HVAC Control System Market Report Scope & Overview:

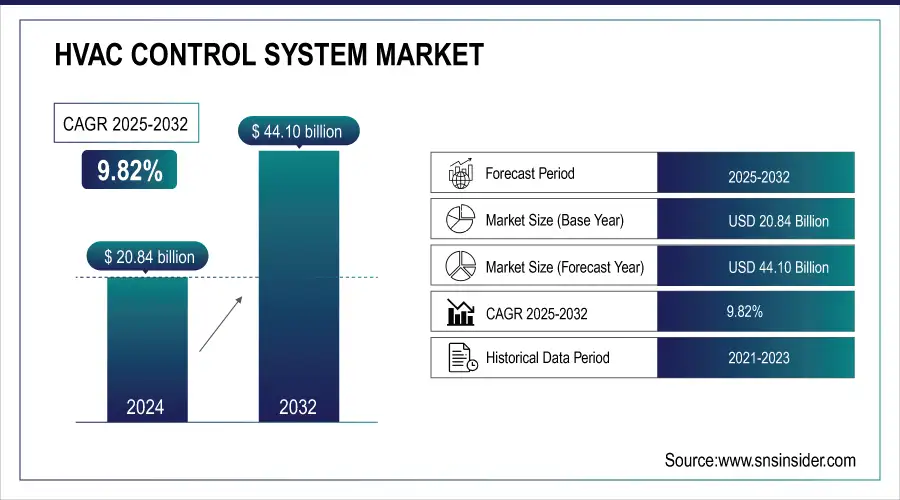

The HVAC Control System Market Size was valued at USD 20.84 Billion in 2025 and is expected to reach USD 44.10 Billion by 2032 and grow at a CAGR of 9.82% over the forecast period 2025-2032.

The HVAC control system market, due to an increase in product application for building automation control systems (BACS). The increasing demand for energy-efficient and cost-effective systems is one of the primary growth factors. Similarly, the surge in government actions for smart cities is a key factor driving the demand of smart buildings. Increasing necessity of green-labeled products due to growing environmental awareness among consumers has stimulated the demand for HVAC systems, which operate with low or zero heating fuel consumption therefore electricity and hydrogen hence is anticipated to foster as an opportunity in this market segment Industrial giants like Daikin and Carrier try to offer cleaner solution for eco-conscious consumers.

To get more information on HVAC Control System Market - Request Free Sample Report

HVAC Control System Market Size and Forecast:

-

Market Size in 2024: USD 20.84 Billion

-

Market Size by 2032: USD 44.10 Billion

-

CAGR: 9.82% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

The number of governmental programs aiming energy-efficient solutions promoting provides the substantial growth of the market. The Energy Policy Act of 2005 by U.S. government provides significant tax benefits for buildings that minimize their energy consumption thus facilitating a move to more advanced HVAC control systems. Severe measures worldwide are ultimately fostering the HVAC manufacturers to design energy-efficient.

The rising geriatric population is boosting the market growth along with technological advancements. Because of this, smart HVAC control systems are becoming a more focus area due to manufacturers priorities being enabled with the Internet of Things (IoT) technology and connectivity for home automation. For example: Control Pad from Cool Automation Ltd. a simple smart HVAC controller for home automation with RS485 network and ASCII interface feature that is rigorous compatibility to standard communication type of various equipment types.

In February 2024: At ACREX India, held, Danfoss India unveiled its Microchannel Heat Exchanger (MCHE) technology as a means of attaining energy efficiency and minimal refrigerant usage. Next Gen Evaporator A 30% more efficient, cost and installation time-saving refrigerant flow optimization to address the industry's ESG commitments.

The change in load performance compared to MCHE may require HVAC control systems and strategies that perform differently. It might encourage the development of new control systems which are specifically adapted to MCHE's individual characteristics and, in turn innovate an entire segment within a market. The increased ESG performance associated with MCHE may further encourage building owners and contractors to utilize these systems. This will result in greater demand for HVAC controlled systems which can monitor and optimize the MCHE operations suitable to deliver as promised, environmental benefits.

Key HVAC Control System Market Trends

-

Adoption of AI-driven thermal regulation platforms enabling dynamic load adjustment, reduced consumption, and prolonged equipment reliability.

-

Rising use of bio-based insulators and sustainable polymers aligning with green architecture directives and circular economy initiatives.

-

Incorporation of digital replicas supporting real-time diagnostics, occupancy forecasting, and lifecycle cost management.

-

Evolution of modular wireless controllers ensuring effortless retrofitting, quicker commissioning, and scalable deployment across diverse infrastructures.

-

Expansion of autonomous service bots and drone-assisted monitoring, delivering continuous operation assurance and predictive servicing accuracy.

HVAC Control System Market Growth Drivers:

-

Concerns about energy use and environmental impact drive the demand for energy-efficient HVAC systems, boosting the market for performance-optimizing control systems.

Rising concern about energy consumption and its environmental cost creates huge opportunities for adoption of energy efficient systems in different sectors such as HVAC (Heating, Ventilation, and Air Conditioning). High efficiency HVAC systems help lower energy consumption, operating expenses and cut down carbon footprints. The growing importance of energy efficiency and cost management has increased the need for cutting-edge HVAC control system designed to deliver excellent performance with minimal wastage. This control system is developed using intelligent algorithms and real-time monitoring of data to adjust the operations that are performed on HVAC systems so as to cut out any unnecessary heating or cooling required, thereby reduces energy consumption. In addition to peace of mind for end-users and important societal goals like cutting back on greenhouse gas emissions and battling climate change, these systems are also helping in reducing utility bills with improved efficiency.

-

Building Automation and Smart Homes the growing trend of smart homes and building automation systems increases the demand for intelligent HVAC control systems with integration and remote-control capabilities.

Smart homes and building automation are changing the way that we use our residential or even commercial buildings. This involves connecting to the multiple systems in a building, such as HVAC, lighting and AV (audiovisual), so that they can operate together. One of the key contributing factors is intelligent HVAC control systems, which can provide features such as remote management and automation while also integrating with other building management systems. Now homeowners and building managers can control settings on their HVAC system remotely over the internet from a smartphone or other connected device. This had the integration of improving user comfort, convenience and reducing energy input as most systems were intelligent enough to learn individual users’ preferences. This increase in the acceptance of smart technologies, driven by consumer choices at end use levels are also boosting demand for HVAC control systems that integrate with building automation thus contributing significantly to market growth.

-

Stricter global regulations on building energy efficiency require the adoption of advanced HVAC control systems that comply with these standards.

Governments globally are enacting legislation aimed at ensuring improved energy efficiency of buildings. Many of these regulations establish targets for HVAC systems based on system performance, energy consumption and other metrics. Therefore, there is a need for multiple capacitive HVAC control systems in buildings to meet the demands of these regulations. This may encompass energy monitoring, predictive maintenance and analytics to guarantee HVAC systems run at optimal capacity. With the implementation of these Airside economizer control systems, building owners hack their way through compliance with regulation while securing cost savings from lesser energy use and better system response. The regulatory push is one of the most dominant forces driving innovation and adoption within in the HVAC control system market, as manufacturers race to ensure that their solutions meet these evolving requirements.

HVAC Control System Market Restraints:

-

Fluctuations in Raw Material Prices Changes in raw material costs can affect the overall price of HVAC control systems, potentially hindering market growth.

Cost of the raw material namely metal, plastic and electronics used in manufacturing HVAC control systems plays an important role on shaping up the market for such types of products. Also, Since the price of these raw materials also keeps fluctuating it is a direct influence on production cost. The cost of metal, such as copper or steel may go up thus raising the cost to manufacture goods and in turn passed on the consumer as a higher price. This could put HVAC control systems out of the reach for some, which might serve to retard market growth as both consumers and business may delay or scale back investments in new system. Conversely, a reduction in the cost of raw materials can reduce production costs and so lower selling prices leading to increased demand on the market for HVAC control systems.

-

Economic downturns can reduce construction activity and lower investments in building automation systems, impacting HVAC control system demand.

The HVAC control systems market is poised to rise, and economic volatility especially dark patches of slowdown can have a profound bearing on it. During times of economic down turn, there is generally reduced construction activity as businesses and consumers save their money. This decrease in building construction will result in the generation of less new buildings and therefore a lower demand for automation systems, especially among HVAC control system. Investments in deploying the advanced control systems on existing buildings could also be curtailed during economic downturns. This decrease in overall demand can then decelerate the expansion of markets as manufacturers and service providers experience lower sales turnover.

-

Strict regulations on data privacy and cybersecurity can increase development and compliance costs for manufacturers, potentially slowing market growth.

The HVAC control systems market is hampered by strict regulations involving data privacy and cybersecurity constraints. So, with the increasing numbers of such new system which includes IoT and AI driven systems it is utmost important to keep data safe or privacy intact . There are stringent regulations from governments and the regulator bodies across all nations on the protection of consumer data & cyber threats. This compliance usually mandates manufacturers to add extra security layers, update software and introduce more processes of controls in place for the purpose of complying with regulations in a way that leads development or operational costs sky-high greater costs. The added expense can also act as a barrier to entry into the market by newcomers: it raises prices, and potentially slows down innovation market growth because existing manufacturers are devoting resources not only for standards compliance but away from developing products that could lead to increased sales.

HVAC Control System Market Segment Analysis

-

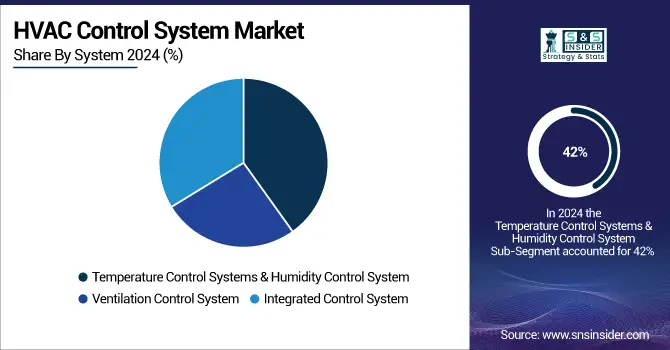

By System

The HVAC control systems market is segmented on the basis of Systems, which are categorized as Temperature and Humidity Control Systems, Ventilation Control System, and Integrated Control. Based on applications, the temperature and humidity control segment held nearly 42% of the market with increasing incorporation of heating cooling systems across various verticals.

-

By Component

The HVAC Control component is formed to take the form of sensors, Controller, and Controlled device. The sensor is a required part to measure environmental variables like temperature and humidity. This information is then passed on to the controllers in order for them to maintain a controlled atmosphere. Temperature sensor for HVAC control systems Multiple sensors is used in the control system of Temperature But it is most commonly implemented using temperature sensors These include humidity, occupancy, economizer, and dew point sensors as well as CO2 monitors.

HVAC Control System Market Regional Outlook

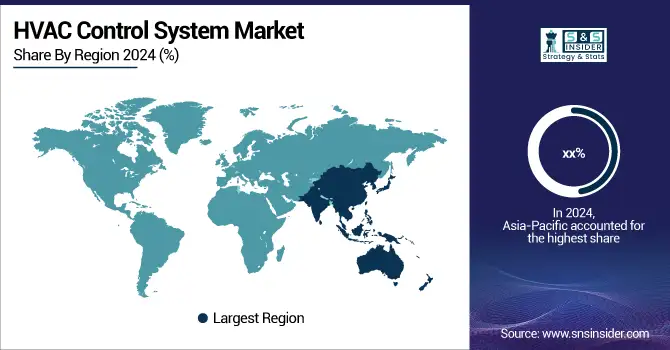

Asia-Pacific HVAC Control System Market Insights

Asia-Pacific region is leading HVAC control system market in 2024. The major reason behind this dominance is the continual innovation and power-efficient products delivered by these companies. The increasing population in developing countries, along with rising environmental awareness are driving the growth of HVAC control systems. The growing trend towards green buildings and various government measures to promote energy-efficient practices in commercial sector is further propelling the regional market expansion.

Need any customization research on HVAC Control SystemMarket - Enquiry Now

North America HVAC Control System Market Insights

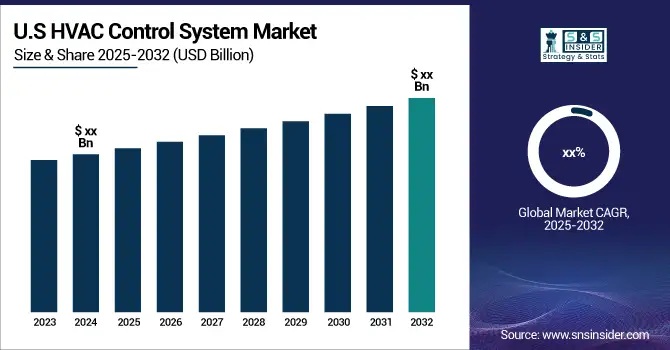

North America is anticipated to grow well HVAC control system market in regional has stabilized over the years. The region is likely to offer lucrative opportunities for the control systems market, owing to increasing deployment of modern technologies and replacement or upgradations of already existing old systems with newer control system. Higher penetration in U.S. available smart homes is another good reason the growth will be most rapid there Smart HVAC control systems can also be installed at home and integrated with other smart devices, such as the thermostat in a refrigerator. Moreover, the region is home to a considerable number of manufacturers and OEMs also comprises an extensive consumer base.

Europe HVAC Control System Market Insights

Europe’s HVAC control system market is expanding steadily due to stringent energy-efficiency regulations and growing adoption of smart building technologies. Countries like Germany, France, and the U.K. are driving demand through incentives for green construction. Rising focus on sustainability and advanced automation in commercial and residential sectors further fuels regional growth.

Middle East & Africa HVAC Control System Market Insights

The Middle East & Africa region is witnessing moderate growth in HVAC control systems, driven by rapid urbanization and expansion of commercial and hospitality sectors. Harsh climatic conditions increase the need for efficient cooling solutions. Investments in energy-efficient infrastructure and smart building initiatives are key factors supporting market adoption.

Latin America HVAC Control System Market Insights

Latin America’s HVAC control system market is gradually growing, led by Brazil and Mexico. Expansion in commercial buildings, industrial facilities, and residential complexes, along with government initiatives for energy conservation, is stimulating demand. Increasing awareness of cost-effective and energy-efficient HVAC technologies is expected to support long-term market development.

HVAC Control System Market Companies are:

-

Johnson Controls

-

Daikin Industries, Ltd.

-

Mitsubishi Electric

-

Trane HVAC US LLC

-

Emerson Electric

-

Schneider Electric

-

Delta Controls

-

Carrier Global Corporation

-

Siemens

-

ICM Controls

-

Lennox International Inc.

-

LG Electronics Inc.

-

Fujitsu General Limited

-

United Technologies Corporation (UTC)

-

KMC Controls Inc.

-

Bosch Thermotechnology

-

Ingersoll Rand

-

Hitachi Ltd.

Competitive Landscape for HVAC Control System Market:

In February 2024: Engineers at Birmingham University built a microwave-powered thermochemical system for EV air conditioning as part of an e-Thermal bank - enough to give the vehicle about 70% more range. Without an exhaust system or a battery needing to be tapped for HVAC duties, this serves as extra juice during those summer and winter months.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 20.84 billion |

| Market Size by 2032 | USD 44.10 Billion |

| CAGR | CAGR of 9.82% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Sensors, Controllers, Controlled Devices) • By System (Temperature & Humidity Control System, Ventilation Control System, Integrated Control System) • By Application (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Johnson Controls, Daikin Industries, Ltd., Mitsubishi Electric, Trane HVAC US LLC, Emerson Electric, Schneider Electric, Honeywell International Inc., Delta Controls, Carrier Global Corporation, Siemens, ICM Controls, Lennox International Inc., LG Electronics Inc., Fujitsu General Limited, United Technologies Corporation (UTC), Distech Controls Inc., KMC Controls Inc., Bosch Thermotechnology, Ingersoll Rand, Hitachi Ltd. |