Esoteric Testing Market Size Analysis:

To get more information on Esoteric Testing Market - Request Free Sample Report

The Esoteric Testing Market Size was valued at USD 25.88 Billion in 2023 and is expected to reach USD 61.27 Billion by 2032 and grow at a CAGR of 10.1% over the forecast period 2024-2032.

Esoteric testing market is seen to have increased a lot over the past couple of years with the reasons attributed to technological advancement, increases in chronic diseases, and medicine personalization. The Esoteric Testing is defined as the specialized tests generally not conducted at ordinary clinical sites. Generally, the test requires advanced techniques and technology to detect hidden conditions in the body that are quite impossible to find easily with ordinary methods.

The CDC has identified significant facts related to chronic diseases that align with the growth of the Esoteric Testing Market. As of February 2024, nearly 6 out of 10 adults have some type of chronic disease in the United States. This creates a large requirement for advanced diagnostic methods like esoteric testing. Moreover, chronic diseases contribute to around 7 out of 10 deaths each year in the U.S. This indicates that it is very essential to have specialized tests for early detection and treatment. It is found that the prevalence of diseases such as diabetes has increased by 5% over the past decade.

Therefore, there is an increased need for targeted testing practices to manage and monitor diseases effectively. This calls for personalized medicine because an estimated 117 million Americans live with two or more chronic conditions. Rising complexity in patient health profiles directly correlates with the need for esoteric tests, providing more specific insight into the mechanisms of diseases and their treatment responses.

Esoteric Testing Market Dynamics

Key Drivers:

-

Growing Investment in Precision Medicine Fuels Advances in Esoteric Testing

There has been a lot of funding for research in the direction of precision medicine, genetic analysis, and personalized medicine. There have been many research grants given out to further the exploration of genomics, precision medicine, and personalized therapies. These efforts are aimed at improving the understanding, diagnosis, and treatment development for rare molecules, thus allowing esoteric testing laboratories to expand their diagnostic capabilities. Investment in R&D drives growth in the market as regards technological, diagnostic, and healthcare solutions.

Through investment, the field of precision medicine and genetic analysis has witnessed massive growth, and funding to the tune of nearly USD 3.2 billion has been allocated just in the United States alone for research and development. Thus, this increased funding will allow many studies on rare diseases and other novel therapeutic approaches that will consequently improve the capabilities of these esoteric testing laboratories. Specifically, over 500 grants have been awarded thus far for research projects that accelerate genomics and personalized medicine. The efforts that will be developed are expected to increase the number of developed esoteric tests to around 20% more by 2025 to remain committed to improving accuracy rates in diagnostics and thus positive impacts on patient outcomes. Moreover, more than 40 nations are taking part in the international efforts toward the establishment of personalized therapies. This will require more esoteric testing because the demand for specific and individualized treatment for patients is at an all-time high.

-

Surge in Chronic Diseases Propels Demand for Esoteric Testing Solutions

An ever-growing rate of chronic conditions such as cancer, diabetes, and cardiovascular conditions gives the market a call to evolve specialized diagnostic testing, especially with esoteric testing to help in discovering markers of these conditions; earlier discovery would be used in forming specific treatments and leading to better outcomes.

Presently, 6 in 10 adults have a chronic disease with 40% having more than two conditions. Heart disease causes almost 697,000 deaths annually, while diabetes is present in about 1 in 10 adults and affects approximately 37 million Americans. Epidemics of chronic diseases have extremely heavy economic costs. Current estimates project expenditures exceeding USD 4.1 trillion in 2030. From this view, it is only common sense to apply appropriate early detection and management methods, as well supported by esoteric tests, for the betterment of the treatment results and quality of life of the patients by earlier detection of the biomarkers essential in diagnosing complex cases.

Restrain:

-

Capital Investments and Cost-Benefit Challenges Hinder Biomarker Development in Esoteric Testing

The creation of esoteric testing methodologies usually leads to the discovery of new biomarkers. Although these tests improve the knowledge of how biomarkers are associated with health and disease, they are expensive to discover, develop, and validate. This is a significant constraint on the growth of the biomarkers market and related industries like diagnostics, including in vitro and companion diagnostics, as well as personalized medicine.

There is a huge esoteric testing market due to the capital investment in the development and validation of biomarkers. Finding new biomarkers and their validation is a capital-intensive process in that it costs hundreds of thousands or sometimes millions of dollars. It is further noted in research that 25% of all research projects incur cost overruns, and therefore the issue of financial planning cannot be overlooked in this domain. Moreover, the payback on investment for the exotic tests is usually relatively low as well. An estimate says that only 30% of the projects work out into a commercially viable product. These economic hurdles are contributing to the slower growth in this market, primarily in personal medicine and diagnostics.

Esoteric Testing Market Segmentation Analysis

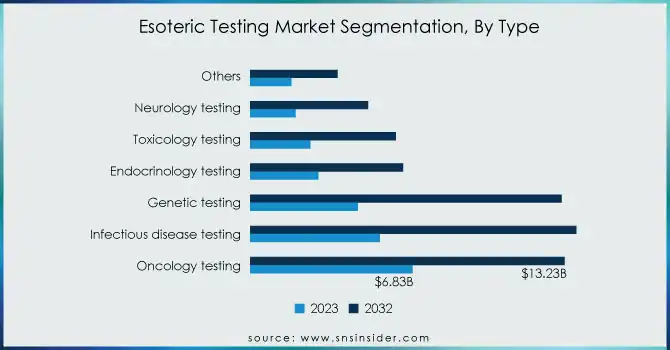

By Type

The Oncology Testing segment was leading the esoteric testing market with a revenue share of 26% in 2023. It was because advanced diagnostic solutions were gaining popularity in the care of cancer. Guardant Health, for instance, launched the Guardant 360 CDx. This is a multi-panel liquid biopsy that detects genomic alterations across all cancers. The major players innovate new products to meet that demand. An example of this approach is recently when Guardant Health came out with a broad liquid biopsy test that can diagnose genomic alterations in more than 90% of the patients suffering from advanced cancers

The Genetic Testing segment of the esoteric testing market is poised for robust growth, projected to achieve a CAGR of 12.55% during the forecast period. This is driven by increased consumer demand for personalized medicine and advances in genomics. Companies such as 23andMe and Myriad Genetics are leading the charge, launching innovative genetic tests that cater to both consumers and healthcare providers. For example, Myriad Genetics has expanded its MyRisk test, which assesses hereditary cancer risk based on an individual's genetic profile, improving the accuracy of risk assessments.

By Technology Type

In 2023, the Chemiluminescence Immunoassay (CLIA) segment dominated the esoteric testing market, capturing a significant revenue share of 30%. This technology is high in sensitivity and specificity, meaning it's very effective for detecting a wide variety of biomarkers, such as hormones, infectious agents, and cancer markers. Recently, for instance, Roche Diagnostics launched the Cobas e801 immunoassay analyzer, designed to enhance the detection of cardiac biomarkers, a critical factor in patient management, particularly in cardiology.

Siemens Healthineers also presented the Atellica solution, which adds to improving laboratory efficiency and throughput, with advanced CLIA technology integrated into routine testing.

The Enzyme-Linked Immunosorbent Assay (ELISA) segment is experiencing robust growth in the esoteric testing market, projected to achieve a CAGR of 13.05% during the forecast period. The major driving force behind this growth is the growing demand for reliable and high-throughput diagnostic tests in applications like infectious disease detection, allergy testing, and hormone level measurement. Recent product launches have contributed significantly to this trend. For instance, Thermo Fisher Scientific introduced its TMB Substrate designed to enhance the sensitivity and accuracy of ELISA tests.

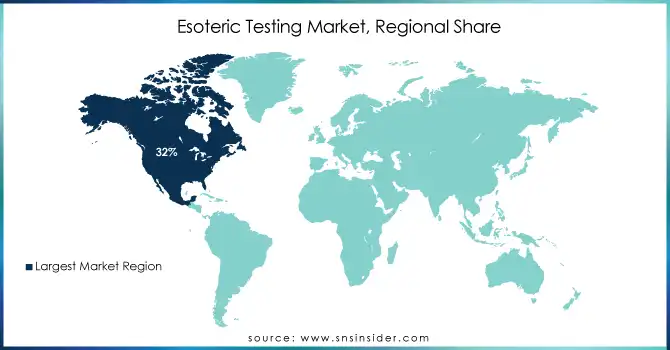

Esoteric Testing Market Regional Overview

In 2023, the North American esoteric testing market accounted for a significant share of 32%. All these are driven by factors such as robust government support for quality health care, comprehensive reimbursement policies, and substantial purchasing power in the region. In addition, the growth in chronic diseases, most notably cancer, and cardiovascular disease, plays a significant role in increased demand for advanced diagnostic testing. For instance, it indicates a regular trend that since some 60% of U.S. adults live with at least one chronic disease, the demand for effective diagnostic solutions becomes an important need.

Additionally, according to the American Cancer Society, it is estimated that nearly 1.9 million new cancer cases will be diagnosed in 2023. These numbers reflect the importance of esoteric testing in early diagnosis and especially in treatment strategies customized for cancer patients. The established healthcare infrastructure in the US provides an appreciable base for the adoption of advanced diagnostic tests, thereby significantly increasing the growth of the esoteric testing market.

The Asia Pacific region is projected to experience substantial growth during the forecast period. This growth is further spurred by an increase in patient populations and the rising number of established healthcare providers in emerging economies such as India and China. For example, government initiatives designed to enhance the diagnosis and treatment of chronic diseases contribute to better healthcare utilization.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the Esoteric Testing Market are:

-

Laboratory Corporation of America Holdings (Genetic Testing Services, Specialized Chemistry Testing)

-

OPKO HEALTH, INC. (Hormone Replacement Therapy, Autoimmune Disease Testing)

-

Quest Diagnostics Incorporated (Genetic Testing Services, Specialized Chemistry Testing)

-

Sonic Healthcare Limited (Molecular Diagnostics, Clinical Pathology)

-

H.U. Group Holdings, Inc. (Molecular Diagnostics, Clinical Pathology)

-

Kindstar Globalgene Technology, Inc. (Genetic Testing Services, Personalized Medicine Testing)

-

Stanford Health Care (Clinical Trials and Research, Specialized Diagnostic Services)

-

Mayo Foundation for Medical Education and Research (Clinical Trials and Research, Specialized Diagnostic Services)

-

ARUP Laboratories (Molecular Diagnostics, Clinical Pathology)

-

Athena Esoterix (Molecular Diagnostics, Clinical Pathology)

-

ACM Global Laboratories (Molecular Diagnostics, Clinical Pathology)

-

Healius Limited. (Molecular Diagnostics, Clinical Pathology)

-

Fulgent Genetics (Genetic Testing Services, Personalized Medicine Testing)

-

Healthscope (Pathology Services, Radiology Services)

-

Essential Health Care (Clinical Pathology, Molecular Diagnostics)

-

Miraca Holdings (Molecular Diagnostics, Clinical Pathology)

-

Spectra Laboratories (Molecular Diagnostics, Clinical Pathology)

Recent Trends

In May 2024, an additional innovation developed by Geneoscopy, Inc. is the FDA-approved colon cancer screening test called Colosense. The test is non-invasive and detects markers for colon cancer in stool samples. This brings alternative diagnoses for patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 25.88 Billion |

| Market Size by 2032 | US$ 61.27 Billion |

| CAGR | CAGR of 10.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Oncology testing, Infectious disease testing, Genetic testing, Endocrinology testing, Toxicology testing, Neurology testing, Others) • By Technology Type (Chemiluminescence immunoassay, Enzyme-linked immunosorbent assay, Mass spectrometry, Real-time polymerase chain reaction, Flow cytometry, Other) • By End-use (Hospital-based laboratories, Independent and reference laboratories, Others) • By Specimen Type (Blood, Serum, and Plasma, Urine, Other Specimens) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Laboratory Corporation of America Holdings, OPKO HEALTH, INC., Quest Diagnostics Incorporated, Sonic Healthcare Limited, H.U. Group Holdings, Inc., Kindstar Globalgene Technology, Inc., Stanford Health Care, Mayo Foundation for Medical Education and Research, ARUP Laboratories, Athena Esoterix, ACM Global Laboratories, Healius Limited., Group Holdings, Fulgent Genetics, Healthscope, Essential Health Care, Heap Genetics, Establishment Medicine, Miraca Holdings, Spectra Laboratories |

| Key Drivers | • Growing Investment in Precision Medicine Fuels Advances in Esoteric Testing • Surge in Chronic Diseases Propels Demand for Esoteric Testing Solutions |

| Restraints | • Capital Investments and Cost-Benefit Challenges Hinder Biomarker Development in Esoteric Testing |