Artificial Intelligence of Things (AIoT) Market Size & Overview:

Get more information on Artificial Intelligence of Things (AIoT) Market - Request Free Sample Report

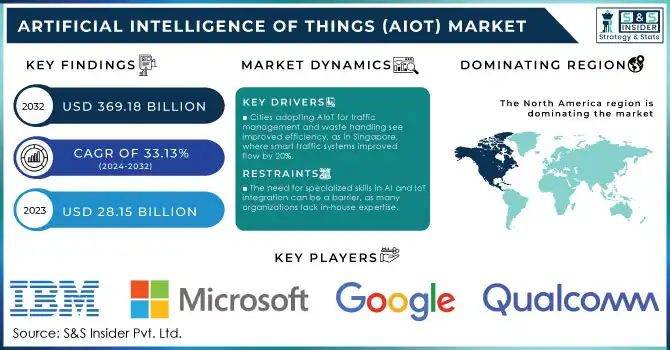

Artificial Intelligence of Things (AIoT) Market was valued at USD 28.15 billion in 2023 and is expected to reach USD 369.18 billion by 2032, growing at a CAGR of 33.13% over 2024-2032.

The Artificial Intelligence of Things Market, a combination of AI and IoT technologies, is rapidly expanding in response to growing demand for smart, interconnected devices. AIoT allows devices to autonomously collect, process, and respond to data, creating real-time insights and automation across industries like manufacturing, healthcare, retail, and smart homes. A key factor driving this growth is the projected rise in IoT devices, expected to reach 32.1 billion by 2030, generating massive data volumes that require AI to derive actionable insights. For instance, in manufacturing, AIoT-driven predictive maintenance has been shown to cut equipment downtime by up to 50%. The expansion of 5G technology is also fueling AIoT’s growth, facilitating high-speed, low-latency data transfer essential for applications such as autonomous vehicles. As of 2024, companies like Tesla are utilizing AIoT in vehicle systems for real-time decision-making and autonomous functions, and this adoption is likely to rise, with self-driving vehicles predicted to represent 30% of all vehicles by 2030.

In healthcare, AIoT is revolutionizing patient monitoring through real-time health tracking and emergency alerts. Studies show that AIoT-enabled medical devices have decreased response times in critical situations by 25%, enhancing patient outcomes. Hospitals are increasingly implementing these systems for efficient remote monitoring. Smart cities are also adopting AIoT for urban management, including traffic and waste management. In Singapore, AIoT-enabled smart traffic systems have improved traffic flow by 20%, illustrating its impact on efficiency. Additionally, initiatives like the U.S. government’s USD 10 billion investment in AI and IoT are accelerating innovation and widespread adoption.

Overall, the growth of the AIoT market is driven by the rise in IoT devices, advancements in 5G, increased adoption in autonomous vehicles and healthcare, and government support. These factors, along with applications in manufacturing, healthcare, and smart cities, emphasize AIoT’s transformative role across industries.

Artificial Intelligence of Things (AIoT) Market Dynamics

Drivers

-

Cities adopting AIoT for traffic management and waste handling see improved efficiency, as in Singapore, where smart traffic systems improved flow by 20%.

-

AIoT solutions help industries reduce downtime and maintenance costs, with predictive maintenance lowering equipment downtime by up to 50%.

-

High-speed, low-latency 5G networks enable rapid data transmission essential for real-time AIoT applications like autonomous driving.

The integration of high-speed, low-latency 5G networks has transformed the Artificial Intelligence of Things market by enabling rapid data transfer and real-time responsiveness essential for immediate data processing and decision-making. This advancement is particularly valuable in autonomous driving, where vehicle systems rely on AIoT to continuously gather, process, and transmit large volumes of sensor and camera data for safe navigation, collision prevention, and optimized route planning. With 5G, these vehicles communicate swiftly and reliably with other vehicles, infrastructure, and cloud platforms, dramatically reducing latency and enhancing performance. Beyond autonomous driving, 5G-powered AIoT is revolutionizing other sectors reliant on real-time connectivity. In manufacturing, for example, AIoT predictive maintenance systems use 5G to monitor equipment, predict failures, and trigger maintenance activities quickly, thus minimizing downtime. In healthcare, 5G-enabled AIoT devices allow for real-time remote monitoring, instantly transmitting patient health data to medical teams for swift emergency responses and continuous care.

Moreover, the high-speed data capabilities of 5G support processing massive data volumes on cloud platforms, where sophisticated AI algorithms extract insights and facilitate decision-making in real-time. This capability is accelerating AIoT adoption, especially in smart cities, which rely on low-latency interactions for optimizing traffic flow, managing energy, and enhancing public safety with precision.

In conclusion, 5G networks are pivotal to the AIoT market’s growth, enabling seamless connectivity and instant data processing essential for various applications. Across sectors like autonomous driving, healthcare, and urban management, 5G is driving AIoT’s expansion, redefining automation, safety, and operational efficiency.

Restraints

-

The initial investment for AIoT technology, including 5G infrastructure and advanced IoT devices, is high, which can deter smaller enterprises.

-

The need for specialized skills in AI and IoT integration can be a barrier, as many organizations lack in-house expertise.

-

Compatibility issues between various IoT devices and AI platforms hinder seamless integration, impacting functionality and scaling.

In the Artificial Intelligence of Things Market, compatibility issues between IoT devices and AI platforms create significant barriers. AIoT solutions rely on integrating a range of devices, such as sensors, cameras, smart appliances, and industrial machinery, which often come from different manufacturers with varying standards and protocols. This lack of standardization leads to interoperability challenges, making it difficult for devices to communicate effectively. When AI platforms attempt to process data from incompatible IoT devices, integration becomes complex, and system performance may suffer, ultimately affecting the functionality of AIoT solutions.

In sectors like manufacturing, factories commonly used equipment from multiple vendors. When IoT sensors and AI platforms don't align, creating a unified system for predictive maintenance or real-time monitoring becomes a challenge. This results in inefficiencies and hinders the scalability of AIoT in manufacturing, as substantial time and resources are spent resolving compatibility issues or developing custom integration solutions. In smart cities, the problem is even more pronounced. AIoT systems managing traffic, waste, and energy rely on data from a variety of sources, including street cameras, smart meters, and transportation networks. Without compatibility, these devices cannot operate in unison, diminishing the effectiveness of AI-driven insights and automation.

These compatibility issues also limit scalability. Expanding the AIoT network or adding new IoT devices becomes more complicated and expensive without standardized methods for ensuring compatibility. This challenges organizations trying to scale their AIoT capabilities and keep up with technological progress. While industry leaders work to establish universal standards and protocols, these efforts are ongoing. Until these standards are widely adopted, compatibility issues will remain a major constraint on the AIoT market's growth.

In conclusion, compatibility challenges between IoT devices and AI platforms hinder integration, reduce functionality, and limit scalability, preventing AIoT from realizing its full potential across industries. Addressing these challenges is essential for unlocking AIoT's full capabilities.

Artificial Intelligence of Things (AIoT) Market Segment Analysis

By Deployment

The cloud segment dominated the market and represented significant revenue share in 2023, allowing for benefits of lower costs because of the transfer of data storage and processing responsibilities to the cloud organization. This approach minimizes capital expenditure for infrastructure, enabling organizations to hit the ground running by using real-time data analytics for quicker decision-making while ensuring that the decision-making process is more data-driven and more robust, thereby enhancing their competitive advantage.

Edge AIoT, is expected to register the highest CAGR during the forecast period. Edge AIoT, unlike cloud-based systems, processes data at the device level, which avoids the delay that occurs when sending data to and from the cloud. Such speed in processing makes edge AIoT the perfect solution for industries that need quick-response applications like autonomous vehicles or predictive maintenance in manufacturing as even the slightest hiccup in the process could result in a true business failure.

By Application

Video surveillance dominated the market in 2023, primarily due to the growing adoption of AI-driven systems that improve security and aid business decision-making. These systems can detect and track suspicious activities, playing a crucial role in crime prevention and criminal identification. Furthermore, AI-powered video analytics provide valuable insights into customer behaviour and traffic patterns, enabling businesses to refine their operations and strategies.

Predictive maintenance is expected to experience the fastest growth, with the highest compound annual growth rate (CAGR) projected for the coming years. This maintenance strategy leverages data and analytics to anticipate when assets might fail, allowing companies to take preventive measures. By doing so, predictive maintenance minimizes downtime, reduces maintenance costs, and enhances the safety and security of assets.

Artificial Intelligence of Things (AIoT) Market Regional Analysis

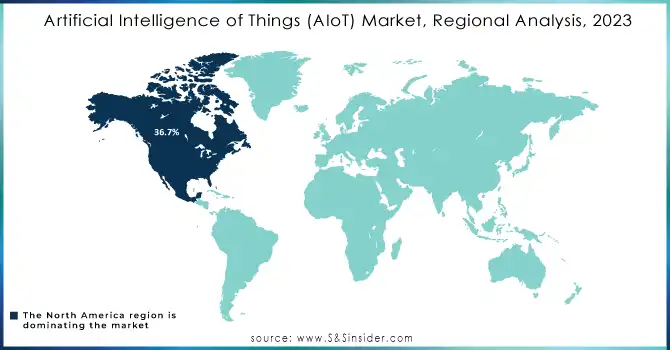

In 2023, North America accounted for the largest share of the global Artificial Intelligence of Things Market, with a 36.7% share. This dominance is primarily attributed to the region's extensive adoption of IoT technologies across various industries. The increasing use of sensors and devices for data collection and operational optimization has been critical to this growth. AIoT platforms play a central role in managing and analyzing the ever-growing data, with predictive analytics helping businesses to anticipate trends, detect anomalies, and generate real-time insights. These capabilities not only enhance customer experiences but also streamline operations and fuel innovation, reinforcing North America's leadership in the AIoT market.

The Asia-Pacific region is expected to witness substantial growth in the AIoT market during the forecast period. Countries such as China, India, and Japan are poised to be key contributors to this expansion, driven by the widespread adoption of internet and mobile technologies, a large and growing population, and a robust manufacturing sector. These factors are propelling the rising demand for AIoT applications in the region.

Need any customization research on Artificial Intelligence of Things (AIoT) Market - Enquire Now

Key Players

The major key players are

-

IBM – Watson IoT Platform

-

Intel – Intel AI-powered IoT Solutions

-

Cisco Systems – Cisco IoT Cloud Connect

-

Microsoft – Azure IoT Suite

-

Google – Google Cloud IoT

-

Amazon Web Services (AWS) – AWS IoT Core

-

Qualcomm – Qualcomm AI and IoT solutions

-

NVIDIA – Jetson AI platform for edge computing

-

Samsung Electronics – SmartThings

-

Siemens – MindSphere IoT platform

-

Honeywell – Honeywell Connected Plant

-

General Electric (GE) – Predix Platform

-

Hitachi – Lumada IoT platform

-

Palo Alto Networks – IoT Security Platform

-

Bosch – Bosch IoT Suite

-

Schneider Electric – EcoStruxure IoT-enabled solutions

-

Dell Technologies – Dell Edge Gateway 5000

-

Arm – Arm Pelion IoT Platform

-

SAP – SAP Leonardo IoT

-

Rockwell Automation – FactoryTalk Analytics

Recent Developments in the Artificial Intelligence of Things (AIoT) Market

In June 2023, Dahua Technology, a leader in video-focused AIoT solutions, hosted the Smart Building Global Summit at its headquarters in Hangzhou. Over 50 influential real estate executives and industry leaders attended the event to address current challenges, explore emerging trends, and exchange valuable insights and best practices.

In June 2023, Fibocom, a prominent provider of IoT wireless communication modules, unveiled its latest cellular modules at Computex 2023. The company introduced the FG132-NA series 5G RedCap module, designed for applications in Fixed Wireless Access (FWA), industrial automation, smart wearables, and smart cities, highlighting the transformative impact of 5G AIoT across various industries.

| Report Attributes | Details |

| Market Size in 2023 | US$ 28.15 Bn |

| Market Size by 2032 | US$ 369.18 Bn |

| CAGR | CAGR of 33.13% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Video Surveillance, Robust Asset Management, Inventory Management, Energy Consumption Management, Predictive Maintenance, Real-Time Machinery Condition Monitoring, Supply chain Management) • By Deployment (Cloud-based, Edge AIoT) • By Vertical (Healthcare, Automotive & Transportation, Retail, Agriculture, Manufacturing, Logistics, BFSI, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Intel, Cisco Systems, Microsoft, Google, Amazon Web Services, Qualcomm, NVIDIA, Samsung Electronics, Siemens, Honeywell, General Electric, Hitachi, Palo Alto Networks, Bosch, Schneider Electric, Dell Technologies, Arm, SAP, Rockwell Automation |

| Key Drivers | • Cities adopting AIoT for traffic management and waste handling see improved efficiency, as in Singapore, where smart traffic systems improved flow by 20%. • AIoT solutions help industries reduce downtime and maintenance costs, with predictive maintenance lowering equipment downtime by up to 50%. • High-speed, low-latency 5G networks enable rapid data transmission essential for real-time AIoT applications like autonomous driving. |

| Market Restraints | • The initial investment for AIoT technology, including 5G infrastructure and advanced IoT devices, is high, which can deter smaller enterprises. • The need for specialized skills in AI and IoT integration can be a barrier, as many organizations lack in-house expertise. • Compatibility issues between various IoT devices and AI platforms hinder seamless integration, impacting functionality and scaling. |