Intraoral Scanners Market Report Scope & Overview:

Get More Information on Intraoral Scanners Market - Request Sample Report

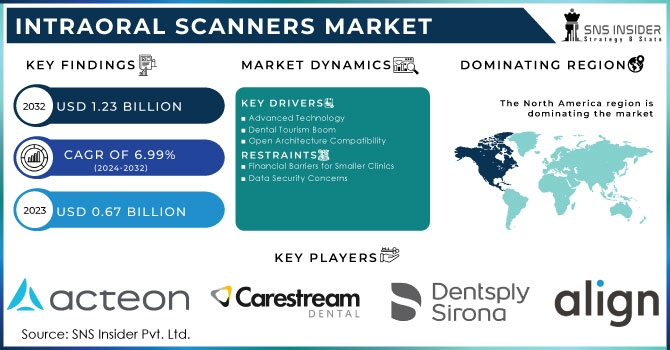

The Intraoral Scanners Market valued USD 0.67 billion in 2023, estimated to reach USD 1.23 Billion By 2032 with a CAGR of 6.99% over the forecast period 2024-2032.

Rising dental issues, growing oral health awareness, and the popularity of clear aligners and same-day dentistry, the demand for intraoral scanners is on the rise. This technology is further fueled by advancements in scanners themselves and the expanding dental tourism market. However, high costs associated with both the scanners and dental procedures remain a hurdle for even faster market growth.

The emergence of small, handheld scanners provides chairside solutions that are convenient for both dentists and patients. This mobility improves clinic efficiency and patient comfort. Portable scanners allow dentists to move between patients quickly, reducing downtime and potentially increasing revenue. Integration of Artificial Intelligence (AI) and Machine Learning (ML) into scanners automates complex tasks, improves diagnosis accuracy, and creates a data-driven approach to treatment planning. This positions dental practices at the forefront of technology and enhances their diagnostic capabilities. Manufacturers are focusing on features like VR distraction, real-time treatment visualizations, and user-friendly interfaces to improve the patient experience. This strategy increases patient satisfaction and portrays companies as innovative and patient-focused, potentially influencing purchasing decisions.

Companies like Neoss Group are responding to the demand for portability with the introduction of user-friendly wireless scanners like the NeoScan 2000.

DentalMonitoring's ScanAssist scanner exemplifies how AI is being incorporated to enhance the patient experience by providing real-time feedback and guided instructions.

These advancements suggest that the intraoral scanner supply chain is adapting to meet the growing demand for portability, AI integration, and patient-centric features.

Factors fueling intraoral scanner market growth with the increasing geriatric population is a major driver. As people age, their need for dental care, including crowns, bridges, and dentures, rises. Intraoral scanners streamline the process of creating precise dental restorations. The prevalence of dental diseases like dental caries means cavities is another significant factor. For example, a 2022 National Dental Epidemiology Program survey in England revealed a national prevalence of 29.3% among 5-year-old children with enamel and dentinal decay. This highlights the widespread need for improved dental care, and intraoral scanners offer a faster and more comfortable way to diagnose and treat such issues. Advancements in intraoral scanner technology itself are a major driver. These scanners eliminate the unpleasant experience of traditional dental impressions with messy materials. They also offer instant data transfer and manipulation, allowing for faster and more efficient treatment planning. This combination of improved patient experience and increased workflow efficiency is driving adoption across healthcare facilities.

The aging population is a major force propelling the intraoral scanner market forward. Older adults are more susceptible to dental issues due to reduced saliva production that is saliva plays a critical role in maintaining oral health. However, saliva production naturally declines with age, leading to a dry mouth environment. This increases the risk of cavities and gum disease. Changes in nutritional habits as people age can contribute to dental problems due to gum recession means as gums recede, tooth roots become exposed, making them more vulnerable to decay. This heightened susceptibility to dental problems creates a strong demand for improved dental care solutions. Intraoral scanners address this need by offering a faster, more comfortable, and more precise alternative to traditional impression methods.

For instance, a September 2023 report by the World Economic Forum highlights the rapid aging population in Japan, with over 10% exceeding 80 years old. Similarly, projections by the National Institute of Population and Social Security Research in Japan anticipate that by 2040, nearly 35% of the population will be 65 or older. This trend is mirrored globally, creating a positive correlation between the aging population and the rise in tooth loss and other dental ailments. This translates to a significant growth opportunity for the intraoral scanner market.

Market Dynamics

Drivers

-

Advanced Technology

There's a strong demand for scanners that are accurate, user-friendly, and integrate seamlessly with existing workflows. Firms that deliver on these aspects can capture a significant market share.

-

Dental Tourism Boom

The growing dental tourism market creates a strategic opportunity for manufacturers. Developing scanners that meet international compliance standards positions businesses to support clinics catering to international patients.

-

Open Architecture Compatibility

Easy integration with existing dental software ecosystems (CAD/CAM systems, practice management software) is crucial. Open-architecture scanners that seamlessly connect with various systems offer significant value to dental practices.

-

Training and Education

Providing comprehensive and engaging training programs for dental professionals is a strategic advantage. Businesses that invest in such programs empower practitioners to effectively utilize intraoral scanners and unlock their full potential.

-

Sustainability Focus

Manufacturers who develop eco-friendly scanners made from recyclable materials, with lower energy consumption and eco-friendly production techniques, align themselves with consumer preferences for sustainable products.

-

Rising Demand and Adapting Technology

-

Portability and Flexibility

-

Increased Revenue Potential

-

AI Integration

-

Patient-Centric Features

Restraints

-

Financial Barriers for Smaller Clinics

The high upfront costs associated with acquiring intraoral scanners, along with the additional software and training needs, can be a major obstacle for smaller dental clinics. This can hinder market penetration, especially in resource-constrained regions. These clinics may struggle to justify the initial investment, limiting the overall market reach of intraoral scanners.

-

Data Security Concerns

Key Segmentation

By Modality

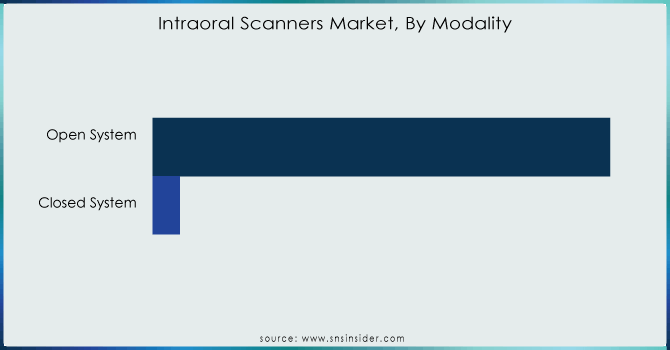

The intraoral scanner market is clearly dominated by open systems, held a staggering 97.3% share in 2023. Open systems liberate dentists from the constraints of vendor lock-in. Unlike closed systems tied to a single manufacturer, open systems allow for greater flexibility in choosing, replacing, or upgrading scanner components. This ensures dentists are not restricted by proprietary technologies and can adapt to their evolving needs.

The open architecture of these scanners makes them future-proof. As digital dentistry continues to evolve at a rapid pace, open systems allow dental clinics to effortlessly integrate new technologies. This eliminates the need for costly system replacements or major modifications, ensuring clinics stay competitive and their technology remains relevant in the long run.

Need any customization research on Intraoral Scanner Market - Enquiry Now

By End User:

Dental clinics represent a major force driven the intraoral scanner market, captured a significant 36.1% share in 2023. This dominance is fueled by key trends like dental offices are increasingly recognizing the importance of digital recordkeeping and regulatory compliance. Intraoral scanners play a crucial role in this shift by facilitating the secure and accurate storage of patient data, ensuring adherence to legal regulations and industry standards. By implementing these scanners, dental clinics can effectively manage and demonstrate compliance with data protection and healthcare requirements. Intraoral scanners also serve as a powerful tool for dental clinics to project a modern and technologically advanced image. As patients become more informed and selective, clinics equipped with advance technology like intraoral scanners gain a competitive advantage. This technological prowess can attract new patients and enhance the clinic's reputation within the community.

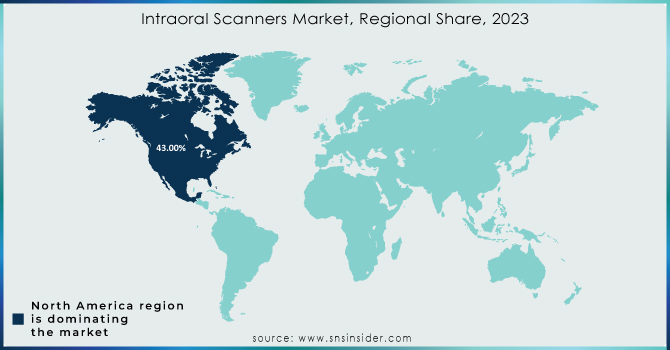

Regional Analysis

North America is poised for significant growth in the intraoral scanner market throughout the forecast period with 43% share in 2023. This dominance can be attributed to several key factors like the rising geriatric population is particularly susceptible to oral disorders like tooth decay. With age comes a higher likelihood of needing dental interventions due to tooth loss and decay. For example, a 2022 update by the National Institutes of Health (NIH) revealed that nearly 90% of American adults between 20 and 64 have experienced tooth decay in the past two years. Similarly, Canada's population statistics from the United Nations Population Fund in 2022 show that roughly 19% are aged 65 and above. These growing elderly population translates to an increasing burden of dental diseases, propelling the demand for intraoral scanners for early detection and treatment.

As the healthcare system in the United States continues to evolve and dental problems gain more recognition, people are increasingly seeking dental care. This trend is further amplified by initiatives like the collaborative Oral Health campaign launched by the American Diabetes Association (ADA) in October 2022. This campaign, partnered with Pacific Dental Services (PDS), aims to raise awareness about gum disease and empower patients with knowledge on prevention and management strategies. Such initiatives are likely to contribute to a rise in dental visits, ultimately driving market growth for intraoral scanners.

Favorable government reimbursement policies for dental procedures are another factor bolstering market growth. For instance, the Canadian government introduced the Canadian Dental Benefit in September 2022. This program offers financial aid with USD 260 – USD 650 per child under 12 to low-income families with annual income under USD 90,000 for dental care.

Leading players in the region are actively launching new and improved scanners. For example, Ori Dental introduced the Ori Intraoral Scanner in April 2023, designed to be faster, lighter, more accurate, and more affordable than traditional impression methods. This focus on innovation ensures that North American dental practices have access to the latest and most efficient technologies.

Key Players

Acteon Group Ltd., Dentsply Sirona, Carestream Dental, Align Technology, DÜRR DENTAL SE, Hint-Els GmbH, 3Shape, Straumann Group, Smart Optics Sensortechnik GmbH, Planmeca Oy, DOF Inc., Dental Wings Inc., IOS Technologies, Inc., Roland DG Corporation, Condor Scan AG, Medit Corp., Zimmer Biomet Holdings, Inc., Ormco Corporation, Dental Corporation (Envista Holdings Corporation), Shining 3D Tech Co., Ltd. And others.

Recent Development

3Shape's new Trios 5 scanner in Sept. 2022 is a game-changer. This lightweight, wireless scanner offers easy handling and portability. Its ScanAssist tech and haptic feedback ensure accurate scans, while a built-in LED light promotes hygiene.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 0.67 billion |

| Market Size by 2032 | US$ 1.23 Billion |

| CAGR | CAGR of 6.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type [Intraoral Scanners (Benchtop Intraoral Scanners, Stand-Alone CAD/CAM Scanners, 3D Handheld Scanners), Intraoral Cameras, Intraoral Sensors, Stand-Alone Software] • By Modality [Closed System, Open System] • By End User [Hospitals, Dental Clinics, Group Dental Practices, Ambulatory Surgical Centres] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Acteon Group Ltd., Dentsply Sirona, Carestream Dental, Align Technology, DÜRR DENTAL SE, Hint-Els GmbH, 3Shape, Straumann Group, Smart Optics Sensortechnik GmbH, Planmeca Oy, DOF Inc., Dental Wings Inc., IOS Technologies, Inc., Roland DG Corporation, Condor Scan AG, Medit Corp., Zimmer Biomet Holdings, Inc., Ormco Corporation, Dental Corporation (Envista Holdings Corporation), Shining 3D Tech Co., Ltd. And others. |

| Key Drivers | • Advanced Technology • Dental Tourism Boom • Open Architecture Compatibility • Training and Education • Sustainability Focus • Rising Demand and Adapting Technology • Portability and Flexibility • Increased Revenue Potential • AI Integration • Patient-Centric Features |

| Restraints | • Financial Barriers for Smaller Clinics • Data Security Concerns |