Long Chain Dicarboxylic Acid Market Report Scope & Overview:

Get More Information on Long Chain Dicarboxylic Acid Market - Request Sample Report

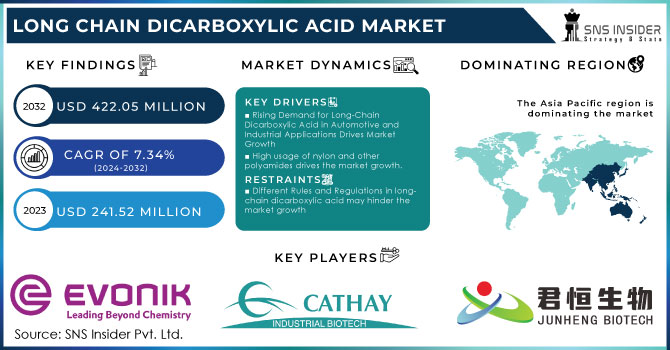

The Long Chain Dicarboxylic Acid Market Size was valued at USD 241.52 million in 2023 and is expected to reach USD 422.05 million by 2032 and grow at a CAGR of 7.34% over the forecast period 2024-2032.

The long-chain dicarboxylic acid market is booming, by a dynamic interplay of various applications and innovative production methods. Industries like nylon and polyamide production, cornerstones for products ranging from electronics to car parts, are experiencing a significant increase. As long-chain dicarboxylic acids are essential building blocks for these materials, their demand is rising sharply in equivalent. Similarly, the growing preference for powder coatings, prized for their durability and aesthetics on appliances and furniture, is propelling the market forward.

In 2030, China is estimated to spend almost USD 13, 000 billion on buildings, accounting for 20 percent of all construction investments worldwide, according to an article published by the International Finance Corporation.

Moreover, according to the United States Environment Protection Agency, for every 100 pounds taken out of the vehicle, the fuel economy is increased by 1-2 percent. Therefore, the increase in the use of nylon also propels the growth of long chain dicarboxylic acids.

On the supply side, advancements are paving the way for a more sustainable future. Research is diligently focused on cultivating algae, a potential game-changer as a source of these acids, with improved efficiency. This could intensely reduce production costs and usher in an era of wider accessibility. Furthermore, the development of bio-based feedstocks, supplanting the traditional dependence on petrochemicals, resonates with growing environmental concerns. Supportive government policies promoting sustainable initiatives could provide a further tailwind for this shift.

In essence, the robust demand from key applications, coupled with the promising transition towards bio-based, efficient production methods, is raising the demand for the long-chain dicarboxylic acid market.

Market Dynamics

Drivers

Rising demand for long-chain dicarboxylic acid in automotive and industrial applications drives the market growth.

A revolution is brewing in the automotive and industrial sectors, fueled by the transformative potential of long-chain dicarboxylic acids. Its unique ability to be both lightweight and exceptionally strong is driving this surge in demand. Under the top of performance, long-chain dicarboxylic acid plays a featuring role in engineering plastics like nylons and polyamides. These materials boast superior strength, heat resistance, and remarkable lightness.

In cars, they're replacing heavier metals in components like engine parts, dashboards, and interiors, leading to significant gains in fuel efficiency and overall vehicle performance. Industrial applications are also embracing long-chain dicarboxylic acid-based engineering plastics for their ability to resist demanding environments. Gears, bearings, and machine components made with these materials exhibit exceptional durability and longevity.

In the automotive industry, long-chain dicarboxylic acid-based powder coatings enhance the aesthetics and protect car rims, while industrial settings leverage them to shield appliance casings and machinery from corrosion and chemicals. The automotive industry's relentless pursuit of fuel efficiency perfectly aligns with long-chain dicarboxylic acid's lightweight properties. Hence these are all the properties of long-chain dicarboxylic acid drive its growth in the market.

High usage of nylon and other polyamides drives the market growth.

Nylon and other polyamides are conquering new sources across numerous industries owing to their supreme of properties such as unmatched durability, exceptional heat resistance, and impressive strength. This winning combination makes them ideal for a wide range of applications, from automotive components and electronics to packaging materials and construction projects.USD 10.33 billion of nylon are produced annually worldwide, accounting for 20 percent of all manmade fibers produced, according to the American Chemical Society. Thus, the market grows and there is a greater need for long-chain dicarboxylic acids.

Moreover, in the automotive sector, high-performance nylon takes center stage in the production of manifolds. Its lightweight nature translates to significant advantages: better fuel efficiency and lower production costs. This makes it better than traditional materials. LCDA is a crucial building block for nylon production, so its growth is directly tied to the success of polyamides.

Restrain

Different Rules and Regulations in long-chain dicarboxylic acid may hinder the market growth

The long-chain dicarboxylic acid market's momentum faces a roadblock in the form of complex regulations. Stringent requirements and time-consuming testing processes for new long-chain dicarboxylic acid applications act as a bureaucratic maze, stifling innovation and stalling market growth. This intricate regulatory landscape throws up hurdles for manufacturers who are keen to introduce next-generation long-chain dicarboxylic acid products.

Market segmentation

By Application

Nylon& Other Polyamides held the largest market share around 35.12% in the application segment in 2023. The unparalleled strength, heat defiance, and enduring nature of nylon and its polyamide kin propel them toward market dominance across a wide spectrum of industries. These remarkable properties make them the go-to material for a wide range of applications, from delicate electronic components and robust packaging solutions to lightweight automotive parts and long-lasting building & construction materials.

In the automotive realm, high-performance nylon takes center stage in the production of manifolds. Its exceptional lightness translates to a double advantage: lower production costs and enhanced fuel efficiency.

Throughout the projection period, the powder coating segment is anticipated to develop at a CAGR of 7.9% in forecast period. Powder coatings are used in a variety of industries, including general metal manufacturing, furniture, electrical, transportation, infrastructure, and construction equipment. As a result, throughout the projection period, the need for powder coatings from a variety of industries is anticipated to drive its growth.

Need any customization research on Long Chain Dicarboxylic Acid Market - Enquiry Now

Regional Analysis

Asia Pacific dominated the market and held the largest market share around 32.7% and is estimated to grow at the quickest CAGR of 7.01% throughout the forecast period. China's building and construction sector is on a tear, fueled by the government's strategic investment policies. This construction boom creates a fertile ground for the flourishing of high-performance nylon. Boasting exceptional properties, nylon is increasingly being incorporated into various exterior building products, including glazing systems, expansion joints, seals, window setting blocks, and door bulb seals. This surge in demand for high-performance nylon in China's construction sector, coupled with the growing needs of other industries like automotive and industrial equipment manufacturing, is a key factor propelling the long-chain dicarboxylic acid market. At the core of it all, long-chain dicarboxylic acid is the essential building block for these high-performance nylons.

Key Players

Cathay Biotech Inc., Evonik Industries AG, Nantong Senos Biotechnology Co. Ltd, Henan Junheng Industrial Group Biotechnology Co., Ltd, Capot Chemical Co., Ltd., INVISTA, AECOCHEM, Shandong Guangtong New Materials Co., Ltd., Shandong Hilead Biotechnology, DAYANG CHEM, Corvay, and Others.

Recent Development:

-

In June 2023, Cathay Biotech Inc. strategic alliance with China Merchants Group. This partnership positions both companies as major players in the bio-based materials market. CMG's commitment to purchase at least 10,000 tons of Cathay's bio-based polyamides in 2023 signifies the substantial potential of this collaboration.

-

In May 2023, DuPont, acquired Spectrum Plastics Group from AEA Investors. This strategic acquisition serves as a knockout punch, significantly bolstering DuPont's existing portfolio in packaging, biopharma & pharma processing, and medical devices.

-

In September 2022, INVISTA invested in a new production facility in Shanghai, DuPont christened its new Asia Innovation Center. The Shanghai International Chemical New Materials Innovation Center facility serves as a dedicated hub for addressing the specific application needs of engineering polymers in industries. With a laser focus on the automotive and electrical & electronics sectors, the center aims to spearhead advancements in these key areas.

| Report Attributes | Details |

| Market Size in 2023 | US$ 241.52 Million |

| Market Size by 2032 | US$ 422.5 Million |

| CAGR | CAGR of 7.34 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Nylon& Other Polyamides, Powder Coatings, Lubricants, Adhesives, Pharmaceuticals, Corrosion Inhibitors, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cathay Biotech Inc., Evonik Industries AG, Nantong Senos Biotechnology Co. Ltd, Henan Junheng Industrial Group Biotechnology Co., Ltd, Capot Chemical Co., Ltd., INVISTA, AECOCHEM, Shandong Guangtong New Materials Co., Ltd., Shandong Hilead Biotechnology, DAYANG CHEM, Corvay, and Others. |

| Key Drivers | • Rising demand for long-chain dicarboxylic acid in automotive and industrial applications drives the market growth |

| RESTRAINTS | •Different rules and regulations in long-chain dicarboxylic acid may hinder the market growth. |