Fetal Bovine Serum Market Report Scope & Overview:

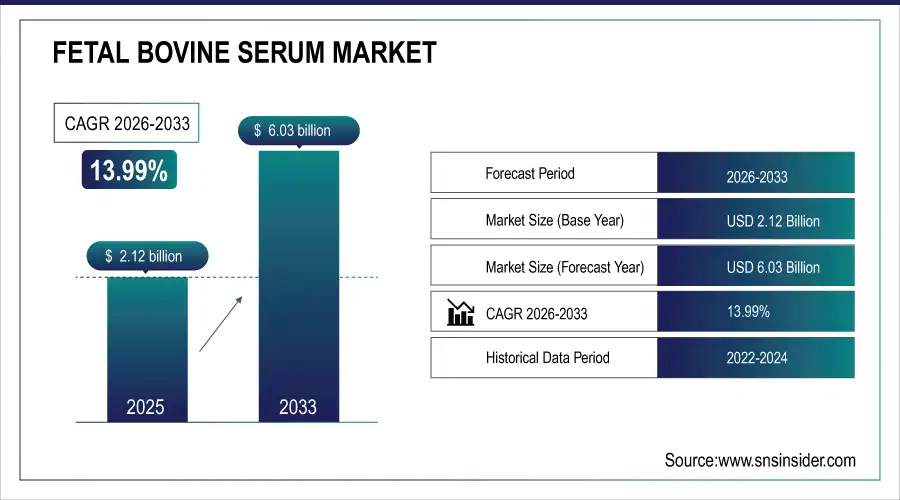

The fetal bovine serum market size was valued at USD 2.12 billion in 2025E and is projected to reach USD 6.03 billion by 2033, growing at a CAGR of 13.99% during 2026-2033.

To Get more information on Fetal Bovine Serum Market - Request Free Sample Report

Increasing demand for cell-based research and biopharmaceutical production is one of the dominating trends in the global Fetal Bovine Serum market. FBS is a critical reagent in mammalian cell culture for stem cell research, CAR-T therapies, and regenerative Human and animal vaccine production. Growing utilization in vaccine production and antibody generation, owing to global biopharmaceutical growth, is also propelling the market. The fetal bovine serum market trend report shows the competitive situation among the top manufacturers, with sales, revenue, and market share, and the market by type and application.

For instance, in September 2024, over 60% of top FBS suppliers adopted ISO and cGMP standards, boosting traceability, quality assurance, and confidence in the global Fetal Bovine Serum market.

Fetal Bovine Serum Market Trends

-

Rising demand for cell-based research and regenerative Human and animal vaccine production is driving global FBS consumption.

-

Expansion of biopharmaceutical and vaccine production is boosting FBS adoption in commercial manufacturing.

-

Growing use of specialty FBS products, including stem cell-grade, exosome-depleted, and dialyzed FBS, is supporting high-value applications.

-

Increasing investment by academic institutions and CROs is creating steady demand for research-grade FBS.

-

Adoption of ISO and cGMP-compliant FBS enhances quality assurance and traceability, strengthening market confidence.

-

Expansion of premium and specialty FBS products across North America, Europe, and Asia-Pacific offers new opportunities for suppliers.

U.S. Fetal Bovine Serum Market Insights

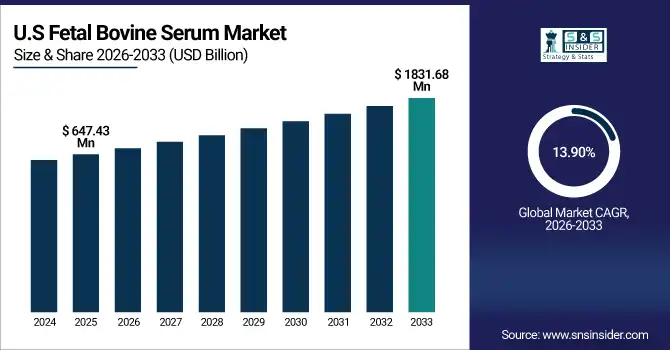

The U.S. fetal bovine serum market size was valued at USD 647.43 million in 2025E and is projected to reach USD 1831.68 million by 2033, growing at a CAGR of 13.90% during 2026-2033. The U.S. is the leader in the fetal bovine serum market analysis because of the large academic and research infrastructure, comprising universities, research institutes, and CROs that demand high cell culture, stem cell, and drug discovery. Also, US labs and companies in biopharma are early adopters of special, FBS-products, including stem cell-grade, exosome-depleted, and dialyzed serum, which enable advanced therapies and high-value research.

Fetal Bovine Serum Market Growth Drivers:

-

Growth in Cell-Based Research Driving Fetal Bovine Serum Consumption Growth

Cell-based research is one of the key forces fueling the growth of the global fetal bovine serum market. Increasing use of stem cell research, CAR-T therapy, and regenerative Human and animal vaccine production is greatly contributing to the consumption of FBS. It is used as an essential component in mammalian cell culture practices, including scientific research and drug development, and in high-value therapeutics.

For instance, in November 2024, the regenerative Human and animal vaccine production sector’s FBS usage grew by ~12% YoY, driven by tissue engineering and stem-cell-based therapeutic research, boosting the global Fetal Bovine Serum market trend.

Fetal Bovine Serum Market Restraints:

-

Ethical and Animal Welfare Concerns Limit Market Expansion Globally

Ethical and animal welfare issues act as a significant restraint in the fetal bovine serum market. FBS is isolated from fetal bovine serum, which may provoke moral concerns and public concern. These factors can be a barrier to research and pharmaceutical adoption, particularly in areas with stringent animal welfare rules, possibly inhibiting overall market expansion despite increased need for cell-based research and therapies.

Fetal Bovine Serum Market Opportunities:

-

Expansion in Stem Cell & Regenerative Human and animal vaccine production Creates Growth Opportunities for Fetal Bovine Serum Market

The global fetal bovine serum market is especially influenced by the rise in stem cell research and regenerative medicine and animal vaccine production. Rising investment in CAR-T therapies, tissue engineering, and advanced cell-based research is fuelling demand for premium FBS products. FBS is used as an essential supplement in mammalian cell culture applications by labs and biopharma firms, which are crucial for drug discovery, personalized Human and animal vaccine production, and cutting-edge therapeutic applications, resulting in significant growth opportunities for suppliers globally.

For instance, in October 2024, global stem cell research funding reached USD 14.8 billion, significantly boosting the Fetal Bovine Serum market growth globally.

Fetal Bovine Serum Market Segment Analysis

-

By product, standard FBS led the fetal bovine serum market with a 14.57% share in 2025e, while stem cell is the fastest-growing segment with a CAGR of 14.78%.

-

By application, the cell culture media dominated the market with 58.80% share in 2025e, whereas the human and animal vaccine production segment is expected to grow fastest with a CAGR of 14.92%.

-

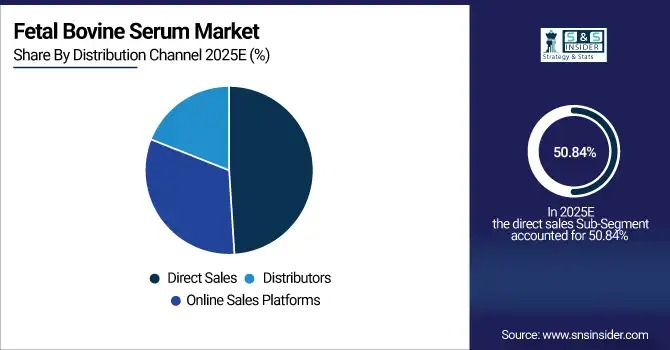

By distribution channel, direct sales led the market with 50.84% share in 2025e, while online sales platforms are registering the fastest growth with a CAGR of 14.57%.

-

By end-user, pharmaceutical & biotechnology companies held 42.814.38% share in 2025e, while contract research organizations (CRO) are growing the fastest with a CAGR of 14.38%.

By Product, Standard FBS Leads Market While Stem Cell Registers Fastest Growth

The standard FBS segment dominated the fetal bovine serum market with a revenue share of about 14.57% in 2025E, as it is used extensively in regular cell culture and research. Market drivers are its cost efficiency, and its applicability for a wide range of cell lines, the availability of high-throughput devices, and the high demand from academic labs, CRO’s. Stem cell segment will grow at the highest CAGR of nearly 14.78% CAGR between 2026 and 2033, due to the growing demand for regenerative medicine, CAR-T treatments, and the advancement of stem cell technologies, and the requirement for high-quality, specialty-grade product that enables consistent results while helping to safeguard high-value therapeutic and research applications.

By Application, Food Dominates While Human and animal vaccine production Shows Rapid Growth

Food segment was estimated to be the largest revenue generator with an approximate 58.80% of the total market share in 2025E, due to its crucial importance in mammalian cell growth, stem cell studies, drug screening tests and is currently used in numerous academic and biopharmaceutical laboratories, and its need of FBS as a critical supplement for sustaining the cell and the experiments performed. For instance, the Human and animal vaccine production segment is anticipated to be the fastest growing with a CAGR of around 14.92%, by 2026-2033, driven by increased global vaccine manufacturing, rising demand for monoclonal antibodies, and expansion of biopharmaceutical production. FBS provides essential nutrients for cell culture, ensuring efficient vaccine development and large-scale therapeutic protein production.

By Distribution Channel, Direct Sales Lead While Online Sales Platforms Register Fastest Growth

The direct sales segment accounted for the highest share of revenues in the fetal bovine serum market at 50.84% in the year 2025E as manufacturers shipped directly to academic labs, biopharmaceutical companies, and CROs. These are facilitated by strong customer relationships, high-capacity bulk order supply, and stringent quality control. While the online sales platforms segment is expected to achieve the fastest CAGR of approximately 14.57% during the predicted period from 2026-2033, due to convenience, low volume orders, fast sourcing for research labs, and ready availability of specialty FBS products. Digital platforms extend global reach, allowing suppliers to tap new markets and deliver fast, accurate fulfillment seamlessly.

By End-user, Pharmaceutical & biotechnology companies Lead While Contract Research Organizations (CRO) Grow Fastest

The pharmaceutical & biotechnology companies segment accounted for the largest share of the fetal bovine serum market at around 42.86% in 2025E, owing to the wide application of FBS in vaccine development, monoclonal antibody production, and cell therapy. Drivers for this market include high volumes of serum consumption, increasing focus on advanced applications. The Contract Research Organizations (CRO) segment will have the highest CAGR of nearly 14.38% during 2026–2033, fueled by the outsourcing of preclinical research, drug discovery, and cell-based assays, accompanied by the rising demand for FBS in mammalian cell culture. To achieve reproducible results & extend research capacity globally.

Fetal Bovine Serum Market Regional Analysis:

North America Fetal Bovine Serum Market Insights

North America dominates the fetal bovine serum market with a market share of 40.60% 2025E, due to its well-established biotechnology and pharmaceutical sectors, extensive academic and research infrastructure, and early adoption of specialty FBS products. High demand from stem cell research, regenerative medicine, vaccine production, and CAR-T therapies drives consumption. Additionally, robust regulatory compliance, quality standards, and efficient cold-chain distribution networks ensure reliable supply, reinforcing the region’s leadership and contributing significantly to global market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Fetal Bovine Serum Market Insights

The U.S. is the leader in the fetal bovine serum market analysis because of the large academic and research infrastructure, comprising universities, research institutes, and CROs that demand high cell culture, stem cell, and drug discovery. Also, US labs and companies in biopharma are early adopters of special products.

Asia-Pacific Fetal Bovine Serum Market Insights

Asia-Pacific is the fastest-growing region in the Fetal Bovine Serum market, registering a CAGR of 14.79% over the forecast period, owing to the growing biotech and pharmaceutical sectors, escalating academic research, and greater investment in regenerative medicine and cell-based therapies. Increased Chinese, Indian, and Southeast Asian demand for vaccine production, drug discovery, and stem cell research fuels the use of FBS. Enhanced import infrastructure, growing lab facilities, and government backing also strengthen acceptance, leading to a quick growth of the regional market.

China Fetal Bovine Serum Market Insights

China is set to become a significant fetal bovine serum market player in the wake of rapidly growing biotech and pharmaceutical industries, a burgeoning domestic research landscape, and surging demand for vaccine production and regenerative medicine products. With a mature supply chain and increasing consumption of high and special FBS products, including in the export market, the domestic market soars.

Europe Fetal Bovine Serum Market Insights

Europe holds the second-largest share of the fetal bovine serum market. The region has a strong pharmaceutical and biotechnology sector, excellent academic and research infrastructure, and a higher uptake of specialty FBS products. Demand is also influenced by vaccine manufacturing, stem cell research, and regenerative medicine, aided by tight regulatory access and high-quality standards through effective distribution facilities throughout the key countries including Germany, France, and the UK.

Germany Fetal Bovine Serum Market Insights

The German market is still dominating the European fetal bovine serum market due to the high imports of the fetal bovine serum, along with an established biotechnological and pharmaceutical structure, contributing to the rising adoption of specialty FBS products. Germany is the regional leader, albeit with large contributions from France, Italy, and the UK, due to strong research, vaccine production, and regenerative medicine end uses.

Latin America (LATAM) and Middle East & Africa (MEA) Fetal Bovine Serum Market Insights

The markets in Latin America and the Middle East & Africa are developing markets in the fetal bovine serum market due to the expansion of biotechnology and pharmaceutical industries, rising research activities, and growing use of cell-based therapies. Brazil, Mexico, South Africa, and UAE are the major markets. Rising imports and an increasing cold-chain infrastructure, combined with government subsidies supporting biotech research, will drive demand for FBS on the way to much faster growth, albeit off lower market shares relative to North America and Europe.

Fetal Bovine Serum Market Competitive Landscape:

Thermo Fisher Scientific is the world's most comprehensive and most used supplier of Fetal Bovine Serum, with FBS products of unrivaled quality ranging from superb value-priced offerings to application-specific reagents for research, biopharma, and cell culture applications. With a wide distribution network, robust R&D facility, and adherence to stringent quality compliances (ISO and cGMP), it is no wonder that it is a leading global player.

-

In March 2025, Thermo Fisher expanded its FBS production capacity in North America, introducing high-purity stem cell-grade serum, supporting increased demand from regenerative medicine and biopharmaceutical research globally.

GE Healthcare Life Sciences supplies high-quality FBS and cell culture media for vaccine manufacturing, stem cell studies, and advancing regenerative medicine. FEBS' strong global distribution network and relationships with research institutions globally underpin its position as a leader in the FBS market.

-

In September 2024, GE Healthcare launched a new line of exosome-depleted FBS, enhancing cell therapy research reproducibility and strengthening its global supply network across Europe, North America, and Asia-Pacific.

Lonza Group Ltd. provides high-performance, specialty FBS for biopharmaceutical production, stem cell research, and vaccine development. The company focuses on regulatory compliance, traceability, and personalised solutions and serves global research and industrial applications, making it a major driver of the growing Fetal Bovine Serum market.

-

In January 2025, Lonza announced upgraded traceability and ISO-certified FBS batches, targeting vaccine production and advanced cell therapy markets, improving quality assurance and meeting growing global demand.

Fetal Bovine Serum Market Key Players:

Some of the fetal bovine serum market Companies are:

-

Thermo Fisher Scientific

-

GE Healthcare Life Sciences

-

Lonza Group Ltd.

-

Sigma-Aldrich

-

Corning Incorporated

-

Hyclone

-

Biowest

-

Avantor, Inc.

-

South American BioProducts

-

Atlas Biologicals, Inc.

-

Valley Biomedical Products & Services, Inc.

-

Serum Source International

-

Bovogen Biologicals Pty Ltd.

-

Zenbio, Inc.

-

Capricorn Scientific GmbH

-

Gemini Bio-Products, Inc.

-

PAA Laboratories GmbH

-

EuroClone S.p.A

-

TCS Biosciences Ltd

-

BioIVT

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.12 Billion |

| Market Size by 2033 | USD 6.03 Billion |

| CAGR | CAGR of 13.99% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Stem cell, Charcoal stripped, Exosome depleted, Dialyzed fetal bovine serum, Chromatographic, Other product types) • By Application (Cell culture media, Human and animal vaccine production, Drug discovery, Cell-based research, Other applications) • By Distribution Channel (Healthcare, Food and Beverage and Consumer Goods) • By End-user (Pharmaceutical & biotechnology companies, Contract Research Organizations (CRO), Academic and research organizations, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Thermo Fisher Scientific, GE Healthcare Life Sciences, Lonza Group Ltd., Sigma-Aldrich, Corning Incorporated, Hyclone, Biowest, Avantor, Inc., South American BioProducts, Atlas Biologicals, Inc., Valley Biomedical Products & Services, Inc., Serum Source International, Bovogen Biologicals Pty Ltd., Zenbio, Inc., Capricorn Scientific GmbH, Gemini Bio-Products, Inc., PAA Laboratories GmbH, EuroClone S.p.A, TCS Biosciences Ltd, BioIVT and other players. |