Smart Wearable ECG Monitors Market Report Scope & Overview:

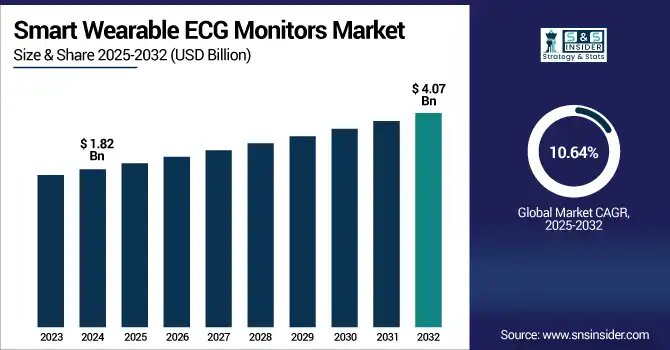

The Smart Wearable ECG Monitors Market size was valued at USD 1.82 billion in 2024 and is expected to reach USD 4.07 billion by 2032, growing at a CAGR of 10.64% over the forecast period of 2025-2032.

The rapid growth in the global smart wearable ECG monitors market is due to rising awareness regarding cardiovascular diseases, increasing prevalence of atrial fibrillation and arrhythmia, and the trend towards preventive healthcare. Advances in wearables and AI are bringing real-time ECG analysis to the user. Electromyographic and blood oxygen readings are also starting to take a significant role in commercial wearable devices. More and more people want at-home monitoring, and the growing use of remote diagnostics and fitness monitoring is driving adoption in the clinical and personal wellness sectors globally.

To Get more information on Smart Wearable ECG Monitors Market - Request Free Sample Report

The U.S. smart wearable ECG monitors market size was valued at USD 0.61 billion in 2024 and is expected to reach USD 1.33 billion by 2032, growing at a CAGR of 10.34% over the forecast period of 2025-2032.

In North America, the U.S. is leading the smart wearable ECG monitors market due to high healthcare spending, a strong embrace of digital health technologies, and the widespread availability of FDA-approved wearable ECG devices. Major players such as Apple, iRhythm, and Fitbit are making continuous innovations, and the strong consumer demand for remote cardiac monitoring only cements the U.S.'s top position in this field.

Smart Wearable ECG Monitors Market Dynamics:

Drivers

-

The Rising Prevalence of Cardiovascular Diseases (CVDS) is Significantly Fueling Market Growth

The global impact of conditions such as atrial fibrillation, arrhythmias, and coronary artery disease is on the rise, largely due to aging populations, sedentary lifestyles, and unhealthy eating habits. These health issues often necessitate ongoing monitoring of heart rhythm to catch any irregularities early on. Smart wearable ECG monitors, these handy, non-invasive devices allow for real-time tracking of heart activity, paving the way for prompt medical intervention. With heart disease being a top cause of death around the globe, the need for accessible and reliable ECG monitoring tools is skyrocketing among patients and healthcare professionals alike.

Cardiovascular disease (CVD) remains the leading cause of death on the globe, with approximately 17.7 million deaths globally in 2015 according to the World Health Organization (WHO). In addition to the human tragedy of these deaths, CVD is also extremely costly, more costly than even Alzheimer’s and diabetes, with a burden of indirect costs reaching USD 237 billion per year, and peaking at an estimated USD 368 billion in 2035.

According to research on NCBI, wearable ECG devices are most effective in screening atrial fibrillation and arrhythmias. In a single study, the addition of ECG monitoring for rhythm identification led to a substantial rise in the detection of new AF diagnoses in only four months.

-

Advancements in Wearable and Sensor Technology Accelerating the Market Growth

Wearable and sensor technology is rising due to the incredible advancements. Modern wearable ECG monitors boast sleek designs, longer-lasting batteries, Bluetooth connectivity, and the ability to transmit real-time ECG waveforms to mobile apps and cloud platforms. The sensors are more precise than ever, effectively filtering out motion artifacts to deliver clinical-grade readings. With the integration of AI analytics, these devices can identify early signs of arrhythmias or cardiac stress, turning them into essential tools for personal wellness and remote healthcare. ECG wearables are becoming more appealing and practical for a wider audience.

At CES 2025, leading wearable tech brands showcased their medical-grade sensing capabilities, highlighting improved accuracy, motion resistance, better battery efficiency, and advanced AI algorithms.

Restraint

-

High Cost of Advanced Devices is Restraining the Market Growth

The high cost of smart wearable ECG monitor devices is the major deterrent in the smart wearable ECG monitor market. Their product are "feature-rich," including AI-powered insights, continuous monitoring for multiple days, and wireless and clinical-grade sensors - all of which contribute to increasing production costs. These costs are passed on down the line to patients and providers. Thus, most of the high-end wearable ECG recorders are cost-prohibitive to the average person, and particularly those in low and middle-income countries. This financial obstacle has limited widespread acceptance, particularly in places with high out-of-pocket health expenses and limited or no health insurance.

Smart Wearable ECG Monitors Market Segmentation Analysis:

By Type

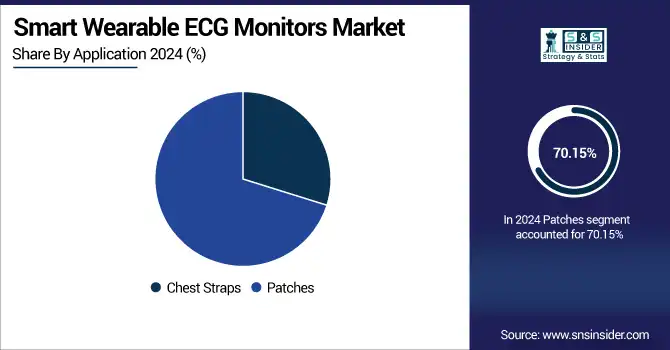

In 2024, the patches segment dominated the smart wearable ECG monitors market growth with 70.15% of the market, owing to the small size and discrete design that allows long-term cardiac monitoring. ECG patches are more comfortable and easier to use in both clinical and home settings while also allowing real-time data transfer without disrupting everyday life. They are the top choice for providers and patients in the increasingly popular practice of remote patient monitoring, including for tracking arrhythmia and for post-surgery patient care.

The chest straps segment is anticipated to witness the fastest growth over the years. This is being driven by an ever-increasing desire among fitness enthusiasts, competitive athletes, and everyday consumers to have accurate real-time data on their heart rate and electrical activity of the heart (ECG) during exercise. Chest straps work well when losing or gaining weight or experiencing other physiological factors that may affect your HRV. Since more and more people are paying attention to cardiovascular health, and since advanced sensor technology can be easily implemented with smartphones and other wearables, the market of chest strap-based ECG monitors for sport and wellness applications has been growing tremendously.

By Distribution Channel

The pharmacies segment dominated the smart wearable ECG monitors market share, 38.44% in 2024, due to being an established, trusted source for healthcare information, particularly in the developed economies. Pharmacies provide quick access to both over-the-counter and professionally recommended wearable ECGs, making health-monitoring tools more accessible to consumers. The additional benefit of sourcing simple advice and tailored recommendations directly from pharmacists also underpins consumer confidence and drives product uptake, particularly amongst the elderly and those suffering from chronic heart conditions.

The online channel is projected to expand at the fastest CAGR over the forecast years. This expansion is led by increasing internet penetration, a trend toward direct-to-consumer purchases, and the emergence of e-commerce platforms. As consumers shop for health devices online, they are hunting for convenience, a wider selection of products, and transparent pricing, analysts say. In addition, the influx of AI-based ECG monitors from international companies sold on official websites and third-party websites is increasing availability, especially in developing markets with fewer options for in-store purchases. This move toward online purchases is likely to be a market growth driver.

By End Use

The hospitals segment dominated the smart wearable ECG monitors market and accounted for a market share of 43.69% in 2024, owing to the increasing adoption of smart wearables for real-time heart monitoring and post-surgery care. Hospitals are integrating such monitors into patient surveillance systems that allow rates of the ECG to be checked at any time, which is particularly important for high-risk patients who have arrhythmias or heart disease. The devices are accurate, trustworthy, and represent clinical-grade performance, making them invaluable tools in places such as hospitals where the stakes of testing and intervention are high.

The home health care segment is expected to grow at the fastest rate during the forecast period, owing to the rising demand for remote patient monitoring among geriatric and chronic cardiac patients. Wearable ECG units allow individuals to check their heart activity at home in real time, hence reducing hospital readmissions. The cost-effectiveness, convenience, and popularity of telemedicine are helping to fuel the move toward care at home. With technology increasingly becoming intuitive and accessible, the home care segment is expected to grow fastest, providing long-term disease management and preventive health services.

Smart Wearable ECG Monitors Market Regional Insights:

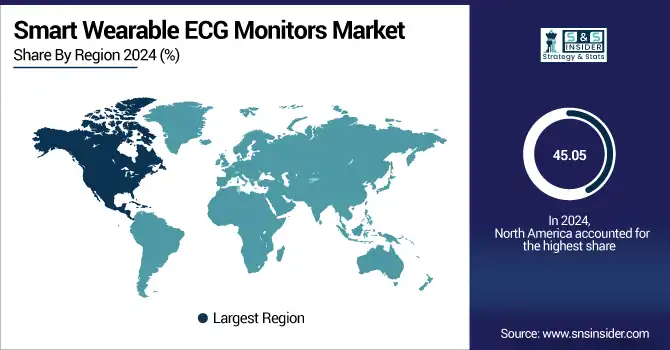

North America dominated the smart wearable ECG monitors market share of 45.05% in 2024, owing to the advanced healthcare system, adoption of digital health solutions at an early stage, and rise in prevalence of cardiovascular diseases such as atrial fibrillation and arrhythmia. The region is well supported from a regulatory standpoint with FDA clearance for clinical-grade wearables, and also has a high level of awareness and consumer acceptance of preventative health solutions. The major technology and med-tech players, such as Apple, iRhythm, and Fitbit, are based in the U.S., which keeps the innovation coming and leads to a constantly refreshed set of products.

Asia Pacific is expected to be the fastest-growing smart wearable ECG monitors market, growing at a CAGR of 11.5% due to growing healthcare awareness, increasing elderly population, and growing heart-related diseases. Demand is driven in part by rapid urbanization, the ubiquity of smartphones, and increasingly easy access to digital health services. As a result, there are government initiatives to invest in remote healthcare infrastructure, and local and global companies are investing in low-cost, feature-rich wearable devices designed for the specific needs of this region. These factors are driving the market growth in APAC.

Smart wearable ECG monitors are increasingly adopted in clinical settings and consumer health throughout Europe. The rising prevalence of cardio diseases, especially in older people, is generating a high requirement for continuous monitoring of the heart. World leaders, including Philips, Medtronic, and GE Healthcare, are launching AI-enabled, patch-based ECG wearables tailored specifically for European healthcare, driving early detection and remote patient management.

Latin America is experiencing moderate growth in the Smart wearable ECG monitors market trends due as Latin America is witnessing a consistent demand for smart wearable ECG monitors, which can be attributed to mounting cases of cardiovascular diseases, combined with growing awareness of preventive heart care. While public health systems are cash-strapped, private sector participation and consumer enthusiasm for fitness and wellness tracking are ensuring a steady demand for wearable ECG technology.

The MEA region is a significant growth in the smart wearable ECG monitors market, which is mainly fueled by the wealthier countries such as Saudi Arabia and the UAE. These countries are committed to the digital health transformation, especially the remote patient monitoring solutions such as the wearable ECG devices. The prevalence of chronic diseases is increasing the with the government supporting digital health through telemedicine is driving the market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Smart Wearable ECG Monitors Market Key Players

The smart wearable ECG monitors market companies are Apple, Samsung Electronics, Withings, AliveCor, Fitbit (Google), iRhythm Technologies, Medtronic, Philips Healthcare, Qardio, CardiacSense, and other players.

Recent Developments in the Smart Wearable ECG Monitors Market

-

July 2024 Samsung Electronics announced the introduction of its newest wearable devices—the Galaxy Ring, Galaxy Watch7, and Galaxy Watch Ultra. The new devices come with Galaxy AI to provide improved end-to-end wellness experiences, seeking to empower users with smart, real-time health information and personalized advice across their fitness and everyday health habits.

-

September 2023 – iRhythm Technologies, Inc. revealed the U.S. availability of its next-generation Zio monitor and expanded Zio Long-Term Continuous Monitoring (LTCM) service. The new Zio unit is the smallest, lightest, and thinnest cardiac monitor iRhythm has ever produced, providing enhanced patient comfort and convenience with the power to perform advanced long-term cardiac monitoring capabilities for health care professionals.

Smart Wearable ECG Monitors Market Report Scope:

Report Attributes Details Market Size in 2024 USD 1.82 Billion Market Size by 2032 USD 4.07 Billion CAGR CAGR of 10.64% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Type (Chest Straps, Patches)

• By Distribution Channel (Pharmacies, Online Channel, Direct-to-Consumer (DTC), Others)

• By End Use (Hospitals, Clinics, Home Care, Others [Sports, Fitness Centers, Assisted Living]

Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Apple, Samsung Electronics, Withings, AliveCor, Fitbit (Google), iRhythm Technologies, Medtronic, Philips Healthcare, Qardio, and CardiacSense.