Diaphragm Pump Market Report Scope & Overview:

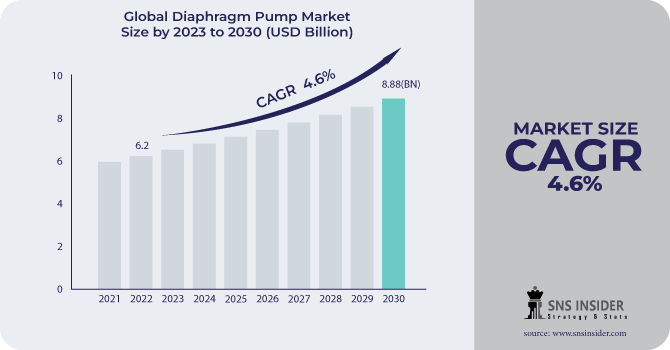

The Diaphragm Pump Market Size was estimated at USD 7.26 billion in 2023 and is expected to arrive at USD 11.25 billion by 2032 with a growing CAGR of 4.99% over the forecast period 2024-2032. The Diaphragm Pump Market report offers unique insights into production output and utilization rates across key regions, highlighting shifts in manufacturing efficiency. It examines technological adoption trends, showcasing advancements in smart monitoring and energy-efficient designs. Additionally, the study details export/import volumes, reflecting global trade dynamics. A deep dive into maintenance costs and downtime metrics provides crucial data on operational reliability. Furthermore, the report includes sustainability-driven innovations, such as material advancements and eco-friendly pumping solutions, shaping the future of diaphragm pumps.

To Get More Information on Diaphragm Pump Market - Request Sample Report

Market Dynamics

Drivers

-

The growing demand for efficient water treatment solutions, driven by urbanization and environmental regulations, is boosting the adoption of diaphragm pumps in municipal and industrial sectors.

The diaphragm pump market is witnessing significant growth, driven by rising demand from the water and wastewater treatment industry. In light of ever-increasing urbanization and industrialization, the demand for water management solutions has witnessed a surging growth, especially in municipal and industrial sectors. There are various types of diaphragm pumps for moving fluids, including important applications to chemical dosing, sludge handling, and wastewater transfer within water treatment plants. Tightened environmental regulations as well as government initiatives regarding treating wastewater recycle also propel growth in the market. The industrial pumps market is showing steady growth, driven by technological advancements in pump technology, like automation and energy-efficient designs, further improving operational efficiency in industries. Moreover, the use of smart monitoring systems in diaphragm pumps is gaining popularity across the globe, which in turn is expected to enhance the performance and minimize the maintenance costs associated with diaphragm pumps. Geographically, the Asia-Pacific region, with a burgeoning infrastructure and rising investment in water treatment projects, is expected to be the fastest growing market over the forecast period.

Restraint

-

Diaphragm pumps have higher initial costs and maintenance requirements due to their complex design and wear-prone components, limiting adoption in cost-sensitive industries.

Diaphragm pumps, while highly efficient and versatile, come with higher initial costs compared to conventional pump systems. The complexity in their design, diaphragms, valves, complex sealing stackup adds to the production cost. These pumps also need ongoing maintenance to deliver optimal performance, as wear and tear will cause diaphragms and seals to wear down. Hence, the regular operational expenditure makes it difficult for some industries to afford diaphragm pumps. Skilled labor is also required to undertake maintenance and repairs, increasing the overall cost of ownership as well. In cases where other pumping technologies (like centrifugal or peristaltic pumps) may be good enough and less costly, companies may turn to cheaper options. Nevertheless, despite these cost concerns, diaphragm pumps continue to be a preferred option in industries that need accurate fluid handling, contamination-free transfer, and capability to handle aggressive chemicals or viscous fluids.

Opportunities

-

Advancements in materials and design have enhanced diaphragm pump durability, efficiency, and adaptability, enabling reliable performance across various industries.

Advancements in materials and design have significantly improved the durability and efficiency of diaphragm pumps, expanding their applications across various industries. The advanced materials like polytetrafluoroethylene (PTFE), elastomers, and corrosion-resistant alloys improve the pumps' capability to handle aggressive chemicals, high temperatures, and abrasive fluids. Fluoropolymers also offer superior protection against wear, chemical degradation, and mechanical stress, leading to a longer lifespan of the pump and lower maintenance costs. New and improved pump designs, including double-diaphragm configurations and enhanced valve systems, allow enhanced performance through features such as reduced pulsation, increased flow rates, and leak-proof operation. As a result of these developments, diaphragm pumps now offer increased reliability in critical applications across diverse industries like pharmaceuticals, food & beverage, wastewater treatment, and chemical processing. Diaphragm pumps are also evolving in terms of adaptability to specific industrial requirements, especially as material science advances, thus contributing to their further penetration into harsh working conditions.

Challenges

-

Diaphragm pumps can have higher energy consumption in large-scale applications due to continuous operation, pulsation effects, and pressure fluctuations, making efficiency optimization crucial.

Diaphragm pumps, while highly efficient in various industrial applications, can face energy consumption concerns in large-scale operations. These pumps are driven by compressed air or electric motors, and in large systems with continuous operation, energy costs can add up. For continuous high flow rate applications, diaphragm pumps also tend to be less energy-efficient than centrifugal or peristaltic pumps. Moreover, pulsation effects and pressure fluctuations can cause increased power consumption. As industries dealing with large-scale fluid transfer, such as oil & gas, chemicals, and wastewater treatment, look for improved pumping solutions to realize energy efficiency and lower operational expenses, these concerns are being addressed with new pump designs, more energy-efficient diaphragms coupled with automation. But for those in energy-conscious industries, weighing the diaphragm pump advantages against energy use continues to play a significant role in decision-making.

Segmentation Analysis

By Operation

The Double segment dominated with the market share of over 68% in 2023, due to its superior efficiency, continuous fluid flow, and capability to handle high-pressure applications. In contrast to single-acting pumps, double-acting diaphragm pumps utilize a pair of diaphragms to achieve consistent discharge without pulsation, making these devices indispensable for critical processes in the industrial sector. As a result, they are extensively used in fluids like corrosive, abrasive, and viscous, across industry sectors like oil & gas, chemical processing, pharmaceuticals, and water treatment. Also find their ability to work with little maintenance and high durability, which makes them well-suited for the global market. With increasing requirement for energy-efficient and reliable pumping solutions in industrial applications, the double-acting diaphragm pumps segment will continue to dominate the market.

By Mechanism

The Air Operated segment dominated with a market share of over 58% in 2023, due to its wide versatility and capability of dealing with fluids of any nature, such as corrosive, abrasive, and viscous. The centre of these pumps provides self-driven ability, dry-run working, and they are used in a risk-free area because of electric danger. Their widespread applications across various sectors like chemicals, pharmaceuticals, food & beverage, oil & gas, and wastewater treatment continue to reinforce their market dominance. Also, minimal maintenance, easy installation, and flexibility to various operational conditions lead to their preferred selection for fluid transfer applications. This makes the diaphragm pumps capable of functioning without any sophisticated electrical components, adding to their reliability and further sharpening their competitive positioning in the global diaphragm pump market.

By End-Use

The Water & Wastewater segment dominated with a market share of over 32% in 2023, driven by the rising need for efficient water treatment solutions across industrial and municipal sectors. Strict environmental regulations and an increasing emphasis on sustainable water management have driven demand significantly. They are commonly used in wastewater treatment as they can handle sludge, abrasive and harsh chemical matter with ease and great efficiency. Their ability to transfer corrosive and viscous fluids, along with their durability and low maintenance features, make them the pump type of choice in the sector. Moreover, concerns regarding water scarcity have grown due to the accelerating pace of urbanization and industrialization, thereby driving the adoption of diaphragm pumps in water treatment and recycling applications across the globe.

.png)

Do You Need any Customization Research on Diaphragm Pump Market - Enquire Now

Regional Analysis

The Asia-Pacific region dominated with a market share of over 38% in 2023, owing to rapid industrialization, growing infrastructure, and increasing demand for efficient fluid handling solutions. Strong industrial base in the region, especially in China, India, and Japan, further drives the high production and adoption of diaphragm pumps across industries. Increase in demand from water treatment, chemical, pharmaceutical, and oil & gas industries is another key driver for the market growth. Moreover, the rising implementation of diaphragm pumps is further attributed to various government initiatives related to waste water treatment along with industrial operations occurring sustainably. The region's leading position is also bolstered by the presence of major market players and the availability of low-cost labor. As consistent strides are being taken in technological development and significant capital investment in industrial automation, Asia-Pacific holds a lead position in the diaphragm pump market.

The Middle East & Africa is the fastest-growing region in the Diaphragm Pump Market, driven by substantial investments in oil & gas, water desalination, and infrastructure development. The demand for diaphragm pumps in upstream and downstream activities is also driven by the need for efficient handling of fluids in vast oil and gas reserves in the region. Furthermore, for the solution of rising water scarcity, governments are significantly investing in desalination plants, that makes diaphragm pumps a necessary component in water facilities, as they conduct the water treatment and the plants that direct the water supply. As cities grow quickly, along with industries, so does the demand for efficient pumping solutions. In addition, favorable government efforts and foreign investments in sustainable projects are driving market growth, rendering the region a crucial hotspot for diaphragm pump adoption.

Some of the major key players in the Diaphragm Pump Market

-

PSG (US) – (Wilden, Blackmer, Almatec, Griswold)

-

Ingersoll Rand Inc. (US) – (ARO Air-Operated Diaphragm Pumps)

-

IDEX Corporation (US) – (Versa-Matic, Warren Rupp, Sandpiper Pumps)

-

Xylem Inc. (US) – (Flojet, Jabsco Diaphragm Pumps)

-

Flowserve Corporation (US) – (Durco, Argus, SIHI Diaphragm Pumps)

-

Grundfos Holding A/S (Denmark) – (DME, DMX Diaphragm Dosing Pumps)

-

Kimray Inc. (US) – (Kimray Pneumatic Diaphragm Pumps)

-

LEWA GmbH (Germany) – (LEWA Ecoflow, LEWA Triplex)

-

Tapflo AB (Denmark) – (Air-Operated Diaphragm Pumps, Sanitary Pumps)

-

Graco Inc. (US) – (Husky Air-Operated Diaphragm Pumps)

-

Yamada Corporation (Japan) – (NDP Series AODD Pumps)

-

Verder Group (Netherlands) – (Verderair Double Diaphragm Pumps)

-

ProMinent GmbH (Germany) – (ProMus, Delta Diaphragm Dosing Pumps)

-

Watson-Marlow Fluid Technology Group (UK) – (Qdos Diaphragm Metering Pumps)

-

SPX Flow (US) – (APV, Johnson Pump Diaphragm Pumps)

-

Dover Corporation (US) – (Blackmer, Wilden Diaphragm Pumps)

-

Tuthill Corporation (US) – (Fill-Rite, Mouvex Diaphragm Pumps)

-

Iwaki Co., Ltd. (Japan) – (IX Series Metering Pumps)

-

Depam (China) – (AODD & Electric Diaphragm Pumps)

-

Shurflo (Pentair) (US) – (Shurflo Industrial & RV Diaphragm Pumps)

Suppliers for (energy-efficient and high-performance diaphragm pumps, widely used in water treatment and industrial applications) on the Diaphragm Pump Market

-

Grundfos

-

IDEX Corporation

-

Ingersoll Rand

-

Graco

-

Wanner Engineering

-

KSB SE & Co. KGaA

-

LEWA GmbH

-

Thompson Pump and Manufacturing

-

Wilo SE

-

Xylem Inc.

Recent Development

-

In April 2024: Dover Corporation unveiled the creation of the Pump Solutions Group (PSG) under its Fluid Solutions platform. PSG brings together prominent brands such as Wilden, Blackmer, Almatec, Mouvex, and Griswold, forming a unified pump organization that offers a range of pump technologies and generates over USD 300 million in annual revenue.

-

In July 2023: LEWA introduced an innovative drive mechanism that provides extensive speed control for diaphragm metering pumps. The LEWA ecodos pumps feature a control range exceeding 1:2000 and offer exceptional energy efficiency, making them ideal for applications in the pharmaceutical and food industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.26 Billion |

| Market Size by 2032 | USD 11.25 Billion |

| CAGR | CAGR of 4.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operation (Single Acting, Double Acting) • By Mechanism (Air Operated, Electrically Operated) • By End Use (Water & Wastewater, Oil & Gas, Chemical & Petrochemical, Pharmaceutical, Food & Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PSG, Ingersoll Rand Inc., IDEX Corporation, Xylem Inc., Flowserve Corporation, Grundfos Holding A/S, Kimray Inc., LEWA GmbH, Tapflo AB, Graco Inc., Yamada Corporation, Verder Group, ProMinent GmbH, Watson-Marlow Fluid Technology Group, SPX Flow, Dover Corporation, Tuthill Corporation, Iwaki Co., Ltd., Depam, Shurflo (Pentair). |