Ferritin Testing Market Size Analysis:

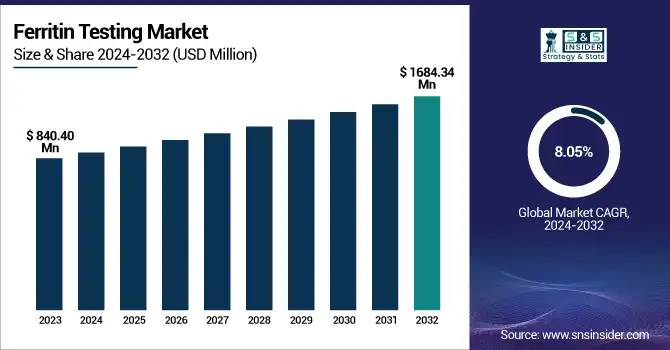

The Ferritin Testing Market Size was valued at USD 840.40 million in 2023 and is expected to reach USD 1684.34 million by 2032 and grow at a CAGR of 8.05% over the forecast period 2024-2032. This report points to the growing prevalence and incidence of iron disorders associated with iron, driving demand for ferritin testing among numerous patient populations. The analysis discusses technological development and adoption patterns, such as the creation of high-sensitivity assays and automated diagnostic systems that improve the accuracy and efficiency of testing. The report also analyzes the market share held by leading ferritin testing suppliers, determining competitive forces and strategic activities. The study also analyzes regulatory and compliance trends with an eye toward their influence on testing standardization and market accessibility in the course of assessing ferritin testing demand in particular demographics, including individuals with anemia, chronic illnesses, and nutritional deficiencies.

To Get more information on Ferritin Testing Market - Request Free Sample Report

The U.S. Ferritin Testing Market Size was valued at USD 212.73 million in 2023 and is expected to reach USD 386.44 million by 2032 and grow at a CAGR of 6.87% over the forecast period 2024-2032. In the United States, increased awareness of iron deficiency and anemia-related illnesses and growing healthcare expenditure are fueling growth in the ferritin testing market, especially in diagnostic laboratories and point-of-care environments.

Ferritin Testing Market Dynamics

Drivers

-

The growth of the ferritin testing market is primarily driven by the rising prevalence of iron deficiency anemia (IDA) and iron-related disorders.

More than 1.6 billion individuals globally have anemia, and the predominant cause is iron deficiency, says the World Health Organization (WHO). Growing knowledge regarding early detection of disease and the need to monitor ferritin levels has heavily increased the requirement for ferritin testing. Furthermore, the increase in the aging population and chronic disease cases, for example, chronic kidney disease (CKD), cancer, and autoimmune diseases, have raised the demand for regular ferritin screening. The presence of advanced diagnostic technologies, such as automated analyzers and point-of-care (POC) testing kits, has increased test efficiency and proximity, thus driving market growth even further. Additionally, government programs for promoting anemia screening programs and awareness campaigns on maternal healthcare have been instrumental in propelling the uptake of ferritin testing. Growth in telemedicine and home-based testing options has also aided market growth, as more patients opt for easy and cost-effective diagnostic solutions. In addition, partnerships between testing firms and health providers to come up with affordable testing alternatives continue to fuel the increasing need for ferritin tests in different healthcare contexts.

Restraints

-

The ferritin testing market faces challenges related to the high cost of advanced diagnostic tests and limited reimbursement policies.

Although conventional laboratory-based ferritin assays are common, automated analyzers for ferritin and rapid test kits are more expensive and therefore less readily available in low-income areas. Furthermore, in many countries, ferritin testing is not reimbursed by health insurance policies as a standard diagnostic test, so patients must pay high out-of-pocket costs. The absence of uniform testing protocols and different reference ranges for ferritin levels in various laboratories may cause inconsistencies in test results, which influence clinical decision-making. In addition, less awareness regarding ferritin testing beyond large healthcare centers limits market penetration, especially in developing countries. Most people are not aware of the significance of ferritin screening, and therefore, test adoption rates are lower. The lack of trained laboratory personnel in some areas also impacts the accuracy and reliability of tests, further slowing market growth. Moreover, regulatory delays in approvals for new ferritin test devices can retard the release of innovative diagnostic products, limiting market expansion. Removing these impediments through price reforms, social education campaigns, and increased insurance coverage could improve accessibility to the market.

Opportunities

-

The ferritin testing market presents significant growth opportunities due to the increasing adoption of point-of-care (POC) testing and home-based diagnostic kits.

With the advance in portable diagnostic technologies, the rapid ferritin test kits have become increasingly accessible, enabling one to check the iron levels on their own with ease. With the increasing demands for personalized medication and preventive medicine, the need for ferritin testing is additionally being driven as early detection of iron imbalance may avoid serious complications in health. The growth of diagnostic services in emerging economies, especially in Asia-Pacific and Latin America, presents profitable opportunities for major players. Moreover, advances in immunoassay methods and AI-based diagnostic solutions are improving the precision and effectiveness of ferritin testing. Partnerships among diagnostic firms and healthcare providers to create cost-effective and innovative testing solutions are likely to fuel market growth. In addition, the growing emphasis on incorporating ferritin testing in standard health check-ups and employer-based wellness programs provides new expansion opportunities. Government programs to raise awareness about anemia and maternal healthcare screening programs also offer significant opportunities. Firms that invest in research and development (R&D) to develop multi-biomarker test panels, such as ferritin, will be at the forefront of the changing diagnostic environment.

Challenges

-

One of the biggest challenges in the ferritin testing market is the risk of misdiagnosis and inconsistent test results due to fluctuating ferritin levels.

Inflammation, infection, liver diseases, and chronic diseases can cause ferritin to be altered and result in false positives or deceptive results. Therefore, it becomes difficult for doctors to diagnose disorders of iron solely based on the level of ferritin, making them require more tests like iron studies or complete blood count (CBC) tests. The low utilization and awareness of ferritin testing in preventive care is a significant problem as well. Several individuals, particularly those in developing nations, do not receive ferritin screening until pronounced signs of iron imbalance manifest, postponing timely intervention. Further, supply chain disruptions and logistics issues in ferritin testing kits production and delivery have impacted market growth, especially during international health emergencies like the COVID-19 pandemic. Regulation barriers and high approval processes for new diagnostic devices further impede innovation and entry into the market for new players. In addition, few healthcare facilities exist in rural and underdeveloped regions, further limiting ferritin testing access and exacerbating the healthcare disparity. Overcoming them calls for increasing investment in public awareness, facilitation of easier regulatory procedures, and enhancing worldwide diagnostic access.

Ferritin Testing Market Segmentation Analysis

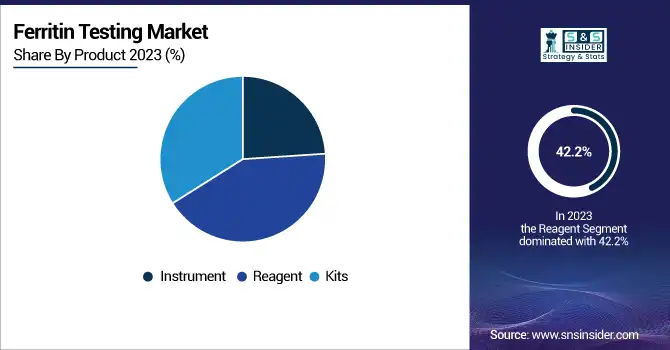

By Product

The reagent segment commanded the highest market share, standing at 42.2% in 2023. The reason for this is the extensive use of reagents in ferritin testing done in laboratories, the growing popularity of automated analyzers, and the necessity for repeated testing when dealing with chronic diseases. Reagents are crucial ingredients in ferritin assays, and hence, they are a common feature in diagnostic laboratories and hospitals.

The kits segment is the most rapidly growing segment, with growth spurred by the increasing demand for point-of-care (POC) and home-based testing. The demand for rapid and convenient diagnostic solutions, along with the development of ferritin self-testing kits, is driving the growth of this segment. Moreover, the growth of at-home healthcare solutions and telemedicine has also played a major role in its fast adoption.

By Application

The anemia segment led the market with a 39.3% share in 2023, led by the widespread global prevalence of iron deficiency anemia (IDA). Anemia is the most prevalent blood disorder globally, most notably affecting women, children, and the elderly. The growing awareness of early diagnosis, screening programs at regular intervals, and government campaigns to control anemia have further cemented this segment's market position.

The pregnancy segment is observing strong growth, as ferritin testing is highly important in checking maternal iron status to avoid complications of anemia during pregnancy. The increasing focus on maternal well-being, in addition to health organization guidelines recommending routine ferritin screening among pregnant women, is driving the usage of ferritin tests in this segment.

By End-Use

The hospitals segment held the largest share of 53.2% in 2023, owing to the huge patient flow, the presence of advanced diagnostic infrastructure, and the choice for hospital-based testing on account of increased accuracy and reliability. Hospitals are the central centers for the diagnosis and management of iron disorders, hence holding a leading market share. Hospitals are also the most rapidly growing end-use category, as they continue to extend their diagnostic capability with newer testing technologies and automated ferritin analyzers. The rising incidence of chronic diseases necessitating monitoring of ferritin and the implementation of high-throughput diagnostic solutions in hospitals are driving this segment to grow rapidly.

Ferritin Testing Market Regional Insights

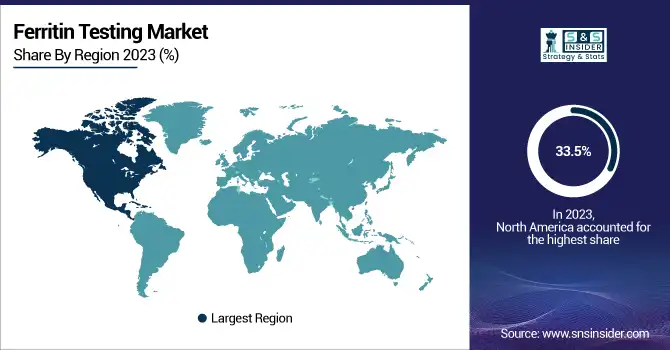

North America led the ferritin testing market in 2023, with a share of 33.5%, due to the high incidence of iron deficiency anemia, robust healthcare infrastructure, and growing awareness regarding iron disorders. The strong market position in the region is also backed by favorable reimbursement practices, extensive use of sophisticated diagnostic technologies, and the presence of key industry players like Abbott, Roche, and Siemens. Moreover, the increasing demand for screening ferritin regularly, particularly in pregnant women and people who have chronic conditions, has further driven North American market growth.

The Asia-Pacific region is the most rapidly growing ferritin testing market due to rising healthcare spending, rising prevalence of anemia-related diseases, and increased access to diagnostic services. These include countries like China, India, and Japan, which are experiencing bovine growth as a result of increased government efforts toward anemia prevention, growing investment in healthcare infrastructure, and the growing role of diagnostic laboratories. Moreover, the rising use of point-of-care (POC) testing solutions and home-based ferritin test kits is driving market growth in APAC. The large population base of the region, combined with increasing interest in early disease diagnosis and low-cost diagnostics, is likely to fuel high growth during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Ferritin Testing Market

-

CTK Biotech, Inc.

-

Cosmic Scientific Technologies

-

Abnova Corporation

-

Aviva Systems Biology Corporation

-

Humankind Ventures Ltd

-

Pointe Scientific, Inc.

-

Eurolyser Diagnostica GmbH

-

Cortez Diagnostics Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 840.40 million |

| Market Size by 2032 | USD 1684.34 million |

| CAGR | CAGR of 8.05% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Instrument, Reagent, Kits] • By Application [Anemia, Hemochromatosis, Lead Poisoning, Pregnancy, Others] • By End-Use [Hospitals, Diagnostic Laboratories] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., bioMérieux, CTK Biotech, Inc., Cosmic Scientific Technologies, Abnova Corporation, Aviva Systems Biology Corporation, Humankind Ventures Ltd, Pointe Scientific, Inc., Eurolyser Diagnostica GmbH, Cortez Diagnostics Inc. |