High-Performance Plastics Market Report Scope & Overview

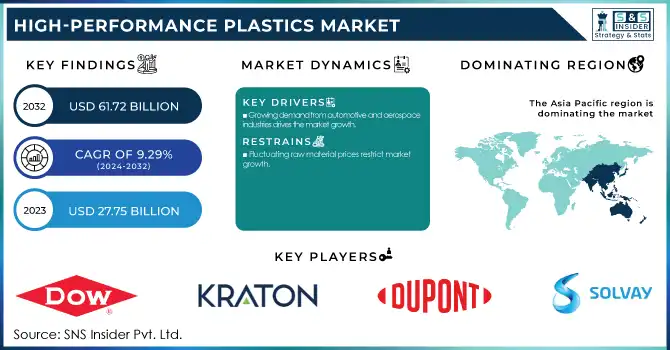

The High Performance Plastics Market size was valued at USD 27.75 billion in 2023 and is expected to reach USD 61.72 billion by 2032, growing at a CAGR of 9.29% over the forecast period of 2024-2032. The high-performance plastics market report provides key statistical insights and trends, including production capacity and utilization rates by type and region, along with an analysis of raw material prices and their impact on costs. It evaluates regulatory influences and compliance trends, highlighting evolving environmental policies. The study also covers sustainability metrics, including recycling rates and carbon emissions, alongside R&D investments driving material innovations. Additionally, it examines market demand by end-use industries, identifying key growth sectors such as aerospace, automotive, and electronics.

Get PDF Sample Copy of High-Performance Plastics Market - Request Sample Report

Drivers

Growing demand from automotive and aerospace industries drives the market growth.

The demand for high-performance plastics in the automotive and aerospace sectors is one of the biggest factors driving the growth of this market. Such plastics are lighter than metals, have a high thermal resistance, and provide great mechanical strength to replace metals in critical parts. Growing demand for fuel-efficient vehicles and electric mobility due to their capacity to improve vehicle performance, emissions, and energy efficiency is anticipated to expedite the adoption of these materials. High-performance plastics are widely used in the aerospace sector to reduce weight and save fuel in a way that meets the stringent regulations of the aerospace industry. This increasing demand for high-performance lightweight and strength applications is driving the expansion of the market.

Restraint

Fluctuating raw material prices restrict market growth.

High production costs and complicated processing are expected to hinder the growth of the high-performance plastics market. Defects in such materials depend on the manufacturing process as they require high-temperature molding and manufacturing, and operating costs increase. Also, a large dependence on high-cost raw materials such as polyether ether ketone (PEEK), polyphenylene sulfide (PPS), as well as fluoropolymers has restricted widespread adoption, especially in cost-sensitive industries. This technology has a top-of-the-line performance, which often fails to be achieved in cost and accessibility for small and medium-scale manufacturers for their penetration market.

Opportunities

Rising demand for lightweight and sustainable materials lucrative opportunities

The high-performance plastics market offers significant opportunity as key industries such as automotive, aerospace, and electronics are constantly focusing on lightweight and fuel-efficient materials. Their high strength-to-weight ratios, thermal stability properties, and chemical resistant properties offer benefits as metal and classic plastic replacement materials. Moreover, the increasing usage of bio-based and recyclable high-performance plastics for sustainability and compliance with strict environmental regulations also erodes market growth. With the developments in polymer technology, low-cost and high-performance materials are making their way into several applications in different industries.

Challenges

Fluctuating raw material prices pose a major challenge to market growth.

Raw material price fluctuation is a major restraint for the high-performance plastics market owing to the dependence of the aforementioned material on specialty polymers that are made from petroleum-based feedstocks, which hinder the high-performance plastics market growth. Crude oil is a major raw material for key products that include, but are not limited to, fluoropolymers, polyether ether ketone (PEEK), and polyphenylene sulfide (PPS), which means that the price fluctuation of crude oil directly influences the price of these raw materials, and thus, the cost-effective stability is increasing concern for a number of manufacturers. Moreover, these uncertainties are exacerbated by geopolitical tensions, supply chain bottlenecks, and trade regulations, which can lead to unforeseen cost inconsistencies and losses in production efficiency and profitability. This means that businesses in this sector have to endure continuous changes in prices, which can curtail investment in the development of new products while stunting the growth of the overall market.

Market segmentation

By Type

Fluoropolymers held the largest market share, around 32%in 2023. It is due to their exceptional chemical resistance, thermal stability, and superior mechanical properties. These polymers, including PTFE, PVDF, and FEP, are widely used in industries such as automotive, aerospace, electronics, and chemical processing, where extreme conditions require durable and non-reactive materials. Their low friction and high dielectric properties make them indispensable in semiconductor manufacturing and wiring insulation for electronic components. Additionally, the growing demand for lightweight materials in fuel-efficient vehicles and the rising adoption of non-stick and corrosion-resistant coatings in cookware and industrial applications further drive the dominance of fluoropolymers in the market.

By End-Use Industry

The transportation segment held the largest market share, around 42% in 2023. Fluoropolymers, Polyimides, and PEEK, High-Performance Plastics, have superior thermal stability, chemical resistance, and mechanical strength, which allows for replacement of metal components. This demand for fuel efficiency and emission reduction have further fueled the use of these plastics in automotive interiors, structural components, and engine components. Moreover, the development of EVs along with the regulation limit for sustainable materials, is also increasing the demand for high-performance plastics in this sector.

Regional Analysis

Asia Pacific held the largest market share around 34% in 2023. The rapid growth of the significant industries in the region such as automotive, electronics, and aerospace in developing countries like China, Japan, South Korea, and India. The area is also presented with solid manufacturing capabilities, lower production costs, and high investment into research and development. Further increasing demand for lightweight and sturdy materials in electric vehicles (EVs), coupled with growing consumer electronics sector, is driving the market growth. The high-performance plastics market in Asia Pacific is further driven by the support given by the government for industrialization as well as growth in urbanization and development of infrastructure.

North America held a significant share and growing in the forecast period. Fluoropolymers and polyimides are largely consumed in the aerospace sector, especially in the U.S., owing to their excellent thermal & chemical resistance. Furthermore, the increase in electric vehicles (EVs) usages and lightweight materials in the automotive industry is also propelling the high-performance plastics usage for improving fuel economy and minimizing CO2 emissions. In addition, the region is also the home to many of the key players investing in advanced polymer solutions, and the government initiatives supporting sustainable materials further reinforces the dominance of the region in the expansion of the biodegradable polymers market. In addition, the North American demand is reinforced by the increasing requirement for biocompatible and sterilizable plastics in the medical sector, especially in surgical instruments and medical implants.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players

-

Dow (ENGAGE, ELITE)

-

Kraton Corporation (Cariflex, Kraton G)

-

DuPont (Zytel, Delrin)

-

Ryan Plastics Ltd. (High-Performance PEEK, PPS Components)

-

RTP Company (RTP 300 Series, RTP 200 Series)

-

Solvay (Ryton, KetaSpire)

-

Eurostar Engineering Plastics (Starflam, Staramide)

-

LyondellBasell Industries Holdings B.V. (Purell, Hostalen)

-

Kuraray Co. Ltd (Genestar, Kurarister)

-

Toray Industries (Toraycon, Torelina)

-

Kureha Corporation (Krefine, Krehalon)

-

SABIC (Noryl, ULTEM)

-

PolyOne Corporation (OnFlex, ECCOH)

-

Victrex plc (VICTREX PEEK, VICTREX HT)

-

Arkema (Rilsan, Kynar)

-

Celanese Corporation (Hostaform, Fortron)

-

Ensinger (TECAPEEK, TECATRON)

-

Mitsubishi Chemical Corporation (Novamid, Kyron)

Recent Development:

-

In 2024, BASF SE launched Ultramid Advanced N, a new polyphthalamide (PPA) grade. It is designed for automotive and industrial applications requiring high thermal and chemical resistance. This innovation enhances material performance in demanding environments.

-

In 2023, Evonik expanded its PA12 high-performance polymer production capacity. This move aimed to meet the rising demand in the automotive and electronics sectors. The expansion enhances supply reliability and supports industry growth.

| Report Attributes | Details |

| Market Size in 2023 | US$ 27.75 Billion |

| Market Size by 2032 | US$ 61.72 Billion |

| CAGR | CAGR of 9.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fluoropolymers, HPPA, Polyphenylene Sulphide (PPS), Sulfone Polymers (SP), Liquid Crystal Polymers (LCP) and Polyamides) • By End Use Industry (Industrial, Electrical and Electronics, Transportation, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Evonik Industries, BASF SE, Dow, Kraton Corporation, DuPont, Ryan Plastics Ltd., RTP Company, Solvay, Eurostar Engineering Plastics, LyondellBasell Industries Holdings B.V., Kuraray Co. Ltd, Toray Industries, Kureha Corporation, SABIC, PolyOne Corporation, Victrex plc, Arkema, Celanese Corporation, Ensinger, Mitsubishi Chemical Corporation |