In Silico Clinical Trials Market Report Scope & Overview:

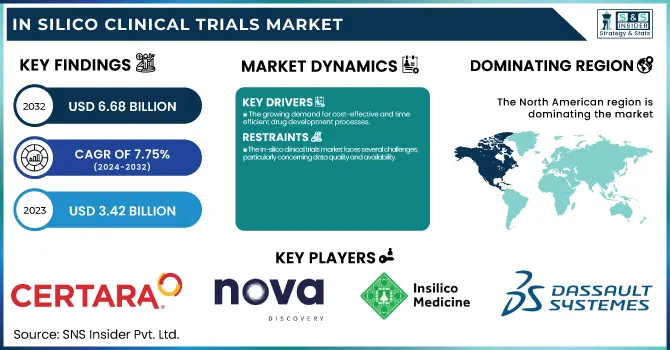

The In Silico Clinical Trials Market was valued at USD 3.42 billion in 2023 and is expected to reach USD 6.68 billion by 2032, growing at a CAGR of 7.75% over the forecast period of 2024-2032. This report analyzes regulatory and approval trends with an emphasis on how changing policies are impacting the use of computational modeling and simulation in clinical trials. The research also discusses technology adoption and integration, emphasizing the increasing use of sophisticated software, AI, and machine learning tools to improve trial accuracy and efficiency. In addition, the report reveals trial simulation insights, highlighting how virtual patient models and predictive analytics are being increasingly used to enhance drug development processes. The report also examines investment trends and funding streams, with venture capital and public-private partnerships fuelling growth in the in-silico sector. Partnerships with biotech startups are at the forefront of developing in silico technologies, driving innovation, and speeding up clinical trial timelines.

To Get more information on In Silico Clinical Trials Market - Request Free Sample Report

The U.S. In Silico Clinical Trials Market was valued at USD 1.11 billion in 2023 and is expected to reach USD 1.98 billion by 2032, growing at a CAGR of 6.66% over the forecast period of 2024-2032. In the United States, the in silico clinical trials market is picking up steam as a result of robust support from the FDA's regulatory favor, increased investments in digital health technologies, and greater emphasis on lowering drug development costs and time-to-market for novel therapies.

Market Dynamics

Drivers

-

The growing demand for cost-effective and time-efficient drug development processes.

In silico trials, the quicker simulation of clinical trials and the minimization of the need for large-scale physical trials and extensive patient recruitment. This is especially important against the backdrop of increasing healthcare expenditures and the need for pharmaceutical firms to reduce the drug development timeline. Furthermore, the combination of AI and machine learning technologies adds to the reliability and accuracy of in silico models, and they become all the more desirable. For example, the application of AI-simulation is assisting in the prediction of drug safety and efficacy profiles before clinical trials, thereby decreasing new drug failure rates substantially. Additionally, regulatory bodies such as the FDA are increasingly embracing digital clinical trials, and guidelines are being revised to include in silico approaches. This trend is assisting in increasing the use of such trials. The pandemic caused by COVID-19 also spurred the application of virtual trials, proving the power of in silico approaches for streamlined vaccine development, such as the production of COVID-19 vaccines. These elements all form a supportive environment for the expansion of the market.

Restraints

-

The in-silico clinical trials market faces several challenges, particularly concerning data quality and availability.

In-silico models depend on high-quality, extensive datasets to effectively simulate real-world conditions, and the absence of standardised, comprehensive clinical data remains a significant barrier. Incomplete or low-quality data can compromise the validity of these models, creating inaccurate trial results and potential regulatory delays. In addition, there is a challenge in getting enough real-world evidence (RWE) to feed these models, as many datasets are dispersed in different healthcare systems and jurisdictions. There is also an absence of universally accepted standards of data integration and validation to makes the problem more complex. Moreover, although in silico trials are becoming increasingly acceptable, most regulatory authorities continue to ask for conventional clinical trial data for licensure, hence restraining the use of digital trials on a large scale. The technology itself also has hindrances in the form of high upfront investment requirements for advanced simulation platforms and a requirement for trained professionals who can effectively use these systems. The sluggish uptake of these technologies in smaller and resource-poor healthcare systems also contributes to the restraint.

Opportunities

-

The in-silico clinical trials market presents numerous opportunities, particularly in the growing demand for personalized medicine.

With advances in genomic information and precision medicine, the need for clinical trials that can mimic individual patient responses to therapy is growing. In-silico trials are perfect for this, as they can simulate treatment for a given genetic profile, enabling more rapid and personalized drug development. Another huge opportunity is in combining in silico trials with real-world data (RWD). By integrating information from wearable devices, patient monitoring systems, and electronic health records, these trials can provide more realistic simulations with greater accuracy. The capacity to perform hybrid trials, blending in silico models with conventional clinical trials, is also a new possibility. This can streamline the clinical trial process, decreasing time and expense. In addition, emerging markets, where resources for traditional clinical trial infrastructure might be scarce, offer great growth opportunities. Asian-Pacific and Latin American countries, for example, would be well-positioned to use virtual and in silico clinical trials as an alternative to the classical approach since it represents a more effective solution to the worldwide healthcare problem.

Challenges

-

One of the primary challenges in the in-silico clinical trials market is the regulatory uncertainty surrounding the use of digital simulations in drug approval processes.

Although regulatory authorities such as the FDA and the EMA have progressed in designing guidelines for conducting virtual trials, the absence of universally agreed-on standards and regulations continues to represent an obstacle. Pharmaceutical firms and research institutions consequently may be unwilling to fully exploit the use of in silico trials due to apprehension of potential regulatory problems and drug delays in approval. Moreover, the complexity of in silico models and their integration with current clinical workflows presents a considerable challenge. Many pharmaceutical companies and CROs are still using traditional clinical trial approaches, and the shift to in silico trials involves major technology and training investments. In addition, although in silico trials can limit physical patient recruitment, replicating human variability in simulations is as yet limited. Ensuring that these models reproduce the wide range of patient responses to treatments accurately continues to be a major technical challenge. These problems could inhibit wider acceptance and broader use of in silico clinical trials within the pharmaceutical and medical device sectors.

Segmentation Analysis

By Phase

In 2023, the Phase II segment captured the largest market share with a revenue share of 40.6%. The reason for its dominance is mostly because Phase II trials play a vital role in determining whether new treatments work and are safe in a wider population of patients. These trials are instrumental in deciding on the best dosage and further optimizing treatment strategies before transitioning to more expansive testing in Phase III trials. The high percentage of Phase II trials represents the vital role played by Phase II trials in the drug development process, with an increasing focus on expedited drug approvals and precision medicine.

The Phase III segment will be the fastest growing in the market. Phase III trials are the last stage before a drug's introduction into the market, where there is large-scale testing to verify the drug's effectiveness and safety. The demand for effective drugs, coupled with regulatory agencies' efforts toward making more patient access to novel therapies available, are propelling growth in Phase III trials.

By Industry

In 2023, the medical devices segment captured the highest revenue share of 54.6%, indicating its well-established position in clinical trials. The universal adoption of medical devices in most healthcare settings and the fast rate of technological evolution in device innovation have largely been responsible for this leadership. Medical devices are an integral component of contemporary healthcare, and the consistent innovations, especially in diagnostics, wearables, and surgical devices, continue to fuel market growth.

The pharmaceutical sector is expected to record the highest growth in the forecast period. Increased demand for advanced treatments such as biologics, personalized medicine, and gene therapies will fuel pharmaceutical trials' growth. Moreover, pharmaceutical companies' heightened emphasis on the efficiency of drug development and approval processes is translating into an uptrend in clinical trials, thereby fueling the growth of this segment.

By Therapeutic Area

In 2023, the oncology segment represented 22.9% of the overall market revenue, and it was the largest therapeutic area for clinical trials. The widespread incidence of cancer worldwide, combined with the growing need for new and targeted cancer treatments, has played a major role in this segment leading the way. In addition, oncology has been a core focus of investigation for the formulation of immunotherapies, individualized medicines, and targeted medicine, which are likely to continue driving growth in oncology clinical trials.

The infectious disease segment is anticipated to be the most rapidly growing over the forecast period. The COVID-19 pandemic has expedited the demand for quick vaccine and antiviral treatment development, with a focus on infectious disease trials. Due to the growth of emerging diseases and global health threats, the demand for novel therapeutic products in this segment is anticipated to grow, thus driving segment growth.

Regional Analysis

North America led the in silico clinical trials market in 2023, capturing the highest share of global revenue. North America's leadership is largely due to the strong presence of leading pharmaceutical firms, superior healthcare infrastructure, and high investment in research and development (R&D). The U.S., for instance, has taken a lead in embracing state-of-the-art technologies such as in silico trials because of friendly regulatory authorities such as the FDA, which has come up with guidelines promoting the utilization of computer simulations within clinical trials. Also, the extremely high emphasis on precision medicine, the rising requirement for cost-saving solutions for drug development, and the broad adoption of AI-based tools have further led to the regional market leadership. North America is strengthened by its strong healthcare infrastructure and deeply rooted clinical trial ecosystem, which favors the development of digital trials.

Asia-Pacific is likely to be the most rapidly growing region through the forecast period. This rapid growth can be attributed to the rising number of clinical trials carried out in countries like China, Japan, and India, where there is heavy investment in healthcare innovation. Increased demand for low-cost, effective healthcare solutions, alongside increased adoption of technology and regulatory support for digital health technologies, sees the Asia-Pacific as a leading market driver for growth. The growing healthcare infrastructure and big, heterogeneous patient populations in this part of the world create a great setting for the fast development of in silico trials.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players and Their Products Related to In Silico Clinical Trials

-

Certara, Inc. – Simcyp Simulator, Phoenix WinNonlin

-

Novadiscovery Sas – NOVA Simulation Platform

-

Insilico Medicine, Inc. – GENTRL, InSilico AI

-

Dassault Systèmes SE – BIOVIA, SIMULIA

-

GNS Healthcare Inc. – REFS (Reverse Engineering and Forward Simulation)

-

The AnyLogic Company – AnyLogic Simulation Software

-

InSilicoTrials – InSilicoTrials Platform

-

Immunetrics Inc. – Immunetrics Modeling Software

-

Nuventra Pharma Sciences – Pharmacometrics Services

-

Abzena Ltd. – Abzena Platform

Recent Developments

In Oct 2024, Dassault Systèmes unveiled the world’s first guide for the medical device industry on using virtual twins to expedite clinical trials. This guide, developed in collaboration with the U.S. Food and Drug Administration over five years, introduces the ENRICHMENT Playbook, advancing the integration of virtual twins into the regulatory process to enhance patient safety, compliance, and innovation speed.

In Feb 2024, UK-based AdSilico secured USD 4.4 million in funding to advance its virtual trial solution. The platform leverages AI to generate synthetic populations, enabling more time-efficient trials for medical devices. This development aims to streamline the trial process and accelerate product testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.42 billion |

| Market Size by 2032 | USD 6.68 billion |

| CAGR | CAGR of 7.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Phase [Phase I, Phase II, Phase III, Phase IV] • By Industry [Medical Devices, Pharmaceutical] • By Therapeutic Area [Oncology, Infectious Disease, Hematology, Cardiology, Dermatology, Neurology, Diabetes, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Certara, Inc., Novadiscovery Sas, Insilico Medicine, Inc., Dassault Systèmes SE, GNS Healthcare Inc., The AnyLogic Company, InSilicoTrials, Immunetrics Inc., Nuventra Pharma Sciences, Abzena Ltd. |