Electronic Flight Bag (EFB) Market Size & Overview:

The Electronic Flight Bag (EFB) Market Size was valued at USD 3.24 Billion in 2023 and is expected to reach USD 6.01 Billion by 2032 and grow at a CAGR of 7.2% over the forecast period 2024-2032.

The electronic flight bag is an electronic gadget used by team members and flight decks to efficiently and successfully handle aeroplanes. Flight logs, flight charts, airport information, weather information, workbooks, flight records, route information, and other pertinent information are all kept in Electronic Airlines (EFB) bags. Pilots can also get real-time data from the Electronic Airlines (EFB) fund. Pilots can minimise the plane's weight by doing so. Increase the aircraft's fuel economy.

Get more information on Electronic Flight Bag Market - Request Sample Report

Electronic flight bag in planes contain all of the information that a plane requires. The increase in the number of commercial aeroplanes is one of the primary drivers of the electronic flight bag market. The number of passengers, and thus the number of flights, is expanding in tandem with the growing population. To keep the flight under control and everything running properly, an electronic flight bag is required. As a result, consumer demand is increasing. With the increasing expansion of commercial airlines, market revenue will rise in the future years.

Furthermore, when the price of fuel rises, demand for fuel-efficient aircraft rises, prompting airlines to invest in technology that would make their trips more cost-effective. Furthermore, accuracy in aeroplane operations is necessary to reduce all aircraft repair expenses, as well as to improve airline bag market trends. The normal pilot's purse was eventually replaced by an Electronic Flight Bag before it was employed for aeroplane use. The weight difference between ordinary airbags, which weigh 40 pounds, and air force bags, which weigh 5 pounds, is significant. It has the potential to reduce the plane's overall weight and increase its efficiency.

Electronic Flight Bag (EFB) Market Dynamics

Key Drivers:

-

Increasing Adoption of Digital Solutions to Enhance Operational Efficiency and Safety in Aviation Boosts the EFB Market

The growing shift towards digital solutions in aviation is significantly driving the growth of the Electronic Flight Bag (EFB) market. Airlines, business aviation, and military aviation sectors are increasingly adopting EFB systems to streamline flight operations, improve safety, and reduce operational costs. EFBs replace traditional paper-based flight materials such as navigation charts, manuals, and logs, enabling pilots to access real-time flight data directly on electronic devices. This shift is driven by the need for efficient, error-free flight management systems that enhance operational decision-making. By offering features such as automated flight plans, real-time weather updates, and critical data analysis, EFB systems significantly reduce pilot workload and improve flight safety. Additionally, these systems contribute to lower operational costs by eliminating the need for physical documents and reducing fuel consumption by cutting down on aircraft weight. As aviation companies focus on reducing costs and improving safety, the adoption of EFBs becomes crucial. Regulatory bodies, such as the FAA, have also facilitated the adoption of these systems by providing clear guidelines and certifications, further accelerating their implementation. As a result, the demand for EFB systems is set to grow, propelling the overall market expansion.

-

Regulatory Support and Standardization of EFB Systems Promotes Widespread Adoption Across Global Aviation Industry

Regulatory support and the standardization of Electronic Flight Bag (EFB) systems are major driving forces behind their widespread adoption in the aviation industry. Regulatory bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have played a crucial role in providing guidelines and certifications that ensure the safe and reliable use of EFBs in flight operations. The FAA’s Advisory Circular 91-78A provides clear standards for the use of EFBs in aircraft, which has helped in the seamless integration of these systems into commercial, military, and general aviation sectors. As these regulations become more standardized, more aviation operators are encouraged to adopt EFB technology to ensure compliance with safety standards. Furthermore, the growth of international standards and certifications has created a more conducive environment for the introduction of new EFB products, spurring innovation in the market. Leading EFB providers, such as Honeywell, Boeing, and Thales, have invested significantly in meeting regulatory requirements to ensure their systems are compliant with international standards. This support from regulatory bodies, combined with industry-wide standardization efforts, has bolstered the market’s growth, accelerating the transition to digital cockpit technologies across the aviation industry.

Restrains:

-

High Initial Investment and Integration Costs Hinder Widespread Adoption of EFB Systems in Small and Mid-Sized Aviation Fleets

One of the key restraints in the growth of the Electronic Flight Bag (EFB) market is the high initial investment and integration costs associated with implementing EFB systems, particularly for small and mid-sized aviation fleets. The initial cost of purchasing EFB hardware, and software, and integrating it with existing aircraft systems can be prohibitive, especially for smaller operators who have limited budgets. This challenge is compounded by the need for training pilots and ground staff to effectively use the new systems, which adds to the overall cost. Smaller airlines, private aviation operators, and general aviation pilots may find it difficult to justify the upfront expenditure when compared to the more affordable and traditional paper-based alternatives.

Additionally, the complexity of integrating EFB systems with existing avionics and flight management systems further increases the costs for these operators. Despite the long-term operational savings and safety benefits, the high initial costs pose a significant barrier to the adoption of EFBs, particularly in regions where aviation fleets consist mainly of smaller aircraft with limited resources. This restraint has slowed the market penetration of EFBs in these segments, affecting the overall growth of the market.

Electronic Flight Bag Market Segmentation Analysis:

By Type

In 2023, the Portable segment of the Electronic Flight Bag (EFB) market accounted for the largest share, contributing 73% of the revenue. Portable EFBs are lightweight, flexible devices such as tablets and laptops that pilots can carry during flight, providing easy access to real-time flight data. Their popularity stems from their convenience and adaptability, allowing pilots to access essential documents, charts, and real-time information on the go. Companies like Honeywell and Teledyne Controls LLC have significantly advanced portable EFB solutions with products such as GoDirect Flight Bag Pro and GroundLink EFB, which cater to both commercial and military aviation sectors.

The Installed segment of the Electronic Flight Bag (EFB) market is expected to grow at the largest CAGR of 9.16% during the forecast period. Installed EFBs are integrated into the aircraft’s avionics systems, offering a more permanent, in-flight solution for managing flight data and resources. These systems provide higher reliability, connectivity, and integration with other aircraft systems compared to portable devices. Companies like Thales Group and The Boeing Company have been leading developments in the installed EFB space.

By Platform

In 2023, the commercial aviation segment accounted for the largest share of the Electronic Flight Bag (EFB) market, contributing 60% of the revenue. This dominance can be attributed to the high volume of commercial aircraft worldwide, coupled with the increasing need for efficiency and safety in flight operations. EFB solutions in commercial aviation provide pilots with real-time access to flight plans, weather data, and charts, significantly reducing the reliance on paper-based materials and improving decision-making.

The Business and General Aviation segment of the Electronic Flight Bag (EFB) market is expected to experience the largest compound annual growth rate (CAGR) of 8.74% during the forecasted period. This growth is primarily fueled by the increasing adoption of EFB systems in smaller aircraft for efficient flight management. Business and general aviation pilots are increasingly adopting EFBs to streamline flight operations, access real-time data, and improve navigation and safety.

For example, has become popular for its seamless integration with mobile devices, offering features like digital charts, weather updates, and flight planning tools. Similarly, Garmin’s G3000 avionics suite, which integrates an installed EFB with the aircraft’s flight management system, is gaining traction in both business and general aviation sectors.

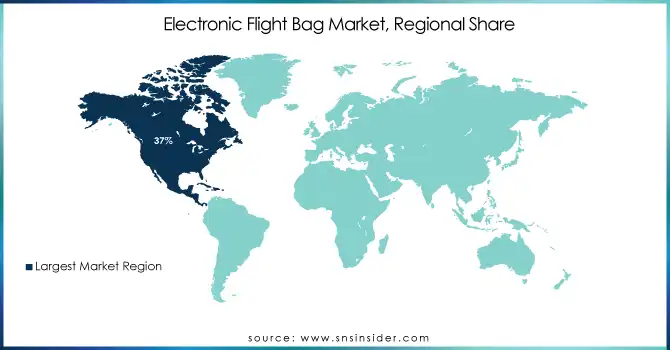

EFB (Electronic Flight Bag) Market Regional Outlook

In 2023, North America dominated the Electronic Flight Bag (EFB) market, holding a market share of approximately 37%. Its sophisticated aviation infrastructure and significant technology investments. Leading U.S. airlines such as Delta and American Airlines have been trailblazers in implementing EFB systems to enhance operations, increase efficiency, and comply with Federal Aviation Administration (FAA) standards. The FAA has established guidelines that encourage the utilization of EFBs to improve safety and operational efficiency, thereby increasing their adoption rate. Additionally, the existence of prominent EFB technology suppliers in the area is vital for the market's expansion, providing innovative solutions designed to meet the aviation sector's requirements. North America's focus on technological advancements, along with its strong aviation industry, perpetuates a high demand for EFB solutions.

In 2023, the Asia Pacific area emerged as the quickest expanding market for Electronic Flight Bags (EFBs), projected to have a CAGR surpassing 8.47% from 2024 to 2032. This considerable growth is driven by the swift development of the aviation sectors in nations like China, Japan, and India, which are progressively embracing EFB technologies to optimize flight operations and boost efficiency. For example, top airlines in Asia are integrating EFB systems to enhance flight planning and strengthen safety measures. Additionally, the increasing need for advanced flight operations in the region and the transition to paperless cockpits are significant factors fueling this market expansion.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Electronic Flight Bag Market are:

-

Esterline CMC Electronics (PilotView EFB, CMA-1100 Display Unit)

-

Honeywell (Primus Epic EFB, GoDirect Flight Bag Pro)

-

Ramco Systems (Aviation M&E MRO Software, Ramco Aviation Analytics)

-

UTC Aerospace Systems (Electronic Flight Folder, Onboard EFB System)

-

Teledyne Controls LLC (GroundLink EFB, Aircraft Data Router)

-

DAC International Inc (GDC64 Tablet Adapter, Gen-X EFB Mounting Solutions)

-

The Boeing Company (Jeppesen FliteDeck Pro, Class 3 EFB System)

-

Navarro AB (NAVSystem EFB, NAVBag Solution)

-

Lufthansa Systems (Lido/eRouteManual, Lido/mPilot)

-

International Flight Support (CrewBriefing EFB, Paperless Flight Bag)

-

L-3 Communications Holdings Inc (ProVision EFB, Class 2 EFB Solution)

-

Thales Group (TopWings EFB, FlytLINK Communications Suite)

-

Astronautics Corporation of America (Nexis Flight Deck, AeroShield EFB System)

-

CMC Electronics (PilotView EFB, CMA-9000 Flight Management System)

-

Thales (Avionics Suite EFB, TopFlight FMS)

-

Airbus Group SE (FlySmart EFB, Skywise Digital Solutions)

-

Flightman (EFB Software Suite, Flightman Module-Based Platform)

-

Rockwell Collins Inc (ARINCDirect EFB, Pro Line Fusion EFB)

-

The Boeing Company (Jeppesen FliteDeck Pro, Class 3 EFB System)

Recent Trends

-

In March 2023, Boeing introduced the ForeFlight electronic flight bag app, now available for general, business, and military aviation pilots in Australia.

-

In June 2024, Airbus selected Honeywell’s Flight Management System for its fleet, enhancing flight operations with improved navigation and integration of advanced data solutions. This collaboration strengthens Honeywell’s presence in the Electronic Flight Bag (EFB) market, offering enhanced safety and efficiency for pilots.

-

In November 2024, Lufthansa Systems introduced a new feature for its Lido mPilot app, enabling iPad EFB mirroring on A350 display units. This enhancement provides pilots with better situational awareness by allowing them to view EFB data directly on the aircraft’s screens, set for deployment with Edelweiss Air in early 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.24 Billion |

| Market Size by 2032 | USD 6.01 Billion |

| CAGR | CAGR of 7.2 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Portable, Installed) • By Platform (Commercial Aviation, Business and General Aviation, Military Aviation) • By Component (Hardware, Software) • By End User (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Esterline CMC Electronics, Honeywell, Ramco Systems, UTC Aerospace Systems, Teledyne Controls LLC, DAC International Inc, The Boeing Company, Navarro AB, Lufthansa Systems, International Flight Support, L-3 Communications Holdings Inc, Thales Group, Astronautics Corporation of America, CMC Electronics, Thales, Airbus Group SE, Flightman, Rockwell Collins Inc. |

| Key Drivers | • Increasing Adoption of Digital Solutions to Enhance Operational Efficiency and Safety in Aviation Boosts the EFB Market. • Regulatory Support and Standardization of EFB Systems Promotes Widespread Adoption Across Global Aviation Industry. |

| Restraints | • High Initial Investment and Integration Costs Hinder Widespread Adoption of EFB Systems in Small and Mid-Sized Aviation Fleets. |