Healthcare Market Growth Analysis

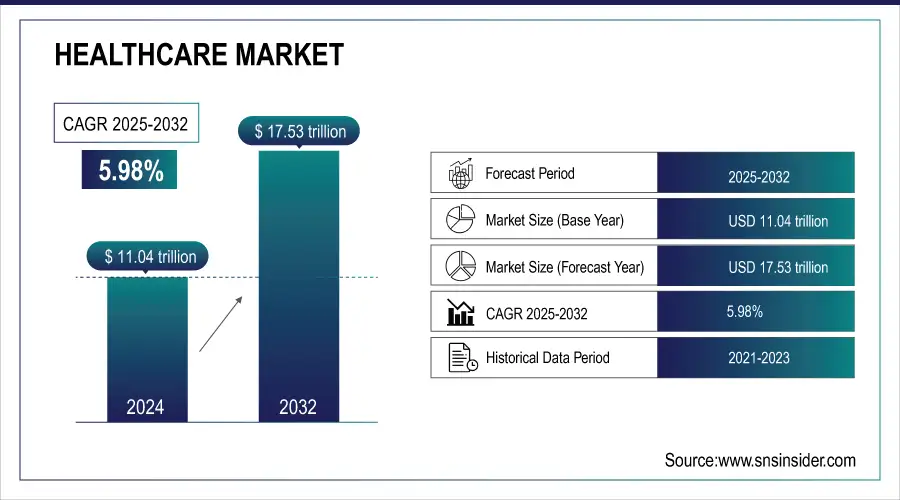

The Healthcare Market size was valued at USD 11.04 trillion in 2024 and is expected to reach USD 17.53 trillion by 2032, growing at a CAGR of 5.98% over the forecast period of 2025-2032.

The global Healthcare Market is supposedly growing at a vigorous rate due to demands for state-of-the-art medical facilities, greater incidence of chronic diseases, and increasing investments made in the healthcare sectors and associated infrastructure and technology. With increased availability of quality treatment, advances in digital health, and tailored treatment offerings being developed, this is leading to strong market growth opportunities. In addition, the shift to AI-based diagnostics, wearables, and biotech products is improving patient outcomes and operational excellence, while government programmes, including public healthcare spending, are adding to longer-term gains. Medical industry leaders are committed to research and the creative use of technology to enhance market position and develop cost-effective ways of delivering care to patients globally.

Japanese giant Takeda wants to trial their global clinical trials in India to launch their innovative drugs faster in the country. The value of India’s clinical trials industry is expected to cross USD 2 billion by 2030 (supported by the country’s diverse patient pool, lower cost, and increasing number of hospitals).

Get More Information on Healthcare Market - Request Sample Report

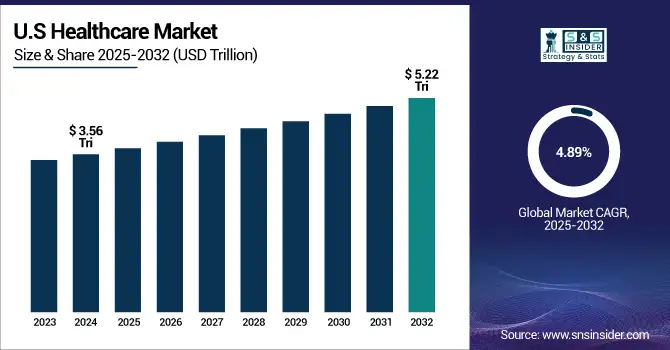

The U.S. Healthcare Market size was valued at USD 3.56 trillion in 2024 and is projected to reach USD 5.22 trillion by 2032, growing at a CAGR of 4.89%during 2025-2032.

The nation dwarfs the whole of North America when it comes to well-established hospital networks, cutting-edge research in pharmaceuticals and biotech, and national commitment to sprucing up healthcare infrastructure. The rising prevalence of digital health solutions, AI-facilitated diagnostics, and precision medicine enables greater efficiency and better patient outcomes nationwide.

Healthcare Market Highlights:

-

Growing adoption of digital health solutions, including telemedicine, mHealth apps, and remote patient monitoring.

-

Increased investment in biotechnology and personalized medicine, including gene and cell therapies.

-

Rising demand for home healthcare services and outpatient care due to aging populations.

-

Expansion of AI and big data analytics for diagnostics, treatment optimization, and operational efficiency.

-

Strong growth in medical devices and wearable health technologies for real-time monitoring.

-

Consolidation through mergers, acquisitions, and private equity investments in healthcare services and pharma.

-

Focus on sustainable healthcare infrastructure and government-backed initiatives to improve access and affordability.

Healthcare Market Growth Drivers

-

Rising Prevalence of Chronic Diseases Drives Market Growth

The healthcare industry worldwide is growing at an unprecedented pace owing to increasing incidences of chronic disorders such as diabetes, cardiac disorders, cancer, and respiratory disorders. These conditions typically require long-term management, regular hospital visits, ongoing medication, and extensive monitoring, greatly expanding the need for health care services, medical devices, pharmaceutical products, and digital health interventions.

Not only do chronic diseases lower patients' quality of life, but they also result in a significant economic burden to healthcare systems globally. The World Health Organization (WHO) has reported that more than 41 million deaths occur every year as a result of chronic diseases, which work out to be about 71% of annual global deaths. Emerging prevalence of these diseases is distinct in aging populations and megacities, where Lifestyles, lack of exercise, and a bad diet are contributing to further risk.

This development is driving governments and companies to increase funding for healthcare facilities, telemedicine, preventive care services, as well as innovative technologies, including personalized medicine, AI-based diagnosis, and connected wearable devices. Anti-ageing is an interest for the developing global healthcare market, and by being proactive in the management of chronic disease, healthcare providers hope to enhance end patient outcomes while also keeping their overall healthcare costs down over the long term.

Healthcare Market Restraints:

-

Stringent Regulatory Policies and Compliance Requirements May Restrain Market Growth

Regulation of drug, device, and health services activities. The response that is top of mind in any government's efforts to manage emerging health technologies relates to the (overriding) focus applied to the regulation of the clinical use of drugs, devices, and health services. Regulatory authorities (e.g., FDA, EMA, and other national authorities) have established stringent requirements for safety, efficacy, and clinical studies.

Although these regulations are necessary to ensure the safety of the patient, they can drive up the cost and duration associated with a product’s development and introduction to the market. Manufacturers are frequently subject to a protracted approval process and face costly compliance audits and hordes of post-market surveillance, which might stifle innovation and reduce the pace at which new therapies and technologies come to market.

Healthcare Market Opportunities:

-

Expansion of Telemedicine and Digital Health Solutions Creates an Opportunity for the Market

Telemedicine and digital health technologies are one of the biggest opportunity zones in the global health care market. Telemedicine systems, mobile and other health (mHealth) applications, and devices for remote patient monitoring allow patients to get healthcare in a way that does not require an individual to physically visit a clinic or hospital. This is particularly helpful for individuals in rural or low-resource settings, which lack healthcare resources.

Investing in telemedicine allows companies to reduce operational costs, improve patient engagement, and expand their service reach globally. Furthermore, integration with AI-driven diagnostics and electronic health records (EHRs) enhances personalized treatment, preventive care, and early detection of diseases, creating a compelling growth avenue.

World Health Organization (WHO) notes that digital health penetration will dramatically enhance access and effectiveness of health care, especially in low- and middle-income countries, which seems to be a high-potential segment in the long run.

Healthcare Market Segment Highlights:

-

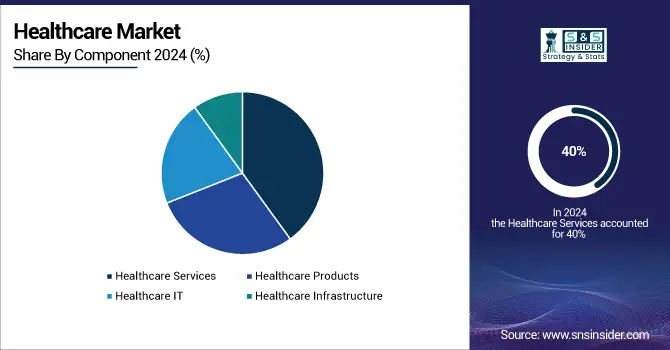

Healthcare Services led the market in 2024 with a 38.2% share, driven by high demand for inpatient, outpatient, and emergency care services, particularly in aging populations and regions with rising chronic disease prevalence.

-

Healthcare Products are the fastest-growing segment with a CAGR of 7.1%, fueled by increasing adoption of medical devices, pharmaceuticals, biotechnology products, and nutraceuticals to improve patient outcomes.

-

Healthcare IT accounted for a 21.5% market share in 2024, supported by widespread adoption of telemedicine, electronic health records (EHRs), clinical decision support systems (CDSS), and mHealth applications to enhance efficiency and remote care delivery.

-

Healthcare Infrastructure represents 18.3% of the market, driven by investments in hospitals, diagnostic centers, specialty care centers, and ambulatory surgical centers, especially in emerging economies seeking to expand access to quality care.

Healthcare Market Segment Analysis:

By Component

Healthcare Services: The Global healthcare market was dominated by healthcare services in 2024, due to the increase in demand for integrated patient care, which is one of the main factors for the high market share of healthcare services. The segment includes both inpatient and outpatient services as well as emergency services that are necessary to address acute needs, chronic conditions, and prevention. An increasingly aging population in developed countries and the increasing prevalence of chronic diseases worldwide are key growth factors. Hospitals, specialty centers, and emergency care facilities are increasing their capabilities and leveraging the utilization of high-end patient care techniques to serve a growing demand. Furthermore, the adoption of value-based care perceptions and patient-focused approaches is optimizing service quality and efficiency, also bolstering the segment’s grip on the market.

Healthcare: The healthcare segment is projected to be the fastest-growing segment with a CAGR of 5.8%, due to the increasing use of medical equipment, pharmaceuticals, biotech products, and nutraceuticals. Medical devices, including radiation imaging systems, surgical devices, wearable monitors, etc, have been routinely used for early diagnosis and continuous patient monitoring with more convenience and wider coverage. Both branded and generic drugs, as well as biosimilars and OTC drugs, are increasing the treatments available for a variety of chronic and acute conditions. Biological products, such as gene and cell therapies, are facilitating personalized medicine strategies. This expansion is driven especially by growing awareness about healthcare, preventive care measures, and higher discretionary spending in developing economies.

Healthcare IT: The healthcare IT section will procure 21.5% market shares in 2024 and has been garnering a huge adoption rate on account of advancements in technologies that are utilized in telemedicine, electronic health records (EHRs), clinical decision support systems (CDSS) & mobile health (mHealth) apps. These technologies are streamlining operations, allowing for the monitoring of patients in real-time, and facilitating remote care that is so vital in remote or underserved areas. AI, big data analytics, and cloud-enabled applications are being woven into healthcare IT solutions, delivering predictive insights, streamlining workflows, and positively impacting patient outcomes. The increasing investments in digital health by the public and the private sector also fuel market growth.

Healthcare Infrastructure: Hospitals, diagnostic centres, specialty care hospitals, and ambulatory surgical centres are the leading users of 18.3% of the market. Developing nations are spending significantly on infrastructure to fill the gaps in healthcare services and manage increasing patient differentiation. “In the mature markets, you will see there's an incremental focus on refurbishing the old hospitals and then the whole facility getting retooled with high-end equipment and being green and patient-friendly, they're all the buzz words here.” Government projects, collaboration between public and private sectors, and foreign investments are driving infrastructure development, allowing the health systems to provide quality healthcare and meet the demand for niche treatments and high-end medical services.

Healthcare Market Regional Analysis:

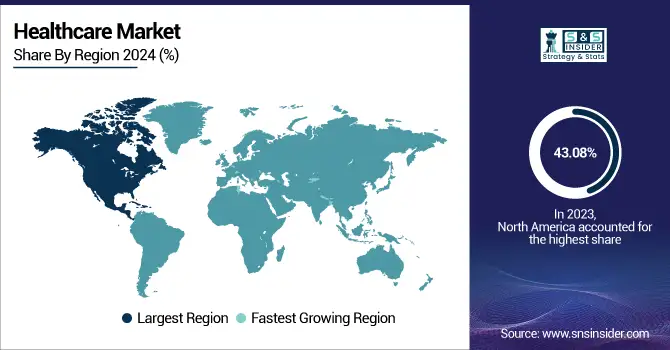

North America Healthcare Market Insights:

North America had the largest healthcare market share of 43.08% in 2024. This is due to high acceptance of sophisticated medical devices, the presence of advanced healthcare infrastructure, and high healthcare expenditure in the U.S. and Canada. The growing incidence of chronic diseases, an ageing population, and increasing patient consciousness have stimulated the demand for inpatient, outpatient, and emergency services. In 2024, several domestic healthcare institutions broadened telemedicine services and collaborated with biotech companies to bring customized therapies, which are a sign of the emphasis on patient- and innovation-based models of care.

Asia Pacific Healthcare Market Insights:

Asia Pacific accounted for 18.77% share in 2024 and was predominant due to China, India, and Japan. The growth is primarily driven by the increase in healthcare infrastructure, higher disposable income, rising chronic diseases, and an increase in awareness of preventive care. Multiple stakeholders in the health industry, including government, are making investments in hospital expansion, telemedicine, and digital health technologies, and private players are coming up with low-cost medical equipment, pharmaceutical, and biotech solutions to cater to the increasing demand. A large number of patient populations and government support are driving massive opportunities for the market to grow.

Europe Healthcare Market Insights:

Europe held 27.69% of the market share in 2024, dominated by countries including Germany, France, and the UK, owing to the strong presence of the public healthcare system, high per capita health care expenditure, and high penetration of medical technologies. "EU regulations are focused on patient safety, quality, and sustainability, and these are driving healthcare providers to offer environmentally sound, state-of-the-art medical devices and treatments." Several European hospitals adopted AI-based diagnostic tools and telemedicine solutions in 2024, enhancing care delivery efficiencies and reaching rural areas.

Latin America (LATAM) and Middle East & Africa (MEA) Healthcare Market Insights:

In 2024, Latin America contributed 6.09% to the global healthcare market as Brazil, Mexico, and Argentina became increasingly accessible to healthcare services, government and industry investments in hospitals and diagnostic centres, and dependence on advanced medical technologies grew. Chronic disease care management, telehealth solutions, and private care services are being rapidly adopted, driven by government initiatives to enhance the quality and affordability of care. The Middle East & Africa (MEA) in the same period accounted for a share of 4.37%, driven by the healthcare infrastructure in Saudi Arabia, the UAE, and South Africa. Growing populations, urbanisation, and government programmes to increase access to healthcare are driving demand for hospitals, specialist care centres, and diagnostics. Global providers of healthcare are also extending their reach and implementing advanced technologies such as telemedicine and digital diagnostics to better serve the region.

Need any customization research on Healthcare Market - Enquiry Now

Healthcare Market Competitive Landscape:

Johnson & Johnson

Johnson & Johnson is a leading global healthcare company with a diverse portfolio spanning medical devices, pharmaceuticals, and consumer health products. The company emphasizes innovation in surgical equipment, diagnostics, and chronic disease management.

-

In March 2024, Johnson & Johnson launched an advanced remote monitoring device in the U.S., enhancing chronic disease management and telehealth integration for hospitals and clinics.

Pfizer Inc.

Pfizer is a major player in the pharmaceutical sector, focusing on vaccines, innovative drugs, and biopharmaceutical solutions. The company invests heavily in R&D and precision medicine to address global health challenges.

-

In May 2024, Pfizer introduced a new mRNA-based therapy in Europe for rare genetic disorders, supporting personalized treatment approaches.

Roche Holding AG

Roche is a global leader in biotechnology and diagnostics, offering solutions across oncology, immunology, and molecular diagnostics. The company emphasizes advanced diagnostics and precision therapies.

-

In July 2024, Roche opened a new digital diagnostics innovation center in Switzerland to develop AI-powered clinical decision support tools for hospitals worldwide.

Medtronic Plc

Medtronic specializes in medical devices, including cardiovascular, diabetes, and surgical solutions. The company focuses on minimally invasive procedures and patient-centric technologies.

-

In September 2023, Medtronic launched a next-generation wearable insulin delivery system in North America, improving diabetes management for patients.

Abbott Laboratories

Abbott Laboratories provides a wide range of healthcare products, including diagnostics, medical devices, nutrition products, and branded generic drugs. The company emphasizes preventive care and chronic disease management.

-

In April 2024, Abbott expanded its cardiovascular device portfolio in Asia-Pacific by introducing AI-enabled cardiac monitoring solutions for hospitals and clinics.

Healthcare Market Key Players:

-

Johnson & Johnson

-

Pfizer Inc.

-

Roche Holding AG

-

McKesson Corporation

-

Merck & Co., Inc.

-

Novartis AG

-

Anthem, Inc. (Now Elevance Health)

-

Cigna Group

-

GlaxoSmithKline (GSK) Plc

-

Sanofi S.A.

-

Siemens Healthineers AG

-

Becton, Dickinson and Company (BD)

-

GE Healthcare Technologies Inc.

-

Abbott Laboratories

-

Bayer AG

-

Cardinal Health, Inc.

-

Medtronic Plc

-

AstraZeneca Plc

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.04 Trillion |

| Market Size by 2032 | USD 17.53 Tillion |

| CAGR | CAGR of5.98% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Healthcare Services, Healthcare Products, Healthcare IT, Healthcare Infrastructure) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Johnson & Johnson, UnitedHealth Group, Pfizer Inc., Roche Holding AG, McKesson Corporation, Merck & Co., Inc., CVS Health Corporation, Novartis AG, Anthem, Inc. (Now Elevance Health), Cigna Group, GlaxoSmithKline (GSK) Plc, Sanofi S.A., Siemens Healthineers AG, Becton, Dickinson and Company (BD), GE Healthcare Technologies Inc., Abbott Laboratories, Bayer AG, Cardinal Health, Inc., Medtronic Plc, AstraZeneca Plc |