Disposable Trocars Market Report Scope & Overview:

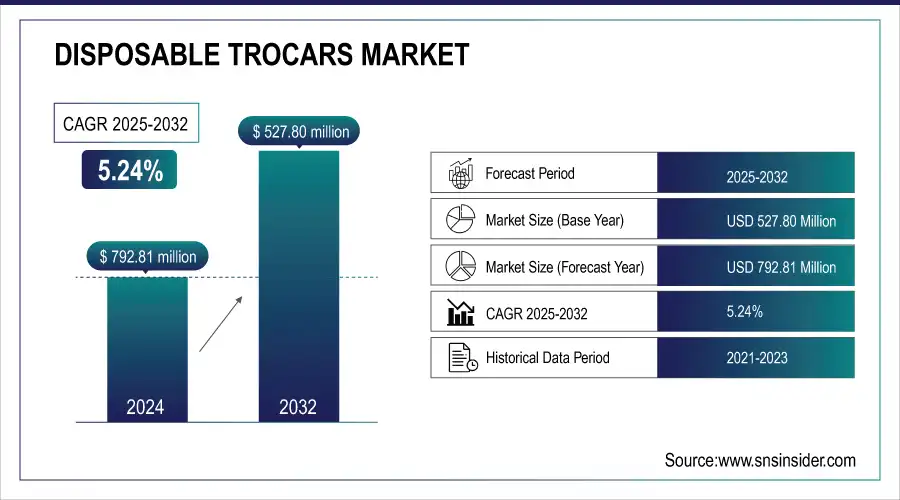

The disposable trocars market size was valued at USD 527.80 million in 2024 and is expected to reach USD 792.81 million by 2032, growing at a CAGR of 5.24% over the forecast period of 2025-2032.

The rising number of minimally invasive surgeries (MIS) and increasing emphasis on infection control are creating significant growth opportunities in the global disposable trocars market. One of the major disposable trocars market trends is the growing preference for laparoscopic procedures including hernia repair, hysterectomy, and bariatric surgeries that necessitate trocar access for safe entry. Single-use trocars are also becoming more common in light of increasing concerns about hospital-acquired infections.

To Get more information on Disposable Trocars Market - Request Free Sample Report

For instance, in January 2024, according to WHO, 78% of hospitals in Europe and North America adopted single-use surgical tools post-COVID, with disposable trocars among the top choices.

For instance, in May 2025, 68% of the U.S. conducted over 52 million MIS procedures in 2024, with 83% using disposable trocars, driven by ASC growth and sterility priorities.

Key Disposable Trocars Market Trends

-

Increasing adoption of smart sensors in trocars and related devices enables real-time monitoring of usage, improving safety and operational efficiency.

-

Development of bio-based, plant-derived, and sustainable materials aligns with growing demand for environmentally conscious and patient-safe surgical products.

-

Expansion of automated sterilization systems in hospitals and surgical centers ensures consistent microbial control and reduces manual errors.

-

Use of data-driven approaches to anticipate high-risk infection zones and optimize cleaning or usage schedules enhances procedural safety.

-

Growing deployment of UV-C and electrostatic misting systems allows rapid and flexible sterilization in diverse healthcare and field environments.

Disposable Trocars Market Growth Drivers:

-

Increasing Surgical Volumes in Emerging Economies is Driving the Disposable Trocars Market Growth

Increased surgery volumes in emerging economies are a major driver for the disposable trocars market. Asia Pacific, Latin America, and the Middle-East countries are investing their resources in developing healthcare infrastructure, followed by minimally invasive assets. The rise in the number of procedures is strengthening the utilization of the disposable trocars market share as health centers are preferring cost-effective, sterile single-use instruments over reusable offerings, which is propelling the market growth.

For instance, in March 2025, Asia-Pacific and Latin America saw a 28% share of the global MIS procedures in 2024, with disposable trocar usage rising 11.4% year-over-year.

Disposable Trocars Market Restraints:

-

Insufficient Training and MIS Adoption in Some Regions are Hampering the Disposable Trocars Market Growth

The need for skilled and trained laparoscopic surgeons in various developing countries is a primary factor acting as a restraining force, causing limitations to the disposable trocars market. Ray added that many rural and semi-urban hospitals still perform open surgeries because of limited access to MIS training and equipment. This difference in skill levels restricts the use of disposable trocars to a certain extent, which hinders market extension even amid rising demand for minimally invasive techniques globally.

For instance, in July 2025, only 32% of surgeons in Sub-Saharan Africa and South Asia are MIS-trained, limiting disposable trocar use and slowing market growth in these regions.

Disposable Trocars Market Segment Analysis

-

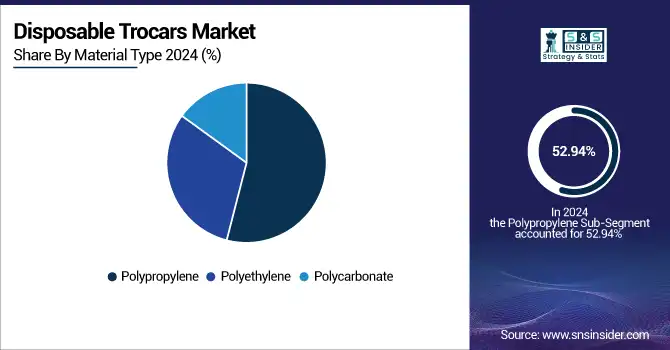

By Material Type

Polypropylene held a dominant disposable trocars market share of 52.94% in 2024, owing to the good biocompatibility, robust features, and economic reasons. This results in high flexibility and chemical resistance, making it well-suited for producing single-use surgical instruments. Wide availability and low price of disposable trocars enabled large-scale penetration across hospitals and surgical centers, thereby driving the market.

Polycarbonate is emerging as the fastest-growing segment in the global disposable trocars market, registering a CAGR of 6.12% over the forecast period, as it provides the best optical clarity, superiority in impact resistance, and is a perfect candidate for optical trocars. This allows for intraoperative real-time visualization during laparoscopy. Such factors include the growing need for precision in minimally invasive surgery, growth in image-guided procedures, and widening applications of advanced visualization tools for surgical access.

-

By Type

Bladeless trocars are the dominant segment in the global disposable trocars market, with a 35.94% market share in 2024, owing to their improved safety, lower tissue trauma, and lower risk of vascular injury. In general, bariatric surgeries are favorable to surgeons for atraumatic entry with no need for cutting a guide wire. The key factors driving the growth of this segment are the increasing preference for minimally invasive surgeries, a surgeon's preference toward atraumatic access, and advancements in trocar design.

The Optical trocars segment is emerging as the fastest growing with a CAGR of 5.77% in the global disposable trocars market, as they can give visual feedback while you insert them to prevent you over getting injured. Their use is increasing in difficult laparoscopic and robot-assisted cases. Key drivers include the need for accuracy, rising image-guided mini-invasive surgery procedures, and surgeon preference for safer visual control entry techniques.

-

By Application

In 2024, the general surgery dominated the antiseptic and disinfectant industry with a 45.23% market share, and was also the fastest growing segment over the forecast period, owing to the laparoscopic appendectomy, hernia repair, and cholecystectomy. These growth drivers comprise a large range of factors including the increasing acceptance of minimally invasive procedures, the rising prevalence of skilled surgeons, and well-developed hospital infrastructure, among others. The growing requirement for secure and efficient access tools has led to an important place on the front bench of routine general surgical practices

-

By End-user

Hospitals are the largest segment of the antiseptic and disinfectant industry, owing to their significant surgical caseloads, wide breadth of practice, and experience with advanced laparoscopic modalities. Growth of this market is driven by factors increasing adoption of minimally invasive procedures, stringent regulations regarding decontamination and sterilization, high incidence of hospital-acquired infections (HAIs), and an increase in the number of surgical procedures.

The ambulatory surgical centers segment is witnessing the highest growth in the global Disposable Trocars Market, as they concentrate on short-stay, ambulatory surgery. This growth can be attributed to decreased overhead expenses along with the increasing patient inclination towards same-day surgeries and the growing need for infection infection-free environment. Disposable instruments are popular with ASCs owing to the sterilization challenges they can present and the regulatory constraints around them.

Disposable Trocars Market Regional Analysis

North America Disposable Trocars Market Insights

In 2024, the North American region held a dominant market share of 34.60% of the global disposable trocars market, owing to the large-scale adoption of minimally invasive surgeries, well-established healthcare infrastructure, and presence of key market players including Ethicon, Medtronic, and Applied Medical. Factors driving the regional market include the large uptake of single-use surgical instruments, stringent regulations with regard to infection control, favorable reimbursement policies in place, and rapid proliferation of ambulatory surgical centers (ASCs), resulting in continued sales of disposable trocars throughout Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Disposable Trocars Market Insights

The U.S. disposable trocars market was valued at USD 150.15 billion in 2024 and is expected to reach USD 222.72 billion by 2032, growing at a CAGR of 5.07% over 2025-2032. The U.S. holds a lion's share in the disposable trocars market due to the high frequency of minimally invasive surgeries, the presence of most prominent manufacturers including Ethicon and Medtronic, and wide adoption of infection control practices, with European countries following closely behind. In addition, there is constant demand in both hospitals and outpatient facilities driven by the rapid proliferation of ambulatory surgical centers (ASCs), favorable reimbursement policies, and the preference for single-use surgical tools over reusables.

Europe Disposable Trocars Market Insights

Europe also demonstrates a significant growth in the global disposable trocars market due to increased adoption of minimally invasive surgeries, strong regulatory support for infection control, and large healthcare expenditure. Additionally, with strong programs for advanced surgical training and an increasing adoption rate of single-use devices in public hospitals in developed economies, including Germany, France, and the U.K., these factors drive stable growth in the market.

Asia-Pacific Disposable Trocars Market Insights

Asia Pacific emerges as the fastest-growing region with the highest CAGR of 5.91%, owing to accelerating healthcare infrastructure in developing economies, a growing number of surgeries, and minimally invasive procedures. The surge of investments for renovation of hospitals and surgical centers in China, India, South Korea, and Japan is also anticipated to amplify demand for state-of-the-art laparoscopic instruments, including disposable trocars. Furthermore, a rise in the middle-class population, a surge in medical tourism, and government initiatives to increase the surgical care accessibility is fuelling the market growth. Moreover, low-cost OEM manufacturers addressing the unmet needs for disposable trocars in the region also have contributed to a favorable market scenario. Moreover, the growing awareness regarding infection control and rising adoption of MIS and single-use devices due to increasing surgical training in this specialty are providing strong growth impetus to the APAC market.

Middle East & Africa Disposable Trocars Market Insights

The disposable trocars market in the Middle East & Africa has been witnessing a gradual rise, which is expected to continue the growth due to improved healthcare infrastructure, surgical demand and rising government investment over several major markets. The UAE and Saudi Arabia are increasingly focusing on developing surgical techniques, infection control has taken a new dimension, and the rise of medical tourism is propelling the popularity of disposable laparoscopic instruments in this region.

Latin America Disposable Trocars Market Insights

Rapidly increasing demand for minimally invasive surgeries and improving healthcare expenditure are driving the growth of the disposable trocars market in Latin America. The private and public surgical facilities are developing in Brazil, Mexico, and Argentina, thus boosting laparoscopic procedure access. Factors, including an increase in medical tourism and advanced surgeon training programs, assist in the market growth. Nonetheless, cost sensitivity and variation in healthcare access between regions are issues yet to be addressed in the context of the adoption of disposable trocars on a larger scale.

Disposable Trocars Companies are:

Some of the Disposable Trocars Market Companies

-

Ethicon

-

Medtronic

-

B. Braun

-

Applied Medical

-

CONMED

-

Genicon

-

Laprosurge

-

Purple Surgical

-

Teleflex

-

CooperSurgical

-

Cooper Companies

-

TROKAMED

-

Grena Ltd.

-

Lagis Enterprise

-

Sejong Medical

-

Mediflex

-

Kii

-

Pajunk

-

Shanghai Medical Corp.

Competitive Landscape for the Disposable Trocars Market:

Medtronic Founded in 1949 and headquartered in Dublin, Ireland, It is a global leader in medical technology, offering innovative devices and therapies across cardiac, neurological, diabetes, and surgical markets, aiming to improve patient outcomes and transform healthcare worldwide.

-

In May 2025, Medtronic enhanced its VersaOne trocar system to support robotic-assisted surgeries, improving instrument alignment and port stability, particularly in bariatric and gynecological minimally invasive procedures.

Genicon Established in 2006 with headquarters in Los Angeles, California, Genicon specializes in cost-effective single-use surgical access systems and trocars, providing hospitals and surgeons with safe, reliable solutions for minimally invasive procedures.

-

In January 2025, Genicon partnered with NHS Supply Chain (U.K.) to supply customized disposable trocar kits, tailored for general and colorectal surgeries, boosting adoption across the U.K.’s public health sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 527.80 million |

| Market Size by 2032 | USD 792.81 million |

| CAGR | CAGR of 5.24% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Bladeless Trocars, Optical Trocars, Blunt Trocars, Bladed Trocars) • By Application (General Surgery, Gynecological Surgery, Urological Surgery, Pediatric Surgery, Other Surgeries) • By Material Type (Polypropylene, Polyethylene, Polycarbonate) •By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Research Institutions) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Ethicon, Medtronic, B. Braun, Applied Medical, CONMED, Genicon, Laprosurge, Purple Surgical, Teleflex, CooperSurgical, Cooper Companies, TROKAMED, Grena Ltd., Lagis Enterprise, Sejong Medical, Mediflex, Kii, Pajunk, Pajunk, Shanghai Medical Corp., and other players. |