Digital Transaction Management Market Size & Overview:

Get more information on Digital Transaction Management Market - Request Free Sample Report

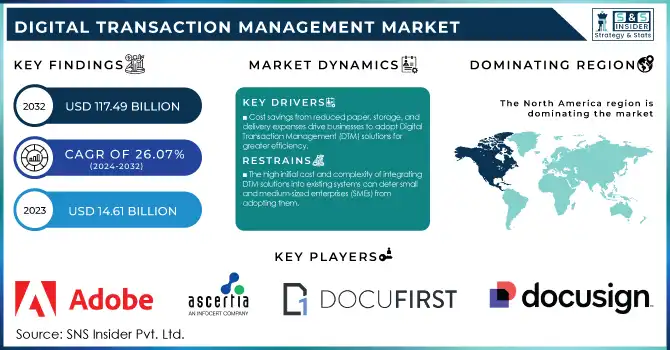

The Digital Transaction Management Market was valued at USD 14.61 billion in 2023 and is expected to increase to USD 117.49 billion by 2032, expanding at a CAGR of 26.07% between 2024 and 2032.

The Digital Transaction Management (DTM) market is experiencing significant growth as organizations continue to shift from traditional paper-based methods to digital solutions that streamline and secure transactions. DTM involves the use of electronic signatures, secure file sharing, and document management systems to automate transaction processes, enhancing operational efficiency and ensuring compliance. This market is driven by the growing demand for businesses to modernize their workflows and offer more seamless, efficient, and secure customer experiences. Key growth drivers include the rise of digital transformation across industries, which is accelerating the adoption of DTM solutions. Remote work trends and the increasing need for secure online transactions are pushing businesses to implement robust solutions that protect data integrity and ensure compliance with various regulations. Moreover, e-commerce's rapid expansion and the need for quicker, secure financial transactions further bolster the demand for DTM tools.

Several trends are shaping the market’s evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into DTM solutions is one of the major developments. These technologies enhance document verification processes, reduce fraud, and optimize transaction management by automating repetitive tasks. Another key trend is the growing popularity of cloud-based DTM platforms, offering scalability, flexibility, and reduced infrastructure costs. Businesses can easily scale these solutions without heavy upfront investments, making DTM accessible for a wide range of organizations, from small startups to large enterprises. Additionally, increasing regulatory requirements, such as GDPR and eIDAS, are pushing businesses to adopt compliant DTM solutions. The market is expected to continue growing as organizations seek paperless solutions to improve operational efficiency, cut costs, and meet regulatory standards. The continuous innovation and evolution in digital transaction technologies indicate a bright future for the DTM market.

MARKET DYNAMICS

DRIVERS

- Cost savings from reduced paper, storage, and delivery expenses drive businesses to adopt Digital Transaction Management (DTM) solutions for greater efficiency.

The Digital Transaction Management (DTM) market is experiencing significant growth as businesses increasingly transition from traditional paper-based processes to digital solutions. One of the key drivers of this growth is the substantial cost savings that DTM solutions offer. By eliminating the need for paper, ink, storage, and physical document delivery, businesses can significantly reduce operational expenses. Digital solutions also streamline workflows, leading to time savings and enhanced productivity. These cost efficiencies are particularly attractive to businesses looking to optimize operations while minimizing overhead. Additionally, as remote work and digital transactions become more common, companies are adopting DTM tools to ensure seamless and secure document management. This trend is further fueled by the rising demand for faster, more efficient processes, especially in industries like finance, healthcare, and legal services. As organizations seek to improve their bottom line, the adoption of DTM solutions continues to rise, driving market expansion.

RESTRAIN

- The high initial cost and complexity of integrating DTM solutions into existing systems can deter small and medium-sized enterprises (SMEs) from adopting them.

The Digital Transaction Management (DTM) market is experiencing rapid growth due to the increasing demand for digital transformation and the need for secure, efficient transaction processes. Cloud-based solutions, integration with business applications, and the use of artificial intelligence (AI) are key trends driving this growth. Businesses are increasingly adopting DTM to reduce costs, enhance security, and improve operational efficiency. The rise in online transactions and government initiatives promoting digital solutions further boost market expansion. However, the initial investment and integration challenges present barriers to adoption, particularly for small and medium-sized enterprises (SMEs). The costs associated with implementing DTM solutions, along with the complexity of integrating them into existing systems, can deter SMEs from adopting these technologies. Despite these hurdles, the benefits of DTM solutions, such as cost savings and improved efficiency, are expected to drive continued growth in the market as businesses seek to stay competitive in a digital-first world.

KEY SEGMENTATION

By Component

The Hardware segment dominated with the market share over 38% in 2023, because it provides the essential physical infrastructure needed for secure and efficient digital transactions. Devices such as biometric systems, card readers, and signature capture tools play a crucial role in ensuring the authenticity and security of transactions. These hardware components enable businesses and organizations to authenticate users, capture signatures, and securely process payments. They are particularly vital in sectors such as banking, retail, and healthcare, where security and compliance are paramount. The growing reliance on secure authentication methods and the need to prevent fraud have made hardware solutions indispensable.

By End-User

The Large enterprises segment dominated with the market share over 62% in 2023, due to their complex needs for secure, scalable, and efficient digital transaction solutions. These organizations handle large volumes of transactions and require robust systems to ensure the security and integrity of sensitive data. DTM solutions provide these enterprises with streamlined document management, enabling them to automate workflows, reduce manual errors, and ensure compliance with regulatory standards. The integration of DTM solutions with other business systems, such as customer relationship management (CRM) or enterprise resource planning (ERP) tools, enhances operational efficiency and facilitates smooth digital processes across various departments.

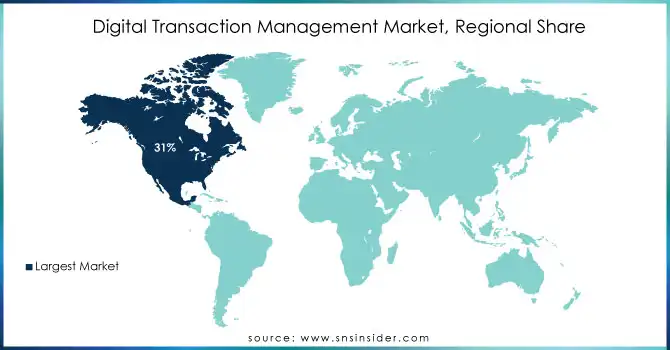

KEY REGIONAL ANALYSIS

North America region dominated with the market share over 31% in 2023, due to its advanced technological landscape and robust digital infrastructure. The region boasts widespread adoption of cutting-edge technologies such as cloud computing, artificial intelligence, and blockchain, which are crucial for securing and streamlining digital transactions. The finance, healthcare, and government sectors, which demand high levels of security and efficiency, are major contributors to this dominance. In finance, the push for secure online banking and payment solutions drives demand for digital transaction tools. Similarly, the healthcare industry’s need for secure patient data management and compliance with regulations like HIPAA accelerates the adoption of DTM solutions.

Asia-Pacific is experiencing the fastest growth in the Digital Transaction Management (DTM) market due to the region’s rapid digital transformation. Countries like China, India, and Japan are leading the charge with significant advancements in technology and infrastructure. The growing adoption of mobile technologies has made digital transactions more accessible, enabling businesses and consumers to engage in secure, efficient transactions. Additionally, the rise of e-commerce across the region has increased the demand for seamless, electronic transaction solutions.

Need any customization research on Digital Transaction Management Market - Enquiry Now

Some of the major key players of Digital Transaction Management Market

-

Adobe (Adobe Acrobat Sign, Adobe Document Cloud)

-

Ascertia (SigningHub, ADSS Server)

-

DocuFirst (Digital Document Management System)

-

DocuSign Inc. (DocuSign eSignature, DocuSign Agreement Cloud)

-

eDOC Innovations (eDOCSignature, DocLogic Suite)

-

Entrust Corp. (Entrust Digital Signing Service, PKI Solutions)

-

Wolters Kluwer N.V. (eOriginal platform, OneSumX)

-

Kofax Inc. (Kofax SignDoc, Kofax TotalAgility)

-

Nintex UK Ltd. (Nintex Workflow Cloud, Nintex Drawloop DocGen)

-

OneSpan (OneSpan Sign, OneSpan Cloud Authentication)

-

Box Inc. (Box Sign, Box Content Cloud)

-

PandaDoc (PandaDoc eSignature, Document Automation)

-

HelloSign (A Dropbox Company) (HelloSign, HelloWorks)

-

SignNow (SignNow Document Workflow, eSignature Platform)

-

SignEasy (SignEasy App, Business API)

-

ZorroSign Inc. (ZorroSign eSignature, Document 4n6 Token)

-

AirSlate (SignNow, PDFfiller)

-

Formstack (Formstack Documents, Formstack Sign)

-

Lexmark International, Inc. (Lexmark Cloud Print Management, Document Solutions Suite)

-

Nitro Software Inc. (Nitro Sign, Nitro Productivity Suite)

Suppliers (Intelligent automation with secure e-signature capabilities) Digital Transaction Management Market

-

DocuSign, Inc.

-

Adobe Systems Incorporated

-

Nintex Global Ltd.

-

OneSpan Inc.

-

HelloSign (A Dropbox Company)

-

PandaDoc

-

AssureSign

-

Zoho Corporation

-

Kofax Inc.

-

Silanis Technology (OneSpan)

Recent Development

In June 2024: OneSpan Inc. launched the OneSpan Integration Platform to streamline eSignature integration, addressing efficiency and security challenges posed by the growing use of SaaS applications.

In January 2023: Adobe launched an updated version of its eSign product, featuring enhanced capabilities for document sharing and process automation.

In February 2023: Kofax unveiled Kofax Capture Pro, its latest solution for document capture and processing.

| Report Attributes | Details |

| Market Size in 2023 | USD 14.61 billion |

| Market Size by 2031 | USD 117.49 billion |

| CAGR | CAGR of 26.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vertical (Retail, BFSI, Healthcare, IT, Telecom, Government, Real Estate, Utilities Others) • By Solutions (Document Archival, Workflow Automation, Authentication, Electronic Signature, Other) • By End-User (Large Enterprises, SMEs) • By Component (Software, Hardware, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Adobe, Ascertia, DocuFirst, DocuSign Inc., eDOC Innovations, Entrust Corp., Wolters Kluwer N.V., Kofax Inc., Nintex UK Ltd., OneSpan, Box Inc., PandaDoc, HelloSign, SignNow, SignEasy, ZorroSign Inc., AirSlate |

| Key Drivers | • Cost savings from reduced paper, storage, and delivery expenses drive businesses to adopt Digital Transaction Management (DTM) solutions for greater efficiency. |

| Market Restraints | • The high initial cost and complexity of integrating DTM solutions into existing systems can deter small and medium-sized enterprises (SMEs) from adopting them. |