Core Material Market Report Scope & Overview:

Get E-PDF Sample Report on Core Material Market - Request Sample Report

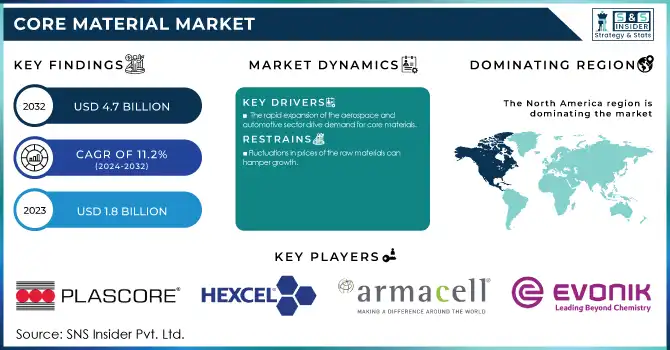

The Core Material Market Size was valued at USD 1.80 Billion in 2023 and is expected to reach USD 4.66 Billion by 2032, growing at a CAGR of 11.15% over the forecast period of 2024-2032.

The Core Material Market is expanding rapidly, driven by rising demand in aerospace, wind energy, and automotive industries. Our report offers a detailed pricing analysis, covering historical trends, regional variations, and cost drivers. A thorough supply chain analysis highlights key suppliers, production challenges, and logistics dynamics. Import-export data examines trade flows, tariff impacts, and emerging market shifts. The regulatory and compliance framework explores industry standards, sustainability mandates, and safety regulations shaping product development. Additionally, investment and funding trends provide insights into mergers, acquisitions, and venture capital driving innovation. Our report delivers a comprehensive market outlook, equipping stakeholders with actionable intelligence to navigate growth opportunities and industry disruptions in the core material landscape.

Market Dynamics

Drivers

-

Expanding Wind Energy Sector with Increased Installation of Wind Turbine Blades Drives the Core Material Market Growth

The rising adoption of renewable energy sources, particularly wind power, is a significant driver for the core material market. Wind turbine blades require durable, lightweight materials to enhance energy efficiency and structural performance. Core materials such as balsa wood, honeycombs, and foam composites provide the necessary strength-to-weight ratio, ensuring optimal blade performance under extreme weather conditions. Government incentives and global commitments to carbon neutrality are further accelerating wind energy investments, leading to an increased demand for core materials. Additionally, advancements in material technology, such as hybrid cores and bio-based composites, are driving innovations in blade manufacturing. As wind farms expand across regions, the market for core materials in wind energy applications is poised for substantial growth.

Restraints

-

Stringent Environmental Regulations and Compliance Requirements Pose Challenges for Core Material Manufacturers

Regulatory frameworks governing emissions, waste management, and sustainability impact the production and application of core materials. Governments worldwide are enforcing stricter environmental policies to reduce carbon footprints, compelling manufacturers to adopt eco-friendly alternatives. Compliance with regulations such as REACH, RoHS, and EPA standards requires significant investments in sustainable raw materials and cleaner production technologies. Additionally, the disposal and recycling of composite materials present challenges due to limited infrastructure and high processing costs. Failure to comply with evolving environmental mandates can result in legal penalties, operational restrictions, and reputational damage. As regulatory frameworks continue to evolve, core material manufacturers must navigate complex compliance landscapes to maintain market presence.

Opportunities

-

Growing Adoption of Sustainable and Recyclable Core Materials Creates New Market Opportunities in Various Industrial Applications

The increasing focus on sustainability is driving the demand for recyclable and bio-based core materials. Industries such as aerospace, automotive, and wind energy are exploring alternatives that reduce environmental impact while maintaining high-performance standards. Manufacturers are investing in biodegradable foam cores, natural fiber composites, and recycled honeycombs to align with sustainability goals. The shift toward circular economy principles presents opportunities for material recovery, reuse, and cost-efficient production. Additionally, government incentives and consumer preferences for green materials further enhance market potential. Companies that innovate in sustainable core materials can gain a competitive edge and capitalize on emerging market trends.

Challenge

-

Limited Awareness and Adoption of Core Materials in Emerging Economies Restrict Market Expansion

Despite growing industrialization, many emerging economies exhibit low awareness and adoption of core materials. The lack of technical expertise, infrastructure, and market knowledge limits the penetration of high-performance composites in developing regions. Traditional construction and manufacturing practices dominate, reducing the uptake of advanced core materials. Additionally, cost considerations and limited access to raw materials hinder adoption in price-sensitive markets. Educational initiatives, industry collaborations, and government support are crucial in promoting the benefits and applications of core materials. Addressing knowledge gaps can accelerate market growth and unlock opportunities in untapped regions.

Segmental Analysis

By Type

Foam dominated the core material market in 2023, accounting for 56.2% of the market share. Among foam types, Polyethylene Terephthalate (PET) Foam emerged as the leading subsegment, holding an estimated 37.4% share within the foam category. PET foam's dominance is attributed to its lightweight nature, superior mechanical properties, and recyclability, making it a preferred choice in aerospace, wind energy, and automotive applications. The American Wind Energy Association (AWEA) and the Global Wind Energy Council (GWEC) have highlighted the increasing adoption of PET foam in wind turbine blade manufacturing due to its cost efficiency and sustainability. Additionally, major aircraft manufacturers, including Airbus and Boeing, are integrating PET foam in aircraft interiors to enhance fuel efficiency and structural performance. Government initiatives promoting sustainability and lightweight materials in transportation further drive its demand.

By Application

Sandwich panels dominated the core material market in 2023, capturing 30.5% of the market share. These panels are widely used across industries due to their exceptional strength-to-weight ratio, insulation properties, and resistance to environmental stress. The construction sector, particularly in Europe and North America, is increasingly adopting sandwich panels for prefabricated buildings and infrastructure projects, aligning with sustainability and energy efficiency mandates set by the European Commission and the U.S. Department of Energy. Additionally, leading wind energy companies like Vestas and Siemens Gamesa are incorporating sandwich panels in wind turbine nacelles and blade structures to enhance durability and aerodynamic performance. Their versatility in aerospace and marine applications further strengthens their market position, driven by regulatory frameworks promoting lightweight materials in structural components.

By End-Use Industry

Wind energy dominated the core material market in 2023, accounting for around 27.1% of the market share. The growing emphasis on renewable energy sources and increasing global wind power installations have significantly propelled the demand for core materials, especially foam and balsa, in turbine blade production. Reports from the International Energy Agency (IEA) indicate a surge in offshore wind energy projects, with China, the U.S., and Germany leading the expansion. Companies like GE Renewable Energy and Nordex Group are continuously innovating blade design with high-performance core materials to enhance efficiency and reduce maintenance costs. Additionally, government policies, such as the U.S. Inflation Reduction Act (IRA) and China's Renewable Energy Development Plan, are fostering substantial investments in wind energy infrastructure, further solidifying the dominance of this segment in the core material market.

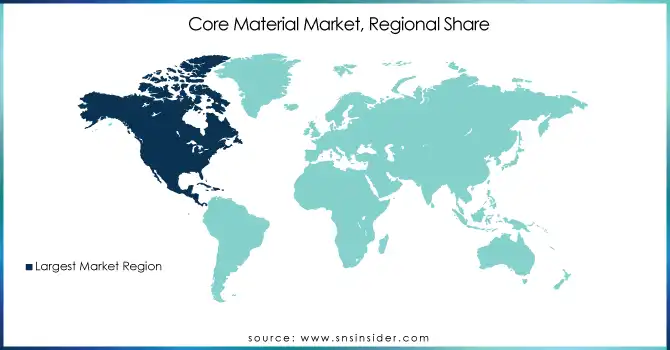

Regional Analysis

Asia Pacific dominated the core material market in 2023, accounting for 41.8% of the total market share. The region's dominance is driven by the rapid expansion of key end-use industries, including wind energy, aerospace, and automotive. China is the leading contributor, with significant investments in wind power infrastructure, as reported by the Global Wind Energy Council (GWEC), which states that China installed over 65 GW of new wind capacity in 2023 alone. The Chinese government’s aggressive push for renewable energy under its 14th Five-Year Plan has accelerated the demand for high-performance core materials in turbine blades. India follows as another strong market, with the Indian Wind Energy Association (IWEA) highlighting the country’s goal of achieving 140 GW of wind energy capacity by 2030, significantly driving the demand for core materials. Japan and South Korea are also key players, leveraging advanced composite materials in aerospace and marine applications, supported by investments from companies like Toray Industries and Mitsubishi Chemical Corporation. The rapid growth of electric vehicle (EV) manufacturing in these nations, driven by companies such as BYD, Toyota, and Hyundai, has further fueled the adoption of lightweight core materials to enhance vehicle efficiency. Additionally, government regulations in China and India mandating energy-efficient construction have boosted the use of core materials in sandwich panels for sustainable infrastructure projects.

Moreover, North America emerged as the fastest-growing region in the core material market during the forecast period, with a significant growth rate during the forecast period. This growth is fueled by increasing investments in renewable energy, aerospace advancements, and the growing adoption of lightweight materials in transportation. The United States leads the region, with the U.S. Department of Energy allocating substantial funding for wind energy projects, particularly offshore wind farms. Reports from the American Clean Power Association (ACP) indicate that the U.S. installed over 10 GW of new wind capacity in 2023, significantly driving demand for foam and honeycomb core materials in turbine blades. The aerospace sector also plays a crucial role, with Boeing and Lockheed Martin incorporating advanced composite core materials in next-generation aircraft to enhance fuel efficiency. Canada is another key contributor, with the government investing CAD 964 million in green energy projects, further propelling the demand for core materials. Mexico, with its booming automotive industry, led by manufacturers such as Tesla and Ford, is adopting lightweight core materials for EV production to comply with stringent fuel efficiency standards under the United States-Mexico-Canada Agreement (USMCA). Additionally, North America's stringent regulatory framework on carbon emissions, particularly in the construction and automotive industries, is pushing manufacturers to adopt core materials in sandwich panels and lightweight components, reinforcing the region’s rapid market expansion.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Evonik Industries AG (ROHACELL, VESTAMID)

-

Armacell International S.A. (ArmaPET, ArmaFORM)

-

Plascore Incorporated (Nomex Honeycomb, Aluminum Honeycomb)

-

Diab Group (Divinycell, ProBalsa)

-

3A Composites (AIREX, BALTEK)

-

Gurit Holding AG (Corecell, Kerdyn)

-

Hexcel Corporation (HexWeb Honeycomb, HexPly)

-

Euro-Composites S.A. (ECM Honeycomb, ECORCELL)

-

The Gill Corporation (Gillcore, Gillfab)

-

Toray Industries, Inc. (Torayca, Nomex Honeycomb)

-

Changzhou Tiansheng New Materials Co., Ltd. (Tiansheng PMI Foam, Tiansheng PET Foam)

-

Corelite (Corelite Board, Corelite PET)

-

Sicomin (GreenPoxy, PB 250)

-

I-Core Composites (I-Core PET, I-Core Balsa)

-

Maricell Core Composites (Maricell PVC Foam, Maricell SAN Foam)

-

Showa Aircraft Industry Co. Ltd. (Showa Honeycomb, Showa Composite Panels)

-

TCCore Applied Honeycomb Technology Co. Ltd. (TCCore Aluminum Honeycomb, TCCore Nomex Honeycomb)

-

Saertex GmbH & Co. KG (Saerfoam, Saerfix)

-

Relcore Composites Inc. (Relcore Aluminum Honeycomb, Relcore Nomex Honeycomb)

-

EconCore (ThermHex, Fynocore)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.80 Billion |

| Market Size by 2032 | USD 4.66 Billion |

| CAGR | CAGR of 11.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Foam [Polyethylene Terephthalate (PET) Foam, Polyvinyl Chloride (PVC) Foam, Styrene-Acrylonitrile (SAN) Foam, Polymethacrylimide (PMI) Foam, Polyetherimide (PEI) Foam], Honeycomb [Aluminum Honeycomb, Aramid Honeycomb, Thermoplastic Honeycomb, Balsa] •By Application (Sandwich Panels, Wind Turbine Blades, Aerospace Structures, Marine Components, Automotive Parts, Others) •By End-Use Industry (Automotive & Transportation, Wind Energy, Aerospace & Defense, Marine, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Evonik Industries AG, Armacell International S.A., Plascore Incorporated, Diab Group, 3A Composites, Gurit Holding AG, Hexcel Corporation, Euro-Composites S.A., The Gill Corporation, Toray Industries, Inc. and other key players |