Document Management System Market Report Scope & Overview:

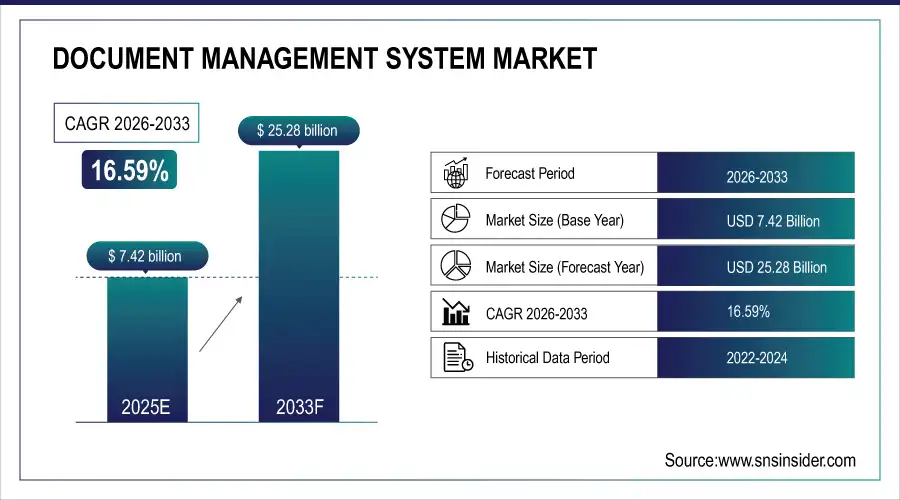

The Document Management System Market Size was valued at USD 7.42 Billion in 2025E and is expected to reach USD 25.28 Billion by 2033 and grow at a CAGR of 16.59% over the forecast period 2026-2033.

The increasing adoption of digitalization across sectors is primarily fueling the growth of Document Management System (DMS) market. To facilitate better efficiency, reduce operational expenditures, and comply with strict data regulations such as GDPR, HIPAA, and ISO standards, organizations are moving away from the traditional paper-based processes and towards digital workflows. The document data also accelerates adoption with requirements for secure storage, version control, and rapid retrieval. Moreover, the increasing trend toward remote and hybrid working arrangements has further accelerated demand for cloud-based DMS solutions, which allow for real-time collaboration and instantaneous access to vital information from any location. According to study, over 80% of organizations are accelerating digital transformation initiatives to replace paper-based workflows with digital systems.

Market Size and Forecast:

-

Market Size in 2025: USD 7.42Billion

-

Market Size by 2033: USD 25.28 Billion

-

CAGR: 16.59% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Document Management System Market - Request Free Sample Report

Document Management System Market Trends

-

Growing compliance-focused adoption as industries adapt to stricter global data regulations.

-

Accelerated shift toward cloud-based DMS driven by hybrid and remote work models.

-

Rising cost optimization pressures limiting DMS adoption among smaller enterprise segments.

-

AI-powered automation boosts document categorization, retrieval accuracy, and overall workflow efficiency.

-

Expanding demand for secure collaboration across globally dispersed, digitally connected workforces.

-

Stronger integration of DMS with ERP and CRM enhances seamless workflows.

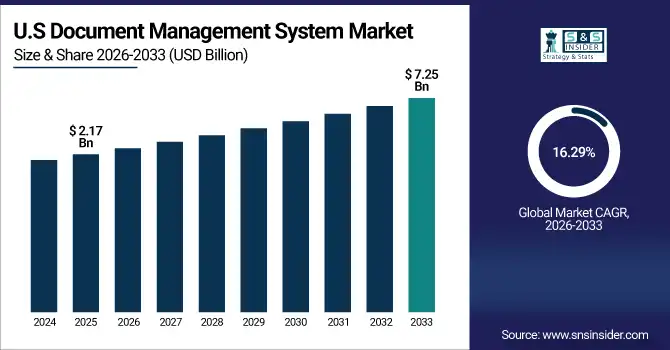

The U.S. Document Management System Market size was USD 2.17 Billion in 2025E and is expected to reach USD 7.25 Billion by 2033, growing at a CAGR of 16.29% over the forecast period of 2026-2033, primarily driven by the rapid adoption of digital transformation initiatives across enterprises seeking efficiency and secure document handling.

Document Management System Market Growth Drivers:

-

Digital Transformation and Cloud Solutions Revolutionize Construction Efficiency and Real-Time Project Collaboration Globally

Data Management solutions are being implemented due to the stringent enforcement of global data protection legislation, including GDPR in Europe, HIPAA (Health Insurance Portability & Accountability Act) in Health Care and ISO standards in corporate environments. Sensitive documents must be stored securely, with limited access, and handled under a proper audit trail to avoid potential penalties and maintain compliance. In addition, a strong DMS comes with version control, encryption, and access controls that prevent leaving sensitive information unmanaged. Thus, compliance is not merely a legal obligation but a key focus driver for the market growth.

Version control reduces document mismanagement incidents by nearly 60% in regulated industries.

Document Management System Market Restraints:

-

High Implementation Costs and Training Challenges Hinder Widespread Construction Software Adoption Worldwide

However, even with the benefits, a considerable number of organizations do struggle due to these high upfront costs involved in DMS deployment, customizing, and integrating DMS with in-house systems like ERP and CRM platforms especially in SMEs. Where on-premise models demand investments in infrastructure, cloud-based models still require expenses for training and migration as well as for subscription. This prevents full-scale adoption by small businesses causing stagnancy in the overall market growth for the high-cost regions.

Document Management System Market Opportunities:

-

Growing Demand for Sustainable Construction Software Enables Eco-Friendly Projects and Regulatory Compliance

The Artificial Intelligence (AI) and automation is another growth opportunity. Today, AI-in-genuine DMS platforms can harness AI to support intelligent search, automated indexing, data extraction, and predictive analytics. Functionalities such as OCR and NLP enhance document discoverability, while workflow automation minimizes manual processes. With smart DMS systems, enterprises are able to marketplace the advantages of enhanced efficiency and decision-making while solutions providers are able to unlock fresh revenue streams.

Predictive analytics in smart DMS boosts decision-making speed by 45%.

Document Management System Market Segmentation Analysis:

-

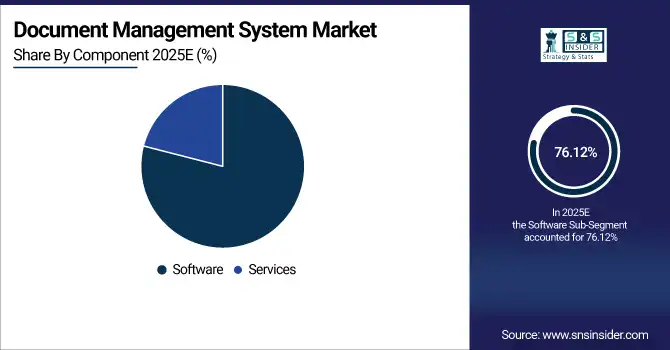

By Component: In 2025, Software led the market with share 76.12%, while Services are the fastest-growing segment with a CAGR 18.90%.

-

By Deployment: In 2025, Cloud the market 55.22%, while On-Premise fastest-growing segment with a CAGR 18.20%.

-

By Enterprise Type: In 2025 Large Enterprise led the market with share 60.22%, while Medium and Small Enterprise the fastest-growing segment with a CAGR 17.80%.

-

By Industry: In 2025, BFSI led the market with share 28.50%, while Healthcare is the fastest-growing segment with a CAGR 16.78%.

By Component, Software Leads Market and Services Fastest Growth

Document Management System (DMS) is a software for challenging enterprise and teams to manage content within the organization, every software for deployment type has a dominant share in 2025, this was driven as high adoption in enterprise with DMS system to facilitate efficient digital workflows, compliance management and secure data storage. For large operations, software solutions offer higher than ordinary features such as: version control, access restrictions, intelligent search, and many more. On the other side, services are expected to be the fastest-growing segment, driven by demand for consulting, implementation, integration, and training. Growing organized reliance on managed services and professional expertise is ensuring seamless deployment and scalability of DMS platforms across verticals.

By Deployment, Cloud Leads Market and On-Premise Fastest Growth

In terms of Deployment, the Document Management System (DMS) market can be categorized into On-premise and Cloud, with Cloud dominating the revenue share in 2025 due to increasing need for remote access, scalability, and affordability. Cloud based DMS provides real-time collaboration, ease of data sharing, and greater security, making them the go-to solution for enterprises in hybrid and remote work mode. On-Premise Deployment is expected to register fastest growth supported by industries that have stringent need for data control e.g. government, healthcare, and BFSI. On-premise models are preferred by organizations in these sectors to maintain absolute ownership, to comply with regulatory requirements, and to ensure security of sensitive information

By Enterprise Type, Large Enterprise Leads Market and Medium & Small Enterprise Fastest Growth

The Document Management System (DMS) market was segmented by Enterprise Type, out of which, large enterprises accounted for the majority share due to the availability of larger IT budgets, high volumes of documents, and strict compliance. These entities adopt leading-edge DMS solution to ease workflows and enhancing operational efficiency across various departments and geographies. On the contrary, small and medium enterprises (SMEs) are expected to have the highest growth rate, due to the growing awareness regarding the advantages of digital transformation, availability of affordable solutions over cloud, and necessity to improve productivity. Flexible DMS on SMEs SMBs are riding the digital wave and fast adapting flexible DMS to bring parity with larger players.

By Industry, BFSI Leads Market and Healthcare Fastest Growth

The global Document Management System (DMS) market was dominated by the BFSI sector in 2025, as this sector heavily depends on secure document handling, regulatory compliance, and streamlined workflows for transactions, customer records, and risk management. The need for digitization within the sector to bring efficiency and comply with stringent regulations such as GDPR or PCI-DSS has further propelled the triumph. At the same time, the fastest-growing segment is healthcare, driven by rising electronic health records (EHRs), the need to secure patient data, and interoperability demands. The drive towards telehealth and HIPAA adherence enhances the fast uptake of cutting-edge DMS in healthcare.

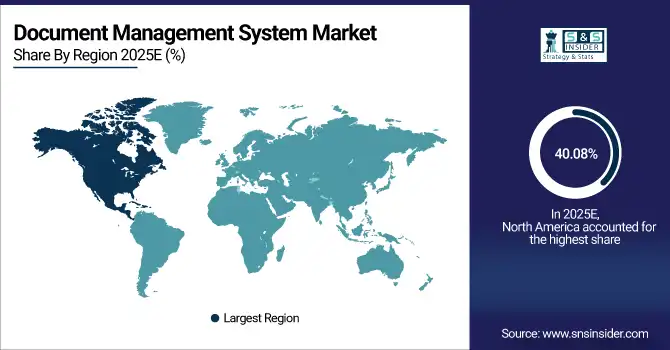

Document Management System Market Regional Analysis:

North America Document Management System Market Insights:

The Document Management System (DMS) market in North America held the largest share 40.08% in 2025, primarily due to the aggressive advances in digital transformation, regulatory frameworks, and substantial market penetration from leading technology providers. BFSI, healthcare, and government industries are among the top adopters of DMS to meet data privacy compliance standards including GDPR, HIPAA, and similar regulatory requirements. The advanced IT infrastructure in the region and a high adoption of cloud-based solution, further drive seamless integration and remote accessibility. In addition, increasing user demand for automation, AI-based document workflows, and real-time collaboration tools contribute to growing market growth in the region, with North America capturing a substantial share of the DMS market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Dominates Document Management System Market with Advanced Technological Adoption

The U.S. dominates the Document Management System market, driven by advanced technological adoption, stringent compliance regulations, widespread cloud integration, and strong demand for AI-enabled document workflows across industries ensuring efficiency and security.

Asia-Pacific Document Management System Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Document Management System (DMS) market, projected to expand at a CAGR of 18.20%, The growth is driven by swift digitalization, government-led initiatives to lessen paper usage as well as increasing adoption of cloud-based platforms by both SMEs as well as larger corporations. Healthcare, IT & telecom, and manufacturing industries are also including DMS to improve efficiency, data security, and regulatory compliance. Which combined with the growth of e-commerce and digital banking heaves adoption to the next level. With China, India and Japan ushering in the change, the Asia-Pacific region is ideal to become a growth hub for next-generation DMS.

China and India Propel Rapid Growth in Document Management System Market

China and India drive rapid growth in the Document Management System market, fueled by digital transformation, government paperless initiatives, booming SMEs, cloud adoption, and rising demand for secure, compliant, and efficient document workflows.

Europe Document Management System Market Insights

Europe is one of the leading regions for the expansion of Document Management System (DMS) market, registering a modest CAGR as driven by stringent regulatory frame works such as GDPR. DMS are being adopted by organizations in BFSI, healthcare, and government sectors that require controlled document access, audit trails, and document encryption. More Businesses in the Region Are Gone Digital transformation is becoming one of the hot topics for enterprises in the Region and they are looking at the solutions that can help them win the growing battle against sustainability, especially reducing paper-based operations which further encouraging the adoption. Flexibility and scalability drive the adoption of cloud-based solutions, while on-premise systems continue to be preferred by industries with strict data sovereignty requirements. Europe is a hotbed for DMS innovation, with strong adoption found in Germany, the UK and France.

Germany and U.K. Lead Document Management System Market Expansion Across Europe

Germany and the U.K. lead Europe’s Document Management System market expansion, driven by GDPR compliance, advanced digital infrastructure, strong enterprise adoption of cloud solutions, and increasing demand for secure, efficient, and paperless workflows.

Latin America (LATAM) and Middle East & Africa (MEA) Document Management System Market Insights

The Document Management System (DMS) market in Latin America (LATAM) and the Middle East & Africa (MEA) is experiencing gradual growth, fueled by rising digital transformation initiatives and increasing awareness of data security. In LATAM, countries like Brazil and Mexico are adopting DMS solutions to streamline workflows, reduce paper dependency, and meet compliance in banking and government sectors. In MEA, the market is supported by smart city initiatives, digital government programs, and the growing demand for cloud-based platforms in the UAE, Saudi Arabia, and South Africa. Both regions show strong potential, with SMEs driving adoption through cost-effective cloud solutions.

Document Management System Market Competitive Landscape

Microsoft leads the DMS market with SharePoint and Microsoft 365 solutions, offering cloud-based collaboration, document versioning, and AI-powered search. Its platforms support regulatory compliance, remote access, and secure storage, helping organizations streamline workflows, improve productivity, and enable real-time collaboration across departments and global operations.

-

In November 2023: Microsoft introduced SharePoint Premium, an AI-powered content management platform, enhancing document processing and governance capabilities.

Oracle provides robust DMS solutions through its WebCenter Content and APEX platforms, focusing on secure content management, version control, and workflow automation. With advanced AI and cloud capabilities, Oracle enables enterprises to manage large volumes of documents efficiently, ensuring compliance, accessibility, and seamless integration with ERP and other enterprise applications.

-

In August 2024: Oracle launched the Redwood User Interface for WebCenter Content, offering a modern and intuitive interface for content management.

IBM is a key player in the DMS market, offering Intelligent Document Processing (IDP) solutions that integrate AI and automation to streamline document workflows. Its platforms provide secure storage, advanced search, and compliance management, enabling enterprises to reduce manual effort, improve operational efficiency, and enhance regulatory adherence across industries.

-

In July 2024: IBM unveiled its Intelligent Document Processing (IDP) platform, integrating AI for automated document handling and workflow optimization.

Document Management System Market Key Players:

Some of the Document Management System Market Companies are:

-

Microsoft Corporation

-

Oracle Corporation

-

IBM Corporation

-

SAP SE

-

Salesforce

-

Adobe Inc.

-

Hyland Software, Inc.

-

OpenText Corporation

-

Xerox Corporation

-

Ricoh Company, Ltd.

-

DocuWare

-

M-Files

-

Zoho Corporation Pvt. Ltd.

-

eFileCabinet Inc.

-

SpringCM

-

MasterControl, Inc.

-

Newgen Software Technologies Limited

-

Kyocera Document Solutions Inc.

-

Konica Minolta, Inc.

-

Lenovo Filez.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 7.42 Billion |

| Market Size by 2033 | USD 25.28 Billion |

| CAGR | CAGR of 16.59% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (Cloud, On-premise) • By Enterprise Type (Small & Medium Enterprise, Large Enterprise) • By Industry (BFSI, IT and Telecommunication, Government, Manufacturing, Real Estate, Retail, Healthcare, Others – Education) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft Corporation, Oracle Corporation, IBM Corporation, SAP SE, Salesforce, Adobe Inc., Hyland Software, Inc., OpenText Corporation, Xerox Corporation, Ricoh Company, Ltd., DocuWare, M-Files, Zoho Corporation Pvt. Ltd., eFileCabinet Inc., SpringCM (a DocuSign company), MasterControl, Inc., Newgen Software Technologies Limited, Kyocera Document Solutions Inc., Konica Minolta, Inc., Lenovo Filez., and Others. |