Dental Practice Management Software Market Overview

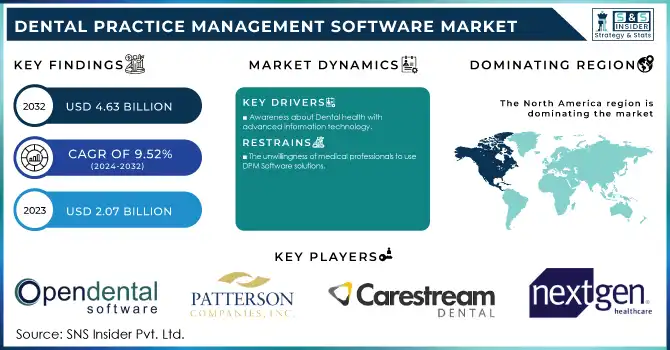

The Dental Practice Management Software Market Size was valued at USD 2.5 billion in 2023 and is expected to reach USD 6.1 billion by 2032, growing at a CAGR of 10.4% over the forecast period 2024-2032.

Get more information on Dental Practice Management Software Market - Request Sample Report

This surge in the dental practice management software market can be attributed to the contribution of various factors, such as the growing government support and healthcare initiatives. The adoption of health information technology (HIT) is vital to patient care and operational efficiency in healthcare settings, including dental practices, according to the U.S. Department of Health and Human Services (HHS). The Health Information Technology for Economic and Clinical Health (HITEC) Act of 2009 has also opened the door for using specific digital solutions in dentistry, encouraging the adoption of electronic health records (EHRs) and practice management software to increase office efficiency. Recent data show that more than 60% of dental practices in America switched to cloud services, with practices reporting an average of 35% efficiency boost and a decrease in billing errors of 25%. Such advancements not only enhance patient management but also ensure compliance with data protection laws like HIPAA.

In addition, according to an American Dental Association (ADA) report, about half (49%) of adults ages 15 and older received dental care from a dentist in the previous 12 months, which builds the increase for efficient software to accommodate a larger volume of patients. The demand for dental software is also bolstered by the increasing number of dental diseases, along with the growing number of the elderly population who go to the doctors frequently for dental purposes, which require meeting dental software that can manage all the appointments, record billing, and maintain Patient data and records. These developments are expected to rapidly grow the dental practice management software market as the practices acknowledge the benefits of digital transformation over traditional operational workflows in providing advanced patient care services.

Dental Practice Management Software Market Dynamics

Drivers:

-

Integration of cloud computing and AI enhances patient data management and operational efficiency.

-

Increasing prevalence of oral diseases leads to higher patient visits, necessitating efficient management solutions.

-

Supportive policies and funding encourage the adoption of electronic dental records and management systems.

Technological advancements are significantly propelling the Dental Practice Management Software (DPMS) market, enhancing both operational efficiency and patient care. A key advancement is the use of Artificial Intelligence (AI) and automation in these systems. For instance, consultation of self-check-in, appointment booking, communication, etc. is some administrative tasks managed with AI-based tools. For instance, AI algorithms can predict no-show rates and suggest optimal appointment times, while automated reminders and follow-ups improve patient engagement and reduce missed appointments.

Cloud-based solutions are also changing the way dental practices handle their operations. Cloud-based DPMS offers flexibility and scalability, allowing dental practices to access their software and data from anywhere, at any time, using any device with an internet connection. Such flexibility can be particularly beneficial for multi-location practices or those with a remote or mobile workforce. They also come with automatic upgrading, data back-up, and high-security features reducing the on-site IT infrastructure need, and the risk of data loss. This not only simplifies the administrative process but also helps in dispensing quality care, as they can spend more time on clinical aspects. This has led to a rapid expansion of the market for DPMS, primarily due to the need for greater efficiency and effectiveness in practice management solutions.

Restraints:

-

Handling sensitive patient information raises issues regarding data security and compliance with regulations.

-

The initial investment and maintenance expenses can be prohibitive for smaller practices.

-

Some dental professionals are hesitant to adopt new technologies, preferring traditional methods.

Increasing data privacy concerns, which is one of the major factors restraining the growth of the Dental Practice Management Software (DPMS) market. Dental practices handle highly sensitive patient information, including medical histories, treatment plans, and billing details. Due to the need for cloud-based solutions and a transfer away from physical record-keeping, the risk of cyber threats, data breaches, and unauthorized access has also significantly increased. Ensuring compliance with stringent regulations like HIPAA (Health Insurance Portability and Accountability Act) in the U.S. or GDPR (General Data Protection Regulation) in Europe adds to the challenge.

In addition, many smaller dental practices do not have traditionally well-established IT systems to successfully enforce cyber security measures. Any data breach can have legal consequences, monetary fines, and patient trust. This hesitation among some dentists to fully transition to digital-only systems has also slowed the evident omnipresent shifting of DPMS even when the system operates more effectively. This restraint can be overcome by strengthening the health of cybersecurity frameworks and ensuring compliance with the regulatory authorities.

Dental Practice Management Software Market Segmentation Analysis

By Deployment Mode

In 2023, the web-based segment led the dental practice management software market and accounted for 55% of revenue. There are several reasons for this dominance that make web-based solutions especially attractive for a dental practice. To start with, web-based systems are cost-effective as on-premise solutions require heavy hardware investment. Rather, these systems are subscription-based, allowing practices to better manage their cash flow while still benefitting from advanced features with little or no upfront investment. Moreover, web-based systems offer increased security through regular updates and backups managed by the service providers to keep sensitive patient data safe from getting compromised. Government data from HHS revealed that practices using web-based systems reported higher compliance with HIPAA regulations thanks to built-in security features that are intended to protect patient information. Additionally, these platforms enable access remotely to patient records and scheduling systems, something that is especially crucial with the rise of telehealth services. The ability to access critically important information from any place bolsters operational efficiency while also supporting patient engagement by enhancing communication channels.

By Application

In 2023, the insurance management segment dominated the market with a revenue share of 23%. The growth of this segment is due to the cruciality of this segment in aiding insurance claims processing and reimbursement handling within dental practices efficiently. A lot of this change has come from government expansion of dental insurance coverage like what Medicaid has done to expand dental care among low-income populations, thereby increasing what dental providers bill insurance. Modern practice management software comes with automation capabilities built-in, which allows for real-time verification of coverage and claim submissions to be completed automatically, causing less burden on admin staff and delivering limited chances of errors due to manual processing. According to the National Association of Dental Plans, nearly 77% of Americans had dental benefits in 2022, so dental practices are becoming increasingly dependent on insurance management systems to manage large volumes of claims in a way that would take human resources hours to do. Increased patient demand for coverage of preventive and elective procedures will drive a need for stronger insurance management capabilities in practice management software.

By End-Use

The dental clinics segment held the largest revenue share of 46% in 2023. This growth is attributed to the rise in the number of dental visits due to growing patient awareness about oral health and preventive care. As per the statistics from the Centers for Disease Control and Prevention (CDC), almost half (49%) of adults aged 15 years and older reported visiting the dentist in the past year. This trend requires management tools that can manage large patient flows with good quality care provision. The Practice management software which can integrate functionalities and effectively manage appointments, billing processes, and electronic health records (EHR) is being adopted by most dental clinics. In addition, initiatives by governments to promote access to oral healthcare services have driven several clinics to adopt innovative technology solutions to improve operational efficiency. The integration of digital tools not only improves workflow but also enhances patient satisfaction through timely communication and appointment reminders.

Dental Practice Management Software Market Regional Insights

North America accounted for the largest share of the dental practice management software market in 2023 and is expected to continue dominating this market throughout the forecast period owing to the favourable government initiatives to promote the adoption of healthcare IT, the strong healthcare infrastructure, supportive government policies to promote healthcare IT integration, and increased investments in IT. The region is expected to retain its leading position over the forecast period due to the continued development of digital healthcare solutions and the growing elderly population that requires significant dental care services. Additionally, North America has the highest dental insurance penetration around the world; HHS government data shows that 75% of Americans are said to have some form of dental coverage, which also increases the demand for practice management systems that can manage the billing process with an insurance company as detailed as ever before.

On the other hand, Asia-Pacific is expected to register the highest CAGR throughout the forecast period as disposable income rises and awareness of oral health increases in China, India, and other countries. The region is also benefiting from several government initiatives encouraging digital healthcare infrastructure that is expected to accelerate market growth over the forecast period.

Need any customization research on Dental Practice Management Software Market - Enquiry Now

Leading Players in the Dental Practice Management Software Market

Key Service Providers/Manufacturers

-

Dentrix (Dentrix, Dentrix Ascend) - (American Fork, Utah, USA)

-

Eaglesoft (Eaglesoft, Eaglesoft Enterprise) - (Beavercreek, Ohio, USA)

-

Open Dental (Open Dental, Open Dental Web) - (Salem, Oregon, USA)

-

Carestream Dental (Carestream Dental Software, CS PracticeWorks) - (Rochester, New York, USA)

-

Curve Dental (Curve Dental, Curve Hero) - (Provo, Utah, USA)

-

SoftDent (SoftDent, SoftDent Cloud) - (Concord, Ohio, USA)

-

PracticeWeb (PracticeWeb, PracticeWeb Cloud) - (Birmingham, UK)

-

DentiMax (DentiMax, DentiMax Cloud) - (Chesterfield, Missouri, USA)

-

ABELDent (ABELDent, ABELDent Cloud) - (Toronto, Canada)

-

Kareo (Kareo, Kareo Clinical) - (Irvine, California, USA)

-

e-Dental (e-Dental, e-Dental Pro) - (London, UK)

-

MediGain (MediGain, MediGain Cloud) - (Dallas, Texas, USA)

-

Practice Central (Practice Central, Practice Central Cloud) - (Fort Worth, Texas, USA)

-

Denticon (Denticon, Denticon Cloud) - (Palm Harbor, Florida, USA)

-

QSIDental (QSIDental, QSIDental Cloud) - (Carlsbad, California, USA)

-

Sesame Communications (Sesame Communications, Sesame Cloud) - (Seattle, Washington, USA)

-

Maxident (Maxident, Maxident Cloud) - (Johannesburg, South Africa)

-

Datacon (Datacon, Datacon Cloud) - (Boca Raton, Florida, USA)

-

3Shape (3Shape Dental Desktop, 3Shape Cloud) - (Copenhagen, Denmark)

-

Solutions for Dentists (Solutions for Dentists, Solutions for Dentists Cloud) - (Leeds, UK)

Recent Developments in Dental Practice Management Software Industry

-

In August 2023, Henry Schein, Inc. acquired a majority stake in Large Practice Sales (LPS) LLC, a consultancy specializing in assisting dental practices with sales and partnerships.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.5 Billion |

| Market Size by 2032 | US$ 6.1 Billion |

| CAGR | CAGR of 10.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment Mode (On-Premise, Web-based, Cloud-based) • By Application (Patient Record Management, Appointment Scheduling, Digital Imaging and Radiography Integration, Lab & X-Ray Orders, Invoice/Billing, Treatment Planning and Charting, Payment Processing, Insurance Management, Dental Analytics, Others) • By End-use (Dental Clinics, Hospitals, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

Dentrix, Eaglesoft, Open Dental, Carestream Dental, Curve Dental, SoftDent, PracticeWeb, DentiMax, ABELDent, Kareo, e-Dental, MediGain, Practice Central, Denticon, QSIDental, Sesame Communications, Maxident, Datacon, 3Shape, Solutions for Dentists. |

| Drivers | • Integration of cloud computing and AI enhances patient data management and operational efficiency. • Increasing prevalence of oral diseases leads to higher patient visits, necessitating efficient management solutions. • Supportive policies and funding encourage the adoption of electronic dental records and management systems. |

| Restraints | • Handling sensitive patient information raises issues regarding data security and compliance with regulations. • The initial investment and maintenance expenses can be prohibitive for smaller practices. • Some dental professionals are hesitant to adopt new technologies, preferring traditional methods. |