Intelligent Document Processing Market Report Scope & Overview:

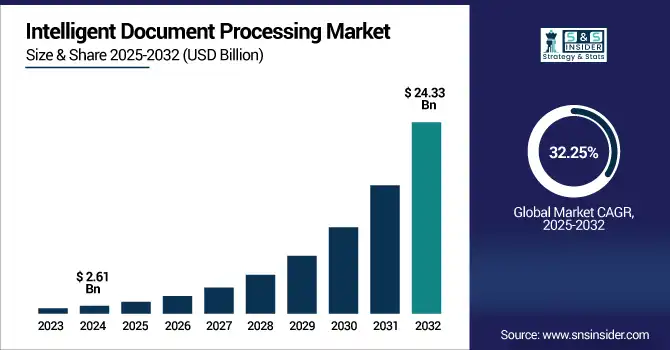

Intelligent Document Processing Market size was valued at USD 2.61 billion in 2024 and is expected to reach USD 24.33 billion by 2032, growing at a CAGR of 32.25% from 2025-2032.

The Intelligent Document Processing market growth is due to rising demand for automation in data extraction, increasing adoption of AI and machine learning, and growing need for compliance and operational efficiency. Enterprises across sectors are leveraging IDP to streamline document-heavy workflows, reduce manual errors, and enhance productivity. Additionally, digital transformation initiatives and the shift toward cloud-based solutions further contribute to the market’s strong upward trajectory.

Get more information on Intelligent Document Processing Market - Request Sample Report

Key trends of the Intelligent Document Processing (IDP) market:

-

Rapid adoption driven by digital transformation and automation initiatives across enterprises

-

Increasing use of AI, ML, NLP, and OCR for intelligent data extraction and processing

-

Cloud-based IDP solutions are gaining traction for scalability and easy integration with ERP and CRM

-

No-code and low-code platforms enable faster deployment by non-technical users

-

Human-in-the-loop and explainable AI improving accuracy, transparency, and trust in IDP systems

-

Focus on data security, privacy, and regulatory compliance across industries

-

Growing demand for multilingual and multimodal document processing capabilities

-

Expansion in finance, healthcare, legal, and logistics sectors for automated document workflows

U.S. Intelligent Document Processing Market size was valued at USD 0.97 billion in 2024 and is expected to reach USD 8.91 billion by 2032, growing at a CAGR of 32.02% from 2025-2032.

The U.S. Intelligent Document Processing market is growing rapidly due to strong digital transformation efforts, rising adoption of AI-driven automation, and increased demand for efficient data management. Industries like BFSI, healthcare, and government are prioritizing IDP to streamline operations, ensure compliance, and improve decision-making through accurate, real-time document processing.

The U.S. Department of Agriculture’s Fiscal Year 2025–2026 AI Strategy emphasizes AI’s critical role in enhancing decision-making and operational efficiency, aligned with the agency’s strategic goals and IT capabilities.

Intelligent Document Processing Market Driver:

-

Surging demand for remote work solutions and digital-first operations is accelerating intelligent automation adoption across industries

The post-pandemic transition to hybrid and remote work fuels the need for IDP platform that takes out manual work. Enterprises require seamless access to structured data across locations to facilitate collaboration and compliance. Key use cases or applications include customer onboarding, HR, supply chain, and invoice processing. Organizations drive towards cloud-based, paperless workflows where IDP becomes a necessary building block of agile digital workplaces. This opens the door for vendors to fill the need for scalable, secure and API friendly IDP solutions that can connect easily with decentralized business models.

According to Microsoft, 73% of workers want flexible remote work options post-pandemic, while 67% of business leaders report that remote work has accelerated their organization’s digital transformation efforts.

The U.S. General Services Administration (GSA) has heavily invested in cloud-first digital services to support remote government workforces, including automated document processing solutions that improve efficiency and compliance.

Salesforce’s 2024 State of the Connected Customer report reveals that 79% of customers expect seamless digital experiences, with intelligent automation and document processing significantly reducing manual delays in onboarding and customer service.

Intelligent Document Processing Market Restraints:

-

Data privacy concerns and regulatory compliance challenges in processing sensitive information through intelligent automation systems

Using AI-driven IDP platforms for sensitive documents comes with serious risks in terms of data security, privacy, and compliance. These systems contain sensitive personal, financial and healthcare data protected by data protection laws, such as GDPR, HIPAA, PCI-DSS, etc. With third parties or cloud solutions, securely handling the data in an audit-able manner is hard. International usage is hampered by data residency laws. This leads to the risk of legal actions and reputation damage, due to which, organizations are avoiding scaling up IDP adoption without fine-tuning governance policies, encryption and ethical AI measures, which also limits the growth of the market.

In 2023, the U.S. Department of Health and Human Services (HHS) reported over 700 breaches involving protected health information (PHI) impacting more than 50 million individuals, many linked to insecure automated data processing systems. The U.S. Federal Trade Commission (FTC) also issued over 100 enforcement actions in 2023 against companies failing to secure consumer data in automated processing environments.

Intelligent Document Processing Market Opportunities:

-

Expansion of AI technologies enabling higher accuracy and contextual understanding of unstructured document data across use cases

The advances in AI and deep learning are helping to improve the ability of IDP solutions to tackle unstructured and semi-structured content that is beyond traditional OCR. Traditional IDP used to struggle, but modern IDP captures context, infers relationships, and uses self-learning algorithms to keep up with new formats. With AI, it allows automated document classification, data extraction, sentiment, and intent analysis. This broadens applications such as contract analysis, loan processing, and legal reviews. With the integration of AI, cloud and analytics, the movement away from rule-based automation to intelligent decision-making will accelerate, changing enterprise document management on a massive scale.

According to Google Cloud, their AI-powered Document AI platform achieves up to 90% accuracy in extracting data from unstructured documents like contracts and invoices. Similarly, IBM Watson’s Natural Language Understanding platform supports sentiment analysis and intent recognition with an accuracy rate exceeding 85% in real-world deployments.

Intelligent Document Processing Market Challenges:

-

Lack of standardized document formats and variability in handwriting, languages, and structures across use cases hinders accuracy

The standard format and structure of documents creates a significant hurdle to the deployment of IDP systems. Different layouts, fonts, text language, and especially handwritten notes, stamps, or images make it difficult for AI models to extract consistent data. Industries with multilingual, scanned, or handwritten documents (such as logistics or government) often magnify the issue. Having overlapping fields on forms, unclear layouts, unnecessarily close fields, all decrease accuracy. To build generalizable models to tackle this heterogeneity requires large amounts of training data and sophisticated natural language processing. If this inconsistency is not addressed, IDP may lose its efficiencies and trust within complex workflows.

Intelligent Document Processing Market Segmentation Analysis:

By Organization Size

Large Size Enterprises commanded the Intelligent Document Processing Market with a dominant revenue share of approximately 62% in 2024, primarily due to their extensive handling of large volume of documents and have larger IT budgets. These enterprises leverage scalable workflow automation solutions that automate complex processes across departments and enforce compliance, resulting in increased adoption. They have already set up digital infrastructure which enables quick integration of intelligent processing technologies.

Small and Medium Sized Enterprises (SMEs) are projected to exhibit the fastest CAGR of about 33.42% from 2025 to 2032, as cloud-based and economical IDP solution gets widespread adoption Growth-oriented SMEs are being forced into digital transformation and with this transition is the demand for automations software that is lightweight, scalable and expedites document processing to allow agile business operations. This is making the adoption curve steeper for the market and vendors with subscription based and AI powered solutions to this market are adding to the speed of adoption.

By Component

The Solution segment dominated the Intelligent Document Processing Market share of a 70% in 2024, as enterprises primarily focus on deploying software platforms for automating document classification, extraction and validation. The holistic facility of applying end-to-end AI-based solutions to any existing framework promotes the demand for such solutions even further since businesses tend to achieve quicker ROI in the form of improved efficiency and lesser reliance on manpower. These platforms form the backbone of document intelligence strategies across sectors and dominate their respective market share consistently.

The Services segment is anticipated to grow at the fastest CAGR of about 33.83% from 2025 to 2032 as organizations seek professional assistance in implementing IDP solutions, training models, integrating, and continuous optimization. The demand for managed services, consultancy and customization is picking up pace, especially from companies that do not have much knowledge of AI. As industries and document types grow, IDP deployment itself, in a traditional setup, poses challenges with its scalability and efficiency; hence, the need for service providers is only going to increase further.

By End-use

The BFSI (Banking, Financial Services, and Insurance) segment held the largest revenue share of about 24% in 2024, as a result of its significant dependence on document-intensive functions such as loan underwriting, claims, KYC, and regulatory reporting. The industry needs high-accuracy, secure automation to handle confidential financial information and compliance processes. Intelligent document processing reduces turnaround time dramatically, increases accuracy, and increases customer satisfaction, making it the main area of investment for banks, insurers, and financial institutions.

The Healthcare segment is forecasted to grow at the fastest CAGR of approximately 35.09% from 2025 to 2032, due to growing patient records, insurance claim, and other compliance records being digitize. IDP is being adopted by hospitals, clinics and payers for extracting data from unstructured medical records, in turn reducing the administrative burden. As healthcare organizations face mounting challenges to improve care, while minimizing costs, intelligent automation for back office transformation is being adopted at a rapid rate.

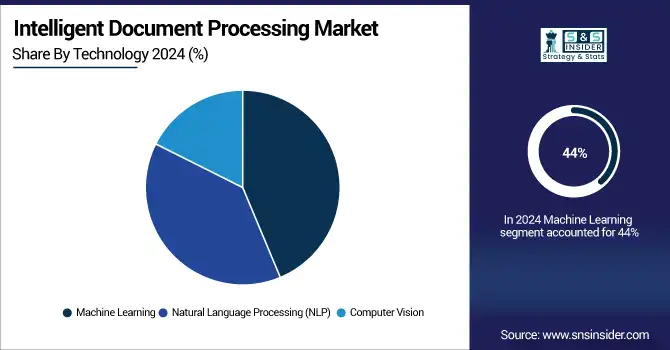

By Technology

The Machine Learning segment led the Intelligent Document Processing Market with a dominant revenue share of around 44% in 2024, because of its vital contribution to model training for extracting structured data from unstructured documents. ML allows for ongoing learning, flexibility in handling new document types, and improved accuracy over time. Organizations from various industries count extensively on ML-based systems to automate document processes, hence making it the core technology for contemporary IDP solutions.

The Natural Language Processing (NLP) segment is expected to register the fastest CAGR of about 33.65% from 2025 to 2032, as companies are increasingly demanding contextual awareness and semantic examination of complicated text data. NLP allows IDP platforms to understand patterns of language, categorize content, and derive meaning from emails, contracts, and legal documents. Its improvement through generative AI and large language models is improving automation possibilities, fostering adoption across industries demanding smart interpretation of text-dense content.

By Deployment

The cloud segment accounted for the largest revenue share of approximately 60% in 2024 and is projected to grow at the fastest CAGR of 32.92% from 2025 to 2032.This predominance and high growth are attributed to the scalability, flexibility, and cost-effectiveness of cloud-based intelligent document processing solutions. Organizations are tending to opt for cloud deployment to allow remote access, effortless integration with current systems, and quicker implementation without substantial infrastructure investments. With data volumes expanding and businesses valuing digital agility, cloud platforms provide exceptional performance, instant processing, and constant updates, driving long-term adoption across sectors.

Regional Analysis

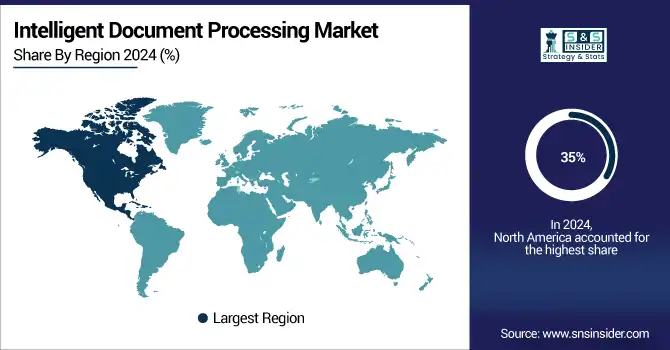

North America dominated the Intelligent Document Processing market in 2024 with a 35% revenue share due to its early adoption of AI solutions and established presence of top players. Companies from BFSI, healthcare, and law sectors have adopted IDP for improving compliance and operational effectiveness. High digital maturity, sound infrastructure, and persistent investments in intelligent automation continue to make North America the dominant regional market.

The United States is leading the Intelligent Document Processing market because of its sophisticated digital infrastructure, high business adoption, and availability of key technology providers.

Asia Pacific is expected to expand at the highest CAGR of 34.76% during the 2025 to 2032 period, driven by speeding digital transformation in emerging economies. Enterprises in India, China, and Southeast Asia are increasingly automating document-intensive workflows through cloud-based IDP offerings. Government digitization initiatives, an emerging startup ecosystem, and growing IT infrastructure are encouraging accelerated adoption. Scalability requirements of the region and cost-conscious environment also enable robust IDP growth

China is leading the Intelligent Document Processing market in Asia Pacific, driven by massive digital initiatives, enterprise-level adoption of AI, and robust investments in automation technologies.

Europe is witnessing consistent growth in the Intelligent Document Processing market due to strict data compliance rules, growing enterprise digitalization, and need for automation within finance and government sectors, especially in Germany, the UK, and France.

Germany is leading the Intelligent Document Processing market trends in Europe, fueled by robust industrial automation, digital transformation projects, and early enterprise adoption of AI technology.

Middle East & Africa and Latin America are developing economies for Intelligent Document Processing, fueled by expanding digital transformation initiatives, heightened cloud adoption, and government moves to automate public services, despite their challenges of limited infrastructure and disparate regulatory landscapes.

Need any Customization Research on Intelligent Document Processing Market - Enquiry Now

Key Players

Intelligent Document Processing Market companies are ABBYY, AntWorks, Appian, Automation Anywhere, Inc., Datamatics Global Services Limited, Hyperscience, IBM Corporation, Open Text Corporation, SHI International Corp, UiPath.

Recent Developments:

-

In 2025, ABBYY launched its Document AI API, enabling developers to integrate advanced OCR and intelligent document processing capabilities into applications with minimal setup, enhancing automation workflows.

-

In 2025, Hirschbach Motor Lines partnered with Hyperscience to automate document processing and workflows, enhancing customer and driver experiences in the trucking industry.

-

In 2024, Datamatics partnered with Microsoft to develop AI-driven copilot solutions, launching a Partner Onboarding Copilot integrated with Azure OpenAI and featured at Microsoft Build 2024.

| Report Attributes | Details |

| Market Size in 2024 | USD 2.61 Billion |

| Market Size by 2032 | USD 24.33 Billion |

| CAGR | CAGR of 32.25% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision) • By Deployment (On-premise, Cloud) • By Organization Size (Small and Medium Sized Enterprises (SMEs), Large Size Enterprises) • By End-use (BFSI, Healthcare, Manufacturing, Retail, Government & Public Sector, Transportation & Logistics, IT & Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABBYY, AntWorks, Appian, Automation Anywhere, Inc., Datamatics Global Services Limited, Hyperscience, IBM Corporation, Open Text Corporation, SHI International Corp, UiPath |