Cosmetic Isoparaffins Market Report Scope & Overview:

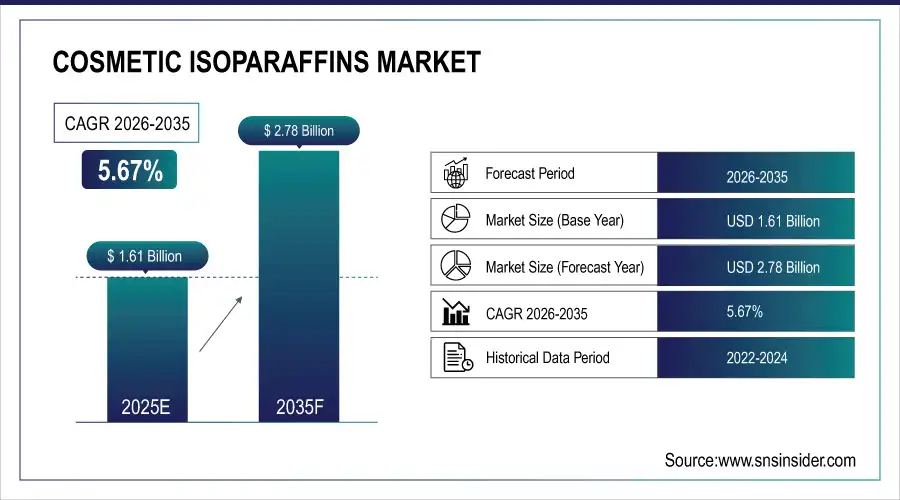

The Cosmetic Isoparaffins Market size was valued at USD 1.61 Billion in 2025 and is projected to reach USD 2.78 Billion by 2035, growing at a CAGR of 5.67% during 2026-2035.

The Cosmetic Isoparaffins Market is growing due to increasing demand for lightweight, non-greasy, and long-lasting formulations in skincare, haircare, and makeup products. Rising consumer awareness of personal grooming, expanding e-commerce channels, and the introduction of innovative cosmetic products are driving growth. Additionally, urbanization, higher disposable incomes, and the shift toward premium and specialty cosmetics are boosting market adoption. Manufacturers are also developing sustainable and safe isoparaffins, further supporting market expansion globally.

Market Size and Forecast:

-

Market Size in 2025: USD 1.61 Billion

-

Market Size by 2035: USD 2.78 Billion

-

CAGR: 5.67% From 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

To Get more information On Cosmetic Isoparaffins Market - Request Free Sample Report

Key Cosmetic Isoparaffins Market Trends

-

Rising consumer preference for lightweight, non-greasy, and long-lasting formulations across skincare, haircare, and makeup.

-

Growth of e-commerce and online retail platforms increasing accessibility and consumption of cosmetic products.

-

Expansion in emerging markets such as Asia Pacific, Latin America, and the Middle East driven by beauty consciousness and international brand popularity.

-

Increasing demand for premium, specialty, and multifunctional cosmetic products including anti-aging, sun protection, and moisturizing solutions.

-

Focus on sustainable and eco-friendly isoparaffins, supported by regulatory emphasis on safe ingredients and innovative formulation technologies.

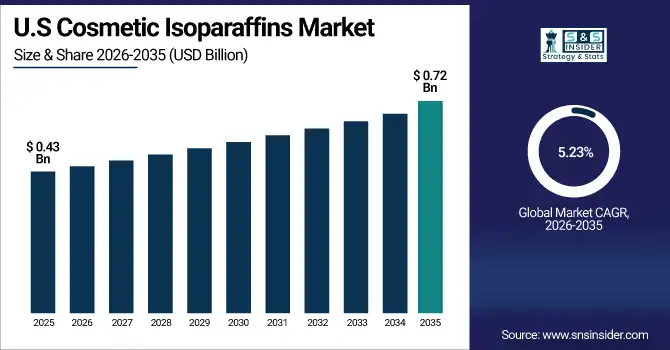

The U.S. Cosmetic Isoparaffins Market size was valued at USD 0.43 Billion in 2025 and is projected to reach USD 0.72 Billion by 2035, growing at a CAGR of 5.23% during 2026-2035. The U.S. Cosmetic Isoparaffins Market is growing due to high consumer demand for premium skincare and makeup products, rising e-commerce sales, increasing awareness of personal grooming, and the adoption of innovative, lightweight, and long-lasting cosmetic formulations.

Cosmetic Isoparaffins Market Growth Drivers:

-

Rising Demand for Lightweight Non-Greasy and Long-Lasting Formulations Drives Global Cosmetic Isoparaffins Market Growth

The global Cosmetic Isoparaffins Market is primarily driven by increasing consumer demand for lightweight, non-greasy, and long-lasting formulations across skincare, haircare, and makeup products. Rapid urbanization, rising disposable incomes, and growing awareness of personal grooming and beauty routines are significantly boosting market adoption. The surge in e-commerce and online retail platforms has also made cosmetic products more accessible, accelerating consumption. Additionally, the trend toward premium and specialty cosmetics, coupled with innovation in formulation technologies, is pushing manufacturers to incorporate isoparaffins for enhanced texture, spreadability, and stability in their products. Regulatory focus on safe and sustainable ingredients is encouraging the development of eco-friendly isoparaffins, further supporting market growth.

Premium, clean‑label, and technologically advanced beauty products are increasingly popular, with more than 60 % of consumers prioritizing wellness‑linked or clean beauty products and over 70 % engaging digitally with brands for discovery and purchase decisions.

Cosmetic Isoparaffins Market Restraints:

-

Consumer Concerns Regulatory Challenges and Raw Material Volatility Restrain Cosmetic Isoparaffins Market Growth

The Cosmetic Isoparaffins Market faces restraints from growing consumer concerns over synthetic ingredients and potential skin irritation, which may limit adoption in sensitive products. Strict regulatory compliance for safety and environmental standards increases formulation costs. Additionally, volatility in raw material availability and prices, along with competition from natural and plant-based alternatives, poses challenges for manufacturers, potentially slowing market growth despite rising cosmetic demand globally.

Cosmetic Isoparaffins Market Opportunities:

-

Emerging Markets in Asia Pacific Latin America and Middle East Drive Cosmetic Isoparaffins Growth Opportunities Globally

Emerging markets in Asia Pacific, Latin America, and the Middle East present significant opportunities for expansion due to rising beauty consciousness, increasing female workforce participation, and the growing popularity of international cosmetic brands. The rise of private-label cosmetic products and personalized skincare solutions offers additional avenues for market penetration. Moreover, innovations in multifunctional formulations, including anti-aging, sun protection, and moisturizing products, are expected to drive higher adoption of isoparaffins globally. Companies investing in research, sustainable production, and strategic partnerships can capitalize on these trends to strengthen their market presence and profitability.

The rise of multifunctional and clean‑label cosmetics was evident in private label launches through 2024, with more than 55 % of new products formulated without parabens, sulfates, and other unwanted ingredients, aligning with consumer demand for safety and sustainability.

Cosmetic Isoparaffins Market Segment Analysis

-

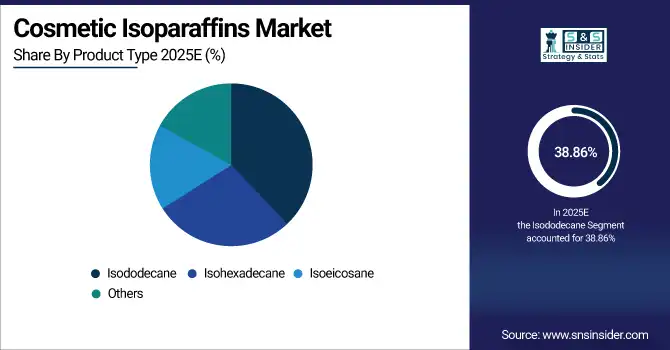

By Product Type, Isododecane dominated with 38.86% in 2025, and Others is expected to grow at the fastest CAGR of 6.64% from 2026 to 2035.

-

By Application, Skincare (lotions, creams, serums) dominated with 38.75% in 2025, and Others (deodorants, sunscreens, lip care) is expected to grow at the fastest CAGR of 6.41% from 2026 to 2035.

-

By Distribution Channel, Online Stores dominated with 34.67% in 2025, and it is expected to grow at the fastest CAGR of 6.04% from 2026 to 2035.

-

By End-User, Cosmetic Manufacturers / Brands dominated with 48.72% in 2025, Retailers / E-commerce Businesses is expected to grow at the fastest CAGR of 6.34% from 2026 to 2035.

By Product Type, Isododecane Dominates Cosmetic Isoparaffins Market While Emerging Variants Gain Popularity By 2035

In 2025, Isododecane remained the most widely used cosmetic isoparaffin, favored for its lightweight, non-greasy texture and versatility across skincare, haircare, and makeup products. Over the coming years, other specialty isoparaffins are expected to gain popularity due to innovation in formulations, including multifunctional and premium cosmetic products. By 2035, these emerging variants are likely to see increased adoption as manufacturers focus on creating novel, high-performance, and consumer-friendly cosmetic solutions worldwide.

By Application, Skincare Leads Cosmetic Isoparaffins Usage While Deodorants Sunscreens And Lip Care Expand Rapidly By 2035

In 2025, skincare products such as lotions, creams, and serums were the primary applications for cosmetic isoparaffins, driven by consumer demand for smooth, long-lasting, and non-greasy formulations. Over the following years, other applications including deodorants, sunscreens, and lip care products are expected to gain traction. By 2035, these segments are likely to expand significantly as consumers increasingly seek multifunctional and specialty cosmetic products with enhanced performance and convenience.

By Distribution Channel, Online Retail Emerges as Fastest Growing Distribution Channel Transforming Cosmetic Isoparaffins Market by 2035

In 2025, online stores were the leading distribution channel for cosmetic isoparaffins, driven by the growing popularity of e-commerce, convenience, and wider product accessibility. Over the coming years, online retail is expected to expand further, becoming the fastest-growing channel. By 2035, digital platforms are likely to play an even more significant role in reaching consumers, supporting increased adoption of cosmetic products and innovative formulations globally.

By End-User, Retailers and E-commerce Set to Dominate Cosmetic Isoparaffins Market by 2035

In 2025, cosmetic manufacturers and brands were the primary end-users of cosmetic isoparaffins, utilizing them extensively in skincare, haircare, and makeup formulations. Over the coming years, retailers and e-commerce businesses are expected to emerge as the fastest-growing end-user segment. By 2035, these channels are likely to expand significantly, driven by direct-to-consumer sales, private-label products, and increasing consumer demand for innovative and convenient cosmetic solutions.

Cosmetic Isoparaffins Market Report Analysis

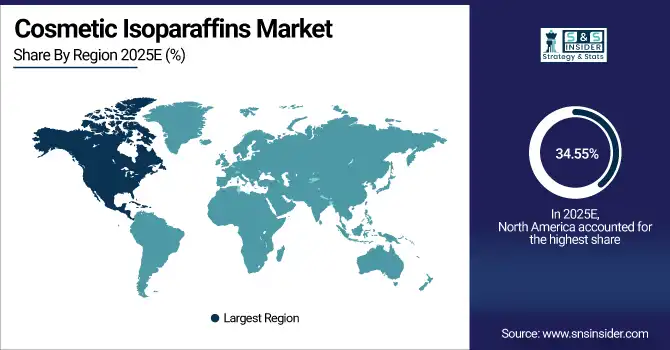

North America Cosmetic Isoparaffins Market Insights

In 2025, North America dominated the global Cosmetic Isoparaffins Market, accounting for approximately 34.55% of total consumption. This leadership is driven by a mature beauty and personal care industry, high consumer awareness of skincare and makeup products, and strong adoption of premium and innovative formulations. The region’s well-established e-commerce platforms and retail networks further supported accessibility and sales. Over the coming years, North America is expected to maintain its significance while emerging markets continue to grow rapidly.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Cosmetic Isoparaffins Market Insights

In North America, the United States dominated the Cosmetic Isoparaffins Market in 2025, driven by high consumer demand for skincare and makeup products, widespread adoption of premium and innovative formulations, and strong e-commerce and retail networks that facilitated accessibility and sales across the country.

Europe Cosmetic Isoparaffins Market Insights

In 2025, Europe accounted for approximately 29.87% of the global Cosmetic Isoparaffins Market. The region’s growth is supported by strong demand for premium skincare, haircare, and makeup products, coupled with high consumer awareness of personal grooming and wellness. Countries like Germany, France, and the UK lead in adopting innovative cosmetic formulations, including multifunctional and eco-friendly products. Established retail networks, rising online sales, and a focus on sustainable and safe ingredients further bolster market growth. Europe continues to be a key hub for cosmetic innovation and consumption.

Germany Cosmetic Isoparaffins Market Insights

In Europe, Germany dominated the Cosmetic Isoparaffins Market in 2025, driven by strong consumer demand for premium skincare and makeup products, high awareness of personal grooming, and widespread adoption of innovative and sustainable cosmetic formulations. Robust retail networks and e-commerce platforms further supported sales and market growth across the country.

Asia Pacific Cosmetic Isoparaffins Market Insights

In the Asia Pacific region, the Cosmetic Isoparaffins Market is expected to experience the fastest growth from 2026 to 2035, with an estimated CAGR of 6.23%. This growth is driven by increasing beauty consciousness, rising disposable incomes, and expanding urban populations. Countries like China, India, and South Korea are leading the adoption of skincare, haircare, and makeup products. The rising popularity of international brands, e-commerce penetration, and demand for innovative and multifunctional cosmetic formulations are further supporting rapid market expansion across the region.

China Cosmetic Isoparaffins Market Insights

In the Asia Pacific region, China dominated the Cosmetic Isoparaffins Market in 2025, driven by rapid urbanization, growing disposable incomes, and increasing beauty consciousness. Strong demand for skincare, haircare, and makeup products, combined with expanding e-commerce platforms and the popularity of international and premium cosmetic brands, fueled market growth.

Latin America (LATAM) and Middle East & Africa (MEA) Cosmetic Isoparaffins Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) cosmetic isoparaffins market is witnessing steady growth driven by rising personal care and beauty product demand, particularly in skincare, haircare, and color cosmetics. Increasing consumer preference for lightweight, non-greasy, and emollient-rich formulations is boosting adoption. Key factors include expanding urban populations, rising disposable incomes, and growing awareness of premium cosmetic products. Additionally, innovations in sustainable and bio-based isoparaffins are supporting market expansion across both regions.

Competitive Landscape for Cosmetic Isoparaffins Market:

Croda International Plc is a global specialty chemicals company focused on personal care, cosmetics, and life sciences markets. It develops innovative ingredients, including emollients, surfactants, and bio-based solutions, enhancing product performance and sustainability. Croda’s offerings support skincare, haircare, and cosmetic formulations across premium and mass-market segments worldwide.

- In April 2025, Croda unveiled Zenakine™, a biotech‑based neuroactive cosmetic ingredient that helps counteract stress effects on the skin and improve overall wellbeing, debuted at the industry’s key event in Amsterdam.

INEOS Group Limited is a British multinational chemicals and petrochemicals conglomerate producing olefins, polymers, specialty chemicals, and oil products for diverse markets including cosmetics, personal care, automotive, packaging, and healthcare. Founded in 1998 and headquartered in London, INEOS operates through multiple business units supplying high‑purity intermediates and raw materials that support modern industrial and consumer applications.

- In April 2024, INEOS Oligomers commissioned a solar farm to provide CO₂‑free electricity to its oligomers facility, supporting more sustainable production of specialty chemicals used in cosmetics, skin care, and other applications.

Cosmetic Isoparaffins Market Key Players:

- Croda International Plc

- INEOS Group Limited

- ExxonMobil Chemical Company

- The Dow Chemical Company

- Shell Chemicals

- Sasol Limited

- Chevron Phillips Chemical Company LLC

- TotalEnergies SE

- Lanxess AG

- Evonik Industries AG

- BASF SE

- Clariant AG

- Honeywell International Inc.

- The Lubrizol Corporation

- Idemitsu Kosan Co., Ltd.

- Nippon Oil Corporation

- Neste Corporation

- SK Global Chemical Co., Ltd.

- Elementis PLC

- Presperse Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.61 Billion |

| Market Size by 2035 | USD 2.78 Billion |

| CAGR | CAGR of 5.67% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Isododecane, Isohexadecane, Isoeicosane, and Others) • By Application (Skincare (lotions, creams, serums), Haircare (conditioners, styling products), Makeup / Color Cosmetics (foundations, lipsticks, eyeliners), and Others (deodorants, sunscreens, lip care)) • By Distribution Channel (Online Stores, Supermarkets / Hypermarkets, Specialty Stores (beauty outlets, professional salons), and Others (direct sales to manufacturers, wholesalers)) • By End-User (Cosmetic Manufacturers / Brands, Professional Salons & Spas, Retailers / E-commerce Businesses, and Research & Formulation Labs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Croda International Plc, INEOS Group Limited, ExxonMobil Chemical Company, The Dow Chemical Company, Shell Chemicals, Sasol Limited, Chevron Phillips Chemical Company LLC, TotalEnergies SE, Lanxess AG, Evonik Industries AG, BASF SE, Clariant AG, Honeywell International Inc., The Lubrizol Corporation, Idemitsu Kosan Co., Ltd., Nippon Oil Corporation, Neste Corporation, SK Global Chemical Co., Ltd., Elementis PLC, Presperse Corporation. |