Foliar Spray Market Report Scope & Overview:

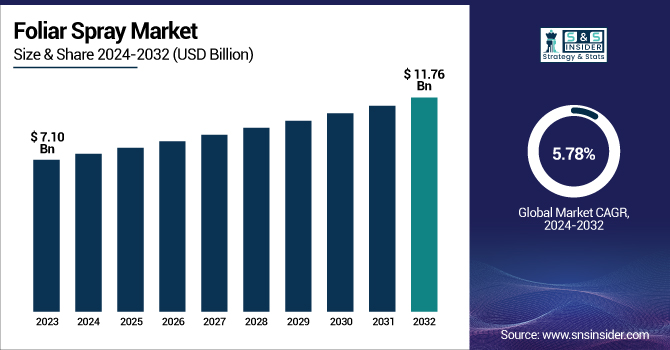

The Foliar Spray Market Size was valued at USD 7.10 Billion in 2023 and is expected to reach USD 11.76 Billion by 2032, growing at a CAGR of 5.78% over the forecast period of 2024-2032.

To Get more information on Aviation Crew Management Systems Market - Request Free Sample Report

The Foliar Spray Market has rapidly expanded with ongoing R&D investments into increasing product efficiency. Regulatory policy largely determines market growth, which influences product compositions and availability. Pricing analysis is detailed in our report, with an investigation into drivers that affect cost structures and regional price differences. Agronomic advantages of foliar sprays are highlighted, focusing on increasing crop yield and health across regions. Furthermore, the transition from conventional to organic uses is also picking up speed, with farmers increasingly using eco-friendly foliar spray solutions for sustainable farming. This market is transforming with innovation, regulation, pricing strategies, and regional trends. Our report addresses these key factors, providing an overall perspective of how they shape the future of the foliar spray industry.

The US Foliar Spray Market Size was valued at USD 956.62 Million in 2023 with a market share of around 70% and growing at a significant CAGR over the forecast period of 2024-2032.

The U.S. foliar spray market is witnessing strong growth, propelled by the rising need for effective crop protection and nutrient delivery systems. Some of the major drivers of growth are the growth in precision agriculture practices, use of sustainable farming practices, and technological advancements in crop management solutions. The U.S. USDA Department of Agriculture, foliar sprays are becoming increasingly important to maximize crop yields, particularly in high-value crops such as vegetables and fruits. Leaders in this are companies such as Nutrien Ltd. and BASF through the development of more eco-friendly and nutrient-efficient products that align with the increasing trend towards organic farm solutions. Such trends identify the U.S. market's emphasis on high-efficiency and sustainable farming practices.

Foliar Spray Market Dynamics

Drivers

-

Increasing Consumer Awareness Regarding Sustainable Farming Practices Drives the Growth of the Foliar Spray Market

Increased consumer consciousness regarding the environmental effects of conventional farming practices has emerged as a major catalyst in the development of the foliar spray market. With growing environmental awareness among consumers, they are increasingly looking for organic and sustainable agricultural practices. This change is prompting farmers to turn to alternatives such as foliar sprays, which provide an environmentally friendly means of increasing crop yields while minimizing the use of chemicals. With increasing demand for pesticide-free foods, foliar sprays enable farmers to fulfill consumers' demands for healthier, safer food. Government policies like those advocated by the U.S. Department of Agriculture (USDA) favor the adoption of sustainable agricultural methods by providing incentives and subsidies to farmers converting to organic methods. This movement is contributing to greater adoption of foliar sprays compatible with organic certification. With increasing popularity of sustainable agriculture practices, demand for foliar sprays will significantly grow, which will pose a significant opportunity for market growth. Increased demand for sustainability and pressure from consumers towards environmentally friendly solutions are hence major drivers behind the growing adoption of foliar sprays in farming.

Restraints

-

Regulatory Challenges and Stringent Standards for Foliar Spray Products Impact Market Dynamics

The foliar sprays market is highly subject to regulatory obstacles, especially for countries such as the United States and Europe, where formulations need to comply with strict environmental and safety regulations. Regulatory agencies including the U.S. Environmental Protection Agency (EPA) and the European Food Safety Authority (EFSA) have stringent stipulations regarding chemical and biological entities used in foliar spray compositions. These regulations make it possible for foliar sprays to be safe for crops and the environment, but they add complexity and expense to the process of product development. They require that manufacturers spend a lot of money and effort in research and testing to meet these regulations, which can cause market entry delays and raise operational expenses. Regulations governing the use of certain ingredients, like biocides or pesticides, may shift often, leaving manufacturers unsure about what to do. For small companies with limited financial resources, moving through this cumbersome regulatory system could be problematic, and non-adherence could be penalized with fines, hindering further growth in the market. With a changing regulatory framework, companies will need to keep up to modify and adjust their compliance in keeping with these modifications to prevent discontinuity.

Opportunities

-

Growing Demand for Organic Farming Practices Creates Market Opportunities for Foliar Spray Manufacturers

The growing demand for organic products is a huge opportunity for foliar spray producers. As consumers become increasingly aware of the environmental and health consequences of conventional agriculture, they are increasingly seeking out organic produce, creating organic farming input demand. Foliar sprays, especially those that are certified organic, are a great solution to increase crop yields while following organic agriculture norms. Foliar spray manufacturers who have the ability to come up with foliar sprays that qualify for organic certification have a huge opportunity to ride this wave. Players like EuroChem Group AG and ICL (Israel Chemicals Ltd.) have already seen the potential in this segment and are creating organic-friendly foliar sprays. Governments across the globe are also offering financial incentives to encourage organic farming, further increasing demand for organic farming inputs like foliar sprays. As the organic farming industry continues to grow, demand for sustainable, environmentally friendly foliar sprays will increase, opening up huge opportunities for innovation and market growth. This increased demand is a great opportunity for manufacturers to expand their product lines and address the changing needs of the marketplace.

Challenge

-

Limited Awareness and Knowledge of Advanced Foliar Spray Solutions in Developing Regions

One of the key challenges to the foliar spray industry is the low awareness and knowledge of sophisticated foliar spray solutions in developing countries. Most smallholder farmers in these countries do not have access to information, technical assistance, or training on the advantages and correct use of foliar sprays. This lack of knowledge can lead to the underutilization of foliar spray products since farmers still stick to conventional and less efficient methods of crop nutrition and pest management. Farmers in areas where agricultural education and technology adoption are low may not be knowledgeable about the potential benefits of foliar sprays, including enhanced crop yield and lower pesticide usage. Manufacturers and industry players in the foliar spray market need to concentrate on educating farmers and offering training programs to create awareness of the advantages of advanced foliar sprays. Through workshops, extension services, and online materials, they can bridge this knowledge gap and promote adoption in new markets. By adequate education and awareness-building programs, farmers would be able to make the right choice in using foliar sprays, promoting market expansion in developing countries.

Foliar Spray Market Segmental Analysis

By Type

Nitrogenous foliar sprays dominated the foliar spray market in 2023 with a market share of 45.2%. Nitrogen is an essential nutrient needed for plant growth, and nitrogen-containing foliar sprays offer a convenient way of supplying this vital element to plants. The dominance of this segment is due to the common agricultural requirement for nitrogen to improve crop yield and quality. Nitrogenous foliar spray is especially dominant in plants such as cereals, vegetables, and fruits, where there is a need for fast growth and high nutrient consumption. Institutions like The Fertilizer Institute (TFI) have highlighted the significance of nitrogen fertilizers in increasing agricultural productivity levels, and various government incentives facilitate the use of innovative foliar spray technologies. Nitrogen-based foliar sprays are also preferred due to their cost-saving nature compared to other forms, further increasing their use in both conventional and organic agriculture. With these benefits, nitrogenous foliar sprays are likely to remain at the forefront of the market.

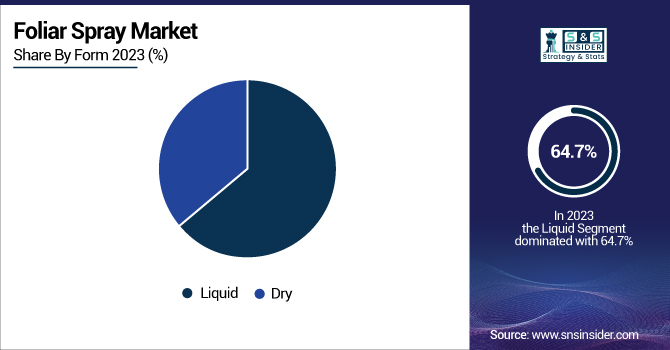

By Form

Liquid formulation of foliar sprays dominated the foliar spray market in 2023 with a market share of 64.7%. Liquid foliar sprays have the advantage of easy application and rapid absorption, which makes them extremely efficient to deliver nutrients to plants directly. The ease of use and efficacy of liquid formulation render it the first choice for large-scale agricultural practices, especially in high-value crops such as fruits, vegetables, and cereals. This supremacy is also complemented by developments in spray technology, including high-efficiency sprayers and liquid products that enhance the rate of nutrient uptake. For example, Bayer AG and Syngenta have both concentrated on enhancing their liquid spray technologies for precision farming. In addition, governments, such as the U.S. Department of Agriculture (USDA), encourage the implementation of these efficient systems to sustainably increase food production. With their universal benefits, liquid foliar sprays are likely to remain on top in the forecast period.

By Application

In 2023, the horticultural open field segment dominated and accounted for the highest share of the foliar spray market of about 42.5% of the total market revenue share. Open field horticulture is the cultivation of a wide variety of fruits, vegetables, and flowers, all of which require different nutrients at different stages of their growth. The use of foliar sprays in open field horticulture has been consistently on the increase as a method of quick correction of nutrient deficiencies, hence improving crop yield and quality. The use of foliar sprays in the segment is strong in market-trend regions like North America and Europe, where there is extensive fruit and vegetable cultivation on a large scale. For example, U.S. agriculture, as classified by the U.S. Department of Agriculture (USDA), has seen a steep increase in the use of foliar sprays for horticultural crops like tomatoes, grapes, and citrus fruits. This is fueled by the need for quick and efficient nutrient-delivery systems in high-value crops, further solidifying the segment's leadership.

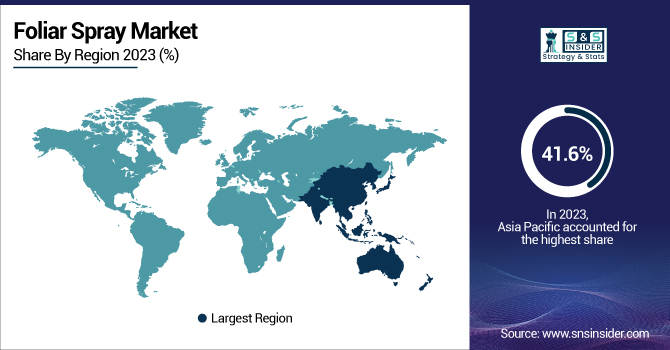

Foliar Spray Market Regional Outlook

Asia Pacific dominated the foliar sprays market in 2023, accounting for a 41.6% market share. The region's large agricultural base, particularly in China, India, and Japan, is a major factor driving this leadership. For instance, the government in China has heavily invested in high-tech agriculture, which includes foliar sprays, in order to boost productivity. As per China National Fertilizer Industry Association, the usage of foliar sprays has increased the efficiency of nutrition of crops such as wheat, rice, and vegetables. Likewise, India, based on its different agricultural requirements, is dependent upon foliar sprays for higher yield in vegetables and cereals. The Ministry of Agriculture, India, has initiated several schemes for promoting modern farming, and that includes the technologies of foliar spray. Additionally, Japan's technology-oriented agriculture has contributed to the growth of foliar spray applications in its horticulture industry. With the tremendous agricultural needs, the Asia Pacific region is still the largest market for foliar sprays, and this is likely to continue during the forecast period.

Moreover, the European region showed a significant growth rate in the foliar spray market over the forecast period of 2024 to 2032. This is due to the rising adoption of sustainable agriculture practices influenced by both consumers and government policies. The Common Agricultural Policy (CAP) of the European Union promotes organic farming schemes, which will fuel additional usage of organics in the form of foliar sprays within the continent. Germany, France, and Italy have witnessed considerable momentum going towards precision agriculture, comprising the utilization of foliar sprays for maximizing fertilizer delivery as well as crop protection. The European Fertilizer Manufacturers Association (EFMA) indicates an increased demand for environmentally friendly, effective farming solutions, particularly in field crops and horticulture. Furthermore, rising consumer demand for organic and pesticide-free products is encouraging the use of more natural foliar spray solutions. These reasons, along with technological innovation, make Europe the fastest-growing market for foliar sprays and its share of the market is likely to increase considerably in the future.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Aries Agro Ltd. (Agromin Foliar Spray Liquid, Aries Total, Aquarite)

-

BASF SE (Priaxor, Revytek, AgCelence)

-

Bayer AG (Nativo, Luna Experience, Aliette)

-

Coromandel International Limited (Abda Foliar, Magnite, Marlett M 45)

-

EuroChem Group AG (Nitrophoska Foliar, UAN, Entec 26)

-

Gujarat State Fertilizers & Chemicals Ltd. (GSFC) (Chelamin, Zinc Sulphate Monohydrate, Boronated Calcium Nitrate)

-

Haifa Group (Haifa Bonus, Poly-Feed Foliar, Magnisal)

-

Hello Nature International Srl (Trainer, Vitanica RZ, Ferticell Active)

-

ICL (Israel Chemicals Ltd.) (Agroleaf Power, Agroleaf Special, Agroleaf Liquid)

-

K+S Aktiengesellschaft (Korn-Kali, ESTA Kieserit, Patentkali)

-

Nutrien Ltd. (ESN Smart Nitrogen, Loveland Products' NutriSync, CoRon)

-

Nutrient Technologies, Inc. (Tech-Flo All Season, Tech-Flo Omega, Tech-Flo Zeta Zinc)

-

OMEX Group (CalMax, Bio 20, Kingfol Zn)

-

Seasol International (Seasol, PowerFeed, EarthCare)

-

Sichuan Shucan Chemical Co. Ltd. (EDTA Chelated Micronutrients, Water Soluble NPK, Amino Acid Foliar Fertilizer)

-

Syngenta (Amistar Top, Ridomil Gold, Revus)

-

The Mosaic Company (MicroEssentials, Aspire, K-Mag)

-

Tribodyn GmbH (Tribodyn BioAktiv, Tribodyn Foliar Plus, Tribodyn MicroMix)

-

Yara International ASA (YaraLiva Tropicote, Krista-MgS, Krista-K Plus)

-

YaraVita (YaraVita Rexolin, YaraVita Gramitrel, YaraVita Thiotrac)

Recent Developments

-

February 2025: BASF initiated the registration of Prexio Active insecticide across Asia-Pacific. The product targets all four major rice hopper species and features a novel mode of action with no known resistance. Suitable for drone spraying, it offers long-lasting protection. BASF expects product rollout by Q2 2025, starting in key markets like India during the Kharif season.

-

December 2024: Coromandel International partnered with Mahindra Krish-e to launch drone-based spraying services across India. Offered under the Gromor Drive platform, the initiative aimed to enhance crop productivity and reduce manual exposure to agrochemicals. Available in seven states, the service leverages the 'Krish-e Kheti Ke Liye' app and utilizes Coromandel's drone subsidiary, Dhaksha, to promote sustainable and efficient farming practices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.10 Billion |

| Market Size by 2032 | USD 11.76 Billion |

| CAGR | CAGR of 5.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Nitrogenous, Phosphatic, Potassic, Calcium, Micronutrients, Others) •By Form (Dry, Liquid) •By Application (Horticultural Openfield, Greenhouse, Field Crops, Turf & Ornamentals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Yara International ASA, Nutrien Ltd., The Mosaic Company, EuroChem Group AG, K+S Aktiengesellschaft, ICL (Israel Chemicals Ltd.), BASF SE, Bayer AG, Syngenta, Coromandel International Limited and other key players |