirit’s conglomerate, holds a significant share of the gin market through brands such as Beefeater, Monkey 47, Malfy, and Plymouth Gin. The company emphasizes premiumization, product innovation, and experiential marketing to capture urban and upscale consumers. Its extensive presence in over 160 countries, strong supply chain, and strategic acquisitions enhance market penetration. By focusing on sustainability, regional brand development, and emerging consumer trends, Pernod Ricard continues to expand its leadership and influence in the competitive gin market.

-

In December 2025, Pernod Ricard SA introduced the Seagram’s Xclamat!on range, including a premium gin variant, aiming to target aspirational consumers in India, blend local botanicals with expertise, strengthen premium positioning, and drive growth in emerging gin markets.

Bacardi Limited is a family-owned multinational spirits company and a dominant player in the gin market, with flagship brands such as Bombay Sapphire. The company emphasizes premium quality, innovative botanical blends, and mixologist-focused marketing to appeal to both on-trade and off-trade consumers. Bacardi’s extensive distribution network, brand heritage, and sustainability initiatives strengthen market presence. Strategic investments in emerging markets, e-commerce, and limited-edition offerings drive adoption. Continuous innovation, brand storytelling, and strong consumer engagement reinforce Bacardi’s leadership in the gin sector.

-

In May 2025, Bacardi Limited (Bombay Sapphire) launched the “Step Into The Blue” brand platform, aiming to enhance brand visibility, elevate consumer engagement through immersive marketing and partnerships, and reinforce leadership in the premium gin segment.

Gin Market Key Players:

Some of the Gin Market Companies are:

-

Diageo plc

-

Pernod Ricard SA

-

William Grant & Sons Ltd.

-

Beam Suntory Inc.

-

Rémy Cointreau SA

-

The Bombay Spirits Company Ltd.

-

Lucas Bols N.V.

-

Suntory Holdings Limited

-

San Miguel Corporation (Ginebra San Miguel)

-

Sipsmith Ltd.

-

The East India Company Spirits Ltd.

-

Greenall’s Gin (Quintessential Brands Group)

-

Adnams plc

-

Masons of Yorkshire

-

Hayman Distillers

-

Aviation American Gin

-

Four Pillars Distillery

-

Brockmans Gin

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 25.49 Billion |

| Market Size by 2035 | USD 46.03 Billion |

| CAGR | CAGR of 6.11% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (London Dry Gin, Plymouth Gin, Old Tom Gin, Genever, Contemporary / New Western Gin, Flavored Gin, Others) • By Botanical Base (Juniper-Dominant, Citrus, Herbal & Spiced, Floral, Fruit-Based, Others) • By Alcohol Content (Below 40% ABV, 40–45% ABV, Above 45% ABV) • By Quality Grade (Economy, Premium, Super-Premium, Craft) • By End-User (Household / Individual Consumers, Bars & Restaurants, Hospitality Sector, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Diageo plc, Pernod Ricard SA, Bacardi Limited, William Grant & Sons Ltd., Beam Suntory Inc., Campari Group, Rémy Cointreau SA, The Bombay Spirits Company Ltd., Lucas Bols N.V., Suntory Holdings Limited, San Miguel Corporation (Ginebra San Miguel), Sipsmith Ltd., The East India Company Spirits Ltd., Greenall’s Gin (Quintessential Brands Group), Adnams plc, Masons of Yorkshire, Hayman Distillers, Aviation American Gin, Four Pillars Distillery, Brockmans Gin |