Document Scanner Market Report Scope & Overview:

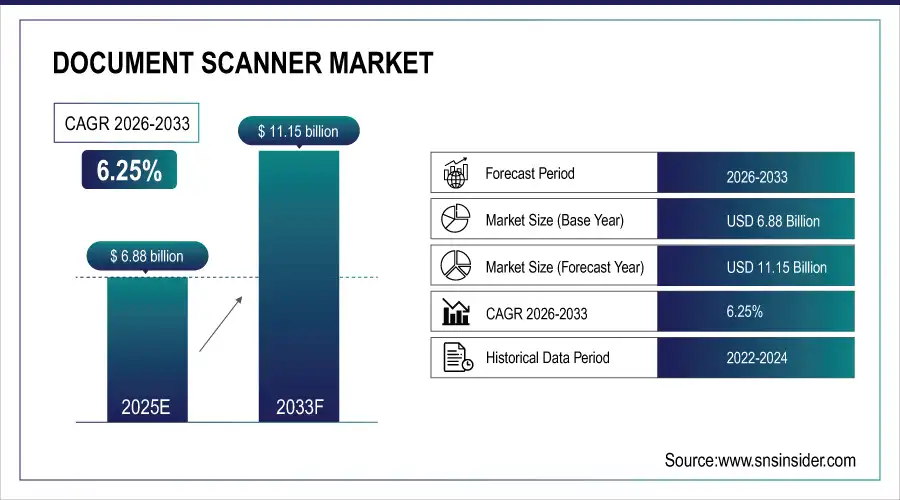

The Document Scanner Market Size is valued at USD 6.88 Billion in 2025E and is projected to reach USD 11.15 Billion by 2033, growing at a CAGR of 6.25% during the forecast period 2026–2033.

The Document Scanner Market analysis report provides a comprehensive insight into market dynamics, emphasizing technological advancements, connectivity integration, and versatile applications. Growing demand for digital documentation, workflow automation, and efficient office solutions is anticipated to drive market growth over the forecast period.

Document Scanner shipments reached 6.88 million units in 2025, driven by digitalization and rising demand for automated document management across offices, healthcare, and education sectors.

Market Size and Growth Projection:

-

Market Size in 2025: USD 6.88 Billion

-

Market Size by 2033: USD 11.15 Billion

-

CAGR: 6.25% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Document Scanner Market - Request Free Sample Report

Document Scanner Market Trends:

-

Growing digital transformation initiatives and remote working are driving demand for high-performance scanners in offices and homes.

-

Increasing adoption of cloud-based and wireless connectivity is expanding scanner applications across enterprises and educational institutions.

-

Rising need for workflow automation, paperless documentation, and secure data management is boosting scanner utilization.

-

E-commerce and online availability of scanners are improving market penetration, making advanced models more accessible to SMEs and home users.

-

Compact, portable, and multifunction scanners are gaining popularity for convenience in urban and mobile work environments.

-

Eco-friendly, energy-efficient scanners with reduced paper usage are trending, aligning with corporate sustainability and green office initiatives.

U.S. Document Scanner Market Size Outlook:

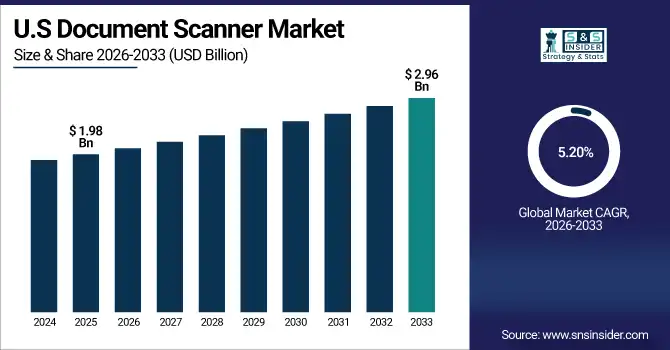

The U.S. Document Scanner Market is projected to grow from USD 1.98 Billion in 2025E to USD 2.96 Billion by 2033, at a CAGR of 5.20%. Market growth is driven by increasing digitalization, adoption of automated workflows, cloud-based solutions, and rising demand for efficient document management across offices and enterprises.

Document Scanner Market Growth Drivers:

-

Increasing digitalization and demand for automated, paperless office solutions driving document scanner market growth.

Increasing digitalization and the demand for automated, paperless office solutions are key drivers of Document Scanner Market growth. Organizations across offices, healthcare, education, and government sectors are adopting advanced scanners to enhance efficiency, secure document management, and streamline operations. Portable, sheet-fed, and cloud-enabled scanners are increasingly preferred for their convenience and integration with digital systems. Rising remote work adoption and growing awareness of workflow automation are accelerating scanner utilization, expanding market reach, and boosting overall demand.

Document Scanner shipments grew 6.5% in 2025, driven by digitalization and rising demand for automated office solutions.

Document Scanner Market Restraints:

-

High equipment costs, complex integration, and data security concerns are limiting widespread document scanner adoption.

High equipment costs, complex integration requirements, and data security concerns pose significant restraints for the Document Scanner Market. Advanced scanners often require IT infrastructure upgrades and employee training, increasing adoption barriers for SMEs and smaller organizations. Concerns over secure handling of sensitive documents, along with compatibility challenges across digital platforms, limit widespread utilization. These factors raise implementation costs, slow market penetration, and create hurdles for new entrants aiming to compete in technologically advanced, enterprise-focused scanner segments.

Document Scanner Market Opportunities:

-

Growing adoption of cloud-based, portable, and AI-enabled scanners creates strong opportunities for innovative document management solutions.

Growing adoption of cloud-based, portable, and AI-enabled scanners presents a major opportunity for the Document Scanner Market. Increasing demand for seamless digital document management, remote collaboration, and workflow automation is driving the development of innovative, user-friendly scanning solutions. Businesses and institutions are integrating smart features, cloud connectivity, and mobile compatibility to enhance efficiency. This shift toward advanced, connected scanning solutions helps improve operational productivity, expand market reach, and create new growth avenues.

Cloud-based and AI-enabled scanners made up 28% of new launches in 2025, driven by demand for digital document management.

Document Scanner Market Segmentation Analysis:

-

By Product Type, Sheet-fed held the largest market share of 38.45% in 2025, while Portable scanners are expected to grow at the fastest CAGR of 9.25% during 2026–2033.

-

By Technology Type, ADF (Automatic Document Feeder) accounted for the highest market share of 42.10% in 2025, while Single-pass technology is projected to expand at the fastest CAGR of 9.80% during the forecast period.

-

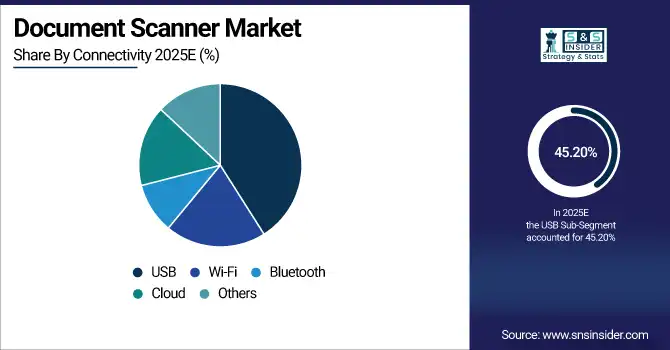

By Connectivity, USB dominated with a 45.20% share in 2025, while Cloud-enabled scanners are anticipated to record the fastest CAGR of 10.05% through 2026–2033.

-

By Application, Office scanners held the largest share of 50.65% in 2025, while Healthcare applications are forecasted to grow at the fastest CAGR of 9.75% during the forecast period.

-

By End-User, Large Enterprises accounted for the largest share of 46.80% in 2025, while SMEs are expected to register the fastest CAGR of 9.50% during 2026–2033.

By Product Type, Sheet-fed Dominates While Portable Expands Rapidly:

Sheet-fed segment dominated the market due to its high-speed scanning capabilities, reliability, and suitability for offices, educational institutions, and large enterprises managing bulk documents. In 2025, sheet-fed scanner shipments exceeded 2.65 million units, reflecting strong adoption across professional environments.

Portable are the fastest-growing segment, catering to remote workers, mobile professionals, and small offices seeking compact, lightweight, and user-friendly devices. In 2025, portable scanner shipments reached 0.85 million units, highlighting the rising demand for flexible scanning solutions.

By Technology Type, ADF Dominates While Single-pass Expands Rapidly:

ADF (Automatic Document Feeder) segment dominated the market due to its ability to scan multiple pages quickly and improve workflow efficiency in corporate, legal, and healthcare settings. In 2025, ADF scanner shipments surpassed 2.90 million units, reflecting widespread enterprise adoption.

Single-pass are the fastest-growing segment, offering speed and convenience for high-volume scanning in offices and mobile settings. In 2025, single-pass scanners reached 0.75 million units, driven by increasing need for fast and accurate digital documentation.

By Connectivity, USB Dominates While Cloud Expands Rapidly:

USB segment dominated the market due to their simplicity, low cost, reliability, and compatibility with almost all computers and office networks. In 2025, USB scanner shipments exceeded 3.10 million units, widely used in offices, homes, and small businesses.

Cloud is the fastest-growing segment, allowing real-time document sharing, remote access, and secure storage, appealing to businesses embracing digital transformation. In 2025, cloud-connected scanner adoption reached 1.05 million units, highlighting the rising shift toward mobile and collaborative document management.

By Application, Office Dominates While Healthcare Expands Rapidly:

Office segment dominated the market due to heavy document processing needs, workflow automation, and digitization initiatives in corporate, legal, and educational institutions. In 2025, office scanner deployments reached 3.50 million units, reflecting high demand for operational efficiency.

Healthcare is the fastest-growing segment, driven by electronic medical records, patient data digitization, and compliance requirements. In 2025, scanner adoption in healthcare reached 0.95 million units, highlighting the sector’s growing need for secure and efficient digital document management.

By End-User, Large Enterprises Dominate While SMEs Expand Rapidly:

Large Enterprises segment dominated the market due to their extensive documentation requirements, investment capacity, and need for high-performance scanning solutions. In 2025, scanner shipments to large enterprises exceeded 3.20 million units, demonstrating strong corporate adoption.

SMEs are the fastest-growing segment, leveraging compact, cost-effective, and portable scanners to enhance productivity and support remote work. In 2025, SME scanner adoption reached 1.25 million units, highlighting the increasing digitization efforts among smaller businesses seeking efficient document management.

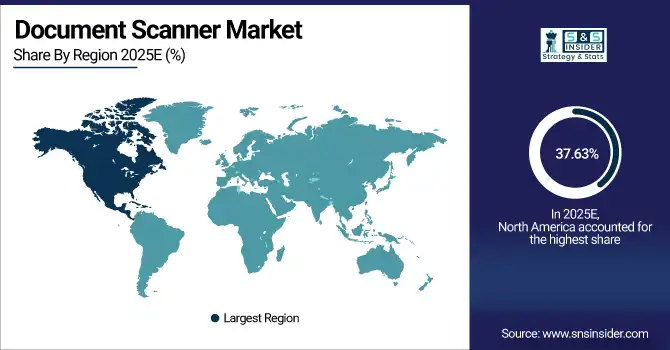

North America Document Scanner Market Insights:

North America dominates the Document Scanner Market with a 37.63% share in 2025. High adoption of office automation, digital workflows, and cloud-based document management solutions are driving demand. Large enterprises and educational institutions are increasingly investing in high-performance scanners for efficiency and secure document handling. Growing emphasis on remote work, regulatory compliance, and workflow optimization further strengthens market presence. The region remains a hub for new product launches, technological innovation, and advanced scanning solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Document Scanner Market Insights:

The U.S. Document Scanner Market is driven by growing digital transformation, rising adoption of cloud-based and AI-enabled scanning solutions, and the increasing need for secure, paperless workflows. Expanding use in offices, healthcare, education, and government, combined with portable and multifunction scanners, strengthens the country’s dominance in the North American market.

Asia-Pacific Document Scanner Market Insights:

The Asia-Pacific Document Scanner Market is the fastest-growing region, projected at a CAGR of 8.10% during 2026–2033. Growth is driven by increasing digitalization, adoption of cloud-based and AI-enabled scanning solutions, and rising demand for paperless workflows across offices, healthcare, education, and government sectors in China, Japan, India, and South Korea. Expanding mobile workforce, workflow automation initiatives, and investments in smart office infrastructure are fueling rapid market expansion across the region.

China Document Scanner Market Insights:

China’s Document Scanner Market is driven by rising digital transformation, increasing adoption of cloud-based and AI-enabled scanning solutions, and growing demand for paperless workflows. Expansion in offices, education, healthcare, and government sectors, along with rising workflow automation and mobile workforce initiatives, positions China as a key contributor to Asia-Pacific market growth.

Europe Document Scanner Market Insights:

The Europe Document Scanner Market is growing due to increasing digitalization, adoption of cloud-based and AI-enabled scanning solutions, and rising demand for paperless workflows. Germany, the UK, France, and Italy are leading contributors, driven by strong enterprise adoption, educational digitization initiatives, and government regulations for secure document management. Growing implementation in healthcare, legal, and corporate sectors, along with workflow automation, underpins Europe’s position as a key growth market in the document scanner industry.

Germany Document Scanner Market Insights:

Germany is a key Document Scanner Market due to strong digitalization initiatives, increasing adoption of cloud-based and AI-enabled scanners, and growing demand for secure, paperless workflows. Rising implementation in offices, healthcare, education, and government, along with workflow automation and enterprise digitization efforts, strengthens Germany’s position in the European market.

Latin America Document Scanner Market Insights:

The Latin America Document Scanner Market is anticipated to register growth with increasing digitalization, adoption of cloud-based and AI-enabled scanners, and rising demand for paperless workflows across Brazil, Mexico, and Argentina. Expansion in offices, education, healthcare, and government sectors is expected to drive regional market growth.

Middle East and Africa Document Scanner Market Insights:

The Middle East & Africa Document Scanner Market continues to expand with increasing digitalization, adoption of cloud-based and AI-enabled scanning solutions, and rising demand for paperless workflows. Growth in offices, education, healthcare, and government, particularly in Saudi Arabia, UAE, and South Africa, is driving regional market expansion.

Document Scanner Market Competitive Landscape:

Fujitsu Limited, headquartered in Tokyo, Japan, is a leading provider of IT solutions and document scanning technologies. It dominates the Document Scanner Market through high-speed sheet-fed, portable, and ADF-enabled scanners designed for enterprises, healthcare, education, and government sectors. Fujitsu leverages strong R&D, cloud integration, and workflow automation to deliver secure, efficient document management solutions. Strategic partnerships, continuous innovation, and a focus on digital transformation have solidified Fujitsu’s market leadership, making it a trusted brand for reliable and advanced scanning solutions.

-

In June 2025, Fujitsu released the ScanSnap iX2500 desktop scanner, offering seamless connectivity, intuitive touchscreen controls, and versatile cloud, USB, Wi‑Fi, and Bluetooth scanning, enhancing productivity and personal document digitization across home, office, and hybrid environments.

Canon Inc., headquartered in Tokyo, Japan, is a leader in imaging and optical technologies. The company dominates the Document Scanner Market with high-performance flatbed, sheet-fed, and portable scanners known for reliability and image precision. Canon emphasizes R&D, multifunctionality, and workflow automation, providing seamless document management for offices, healthcare, and education. Its extensive distribution network, cloud-enabled solutions, and commitment to innovation strengthen its market position, enabling Canon to maintain a dominant role while consistently expanding adoption across enterprise and small-business environments.

-

In November 2025, Canon introduced the imageFORMULA DR‑C350 and DR‑C340 compact office document scanners, featuring USB‑C connectivity, passport scanning functionality, and enhanced capacity for efficient digitization in small offices and diverse enterprise applications.

Epson Corporation, based in Suwa, Japan, is a leading innovator in printing, imaging, and scanning technologies. In the Document Scanner Market, Epson dominates with advanced flatbed, sheet-fed, and portable scanners that focus on speed, accuracy, and energy efficiency. Strong R&D, eco-friendly technology, and integration of AI and cloud solutions support workflow automation for enterprises and home users. Epson’s presence, sustainable product focus, and ability to address diverse scanning needs have cemented its position as a top player in the competitive document scanner market.

-

In February 2025, Epson’s scanner portfolio, including RapidReceipt RR‑400W and WorkForce ES‑C380W, was named Scanner Line of the Year by Keypoint Intelligence, highlighting superior performance, wireless capabilities, and productivity gains.

Top Document Scanner Companies are:

-

Canon Inc.

-

Epson Corporation

-

Brother Industries, Ltd.

-

HP Inc.

-

Ricoh Company, Ltd.

-

Kodak Alaris, Inc.

-

Panasonic Corporation

-

Toshiba Corporation

-

DENSO Wave Incorporated

-

Lexmark International, Inc.

-

Plustek Inc.

-

Avision Inc.

-

Microtek International, Inc.

-

Ambir Technology, Inc.

-

Visioneer, Inc.

-

Mustek Systems, Inc.

-

Image Access GmbH

-

Oki Data Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.88 Billion |

| Market Size by 2033 | USD 11.15 Billion |

| CAGR | CAGR of 6.25% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Flatbed, Sheet-fed, Handheld, Portable, Others) • By Technology Type (ADF, Duplex, Single-pass, Others) • By Connectivity (USB, Wi-Fi, Bluetooth, Cloud, Others) • By Application (Office, Healthcare, Education, Legal, Government, Others) • By End-User (SMEs, Large Enterprises, Home Users, Public Sector, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Fujitsu Limited, Canon Inc., Epson Corporation, Brother Industries, Ltd., HP Inc., Xerox Corporation, Ricoh Company, Ltd., Kodak Alaris, Inc., Panasonic Corporation, Toshiba Corporation, DENSO Wave Incorporated, Lexmark International, Inc., Plustek Inc., Avision Inc., Microtek International, Inc., Ambir Technology, Inc., Visioneer, Inc., Mustek Systems, Inc., Image Access GmbH, Oki Data Corporation. |