Agrochemical Tank Market Report Scope & Overview:

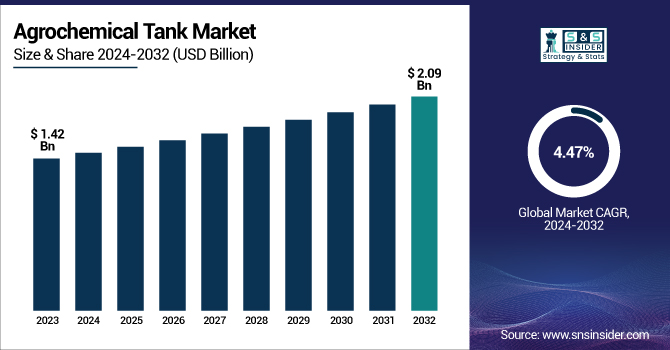

The Agrochemical Tank Market Size was valued at USD 1.42 Billion in 2023 and is expected to reach USD 2.09 Billion by 2032 and grow at a CAGR of 4.47% over the forecast period 2024-2032.

To Get more information on Agrochemical Tank Market - Request Free Sample Report

The Agrochemical Tank Market is rapidly growing due to increasing worldwide demand for efficient chemical storage in agriculture. The tanks play a crucial role in the safe handling, transportation, and storage of fertilizers, pesticides, and other agrochemicals. Improved tank materials, including UV-stabilized polyethylene and corrosion-resistant composites, are driving the performance of the product. The trend of mechanized farming and government safety norms is also boosting the market. This report provides an in-depth analysis of the market forces, upcoming trends, and product innovations.

The U.S. agrochemical tank market was USD 0.23 billion in 2023 and is expected to grow to USD 0.38 billion by 2032 at a CAGR of 5.62% from 2024 to 2032. The Agrochemical Tank Market is increasing steadily because of increasing worldwide demand for safe and efficient storage of fertilizers, pesticides, and other agrochemicals. These tanks are essential to modern agriculture as they provide for proper handling, reduce spillage, and enable large-scale agrochemical usage. Improvements in tank materials, including corrosion-resistant plastics and composites, are leading the way in terms of durability and performance. Higher mechanization, increasing land under cultivation, and stringent environmental laws are also driving market demand.

Agrochemical Tank Market Dynamics

Key Drivers:

-

Increased Adoption of High-Capacity Storage Systems Across Commercial Farms Fuels Agrochemical Tank Market Expansion.

The increased size of commercial farming activities has resulted in the increased requirement for high-capacity agrochemical tanks. These tanks enable bulk buying and secure storage of pesticides and fertilizers, minimizing logistical expenses and downtime. Large farms, especially in North America, Latin America, and Asia-Pacific, are highly mechanized and need tanks that are mobile, robust, and compatible with advanced spraying systems. The response from manufacturers has been to come up with tanks with increased load capacity, corrosion resistance, and temperature tolerance. This is expected to continue and contribute substantially to market growth throughout the forecast period.

Restrain:

-

Growing Concerns Over Chemical Leaks and Soil Contamination Restrain the Agrochemical Tank Market Expansion.

Environmental issues surrounding incorrect storage of agrochemicals are a significant hindrance to market growth. Low-quality or old tanks' leaks and spills can cause soil contamination, groundwater pollution, and health risks, prompting strict government regulations. Small-scale farmers have limited access to high-end tanks due to their unaffordability, hence the likelihood of non-compliance. In addition, poor awareness and training exacerbate the issue. These considerations not only decelerate adoption in some areas but also raise liability for distributors and manufacturers, thus limiting the overall potential of the market.

Opportunities:

-

Technological Innovations in Smart Tanks with IoT Integration Open Up New Growth Prospects in the Agrochemical Tank Market.

The use of smart technologies like IoT, sensors, and remote monitoring systems in agrochemical tanks is creating new growth prospects. These smart tanks can monitor chemical content, temperature, and pressure in real-time and alert users when leaks or topping are due. These solutions enhance safety, efficiency, and regulatory compliance, hence becoming popular with large farming enterprises and agriculture service providers. With precision farming becoming more widespread, the demand for intelligent agrochemical storage systems is rising, especially with advanced technology market countries such as the U.S., Germany, and Australia. This change poses a major opportunity for innovation and differentiation in the market.

Challenges:

-

Inadequacy of Standardization in Tank Manufacturing and Certification Puts Agrochemical Tank Market Growth in Jeopardy.

Despite increasing demand, the agrochemical tank market is hampered by the lack of standardized manufacturing procedures and quality certifications. Differences in tank design, materials, and performance requirements across geographies pose a problem for international trade and compatibility. This fragmentation tends to create compatibility problems, uneven safety standards, and greater maintenance requirements. Moreover, the absence of unified certification systems makes end-user choices more difficult and retards the uptake of newer, more efficient tanks. In the absence of global or regional regulatory harmonization, producers incur delays and additional costs to satisfy different compliance demands, hindering the streamlined growth of the market.

Agrochemical Tank Market Segment Analysis

By Type

Vertical Tanks segment in 2023 dominated the market with the largest revenue share of 31.59% in the Agrochemical Tank Market, fueled by their high efficiency in storage, structural integrity, and ease of integration into farm infrastructure. Such tanks are generally adopted for liquid pesticide and fertilizer storage because they have a compact vertical design that saves space and is long-lasting. Polymaster and Enduramaxx introduced UV-stabilized and corrosion-resistant vertical tanks specifically engineered for agrochemical use. Kingspan also brought in modular vertical storage systems to cater to growing farm-scale needs. This segment continues to lead because it is cost-effective, expandable, and follows current agricultural safety and storage regulations.

The PCU (Polymer Composite Unit) Tanks segment will grow with the highest CAGR of 8.67% due to enhanced preference for weight-reduced, corrosion-proof, and environment-friendly storage solutions. These tanks are specifically designed for transporting and storing numerous agrochemicals with the least risk of contamination. New developments have been the introduction by Agrotank of hybrid polymer tanks with multilayer insulation and chemical-resistant linings, and Tuffa UK's modular PCU tanks for mobile chemical use. With increasing environmental regulations and demand for eco-friendly tank solutions, PCU tanks are becoming increasingly popular among precision farmers and bulk agrochemical distributors, generating strong growth in this segment.

By Application

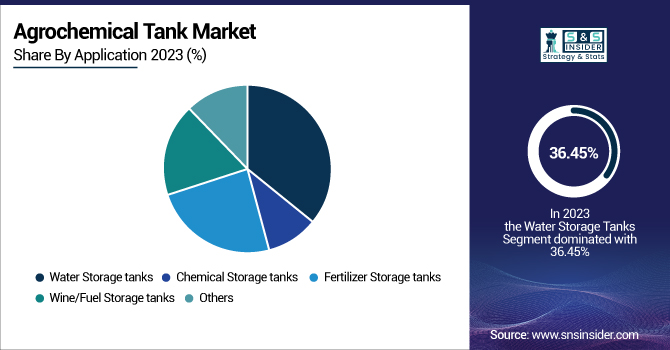

The Water Storage Tanks segment commanded the highest share of 36.45% in 2023, thanks to the growing need for on-farm water saving and irrigation efficiency. These tanks are crucial for mixing agrochemicals, diluting fertilizers, and enabling precision irrigation systems. Firms like Kingspan and Snyder Industries have introduced UV-resistant, modular water tanks designed specifically for agricultural applications. In 2023, Enduramaxx launched a new range of vertical water tanks with reinforced bases to support harsh farm conditions. The growth in water reuse practices and climate-resilient agriculture continues to directly relate to agrochemical applications, underpinning the segment's leadership position in the Agrochemical Tank Market.

The Fertilizer Storage Tank application is expected to expand at the highest CAGR of 6.47%, driven by the escalation of high-yield crop cultivation. Farmers are now using liquid fertilizers that demand special tanks made from corrosion-resistant materials. Double-walled fertilizer tanks with level monitoring integrated in 2024 were introduced by Polymaster. Assmann Corporation also extended its product line with conical-bottom tanks for effective draining of heavy fertilizer liquids. These developments are essential to helping minimize fertilizer wastage and enhance application precision, and thus the segment is an important growth driver in the Agrochemical Tank Market as new-age farming techniques continue to progress.

By Size

The 1000–15000 liters segment had the highest revenue share in 2023, with 28.98%, led by universal adoption across mid-to-large farms requiring effective, mobile agrochemical storage. These tanks provide maximum capacity for mixing, storage, and dispensing fertilizers and pesticides. Polymaster and Enduramaxx have launched durable tanks in this range with UV stabilization and corrosion resistance. Kingspan has recently extended its Titan range aimed at farm cooperatives and contractors. Its popularity is due to its compatibility with mechanized farming machinery and portability capacity balance, and hence it is the favorite among both developed and emerging agricultural economies.

The 15000–30000 liters segment is witnessing the highest growth, with a CAGR of 15.48%, due to industrial-scale farming activity gaining popularity across the world. This size allows bulk storage, minimizing refill frequency and risk of chemical handling. In 2024, Npi Agro released modular tank systems specifically designed for large farms, and Rotoplas launched vertical mega-tanks designed for agrochemical safety. These tanks are becoming more part of centralized chemical supply systems. Their increased application in countries such as Brazil, India, and the U.S. corresponds to increasing agribusiness investments. Improved features such as double-walled construction and real-time tracking are promoting adoption, making this segment one of the most powerful drivers for the future development of the agrochemical tank market.

Agrochemical Tank Market Regional Outlook

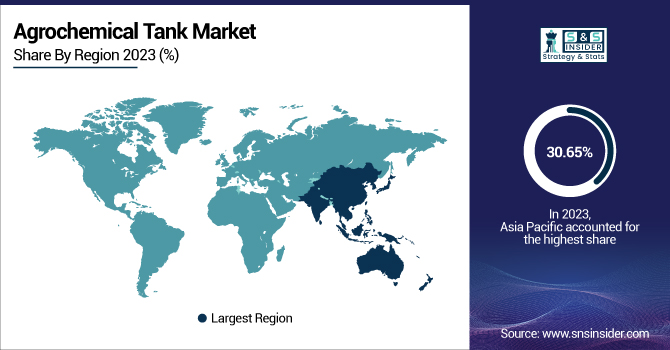

The Asia Pacific region dominated the agrochemical tank market with the largest market share in 2023 at 30.65% of all revenue. The factor behind this market dominance is the expansive agricultural activity in the region, especially in China, India, and Indonesia, where there is an increasing need for effective agrochemical storage due to increased crop protection demands. Product development like Enduramaxx's polyethylene tanks of large capacity and Sintex's vertical, modular tanks have served this need. Governmental assistance for farm infrastructure, combined with increasing agrochemical use, further reinforces the market.

North America is expected to experience the highest growth in the agrochemical tank market at a CAGR of 5.74% over the forecast period, driven by technological innovations and the growing use of precision farming. The U.S. and Canada are at the forefront, led by high-performance, eco-friendly storage demands. Snyder Industries and Chem-Tainer are some of the companies that have come up with intelligent tanks with real-time monitoring technology and corrosion-proof materials. Increased environmental laws by the EPA and the rising demand for secure agrochemical handling are propelling innovation and tank design improvements.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Agrochemical Tank Market are:

-

Highberg Solutions – (AgriGuard Storage Tank, CropSafe Chemical Tank)

-

Poly Processing – (SAFE-Tank Dual Containment System, IMFO Vertical Tank)

-

Balson Polyplast Pvt. Ltd. – (Agrochemical Dosing Tank, HDPE Chemical Storage Tank)

-

Enduramaxx – (Cone Bottom Fertiliser Tank, Bunded Vertical Chemical Tank)

-

AGROCHEM INC. – (Chem-Tainer Cone Tank, AgriBlend Chemical Mixer Tank)

-

National Tank Outlet – (Vertical Polyethylene Chemical Tank, Cone Bottom Injection Tank)

-

Polymaster – (Round Chemical Storage Tank, Liquid Fertiliser Tank)

-

LF Manufacturing – (FRP Vertical Chemical Tank, Horizontal Fiberglass Storage Tank)

-

Grupo Rotoplas – (Roto Agro Tank, Multi-use Chemical Tank)

-

Bnh Gas Tanks – (PE Agrochemical Storage Tank, Dual Layer Chemical Tank)

-

Meridian Manufacturing Inc – (Liquid Hopper Tank, Vertical Chemical Storage Tank)

-

Sintex – (Chemical Dosing Tank, Sintex CV Tank)

-

Sherman Roto Tank – (Heavy-Duty Poly Tank, Cone Bottom Tank for Pesticides)

-

Assmann Corporation – (Double Wall Vertical Tank, Open Top Process Tank)

-

Balmoral Tanks Ltd. – (GRP Sectional Tank, Cylindrical Chemical Tank)

-

JOSHI AGRO INDUSTRIES – (Chemical Sprayer Tank, Portable Agro Tank)

-

NEL TANKS, SINTEX – (Vertical Water & Chemical Tank, Agricultural Dosing Tank)

-

Synder Industries – (Polyethylene Nurse Tank, Square Chemical Tank)

-

Tank Holding Corporation – (Injection-Molded Liquid Tank, Industrial Vertical Storage Tank)

-

FORTI TECHNOLOGY GROUP – (Agrochemical Solution Tank, PE Mixer Tank)

Recent Trends

-

February 2024 – The Smart AgriTank System invented by Highberg Solutions is a next-generation agrochemical storage solution designed to enhance safety, efficiency, and control in chemical handling for agriculture. It combines durable polyethylene construction with an advanced sensor-integrated monitoring system.

-

January 2025 – The Stackable Cone Bottom Tank is an innovative solution designed to optimize space and enhance storage flexibility in the agrochemical sector. It features a modular stacking mechanism that allows users to vertically interlock tanks, effectively increasing capacity without expanding the horizontal footprint.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.42 Billion |

| Market Size by 2032 | US$ 2.09 Billion |

| CAGR | CAGR of 4.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type – (Vertical Tanks, Conical Tanks, Horizontal Tanks, Others, Mother Tanks, PCU Tanks) • By Application – (Water Storage Tanks, Chemical Storage Tanks, Fertilizer Storage Tanks, Others, Wine/Fuel Storage Tanks) • By Size – (200–500 Liters, 500–1000 Liters, 1000–15000 Liters, 15000–30000 Liters, <30,000 Liters) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Highberg Solutions, Poly Processing (Louisiana), Balson Polyplast Pvt. Ltd., Enduramaxx (UK), AGROCHEM INC., National Tank Outlet, Polymaster (Australia), LF Manufacturing (US), Grupo Rotoplas (Mexico), Bnh Gas Tanks, Meridian Manufacturing Inc, Sintex (India), Sherman Roto Tank (Texas), Assmann Corporation (US), Balmoral Tanks Ltd., JOSHI AGRO INDUSTRIES, NEL TANKS, SINTEX, Synder Industries (US), Tank Holding Corporation (USA), FORTI TECHNOLOGY GROUP |