Iron Deficiency Anemia Therapy Market Size Analysis:

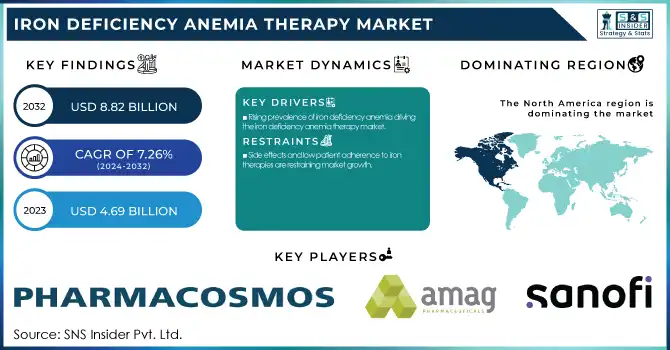

The Iron Deficiency Anemia Therapy Market size was estimated at USD 4.69 billion in 2023 and is projected to reach USD 8.82 billion by 2032, growing at a CAGR of 7.26% from 2024 to 2032.

Our Iron Deficiency Anemia (IDA) Therapy Market report offers insights by presenting a comprehensive regional breakdown of incidence and prevalence rates among major demographics, such as women, children, and the elderly. We examine prescription patterns to identify differences in treatment choices, such as oral iron, IV iron, and RBC transfusions, between various healthcare settings.

To Get more information on Iron Deficiency Anemia Therapy Market - Request Free Sample Report

In addition, we offer therapy volume projections, monitoring the uptake of different treatment modalities across the world. Healthcare expenditure analysis, with a segmentation of expenditures into government, commercial, private, and out-of-pocket sources, is given special emphasis. Through this data-driven methodology, a thorough quantitative analysis of the IDA therapy market is guaranteed.

Iron Deficiency Anemia Therapy Market Dynamics

Drivers

-

Rising prevalence of iron deficiency anemia driving the iron deficiency anemia therapy market.

The growing worldwide prevalence of iron deficiency anemia (IDA) is a major market driver for the therapy market. Based on the World Health Organization, in 2023, anemia affected about 40% of children between the ages of 6 and 59 months, 37% of pregnant women, and 30% of women between the ages of 15 and 49 years. The broad-based prevalence points to the necessity for efficient treatment methods. Underlying causes are poor dietary intake, long-term illnesses, and socio-economic issues that restrict access to healthy food. For example, iron deficiency hospital admissions in England reached 191,927 during 2023-24, an 11% rise from the previous year and a nearly tenfold increase since 1998-99. The growing disease burden has made healthcare systems channel more efforts into managing IDA, and thus, there is greater demand for oral and parenteral iron treatment. Therefore, drug manufacturers are accelerating research and development activities to launch more efficient and patient-friendly treatment patterns, thus driving market growth.

-

The emergence of advances in iron supplementation is heavily contributing to patient compliance and therapeutic efficacy, thus fueling market growth.

Old-fashioned oral iron supplements tend to produce gastrointestinal side effects, hence poor compliance. Accordingly, drug manufacturers have come up with innovative formulations with enhanced tolerability and activity. For instance, the creation of new parenteral iron products enables quick iron storage replenishment with fewer injections for patients with severe anemia or oral intolerance. Furthermore, innovations like iron polymaltose complexes and ferric carboxymaltose minimize gastrointestinal discomfort while providing improved iron absorption. These developments not only increase patient compliance but also entice healthcare professionals to prescribe these advanced solutions, boosting market growth even further. With continuous research into the next generation of therapies, the range of more efficient treatments keeps growing, propelling the growth of the iron deficiency anemia therapy market.

Restraint

-

Side effects and low patient adherence to iron therapies are restraining market growth.

One of the major issues in the iron deficiency anemia (IDA) therapy market is the side effects of iron supplementation, resulting in poor patient compliance. Oral iron supplements, the most widely prescribed treatment, usually result in gastrointestinal distress, such as nausea, constipation, diarrhea, and metallic taste. These side effects often lead to poor compliance, with patients stopping treatment before adequate iron levels are reached. Also, parenteral iron treatments, although more effective for severe anemia, are associated with risks such as hypersensitivity reactions, including anaphylaxis. Government agencies, the FDA and EMA, have issued warnings regarding the possible side effects of intravenous iron treatments, inducing uncertainty among healthcare providers. Consequently, even though IDA is increasing in prevalence, treatment non-compliance and safety issues are a major deterrent to market growth.

Opportunities

-

The growing need for safer and more effective iron deficiency anemia (ida) treatments presents a significant market opportunity.

The expanding demand for safer and more efficient treatments of iron deficiency anemia (IDA) represents a huge market opportunity. Conventional oral iron supplements have gastrointestinal side effects that result in noncompliance by patients. To address this, pharmaceutical companies are investing in developing new formulations like liposomal iron, ferric maltol, and slow-release iron compounds, which enhance absorption and reduce side effects. Also, advances in intravenous (IV) iron treatments, such as newer drugs like ferric carboxymaltose and iron isomaltoside, provide rapid iron replacement with reduced infusions and, therefore, are of great value to those having severe anemia or chronic diseases like chronic kidney disease (CKD). As global health awareness and healthcare activities for early detection and management gain momentum, improved and patient-friendly iron treatments are anticipated to increase market growth.

Challenges

-

One of the major challenges in the iron deficiency anemia therapy market is the high cost of advanced treatments, particularly intravenous (IV) iron therapies.

One of the highest obstacles in the iron deficiency anemia therapy market is the high price of innovative treatments, especially intravenous (IV) iron therapies. Although IV iron preparations are effective against severe anemia, they are costly relative to conventional oral supplements, thus being unaffordable to most patients, especially in low- and middle-income economies. Moreover, poor healthcare infrastructure, narrow reimbursement policies, and unawareness of IDA treatment choices also limit access to effective therapies. Most developing areas continue to use older, less effective, and ill-tolerated iron supplements because of cost limitations. The solution to this problem demands more investment in healthcare infrastructure, broader insurance coverage, and cost-effective drug development efforts to make high-quality IDA treatments available to a wider population worldwide.

Iron Deficiency Anemia Therapy Market Segmentation Analysis

By Therapy Type

The Parenteral Iron Therapy segment dominated the iron deficiency anemia therapy market with a 60.56% market share in 2023 because of its fast and effective treatment advantages, especially for individuals with severe anemia or iron absorption-restricted conditions. Intravenous (IV) iron preparations like ferric carboxymaltose and iron sucrose offer faster iron repletion than oral supplements and are the first choice for patients with chronic kidney disease (CKD), inflammatory bowel disease (IBD), or those on dialysis. Further, evolution in IV iron formulations has reduced infusion-related side effects, enhancing their safety and tolerability. High growth rates in mature markets such as Europe and North America, where healthcare professionals favor effective, hospital-based therapies, also helped this segment lead. In addition, reimbursement policies and insurance coverage of IV iron therapy in these economies increased access, which fueled greater demand in 2023.

The Oral Iron Therapy market is anticipated to register the fastest growth during the forecast period based on its cost-effectiveness, simplicity of administration, and increasing demand in the emerging markets. Oral iron supplementation is less expensive compared to IV iron and does not require expert administration, making it a preferred choice for the treatment of mild to moderate anemia. Governments and health agencies in developing countries, including Asia Pacific and Latin America, are strongly encouraging oral iron supplementation programs to fight widespread anemia, especially among pregnant women and children. Moreover, drug development has seen the emergence of new oral forms, like liposomal iron and ferric maltol, that increase iron absorption with a decrease in gastrointestinal side effects, thereby increasing patient compliance. As healthcare awareness increases and new oral iron therapies gain regulatory approval, this segment is expected to drive the highest market growth in the forecast years.

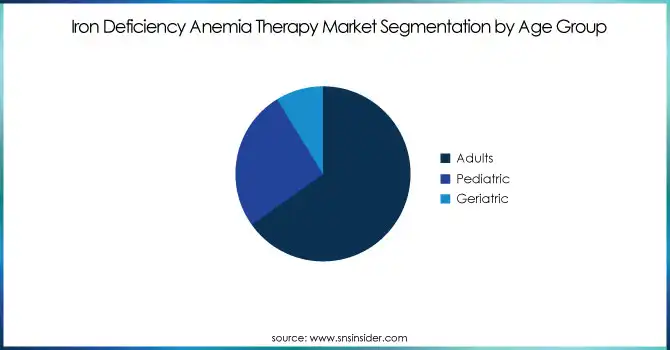

By Age Group

The Adults segment dominated the market with a 65.14% market share in 2023 because of the widespread prevalence of anemia in women of childbearing age, pregnant women, and patients with chronic diseases. The World Health Organization (WHO) states that anemia occurs in almost one-third of non-pregnant women and over 40% of pregnant women worldwide, mainly because of elevated iron requirements, menstrual blood loss, and pregnancy-related deficiencies. Moreover, chronic illnesses like chronic kidney disease (CKD), gastrointestinal diseases, and cancer are also responsible for a high prevalence of IDA among adults and thus require ongoing treatment. The extensive use of oral and intravenous (IV) iron therapy in hospitals, clinics, and home healthcare settings also contributed to the dominance of the segment. The presence of sophisticated treatment facilities and robust awareness campaigns in developed geographies such as North America and Europe also contributed significantly towards fueling the growth of the market for the adult segment.

The Pediatric segment is anticipated to grow at the fastest rate with 8.20% CAGR during the forecast period, owing to mounting cases of iron deficiency anemia among infants and young children, especially in emerging geographies. Poor nutrition, improper eating habits, and insufficient iron consumption are central determinants driving increased anemia rates among children. UNICEF reports state that approximately 50% of children aged under five years in South Asia and Sub-Saharan Africa experience anemia, demonstrating a vital necessity for proper treatment interventions. Governments and international bodies are making greater efforts towards enhancing childhood nutrition via iron supplementation schemes, fortified foods, and public health measures. Further, the introduction of more advanced pediatric-friendly iron preparations, including chewable tablets and liquid iron preparations with higher bioavailability, will stimulate adoption. As global healthcare infrastructure and awareness continue to enhance, the market for pediatric IDA therapy is poised to grow strongly in the future.

By End-user

The Hospitals segment dominated the market with a 43.28% market share in 2023, owing to the strong demand for hospital-based treatment, especially for complicated and chronic anemia. Hospitals are the main healthcare centers for delivering intravenous (IV) iron therapy, blood transfusions, and treating complex anemia cases related to conditions such as chronic kidney disease (CKD), cancer, and inflammatory bowel disease (IBD). Moderate and severe anemia patients usually need close medical attention, hence leading to the need for hospitalization as the treatment location of choice. Furthermore, sophisticated diagnostic equipment, the availability of multidisciplinary care teams, and full treatment plans offered by hospitals also increase patient volume.

Reimbursement policies and insurance coverage of iron therapies provided by hospitals, especially in developed parts of the world like North America and Europe, also continued to consolidate this segment's leadership position. Several clinical trials and research studies comparing new iron formulations and anemia treatment are also being carried out within hospital environments, promoting the adoption of advanced treatments. Consequently, hospitals were the top end-user for IDA therapy in 2023 due to their capacity to provide efficient, secure, and specialty care for patients with anemia.

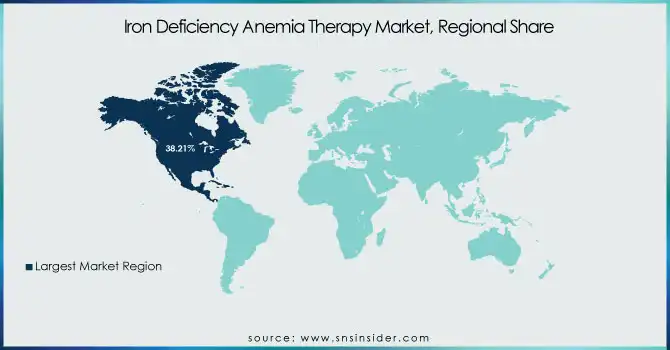

Iron Deficiency Anemia Therapy Market Regional Insights

North America dominated the iron deficiency anemia therapy market with a 38.21% market share in 2023 as a result of its established healthcare system, elevated awareness rates, and large-scale investments by governments and private enterprises in anemia treatment. North America has high IDA prevalence, especially in pregnant women, the elderly population, and people with chronic illnesses like chronic kidney disease (CKD) and inflammatory bowel disease (IBD). Also, the presence of high-end intravenous (IV) iron products, robust regulatory sanctions, and widespread reimbursement policies aid market growth. Key pharmaceutical giants, such as Pfizer, AMAG Pharmaceuticals, and Pharmacosmos, dominate the region with a strong focus on research and development for innovative iron therapies. In addition, North America's large healthcare spending and availability of advanced treatment options guarantee that patients are treated in a timely and effective manner, further cementing the region's leadership.

Asia Pacific is the fastest-growing region with 8.55% CAGR throughout the forecast period because of growing anemia rates, enhanced healthcare infrastructure, and rising government efforts to fight nutritional deficiencies. India, China, and Japan have a large population base, and a considerable percentage of their populations are impacted by IDA as a result of inadequate dietary intake of iron, excessive maternal anemia, and an aging population. The governments of these countries are proactively introducing initiatives to enhance iron supplementation, e.g., India's National Iron Plus Initiative (NIPI). Moreover, economic development and increased access to healthcare are fueling increased demand for oral and IV iron therapy. The increasing size of the pharmaceuticals market and the greater involvement of foreign players that are investing in cost-effective and quality treatment opportunities also enhance market growth. With increased healthcare awareness and accessibility, the Asia Pacific region is poised to experience tremendous market growth in the future.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Iron Deficiency Anemia Therapy Market

-

Pharmacosmos A/S (MonoFerric, CosmoFer)

-

AMAG Pharmaceuticals Inc. (Feraheme, MuGard)

-

Sanofi S.A. (Ferrlecit, Hemax)

-

AbbVie Inc. (Ferrous Sulfate, Ferrous Gluconate)

-

Fresenius SE & Co. KGaA (Venofer, Ferinject)

-

Vifor Pharma Ltd. (Maltofer, Ferinject)

-

Teva Pharmaceutical Industries Ltd. (Ferrous Fumarate, Ferrous Sulfate)

-

Pfizer Inc. (Ferrous Sulfate, Ferrous Gluconate)

-

Novartis AG (Ferinject, Venofer)

-

Mylan N.V. (Ferrous Sulfate, Ferrous Gluconate)

-

Rockwell Medical, Inc. (Triferic, Calcitriol)

-

Akebia Therapeutics Inc. (Vadadustat, Ferric Citrate)

-

Daiichi Sankyo Company (Injectafer, Luitpold)

-

Shield Therapeutics (Feraccru, PT20)

-

Zydus Lifesciences (MonoFerric, Zyfer)

-

Pieris Pharmaceuticals (PRS-080, PRS-343)

-

Bayer AG (Ferrous Sulfate, Ferrous Gluconate)

-

Apotex Inc. (Ferrous Fumarate, Ferrous Sulfate)

-

Acceleron Pharma, Inc. (Sotatercept, Luspatercept)

-

Akorn Operating Company LLC (Ferrous Sulfate, Ferrous Gluconate)

Recent Development in the Iron Deficiency Anemia Therapy Market

-

August 2024: AMAG Pharmaceuticals completes its FDA filing for Feraheme, with a request for approval to treat all adult patients with iron deficiency anemia.

-

April 2024: The U.S. FDA approves Pfizer's BEQVEZ (fidanacogene elaparvovec-dzkt), a one-time gene therapy for adult patients with Hemophilia B.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.69 billion |

| Market Size by 2032 | US$ 8.82 billion |

| CAGR | CAGR of 7.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Oral Iron Therapy, Parenteral Iron Therapy, Red Blood Cell Transfusions, Others) • By Age Group (Adults, Pediatric, Geriatric) • By End-user (Clinics, Hospitals, Home Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pharmacosmos A/S, AMAG Pharmaceuticals Inc., Sanofi S.A., AbbVie Inc., Fresenius SE & Co. KGaA, Vifor Pharma Ltd., Teva Pharmaceutical Industries Ltd., Pfizer Inc., Novartis AG, Mylan N.V., Rockwell Medical, Inc., Akebia Therapeutics Inc., Daiichi Sankyo Company, Shield Therapeutics, Zydus Lifesciences, Pieris Pharmaceuticals, Bayer AG, Apotex Inc., Acceleron Pharma, Inc., Akorn Operating Company LLC, and other players. |