Automotive Digital Cockpit Market Report Scope & Overview:

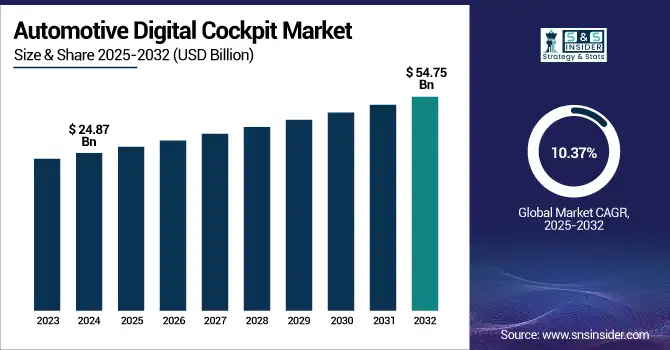

The Automotive Digital Cockpit Market was valued at USD 24.87 billion in 2024 and is expected to reach USD 54.75 billion by 2032, growing at a CAGR of 10.37% from 2025-2032.

Get More Information About This Research Report - Get Sample Report

Several factors play a major role to make the automotive digital cockpit market very promising, with much scope for substantial expansion. Particularly, the increasing demand on the part of consumers for premium in-car experience filled with entertainment, connectivity, and safety features is driving the demand for advanced digital cockpits. Also, the requirement for regulatory compliances, such as the European Union's proposed legislation to make ADAS compulsory in all new vehicles by 2022, will compel the implementation of sophisticated digital cockpit solutions for the delivery of vital information. In addition, plans like the Chinese policy called "Made in China 2025", which includes huge investments for electric vehicles with intelligent connectivity, are very likely to increase demand for digital cockpits considerably in the world's largest automotive market.

Trends of integration of advanced driver assistance systems have emerged, with about 40% inclusion of features such as adaptive cruise control and lane-keeping assistance in digital cockpit systems. This helps make a vehicle both safer and more convenient for the drivers and hence is one of the major growth drivers. Increasing usage of high-resolution displays and infotainment systems also marks another trend, with their contribution standing at about 35% regarding the features of the digital cockpit. These displays provide superior visual clarity and functional capability for an increasing interest in becoming seamlessly connected and involved with each user. Voice-activated controls are also gaining wide popularity; almost 25% of digital cockpits are adopting voice recognition technology to achieve operational capability without manual control and offer better interaction with the user. The market is also witnessing an increasing trend of demand for customizable and modular cockpit solutions by car manufacturers in the process of accommodating the interface and functionality according to their brand and model needs.

MARKET DYNAMICS:

Drivers

-

Increased demand for better user experience inside the vehicle.

-

Concerns developing on safety issues of the drivers and passengers.

-

The promotion and use of advanced features by OEMs, along with the usage by consumers, help the industry grow.

Drivers expect increasing added value from their vehicles, as new technologies for heads-up displays or gesture control enable more advanced user experiences. Worsening concerns over driver distraction and potential cyber threats that can lead to loss of vehicle control. Thus, this has indeed brought about a paradigm shift in the automotive industry, with massive investments in strong cybersecurity protocols and interface design to enable better driver focus. What this auto industry would be in the future depends on making a car experience that integrates safety and smooth functionality-one that requires generous budgets toward innovation. There must be a harmonious balance in the level of technological advancement and welfare of the driver for sustained growth and competitive advantage in the marketplace.

Restraints

- Complex Software Integration and Cybersecurity Risks Hamper Seamless Deployment Across OEM and Tier-1 Ecosystems

The increasing software complexity of digital cockpit platforms poses integration hurdles for OEMs and Tier-1 suppliers. Digital cockpits must seamlessly consolidate infotainment, navigation, telematics, and ADAS into a unified HMI while ensuring real-time performance and fail-safe operation. Achieving this involves intricate system validation and cross-platform compatibility, which extends development timelines. In addition, these interconnected systems are increasingly exposed to cybersecurity threats, requiring robust encryption, over-the-air (OTA) update capabilities, and intrusion detection mechanisms. These technical and security challenges restrict scalability and increase liability concerns, especially as vehicle electronics become more software-defined.

Opportunities

- Rising Electrification of Vehicles Creating Demand for Personalized, Software-Defined Digital Cockpit Architectures

The shift toward electric vehicles (EVs) is opening new possibilities for automotive digital cockpits focused on personalization, modularity, and software-driven innovation. EVs offer fewer mechanical constraints, enabling cabin redesigns centered around large curved displays, heads-up projection, and touch-based control ecosystems. With a reduced need for analog gauges, manufacturers are using digital cockpits to display range, battery analytics, and eco-feedback in real time. These systems also allow for OTA updates and feature enhancements, unlocking monetization opportunities post-sale. The EV boom, particularly in Asia and Europe, thus presents a fertile ground for cockpit digitization.

Challenges

- Lack of Global Standardization for Cockpit Hardware and Software Platforms Creates Integration Incompatibilities Across Regions

The absence of globally harmonized standards for cockpit system architecture is a major challenge that hinders interoperability and scalability. OEMs and Tier-1 suppliers often need to customize digital cockpit platforms for different regional protocols, display formats, and regulatory guidelines, increasing development complexity and cost. Furthermore, proprietary ecosystems prevent seamless integration of third-party applications or ADAS systems. Without open standards for hardware interfaces, middleware, and HMI protocols, digital cockpit innovations remain fragmented, delaying time-to-market and complicating cross-market deployments for both legacy automakaers and startups.

Market Segmentation Analysis:

By Component

Digital Instrument Cluster dominated the Automotive Digital Cockpit Market in 2024 due to its critical role in enhancing driving experience and safety. These clusters provide real-time vehicle information with customizable and high-resolution displays, which improve driver awareness and interface intuitiveness. The growing integration of ADAS features and increasing preference for digital interfaces over analog ones have driven automakers to prioritize digital instrument clusters in both premium and mid-range vehicle models.

HUD (Head-Up Display) segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by rising demand for advanced driver assistance and safety technologies. HUDs project key information like speed, navigation, and alerts directly onto the windshield, minimizing driver distraction. With increasing adoption of AR-based HUDs and growing emphasis on driver focus and safety compliance, automakers are rapidly integrating these systems, particularly in electric and luxury vehicles.

By Technology

Advanced Driver Assistance Systems (ADAS) dominated the Automotive Digital Cockpit Market in 2024 due to their critical role in enhancing vehicle safety, comfort, and automation. Increasing regulatory mandates for safety features, rising consumer demand for collision avoidance systems, and integration of features like adaptive cruise control, lane-keeping assist, and automated emergency braking have driven widespread adoption. ADAS also forms the foundation for semi-autonomous and autonomous driving systems, making it a central cockpit component.

Augmented Reality HUDs segment is expected to grow at the fastest CAGR from 2025 to 2032 due to the increasing push toward immersive and intuitive driving experiences. AR HUDs enhance situational awareness by overlaying navigation, alerts, and hazard indicators onto the real-world view, enabling real-time, heads-up interaction. As automakers focus on advanced HMI and premium features in electric and connected vehicles, the demand for AR HUDs is accelerating, especially among tech-savvy and safety-conscious consumers.

By Display Type

TFT‑LCD dominated the Automotive Digital Cockpit Market in 2024 due to its cost-effectiveness, mature manufacturing ecosystem, and wide availability across vehicle classes. Automakers prefer TFT-LCD for its balance of performance and affordability, making it ideal for mass-market and mid-range vehicles. Its compatibility with existing vehicle electronic architectures and proven durability under varying automotive conditions further reinforces its widespread integration in both instrument clusters and infotainment systems.

REGIONAL ANALYSIS:

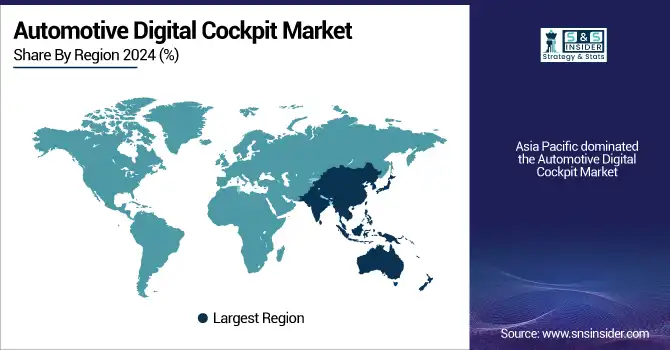

Asia Pacific dominated the Automotive Digital Cockpit Market with the highest revenue share in 2024 due to the region’s strong automotive manufacturing base, high vehicle production volumes, and rapid adoption of in-vehicle digital technologies. Countries like China, Japan, and South Korea lead in technological innovation and integration of connected car features. Additionally, growing consumer demand for advanced infotainment and safety systems in mid-range and premium vehicles has fueled market dominance in the region.

China dominates the Asia Pacific Automotive Digital Cockpit Market due to its massive vehicle production, rapid adoption of smart vehicle technologies, and strong government support for connected cars. Japan and South Korea also contribute significantly, driven by advanced automotive innovation.

Europe is witnessing steady growth in the Automotive Digital Cockpit Market, driven by the region’s strong emphasis on vehicle safety, innovation, and sustainability. The presence of leading luxury and electric vehicle manufacturers is accelerating the adoption of advanced digital cockpit technologies, including high-end infotainment systems, digital clusters, and AR HUDs. Additionally, stringent regulations supporting connected and autonomous vehicles, along with consumer demand for enhanced in-car experiences, are encouraging OEMs to integrate cutting-edge cockpit solutions across various vehicle segments in the European market.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS:

Continental AG; Robert Bosch GmbH, Faurecia; Garmin Ltd.; Denso Corporation; HARMAN International; Hyundai Mobis; Panasonic Corporation, Pioneer Corporation; Visteon Corporation are some of the affluent competitors with significant market share in the Automotive Digital Cockpit Market.

Recent Developments:

- 2024: Continental AG Implemented a cross-domain High‑Performance Computer (HPC) in a test vehicle, combining cockpit, safety, and parking control using Qualcomm’s Snapdragon Ride Flex SoC

- Jan 8, 2024: Panasonic Corporation Introduced Neuron HPC (High‑Performance Compute) platform at CES 2024, consolidating ECUs, scalable to SDVs; can reduce ECU count up to 80%

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2024 |

US$ 24.87 Billion |

|

Market Size by 2032 |

US$ 54.75 Billion |

|

CAGR |

CAGR of 10.37% From 2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Digital Instrument Cluster, Head-Up Display (HUD), Infotainment Unit, Control/Touch Panels, Telematics Control Unit, ECU & SoC Platforms) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Continental AG; Robert Bosch GmbH, Faurecia; Garmin Ltd.; Denso Corporation; HARMAN International; Hyundai Mobis; Panasonic Corporation, Pioneer Corporation; Visteon Corporation |