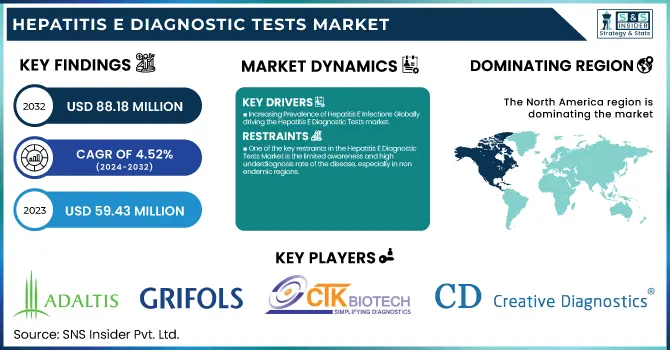

Hepatitis E Diagnostic Tests Market Size:

The Hepatitis E Diagnostic Tests Market was valued at USD 59.43 million in 2023 and is expected to reach USD 88.18 million by 2032, growing at a CAGR of 4.52% from 2024-2032.

To Get more information on Hepatitis E Diagnostic Tests Market - Request Free Sample Report

The Hepatitis E Diagnostic Tests Market report offers insights by concentrating on regional disease burden analysis, outlining incidence and prevalence trends among major markets in 2023. It assesses diagnostic test adoption rates and regional preferences for ELISA, PCR, and rapid tests. The report further provides a complete review of testing volumes and future demand forecasts to analyze market growth dynamics. One of the distinguishing factors is the detailed examination of healthcare expenditure on HEV testing, dividing investments into government, commercial, private, and out-of-pocket spending. These data guarantee a data-driven strategy in understanding market dynamics, adoption trends, and financial allocation in HEV diagnostics.

Hepatitis E Diagnostic Tests Market Dynamics

Drivers

-

Increasing Prevalence of Hepatitis E Infections Globally driving the Hepatitis E Diagnostic Tests market.

The increasing number of cases of hepatitis E virus (HEV) infections is one of the key growth drivers for the Hepatitis E Diagnostic Tests Market. The World Health Organization (WHO) reports that hepatitis E is responsible for an estimated 20 million cases of infection per year, with an estimated 70,000 deaths and 3,000 stillbirths. The infection is highly endemic in countries with low levels of sanitation and unsafe water supplies, e.g., South Asia and Africa. The increasing HEV burden has, in turn, resulted in a higher demand for early and precise diagnostic solutions. The approval of recent HEV diagnostic assays, including Roche's Elecsys Anti-HEV IgM and IgG immunoassays, in November 2023 has also consolidated the market by enhancing testing potentials. Expansion of diagnostic laboratory networks and government schemes for viral hepatitis screening also drive market growth.

-

Advancements in Diagnostic Technologies and Rapid Testing Solutions accelerating the market growth.

Advances in technology in hepatitis E diagnostics, especially molecular and immunoassay-based tests, are driving market growth. PCR-based tests and ELISA kits are highly sensitive and specific and are the first choice for precise HEV detection. Rapid diagnostic tests (RDTs) are also gaining popularity because they can deliver rapid and affordable results, particularly in resource-poor environments. DiaSorin launched the LIAISON Murex Anti-HEV IgG and IgM tests in December 2023, improving laboratory test efficiency. In addition, AI-based diagnostic systems and automation of diagnostic platforms simplify HEV testing, shorten turnaround times, and enhance accuracy. The increased demand for point-of-care (POC) tests in hospitals and blood banks and rising investment in diagnostic research fuel the growth in hepatitis E tests globally.

Restraint

-

One of the key restraints in the Hepatitis E Diagnostic Tests Market is the limited awareness and high underdiagnosis rate of the disease, especially in non-endemic regions.

Hepatitis E is frequently misdiagnosed or underdiagnosed because it is confused with other viral hepatitis infections and influenza-like illnesses. The World Health Organization (WHO) states that hepatitis E is still underreported in most countries because healthcare professionals may not consistently test for HEV, resulting in delayed or missed diagnoses. Furthermore, the absence of uniform screening programs and the limited availability of sophisticated diagnostic equipment in low-income areas further inhibit market growth. Although there has been a recent development, such as Roche's Elecsys Anti-HEV assays released in 2023, the reluctance of HEV testing to take off is still causing challenges. Improving awareness and incorporating HEV testing into the normal diagnosis process is imperative in breaking this limitation.

Opportunities

-

A significant market opportunity for Hepatitis E diagnostic tests lies in the increasing focus on HEV screening in blood banks and organ transplantation.

A huge market potential for Hepatitis E tests exists in the growing interest for HEV screening among blood banks and organ transplants. Research suggests that HEV is spread via contaminated blood transfusions and organ transplantation, creating serious health hazards for immunocompromised recipients. Regulatory agencies such as the European Medicines Agency (EMA) have highlighted the importance of routine HEV screening in blood donations, which has encouraged diagnostic firms to create more sensitive and affordable HEV assays. The launch of high-sensitivity nucleic acid testing (NAT)--based HEV assays by firms such as Grifols and Roche has further consolidated this segment. As the regulations around blood safety increase and awareness around the world for transfusion-transmitted diseases increases, diagnostic players stand to extend their product portfolio, which can boost the uptake of Hepatitis E diagnostic tests among clinical and blood screening laboratories.

Challenges

-

A key challenge in the Hepatitis E Diagnostic Tests Market is the limited availability of advanced diagnostic infrastructure in developing and underdeveloped regions.

One of the challenges that lie ahead for the Hepatitis E Diagnostic Tests Market is that few sophisticated diagnostic infrastructure facilities exist in developing and underdeveloped economies. HEV diagnostics, especially molecular tests such as polymerase chain reaction (PCR) and nucleic acid testing (NAT), demand sophisticated laboratory facilities, qualified staff, and sound cold chain logistics, all of which are not usually available in resource-poor environments. Those countries that bear a heavy burden of hepatitis E, notably South Asia and sub-Saharan Africa, are afflicted with weak health infrastructure, reducing the affordability and accessibility of correct HEV diagnosis. Although firms such as Siemens Healthineers and Abbott have launched rapid and automated diagnostic solutions, penetration is low in areas with limited resources. It will take joint efforts from governments, international health organizations, and diagnostic firms to enhance access to credible HEV testing solutions.

Hepatitis E Diagnostic Tests Market Segmentation Analysis

By Test Type

The ELISA HEV IgM test segment dominated the Hepatitis E Diagnostic Tests Market with around 47.12% market share in 2023 with its high sensitivity, specificity, and prevalence in clinical diagnostics. This test is the reference standard for recent HEV infection diagnosis as IgM antibodies are produced early in infection, thus a valuable tool for early diagnosis. Healthcare professionals prefer ELISA-based tests due to their precise and reliable results, minimizing the possibility of false negatives or delayed treatment. Moreover, numerous hospitals, diagnostic laboratories, and blood banks use ELISA HEV IgM tests as a part of routine screening programs, further increasing their market share. The growing worldwide burden of hepatitis E, especially among immunocompromised individuals and pregnant women, has also driven demand for ELISA HEV IgM tests, reinforcing their market dominance. In addition, regulatory clearances and ELISA technology advancements have enhanced test efficiency and availability, making them widely adopted. The increase in government efforts to contain hepatitis epidemics has also contributed heavily to the growing use of these tests in various healthcare facilities.

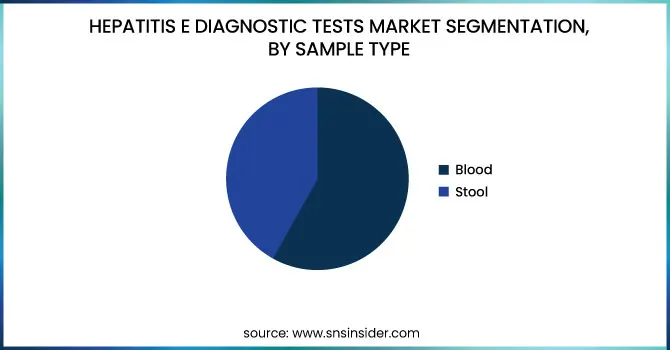

By Sample Type

The Blood segment dominated the market with around 75.26% market share in 2023 because of its high reliability, accuracy, and extensive application in the detection of HEV infections. Blood samples are the preferred option for HEV diagnosis because they enable the detection of HEV RNA, IgM, and IgG antibodies, which give complete information about both acute and past infections. ELISA and PCR-based assays, being the main diagnostic methods for hepatitis E, are also heavily dependent on blood samples because of their capability to provide accurate and early results. Blood tests are also heavily incorporated into hospital routine screenings, diagnostic labs, and blood banks, further establishing their dominance. The increasing incidence of hepatitis E, particularly in immunocompromised patients and pregnant women, has increased the demand for blood-based testing. In addition, technological advancements in automated blood diagnostic platforms and increased use of point-of-care testing solutions have increased accessibility, further supporting the dominance of the blood segment as the top sample type in the market.

By End-use

The Hospitals segment dominated the Hepatitis E Diagnostic Tests Market with around 52.14% market share in 2023 on account of increased patient inflow, access to state-of-the-art diagnostic equipment, and amalgamation of expansive testing facilities. Hospitals are general healthcare centers that cater to suspected cases of hepatitis E infections where the initial diagnosis and treatment of the infection occurs, making it the most desired location for HEV testing employing ELISA, PCR, and rapid tests. Moreover, hospitals are equipped with high-tech laboratory centers, professional healthcare personnel, and computerized diagnostic machines to provide quick and precise results.

In addition, increased cases of hepatitis E infections, especially among immunocompromised individuals and pregnant women, have influenced early diagnosis and hospitalization for complicated cases. The rising government support and funding for infectious disease management, combined with the collaborations of hospitals with research institutions in conducting HEV surveillance, further strengthen their position as market leaders. Additionally, large-scale seroprevalence studies and epidemiological studies are mostly performed by hospital laboratories, strengthening their position as leaders in hepatitis E diagnosis.

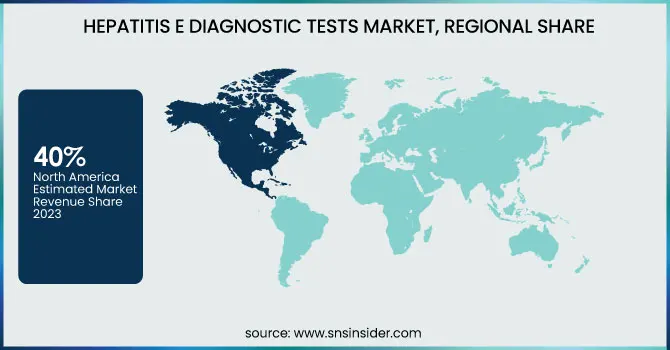

Hepatitis E Diagnostic Tests Market Regional Insights

North America dominated the Hepatitis E Diagnostic Tests Market with around 40% market share in 2023, because of its established healthcare infrastructure, sophisticated diagnostic technologies, and robust regulatory environment. The region is highly aware of infectious diseases, and thus HEV diagnostic tests are used extensively, especially in blood screening and organ transplantation facilities. The dominance of prominent market players like Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers further reinforces North America's dominance, as these players keep investing in innovative HEV testing solutions. Furthermore, the stringent regulations of organizations like the FDA and CDC require regular screening for infectious diseases, which supports market growth. The growing prevalence of hepatitis E among immunocompromised individuals, along with research and development in molecular diagnostics, further establishes North America's leadership in the market.

Asia Pacific is the fastest-growing region with a 5.60% CAGR throughout the forecast period, mainly because of the high prevalence of HEV infections, growing healthcare expenditure, and heightened awareness of viral hepatitis. India and China frequently experience HEV outbreaks, most notably in the regions with less sanitation and cleaner water access. With governments and international health institutions intensifying action against HEV, demand for accurate diagnostic technology is increasing exponentially. The increased healthcare infrastructure coverage and access to affordable rapid diagnostic tests (RDTs) are also fast-tracking market expansion. The growing use of polymerase chain reaction (PCR)-based HEV testing, aided by public health authority initiatives, also increases market growth. With diagnostic firms increasing their presence in emerging markets, Asia Pacific will see significant growth in HEV diagnostics.

Get Customized Report as per Your Business Requirement - Enquiry Now

Hepatitis E Diagnostic Tests Market Key Players

-

ADALTIS (EIAgen HEV IgM ELISA Kit, EIAgen HEV IgG ELISA Kit)

-

Grifols (Procleix HEV Assay, Procleix Panther System)

-

CTK Biotech (HEV IgM Rapid Test CE, HEV IgG Rapid Test)

-

Creative Diagnostics (HEV-Ag ELISA Kit, HEV IgM Antibody ELISA Kit)

-

Roche Diagnostics (Elecsys HEV IgM Assay, Elecsys HEV IgG Assay)

-

DiaSorin (LIAISON Murex Anti-HEV IgG Assay, LIAISON Murex Anti-HEV IgM Assay)

-

Fortress Diagnostics (HEV IgM ELISA Kit, HEV IgG ELISA Kit)

-

Launch Diagnostics (Diapro HEV IgM ELISA, amplitude HEV 2.0 Quant)

-

AdvaCare Pharma (AccuQuik HEV IgM Rapid Test, AccuQuik HEV IgG Rapid Test)

-

Beijing Zhongjian Antai Diagnosis Technology Co., Ltd. (Hepatitis E Detection Kit, HEV IgM ELISA Kit)

-

Bio-Rad Laboratories (HEV IgM ELISA Kit, HEV IgG ELISA Kit)

-

Abbott Laboratories (ARCHITECT HEV IgM Assay, ARCHITECT HEV IgG Assay)

-

Siemens Healthineers (Enzygnost HEV IgM Assay, Enzygnost HEV IgG Assay)

-

Thermo Fisher Scientific (HEV IgM ELISA Kit, HEV IgG ELISA Kit)

-

PerkinElmer (HEV IgM Rapid Test, HEV IgG Rapid Test)

-

BioCheck, Inc. (HEV IgM ELISA Test Kit, HEV IgG ELISA Test Kit)

-

MP Biomedicals (HEV IgM ELISA Kit, HEV IgG ELISA Kit)

-

Euroimmun AG (Anti-HEV IgM ELISA, Anti-HEV IgG ELISA)

-

DRG International, Inc. (HEV IgM ELISA Kit, HEV IgG ELISA Kit)

-

Wantai BioPharm (HEV IgM ELISA Kit, HEV IgG ELISA Kit)

Suppliers (These suppliers provide critical raw materials, reagents, assay components, and laboratory instruments essential for Hepatitis E diagnostic tests.)

-

Merck KGaA

-

Agilent Technologies, Inc.

-

Qiagen N.V.

-

Thermo Fisher Scientific Inc.

-

PerkinElmer Inc.

-

Bio-Rad Laboratories, Inc.

-

Luminex Corporation (DiaSorin Group)

-

Tecan Group Ltd.

-

R&D Systems (Bio-Techne Corporation)

-

GE Healthcare

Recent Development

November 16, 2023 – Roche launched its Elecsys Anti-HEV IgM and Elecsys Anti-HEV IgG immunoassays to detect hepatitis E virus (HEV) infection in CE-marking countries. These assays allow clinicians to accurately diagnose HEV infections, facilitate the identification of symptoms, selection of suitable treatments, and monitoring of disease progression. Early detection with these assays may prevent severe complications and enable early antiviral treatment, which in turn may enhance patient outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 59.43 million |

| Market Size by 2032 | US$ 88.18 million |

| CAGR | CAGR of 4.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (ELISA HEV IgM Test, ELISA HEV IgG Test, Rapid Diagnostics Test, Polymerase Chain Reaction (PCR)) • By Sample Type (Blood, Stool) • By End-use (Hospitals, Diagnostic Laboratories, Blood Banks, Other End-users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ADALTIS, Grifols, CTK Biotech, Creative Diagnostics, Roche Diagnostics, DiaSorin, Fortress Diagnostics, Launch Diagnostics, AdvaCare Pharma, Beijing Zhongjian Antai Diagnosis Technology Co., Ltd., Bio-Rad Laboratories, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, PerkinElmer, BioCheck, Inc., MP Biomedicals, Euroimmun AG, DRG International, Inc., Wantai BioPharm, and other players. |