Corrosion Resistant Fiberglass Pumps Market Report Scope & Overview:

The Corrosion Resistant Fiberglass Pumps Market was valued at USD 1.46 Billion in 2025 and is expected to reach USD 2.85 Billion by 2035, growing at a CAGR 6.92% of from 2026-2035.

The Corrosion Resistant Fiberglass Pumps market is experiencing robust growth, driven by rising demand from chemical processing, water & wastewater treatment, oil & gas, and mining industries handling highly corrosive fluids. Increasing replacement of metal pumps due to corrosion-related failures, lower lifecycle and maintenance costs, and stricter environmental and safety regulations are accelerating adoption. Rapid industrial expansion, infrastructure upgrades, and growing focus on durable, lightweight, and energy-efficient pumping solutions are further supporting market growth across major regions.

In 2025, corrosion-resistant fiberglass pumps were deployed across more than 55 industrialized countries, enabling chemical, water & wastewater, and oil & gas facilities to achieve up to 35% longer equipment lifespan and 25% reduction in maintenance and downtime costs compared to conventional metal pump systems operating in highly corrosive environments.

Corrosion Resistant Fiberglass Pumps Market Report Size and Forecast

-

Market Size in 2025: USD 1.46 Billion

-

Market Size by 2035: USD 2.85 Billion

-

CAGR: 6.92%

-

Base Year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

To Get more information on Corrosion Resistant Fiberglass Pumps Market - Request Free Sample Report

Trends Corrosion Resistant Fiberglass Pumps Market

-

Increasing Adoption in Chemical Processing Industries: Growing handling of aggressive acids, alkalis, and corrosive fluids is accelerating the shift from metal to fiberglass pumps.

-

Rising Demand from Water & Wastewater Treatment: Expansion of desalination, effluent treatment, and wastewater recycling facilities is boosting demand for corrosion-resistant pumping solutions.

-

Replacement of Traditional Metal Pumps: End users are increasingly replacing cast iron and steel pumps to reduce corrosion failures, downtime, and lifecycle costs

-

Lightweight & Energy-Efficient Pump Designs: Manufacturers are focusing on advanced fiberglass composites to improve hydraulic efficiency and reduce energy consumption.

-

Industrial Growth in Emerging Economies: Rapid industrialization, infrastructure expansion, and stricter environmental regulations in Asia Pacific, Latin America, and the Middle East are supporting market expansion.

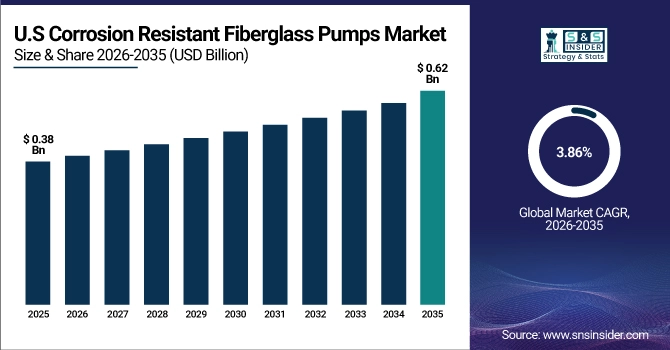

U.S. Corrosion Resistant Fiberglass Pumps Market Insights:

The U.S. Corrosion Resistant Fiberglass Pumps Market is projected to grow from USD 0.38 Billion in 2025 to USD 0.62 Billion by 2035, at a CAGR of 3.86%. Growth is driven by rising demand from chemical processing and water & wastewater treatment industries, increasing replacement of metal pumps due to corrosion-related failures, expanding industrial infrastructure, stricter environmental and safety regulations, and growing adoption of lightweight, low-maintenance fiberglass pump solutions across oil & gas, mining, and power generation sectors.

Corrosion Resistant Fiberglass Pumps Market Growth Drivers:

-

Rising Demand from Chemical Processing, Water & Wastewater, and Industrial Applications

The Corrosion Resistant Fiberglass Pumps market is experiencing steady growth due to increasing handling of aggressive chemicals, acids, alkalis, and saline fluids across chemical processing, water & wastewater treatment, oil & gas, mining, and power generation industries. Growing replacement of metal pumps prone to corrosion, lower lifecycle maintenance costs, and improved operational reliability are accelerating adoption. Industrial expansion, infrastructure modernization, and stricter environmental and safety regulations further reinforce market growth momentum.

In 2025, chemical processing and water & wastewater applications accounted for over 55% of total global demand, highlighting their critical role in market expansion.

Corrosion Resistant Fiberglass Pumps Market Restraints:

-

Higher Initial Costs, Limited Awareness, and Performance Constraints in Extreme Conditions

The market faces restraints related to higher upfront costs compared to conventional metal pumps, limited awareness among small and mid-sized industrial users, and performance limitations under extreme pressure or temperature conditions. Additionally, conservative procurement practices and preference for established metal pump technologies slow adoption in certain industries. Availability of alternative corrosion-resistant materials such as high-alloy metals and lined steel pumps also creates competitive pressure.

In 2025, nearly 30% of end users continued to rely on metal-based pumps due to cost sensitivity and established supplier relationships.

Corrosion Resistant Fiberglass Pumps Market Opportunities:

-

Industrial Expansion, Infrastructure Upgrades, and Advancements in Composite Technologies

The market presents strong growth opportunities driven by rapid industrialization in emerging economies, expansion of wastewater treatment and desalination infrastructure, and increasing focus on corrosion-resistant, energy-efficient equipment. Advancements in fiberglass composite formulations, improved manufacturing techniques, and customization for harsh operating environments are expanding application potential. Growing investments in sustainable industrial infrastructure and lifecycle cost optimization are creating favorable conditions for new installations and replacement demand.

By 2025, over 40% of new fiberglass pump installations were linked to infrastructure upgrades and industrial capacity expansion projects, supporting long-term growth potential.

Corrosion Resistant Fiberglass Pumps Market Segment:

-

By Deployment Type: In 2025, direct sales dominated the market with approximately 48% share; online sales are projected to be the fastest-growing channel during 2026–2035.

-

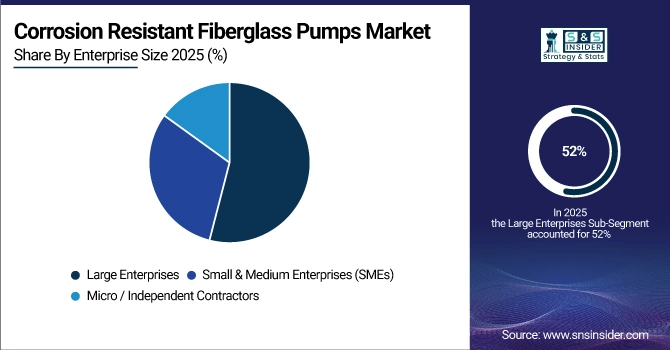

By Enterprise Size: In 2025, large enterprises accounted for around 52% share; small & medium enterprises (SMEs) are expected to be the fastest-growing segment during 2026–2035.

-

By Application: In 2025, chemical processing dominated with nearly 44% share; water & wastewater treatment is anticipated to be the fastest-growing application during 2026–2035

-

By End User: In 2025, industrial manufacturers held about 47% share; water & wastewater utilities are projected to be the fastest-growing end-user segment during 2026–2035.

Corrosion Resistant Fiberglass Pumps Market Segment Analysis

By Enterprise Size: Large Enterprises Lead as SMEs Emerge as Fastest-Growing Segment

Large enterprises dominate the enterprise size segment due to their high-volume procurement needs, capital-intensive operations, and continuous demand for corrosion-resistant pumping solutions across large-scale industrial facilities. These organizations prioritize lifecycle cost optimization, reliability, and long-term operational efficiency, making fiberglass pumps a preferred choice for handling corrosive fluids. Strong capital availability and structured maintenance programs further support dominance of large enterprises.

Small & medium enterprises are the fastest-growing segment, supported by expanding industrial activity, increasing awareness of corrosion-related downtime costs, and growing adoption of cost-effective, low-maintenance fiberglass pumps in regional manufacturing and treatment facilities.

By Deployment Type: Direct Sales Lead as Online Sales Emerge as Fastest-Growing Segment

Direct sales dominate the deployment type segment due to strong preference among industrial buyers for customized pump specifications, technical consultation, on-site evaluation, and long-term service contracts. Large industrial customers in chemical processing, water & wastewater treatment, and oil & gas sectors rely on direct engagement with manufacturers to ensure performance reliability, material compatibility, and compliance with operational standards. Established distributor networks and OEM-led sales channels further reinforce the dominance of direct sales globally.

Online sales represent the fastest-growing segment, driven by increasing digital procurement adoption among small and mid-sized enterprises, improved availability of standardized pump models, and growing use of e-commerce platforms for replacement parts and small-capacity pumps.

By Application: Chemical Processing Leads as Water & Wastewater Treatment Emerges as Fastest-Growing Segment

Chemical processing dominates the application segment due to extensive handling of aggressive acids, alkalis, and corrosive chemicals that require non-metallic, corrosion-resistant pumping solutions. Fiberglass pumps offer superior chemical resistance, longer service life, and reduced maintenance compared to metal alternatives, making them essential in chemical manufacturing, specialty chemicals, and downstream processing operations. Rising regulatory pressure and safety requirements further strengthen adoption in this segment.

Water & wastewater treatment is the fastest-growing application, driven by expansion of municipal and industrial treatment facilities, desalination plants, and wastewater recycling infrastructure. Increasing focus on environmental compliance, corrosion mitigation, and long-term operational reliability is accelerating demand for fiberglass pumps in this application.

By End User: Industrial Manufacturers Lead as Water & Wastewater Utilities Emerge as Fastest-Growing Segment

Industrial manufacturers dominate the end-user segment due to widespread use of corrosion-resistant fiberglass pumps across chemical plants, refineries, power generation facilities, and mining operations. Continuous production environments, exposure to corrosive fluids, and high cost of downtime make durable fiberglass pumps a critical component of industrial fluid-handling systems. Established procurement cycles and replacement demand further support leadership of this segment.

Water & wastewater utilities represent the fastest-growing end-user segment, supported by rising investments in treatment infrastructure, aging pipeline replacement, and increasing adoption of corrosion-resistant equipment to improve system reliability and reduce long-term maintenance costs.

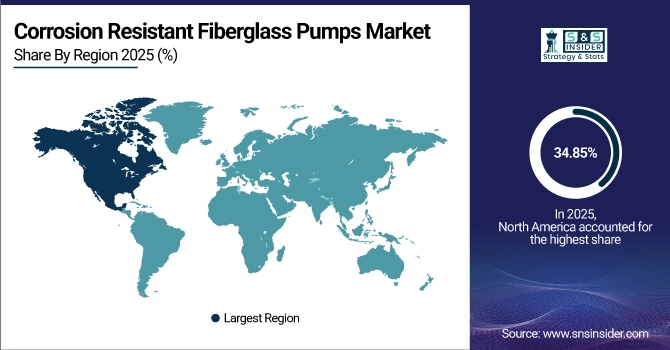

Corrosion Resistant Fiberglass Pumps Market - Regional Analysis

North America Corrosion Resistant Fiberglass Pumps Market Insights:

In 2025, North America Corrosion Resistant Fiberglass Pumps Market accounting for the highest regional revenue share of approximately 34.85%. This dominance is driven by strong presence of chemical processing and water & wastewater treatment industries, high replacement demand for corrosion-prone metal pumps, and early adoption of advanced fiberglass composite pumping solutions. Ongoing investments in industrial infrastructure, stringent environmental and safety regulations, and widespread use across oil & gas, power generation, and mining operations further support North America’s leadership in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Corrosion Resistant Fiberglass Pumps Market Insights:

Asia-Pacific is the fastest-growing region, expected to grow at a CAGR 10.43% during the forecast period 2026-2035. Growth is driven by rapid industrialization, expanding chemical manufacturing, and large-scale investments in water and wastewater treatment infrastructure across China, India, and Southeast Asia. Rising replacement of metal pumps, stricter environmental regulations, cost advantages of fiberglass materials, and increasing adoption in oil, gas, power generation, and mining sectors support demand. Government-backed infrastructure programs, urbanization, and localization of industrial production further accelerate market expansion across the region during the forecast period.

Europe Corrosion Resistant Fiberglass Pumps Market Insights:

Europe holds a significant share of the Corrosion Resistant Fiberglass Pumps Market, supported by strong chemical manufacturing, advanced water & wastewater treatment infrastructure, and strict environmental and safety regulations driving replacement of metal pumps. Focus on energy efficiency, sustainability, and lifecycle cost reduction continues to support steady market growth across major industrial economies.

Latin America Corrosion Resistant Fiberglass Pumps Market Insights:

Latin America is witnessing moderate growth, driven by expanding mining, oil & gas, and water treatment activities across Brazil, Mexico, and Chile. Increasing investments in industrial infrastructure, corrosion mitigation in harsh operating environments, and gradual adoption of cost-effective fiberglass pumping solutions are supporting market expansion.

Middle East & Africa Corrosion Resistant Fiberglass Pumps Market Insights:

The Middle East & Africa market is growing steadily, driven by rising desalination capacity, water & wastewater treatment projects, and oil & gas operations requiring corrosion-resistant equipment. Harsh climatic conditions, high salinity fluids, and increasing infrastructure investments are accelerating adoption of fiberglass pumps across the region.

Corrosion Resistant Fiberglass Pumps Market Competitive Landscape:

Flowserve Corporation, headquartered in Irving, Texas, USA, is a global leader in industrial pumping solutions, with a strong presence in corrosion-resistant fiberglass and composite pumps for chemical processing, water & wastewater, oil & gas, and power generation industries. The company’s extensive product portfolio, global service network, and focus on engineered, application-specific solutions strengthen its competitive position in handling highly corrosive fluids across critical industrial environments.

-

June 2025, Flowserve expanded its corrosion-resistant composite pump portfolio and enhanced manufacturing capabilities to address rising demand from chemical and wastewater treatment projects in North America and Asia-Pacific.

ITT Inc., headquartered in Stamford, Connecticut, USA, is a major player in the corrosion-resistant pump market through its industrial process and specialty pump offerings. The company serves chemical, mining, energy, and water sectors, leveraging advanced materials engineering, reliability-focused designs, and strong aftermarket services. ITT’s emphasis on operational efficiency and lifecycle cost optimization reinforces its market leadership.

-

May 2025, ITT introduced upgraded fiberglass-reinforced pump systems with improved hydraulic efficiency and extended service life for aggressive chemical handling applications.

Sulzer Ltd., headquartered in Winterthur, Switzerland, is a prominent global supplier of engineered pumps, including corrosion-resistant fiberglass and composite solutions for demanding industrial applications. Sulzer has a strong footprint in chemical processing, water & wastewater, and energy industries, supported by advanced R&D capabilities and a global manufacturing and service presence. Its focus on sustainability and energy-efficient technologies strengthens its competitive standing.

-

April 2025, Sulzer expanded its composite materials research and regional service centers to support growing demand for corrosion-resistant pumping solutions in Europe and emerging markets.

Corrosion Resistant Fiberglass Pumps Market Key Players

-

Flowserve Corporation

-

ITT Inc.

-

KSB SE & Co. KGaA

-

Xylem Inc.

-

Grundfos Holding A/S

-

Ebara Corporation

-

SPX FLOW, Inc.

-

Weir Group PLC

-

Wilo SE

-

Watson-Marlow Fluid Technology Group

-

Verder Group

-

Iwaki Co., Ltd.

-

CP Pumpen AG

-

Richter Chemie-Technik GmbH

-

Sundyne Corporation

-

Crane Co.

-

Tsurumi Manufacturing Co. Ltd.

-

Vanton Pump & Equipment Corp.

-

Fybroc (CECO Environmental)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.46 Billion |

| Market Size by 2035 | USD 2.85 Billion |

| CAGR | CAGR of 6.92% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Type (Direct Sales, Distributor / Dealer Sales, Online Sales, Others) •By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises, Micro / Independent Contractors, Others) •By Application (Chemical Processing, Water & Wastewater Treatment, Oil & Gas, Power Generation, Mining & Industrial Processing, Others) •By End User (Industrial Manufacturers, Water & Wastewater Utilities, Oil & Gas Operator, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Flowserve Corporation, ITT Inc., Sulzer Ltd., KSB SE & Co. KGaA, Xylem Inc., Grundfos Holding A/S, Ebara Corporation, SPX FLOW, Inc., Pentair plc, Weir Group PLC, Wilo SE, Watson-Marlow Fluid Technology Group, Verder Group, Iwaki Co. Ltd., CP Pumpen AG, Richter Chemie-Technik GmbH, Sundyne Corporation, Crane Co., Tsurumi Manufacturing Co Ltd., Vanton Pump & Equipment Corp., Fybroc (CECO Environmental) |