Water and Wastewater Treatment Equipment Market Report Scope & Market Overview:

To get more information on Water and Wastewater Treatment Equipment Market - Request Free Sample Report

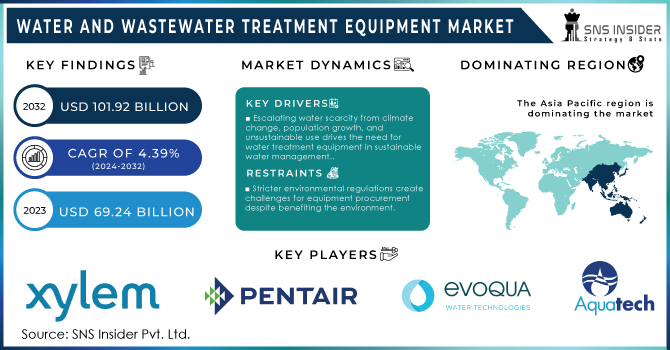

The Water and Wastewater Treatment Equipment Market Size was valued at USD 69.24 Billion in 2023 and is expected to reach USD 101.92 billion by 2032 and grow at a CAGR of 4.39% over the forecast period 2024-2032

The Water and Wastewater Treatment Equipment Market focus on the development which is to produce essential equipment to treat wastewater being released back into the environment after re-use. Several types of development such as urbanization or industrialization have meant that a large amount of untreated wastewater flows into rivers Killing fish and plants, which threaten mankind beyond aquatic systems A combined 380 trillion liters (380 billion) worth of sewage is released globally into rivers and oceans each year. Therefore, global fresh water draw off is thermodynamically dominated by more than 70% in support of crop cultivation A large number of agricultural drains into rivers and streams, leaving them poisoned However, just 24% of economic and domestic effluent is treated before it is thrown away in our rivers or used again on farms. Sustainable water management practices are critical at a time when world's fresh water resources are being overcome by growing populations, expansion of industries and factories. More than consumers, even enterprises are understanding the need for responsible water management and reducing footprint on environment. Every government in the world is making or has a license for stricter regulations on wastewater expulsion, and it demands proper treatment techniques. With penetrating industrialization, the water used in a variety of industrial processes increases considerably and it could be difficult to achieve good results with wastewater treatment. Decrepit water infrastructure in many areas requires investments to replace treatment plants with any advanced technology.

The environmental regulations regarding wastewater discharge and water quality standards, especially enforced by the US Environmental Protection Agency (EPA), have led to a growing demand in advanced treatment technologies. Expansion of industrial sector, which represented more than 35% market revenue share in 2023 is expanding further and will create the need for innovative water treatment solutions that are capable to treat heavy-duty industrial effluents. Approximately 30% of US water infrastructure is over 50 years old, requiring substantial upgrades and replacements, thereby driving the demand for new treatment equipment.

Several factors drive the growth of Water and Wastewater Treatment Equipment Market. Rise in demand for advanced wastewater treatment technologies due to stringent government regulations is major represent the growth of this industry across several regions. Increasing consumer and industrial awareness for environmental protection, sustainable water consumption is driving the demand of advance treatment systems. In addition, expansion of cities and industrial land is increasing pressure for available water resources, thereby requiring investments in infrastructure related with sewage treatment. Broad technological developments in the Water and Wastewater Treatment Equipment Market have resulted in increased efficiencies of treatment systems and further environmental sustainability of these solutions.

Established players are seeking to expand their product portfolios and geographical reach through strategic acquisitions. For example, in November 2023: Evoqua Water Technologies, an industry leader in mission-critical water treatment solutions, announced that it has entered into a definitive agreement to acquire privately-held Smith Engineering, Inc. The acquisition will enhance Evoqua's portfolio of high purity water treatment systems and expand its service footprint in North America.

MARKET DYNAMICS

KEY DRIVERS

-

Escalating water scarcity due to climate change, population growth, and unsustainable usage drives the need for water treatment equipment in sustainable water management practices.

Water scarcity is a growing concern globally, influenced by several factors including climate change, burgeoning population and unsustainable water management approaches. Longer droughts and less freshwater supply in many regions will result from abrupt changes throughout the year as a consequence of climate change. At the same time, as population grows demand for scarce water derives exponentially. The unsustainable practice of over-extraction from underground water sources, as well as high inefficiencies in agricultural and industrial consumption have increased the problem. The increasing scarcity of fresh water resources accordingly requires the use of sophisticated water treatment systems in addition to comprehensive sustainable solutions for optimized management, application and return. With these technologies we can recycle and reuse water, prevent wastage of water as well as reliable supply of clean for different purposes When incorporated into a water management strategy, these tools can help communities and industries alleviate some of the effects from scarcity, thereby reinforcing environmental sustainability and adaptability against variability in climate.

-

Population growth and urbanization are steadily increasing, putting immense pressure on existing water infrastructure.

World population, which rises now at modest pace with a majority of growth in cities, also makes heavy demand on existing water facilities. The needs for clean water and sanitation are dramatically expanded as more urban dwellers come to cities in search of jobs. The development and maintenance of water infrastructure usually lags behind urbanization, which results in overtaxed systems that also tend to be outmoded. This pressure leads to more common outages, water quality problems, and a higher likelihood of contamination. This predicament demands substantial expenditure on improving and extending water treatment plants in line with the city expansion. The importance of advanced water treatment equipment in these upgrades cannot be overemphasized, providing a way for manufacturers to increase capacity and efficiency as well as offer the peace-of-mind that comes with reliable clean water delivery. If infrastructure projects and those driven by population growth or urbanization take better account of the needs of nature too, then cities can certainly build a more positive future around their water resources.

RESTRAINTS

-

Stricter environmental regulations create challenges for equipment procurement despite benefiting the environment.

Stricter environmental regulations are a double-edged sword when it comes to equipment procurement in industries dependent on water treatment solutions. Despite the fact that these regulations are for a good reason, therefore to improve environmental protection and sustainability; they come with challenges in term of complexity as well as cost for businesses. Given this, compliance often requires an upgrade to advanced & usually more costly technical solutions and innovative processes for meeting the strict standards of water treatment and pollution control. A smaller business with a small budget can undoubtedly struggle due to this. Moreover, negotiating the regulatory minefield demands expert knowledge and resources, making it even harder to buy. However, although these factors make it challenging for water treatment vendors to adjust and develop new products; stringent regulations also serve as one of the key drivers pushing innovation in this market, because manufacturers must strive to meet a range of strict requirements aimed at promoting efficiency plus environmental sustainability. Compliant technologies allow companies to show their dedication with sustainability and in a non-biased way draw attention for presenting clear solutions on how they can be compliant, also helping the planet.

-

Aging water infrastructure worldwide creates market opportunities for upgrades but also presents significant challenges.

The worldwide water treatment equipment market is facing challenges due to aged infrastructure. The reality is that regions all over the world have ageing infrastructure, a lot of it in poor condition and unfit for modern water quality requirements or adequate quantities. Which means there is now a strong market need to refresh and replace old systems with smarter technologies which can deliver improved productivity, efficiency. With infrastructure renewal needed on the municipal, industrial and agricultural sides of business there are significant growth opportunities for equipment manufacturers as well service providers. But taking on the issue of aging infrastructure means making big investments and navigating logistical challenges. For public projects it takes long-term, careful planning with regulatory bodies and involves budgetary constraints. In addition, service disruption by infrastructure upgrade can affect the delivery of services including temporary measures to maintain water supply continuity.

KEY MARKET SEGMENTATION

By Product Type

-

Filtration

-

Disinfection

-

Desalination

-

Sludge Treatment

-

Biological

-

Testing

By Process

-

Primary

-

Secondary

-

Tertiary

The tertiary it is expected to be most profitable sector in 2023 by more than 45% share of revenue with CAGR approximately greater than or around 5.2%. The dominance can be attributed to tertiary treatment's vital function in eliminating leftover impurities and contaminants from wastewater, subsequently making the treated water compliant with stringent environmental standards as well safe for reuse purposes. The membrane filtration and disinfection systems provided in this segment are designed to further polish the already treated wastewater by removing any remaining particles, so that it is free from all kinds of contaminants a required for using reuse as irrigation or even industrial water.

By End-User

-

Municipal

-

Industrial

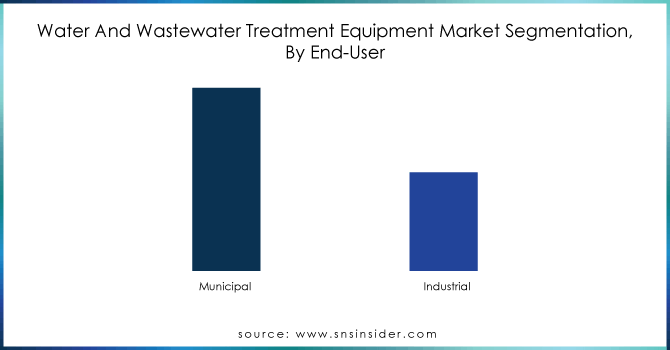

In 2023, municipal segment held a revenue share of around 65% in the market. The burgeoning population in urban regions and government initiatives promoting the development of infrastructure will bolster investments, further enclosing prospects for wastewater treatment systems across developing world including India & China.

The industrial segment is on track to witness CAGR through the projection period. Rapid urbanization, technological progress and an increase in the number of manufacturing facilities are driving up demand for clean fresh or processed water that is to be provided by this capacity build-up.

Need any customization research on Water and Wastewater Treatment Equipment Market - Enquiry Now

Key Regional Analysis

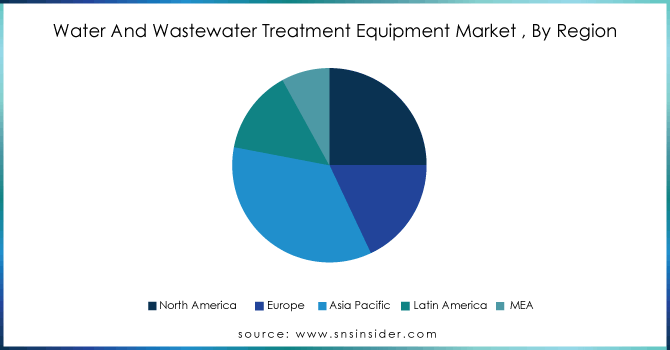

The Asia Pacific region holds the dominant position in the market, accounting for above 35% of the revenue share in 2023. This dominance can be attributed to factors like growing awareness of water conservation and environmental protection among consumers and industries in the region. Additionally, the presence of a large number of established and emerging players in the water and wastewater treatment equipment industry, coupled with government initiatives promoting sustainable water management practices, further fuels market growth in this region. It is estimated that in India almost USD 600 million (48.60 billion INR) is spent per year to tackle waterborne diseases (WBD). In light of this, immediate action is needed to effectively treat wastewater and develop safer reuse prospects. Various wastewater treatment technologies have been established and they work well to provide an alternative water source to meet the growing demand.

In Central and South America, the market is also expected to grow steadily due to government efforts to improve water quality and manage water resources sustainably. This, combined with a strong presence of industries that require effective wastewater treatment, such as food and beverages, is driving market growth there.

North America's water and wastewater treatment equipment market was the fastest-growing region. The United States government offers funds to construct sewage treatment facilities, where wastewater undergoes primary and secondary treatment to fulfill the necessary water standards. Therefore, the government's rigorous regulations are expected to increase demand for water and wastewater treatment equipment in the nation. Furthermore, airport expansions and the construction of large-scale commercial complexes are predicted to drive demand for water treatment equipment throughout the forecast period. Moreover, the US water and wastewater treatment equipment market held the largest market share, and the Canada water and wastewater treatment technology market was the fastest-growing market in the region.

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major Key players are Xylem Inc., Pentair plc, Evoqua Water Technologies LLC, Aquatech International LLC, Ecolab Inc., DuPont, Calgon Carbon Corporation, Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION), Veolia, Group, Ecologix Environmental Systems, LLC, Evonik Industries AG, Parkson Corporation, Lenntech B.V., Samco Technologies, Inc., Koch Membrane Systems, Inc, General Electric and others.

Calgon Carbon Corp-Company Financial Analysis

Recent Development

In November 2023: Veolia (France) and Vendée Eau invested France's first drinking water production unit from treated wastewater in the framework of the Jourdain program. This integrated recovery process is expected to add over 1.5 million cubic meters of potable water into the Vendée area in case of prolonged and increased water stress periods between May and October.

In October 2023: Xylem Inc., a leading player in the market, launched its innovative Leopold Legacy clarifier. This next-generation clarifier offers superior performance and efficiency in removing solids from wastewater, contributing to cleaner water expulsion.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 69.24 Billion |

|

Market Size by 2032 |

US$ 101.92 Billion |

|

CAGR |

CAGR of 4.39% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Product Type (Filtration, Disinfection, Desalination, Sludge Treatment, Biological, Testing) •By Process (Primary, Secondary, Tertiary) •By End-User (Municipal, Industrial) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Pentair plc, Evoqua Water Technologies LLC, Aquatech International LLC, Ecolab Inc., DuPont, Calgon Carbon Corporation, Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION), Ecologix Environmental Systems, LLC, Evonik Industries AG, Parkson Corporation, Lenntech B.V., Samco Technologies, Inc., Koch Membrane Systems, Inc, General Electric |

|

Key Drivers |

• Escalating water scarcity due to climate change, population growth, and unsustainable usage drives the need for water treatment equipment in sustainable water management practices. • Population growth and urbanization are steadily increasing, putting immense pressure on existing water infrastructure.

|

|

Restraints |

• Stricter environmental regulations create challenges for equipment procurement despite benefiting the environment. • Aging water infrastructure worldwide creates market opportunities for upgrades but also presents significant challenges.

|