Fire Stopping Materials Market Report Scope & Overview:

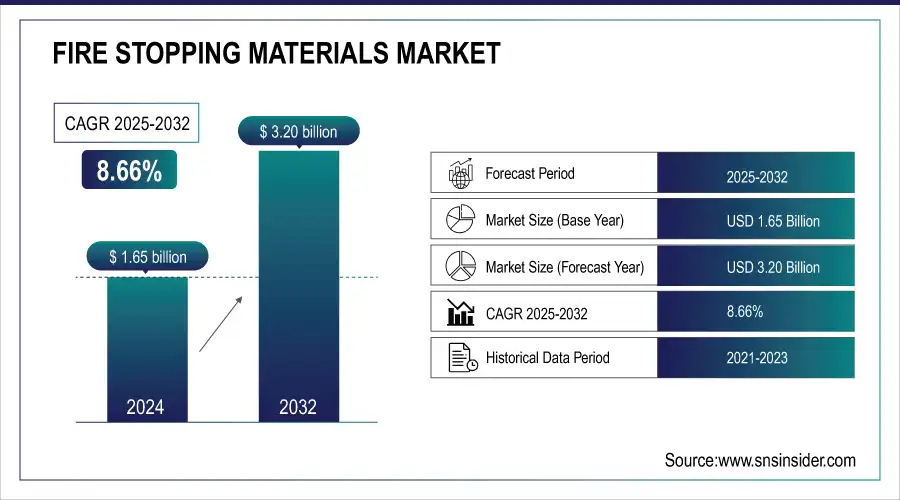

The Fire Stopping Materials Market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 3.20 billion by 2032, growing at a CAGR of 8.66% over the forecast period of 2025-2032.

The global fire stopping materials market is experiencing robust momentum due to stricter building safety regulations and rising awareness about passive fire protection. The fire stopping materials market growth is driven significantly, increasing due to the rise in the implementation of safety norms across commercial, residential, and industrial constructions. Recently introduced products, including intumescent sealants, fire-rated putty, mortars, boards, etc., are gaining acceptance due to their excellent fire resistance and ease of application. The evolution of technology has created better and cost-effective green solutions that keep up with the changing demands of safety and construction standards at the same time.

To Get more information on Fire Stopping Materials Market - Request Free Sample Report

The fire stopping materials market trends are the inclusion of multi-functional fire-stopping systems that combine acoustic, thermal, and fire protection in a single solution. Moreover, there is a lucrative demand in the industrial market, including oil & gas, marine, and power generation, due to the high cost of operational loss from downtime from fire hazards. Moreover, sustainability is becoming a trend in the fire-stopping materials market, with manufacturers launching low-VOC, halogen-free, recyclable fire-stop materials. Sealants, for example, had segment revenue of USD 600 million or so in the recent past, with intumescent sealants comprising nearly 70%. Industrial end-use accounts for nearly half of total product consumption due to the greater dependence of this sector on fire-resistant infrastructure.

In June 2025, Bihar’s Building Construction Department approved a USD 2.08 million project to set up a Centre of Excellence for Fire Safety at IIT-Patna. The center will focus on testing fire-resistant materials, post-fire damage analysis, and fire behavior in buildings. It will also train engineers in modern fire safety and rescue operations. IIT-Patna will provide academic support, while BCD handles initial funding and operations.

Fire Stopping Materials Market Dynamics:

Drivers

-

Smart Technologies and Innovation Are Transforming Industries Through Enhanced Efficiency and Sustainable Operations

The ongoing expansion of smart technologies, including automated processes, artificial intelligence (AI) powered solutions, Internet of Things (IoT) tools, and sustainable systems, is changing the possibilities for virtually all industries, including the fire protection materials market & fire stopping materials industry. These technologies enhance operational efficiency, trim costs, and improve service delivery. Roughly about 85% of manufacturers have implemented digital transformation initiatives, and 75% of the data generated by enterprises is now processed by automated tools. Over 30% productivity improvements have been reported by companies that have implemented automation. AI-based smartphones have improved predictive maintenance effectiveness to more than 85% in manufacturing, while decreasing unplanned downtime by 30 – 50%, and robots can now perform 40% of repetitive tasks. Such innovations help enhance functionality, facilitate data-driven decision making, and move towards environmentally sustainable operations, thus contributing to the high demand for fire safety solutions in various end-user industries.

Restraint

-

High Upfront Costs Limit Advanced Technology Adoption Among Cost-Sensitive Industries

Advanced systems like these have significant barriers to uptake in the form of high initial costs, which is especially problematic for cost-critical users. For example, in the U.S. healthcare space, small practices incur an average first-year cost of up to USD 162,000 with annual upkeep fees of USD 85,000—66% of non-EHR practicing doctors cite this capital burden as a primary obstacle. And cloud adoption studies have found that security and cost concerns also increase the frequency of non-adoption by as much as 26 times. In manufacturing, SMEs spending more than USD 300,000 on new bottling equipment chose not to adopt until they were sure the capital expense would decrease production time by 40% and increase sales by 25% within two years. Those numbers highlight the limitation on technology adoption by cash-strapped organizations due to high upfront costs.

Fire Stopping Materials Market Segmentation Analysis:

By Application

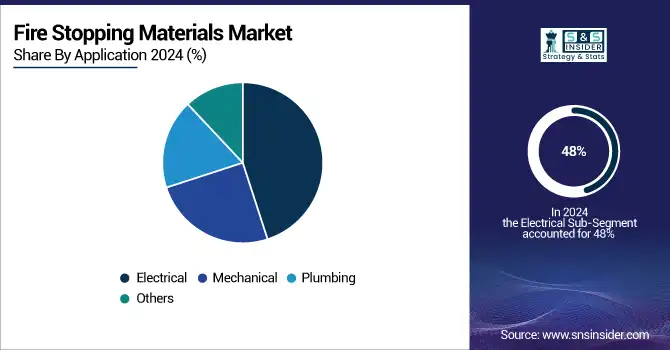

In 2024, the electrical segment accounted for the largest share (48%) of fire-stopping material applications. Driving this dominance is the high risk of fire outbreaks from short circuits, overheating, and electrical faults in both commercial and residential buildings. Cable penetrations, electrical conduits, and junction boxes need to be sealed using fire-stopping materials to avoid the spread of fire and smoke through wiring channels. As automation powered by smart devices, power infrastructure, and renewable energy solutions becomes more widespread, the demand for electrical fire protection also increases. The segment is further catapulted due to regulatory bodies urging compartmentalization and passive protection surrounding electrical components.

The mechanical segment is witnessing the fastest growth due to rising demand for fire protection in HVAC systems, plumbing networks, and ventilation ducts, which often breach fire-rated barriers. However, as new buildings utilize increasingly complex mechanical systems, the potential for fire spread along these routes has risen. Fire-stopping materials are utilized for sealing pipe penetrations and ductwork to aid in compartmentalized fire control. Moreover, well-developed industrial and healthcare sectors follow consistent operational continuity and high safety standards, which in turn are augmenting the demand for fire-resistant mechanical penetrations and systems.

By Materials

The sealants segment dominated the market and accounted for 32% of the fire stopping materials market share. They are predominant due to their versatility, user-friendliness, and high-performance joint, gap, and seam sealing abilities in fire-prone areas. Sealants are extensively applied in the construction and renovation of residential, commercial, and institutional buildings because these sealants follow fire safety codes and have good insulation to lessen the sound and heat transmission. Potential for rapid growth across widely used substrates, along with improved fire-resistant formulations, supports steady demand across developed markets such as the U.S. and Europe. Moreover, the rise in focus on fire safety in high-rise buildings and smart infrastructure is another growth driver for sealants.

Putty is emerging as the fastest-growing material type in the fire-stopping market due to its superior moldability, reusability, and ease of installation, particularly in tight or irregular spaces. With construction practices shifting toward modular and prefabricated designs, fire-stopping putties offer flexible solutions for sealing around electrical outlets, cable trays, and wall penetrations. This dynamic response has led to their increasing adoption in mission-critical infrastructure like data centers and healthcare facilities, which you can read more about here. In addition, putty-based solutions are preferred by contractors due to their effectiveness in passive fire protection and less disruption during installation, as they do not require complete service removal, along with the growing awareness regarding passive fire protection and stringent building safety codes across the world.

By End Use

Commercial buildings, including offices, malls, hospitals, and educational institutions, dominated the fire-stopping materials market in 2024 with a 52% share. This is largely because compliance with fire safety regulations and building codes in urban infrastructure is strictly enforced. These installations frequently consist of intricate electrical and mechanical systems, necessitating fire-stopping options for passive fire protection. Moreover, the growing investments towards smart cities and infrastructure upgradation in parts of North America and Europe also contribute to the increasing demand. Commercial measures accommodating a vast number of people and valuable belongings require heavy-duty fire containment systems.

The industrial sector is the fastest-growing end-use segment in the fire stopping materials market, due to rising regulation of plant safety in manufacturing plants, warehouses, oil & gas facilities, and chemical processing units. Fire protection is one of the top priorities in these settings where explosive processes operate with flammable substances and heavy machinery. These fire-stopping materials assist in compartmentalizing fire and are essential in minimizing interruptions for equipment loss or operational downtime. Major factors for rapid growth in the segment include strengthening industrial infrastructure, coupled with the rising trend of workplace safety in several emerging economies across the Asia-Pacific and the Middle East.

Fire Stopping Materials Market Regional Outlook:

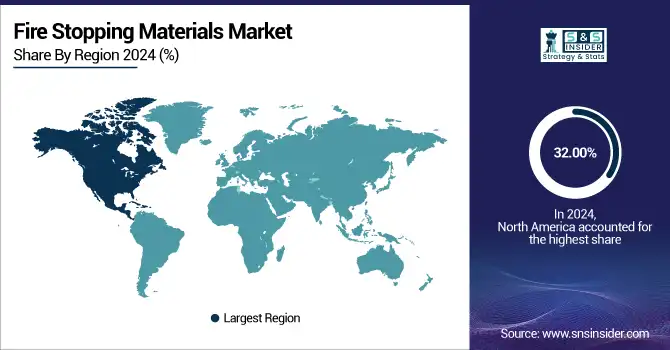

North America held the dominant position in the fire stopping materials market, capturing 32.00% of the global share in 2024. The region follows stringent building safety codes, is characterized by high fire safety awareness, and has early adoption of advanced fire protection systems in residential, commercial, and industrial applications. Moreover, the growing renovation activities of aging infrastructure and the presence of prominent players like Hilti and 3M have contributed to increasing the demand for the products. The U.S. has specific fire protection codes and standards that are enforced in high-rise buildings and hospitals, and this is strongly driving the demand for firestopping sealants, mortars, and putties. Such a sound regulatory environment and continuous modernization of the construction sector continue to strengthen North America as the leading global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

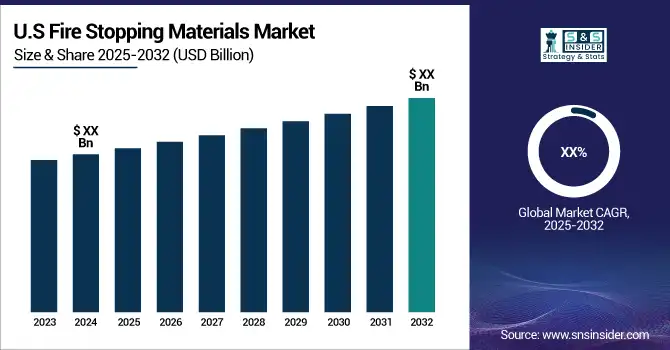

The U.S. fire-stopping materials market is the largest in North America, valued at USD 0.41 billion in 2024 and projected to reach USD 0.78 billion by 2032, growing at a CAGR of 8.33%. Increasing infrastructure upgrades, strict fire safety regulations, and demand from commercial and residential sectors drive growth. One of the major driving forces for the growth of the regional market is the U.S.

Europe is expected to be the fastest-growing region in the fire stopping materials market, owing to increasing investments in green and fire-resilient buildings. The demand for passive fire protection systems has substantially increased due to the imposition of the latest EU building codes and fire safety regulations. Many nations, such as Germany, the UK, and France, are doubling down on higher construction safety standards in the wake of tragedies like the Grenfell Tower fire. In addition, the expansion of sustainable infrastructure projects in combination with low-emission fireproofing products is boosting the market growth. Another important factor behind the acceleration of Europe is the transition from using modern firestopping in new assemblies to using it in existing ones.

Germany is the dominant country in the fire-stopping materials market. A well-established construction industry, strict fire protection regulations, and high passive fire safety systems adoption in commercial and industrial structures account for its leadership. Demand is enhanced by the renovation of old structures and sustainable infrastructure in Germany, where the country is the market leader in the region.

The Asia-Pacific region holds a significant share in the Fire Stopping Materials Market and continues to show robust potential due to rapid urbanization and industrialization. With China, India, and Japan among several major economies investing heavily in infrastructure development, the demand for fire protection materials in commercial complexes, high-rise buildings, and manufacturing facilities is at an all-time high. In addition to this, government regulations are slowly harmonizing with the international fire safety norms, ensuring construction compliance. Asia-Pacific, although not the fastest growing, is also one of the largest revenue contributors to global market revenue owing to its huge population base, ever-growing construction industry, sustainable economic growth, and continuously adopting growing technologies.

Key Players in the Fire Stopping Materials Market are:

Fire Stopping Materials Companies are Knauf Insulation, Sika AG, RECTOREAL CORPORATION, Hilti Corporation, Morgan Advanced Materials, RPM International Inc., 3M, BASF SE, Etex Group, Specified Technologies, Inc.

Recent Development:

-

In May 2025, Hilti Corporation partnered with BoxLock to launch a real-time Lockout/Tagout (LOTO) integration within its Fieldwire platform. This solution links electrical safety protocols directly to jobsite drawings, offering live updates on lockout status. It enhances compliance with OSHA and NFPA 70E standards and improves overall construction site safety.

-

In May 2025, RPM International Inc. acquired Star Brands Group, the parent company of The Pink Stuff, adding it to the Rust-Oleum portfolio. The UK-based brand generated around USD 190 million in 2024 sales. The move strengthens RPM's consumer products segment and expands its global household cleaning presence.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.65 Billion |

| Market Size by 2032 | USD 3.20 Billion |

| CAGR | CAGR of 8.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Materials (Sealants, Coatings, Mortars, Putty, Boards, Others) • By Application (Electrical, Mechanical, Plumbing, Others) • By End Use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Knauf Insulation, Sika AG, RECTOREAL CORPORATION, Hilti Corporation, Morgan Advanced Materials, RPM International Inc., 3M, BASF SE, Etex Group, Specified Technologies, Inc. |