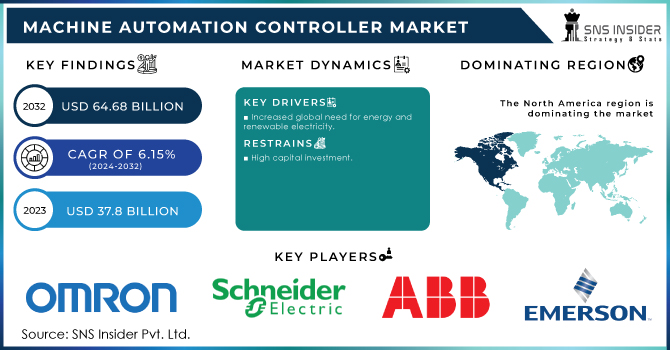

Machine Automation Controller Market Size

Get More Information on Machine Automation Controller Market - Request Sample Report

The Machine Automation Controller Market was valued at USD 42.08 billion in 2023 and is expected to reach USD 61.66 billion by 2032, growing at a CAGR of 4.39% over the forecast period 2024-2032. High automation adoption encouraged by the integration of AI, IoT, and edge computing with automation systems is one of the key factors driving the growth of the machine automation controller market. Such controller types likely enhance energy efficiency due to their more efficient exploitation of available resources and/or reduced operational wastage. End-users are increasingly utilizing advanced features such as predictive maintenance, remote monitoring, and real-time analytics to boost productivity and reduce downtime, leading to a high functionality utilization rate. Moreover, the penetration of technology is deepening in industries such as automotive, electronics, and pharmaceuticals, with the adoption of smart manufacturing and digitalization for increased efficiency, safety, and precision.

Market Dynamics

Key Drivers:

-

Revolutionizing Manufacturing with Machine Automation Controllers Powering Efficiency Safety and Smart Production

Industrial automation is one of the major trends that have influenced Machine Automation Controller Market demand, as manufacturers seek to automate production processes to enable more productive, efficient, and safe plant floor environments. With smart manufacturing and Industry 4.0 on the rise, there's a business need for more sophisticated controllers that can be used to complement IoT devices and feature set extensions through cloud platforms. Furthermore, the increased focus on energy conservation and sustainability is motivating manufacturers to deploy automation solutions for enhancing resource efficiency. The growth of the semiconductor and electronics industry along with the rapid growth in automotive manufacturing is further prophesizing the requirement of automation controllers. The market is driven by the increasing need for safety and a growing range of precision medicines and medical device manufacturing.

Restrain:

-

Overcoming Integration Complexity and Cybersecurity Challenges in Machine Automation Controller Market Adoption

The complexity of integration is one of the key restraints of the Machine Automation Controller Market. Most legacy systems in many industries are incompatible with the modern automation controller which challenges their integration and interoperability seamlessly. There is also a lack of a skilled workforce that can run and maintain advanced automation systems and this has been a large barrier. That creates a skills gap, which can lead to underutilization of automation and downtime caused by operational errors. In addition, since automation controllers are now being linked with IoT devices and cloud platforms, cybersecurity and data privacy issues are also rising as automation controllers are becoming vulnerable to cyber threats as they also have data transfer capabilities.

Opportunity:

-

Unlocking Opportunities with AI-driven Machine Automation Controllers in Industrial and Electric Vehicle Manufacturing

The growing use of automation in industries and the growing use of Artificial Intelligence (AI) and Machine Learning (ML) in these industries provides lucrative opportunities for the market. This allows performance tracking and predictive maintenance along with advanced analytics. The robustness and reliability of these controllers make them ideal for harsh environments such as oil & gas and energy & power sectors, thus creating potential opportunities for the market. High industrialization and development in emerging economies of Asia-Pacific and Latin America are opening an enormous market for automation solutions. In addition, the trend in the automotive space towards electric vehicles brings new additional applications of automation controllers in battery manufacturing and battery assembly lines.

Challenges:

-

Navigating Challenges in Machine Automation Controllers Adapting to Evolving Standards and Customer Demands

Booming technologies always leave a challenge ahead for market players in terms of human assets, where everyone needs to be on their toes to react to the evolving software-revolutionized standards and the changing customer needs. Manufacturers face constant pressure to innovate and offer scalable solutions that can address future automation challenges. Moreover, the varying customer needs across industries result in additional customization, increasing product complexity. With sectors like pharmaceutics, medical devices, and so on, having strict regulatory standards, it can also be tough to comply with these. Automation solutions demand high reliability and safety, along with compliance with industry-specific regulations that necessitate the testing and certification of industrial automation solutions before they can be market-made or ramped up, thereby further complicating the market entry and expansion.

Segments Analysis

By Controller Type

In 2023, the Machine Automation Controller Market was dominated by Programmable Logic Controller (PLC), which occupied a largest share of 42.6%. The main reason for its abundance in industrial automation is its reliability, ease of programming, and cost-effective nature. The broad market share of PLCs can be attributed to their extensive usage in real-time control and monitoring of manufacturing processes.

The Distributed Control System (DCS) is anticipated to support and drive the fastest CAGR growth from 2024 to 2032. Within this area, growth is propelled by rising demand for complex process automation in sectors like oil & gas, chemicals, and power generation. DCS systems are preferred for centralized process control and data integration in large manufacturing plants.

By Form Factor

In 2023, the Machine Automation Controller Market was led by IP65, with a market share of 39.8% This is because it has better dust and water protection which is needed in some harsh industrial conditions. Durable and reliable controllers, such as IP65-rated ones, are extensively used in the automotive, food & beverages, energy, and other sectors. Reliability in design ensures that they can operate efficiently and safely leading their market.

Others (P40, IP67, and IP69K) are expected to grow at the fastest CAGR from 2024 to 2032. Such growth is fueled by rising requirements for protection in specialized scenarios, for example, high-pressure cleaning, chemical exposure, and installations outdoors. Such ratings serve specific needs in the areas of pharmaceuticals and medical devices in which a higher degree of protection is required as well as in heavy industries.

By Application

Energy & Power dominated the Machine Automation Controller Market with a 19.4% share in 2023. This can be attributed to the increasing direct view of Power Generation, Transmission, and Distribution automation to improve operational efficiency and reliability. The growing integration of smart grid technologies and renewable energy sources also stimulates the demand for highly advanced controllers for automation. Their ability to enhance energy management and maintain system stability further solidifies their top position in the industry.

Automotive is expected to grow at the fastest CAGR from 2024 to 2032. The growth is fueled by the fast conversion to electrical vehicles (EVs) and rising smart production adoption. Automotive assembly lines benefit from automation controllers that increase production efficiency, precision, and quality control. Demand for EVs and autonomous vehicles is booming, with manufacturers pouring big bucks into automated solutions, meaning this market is growing quite rapidly.

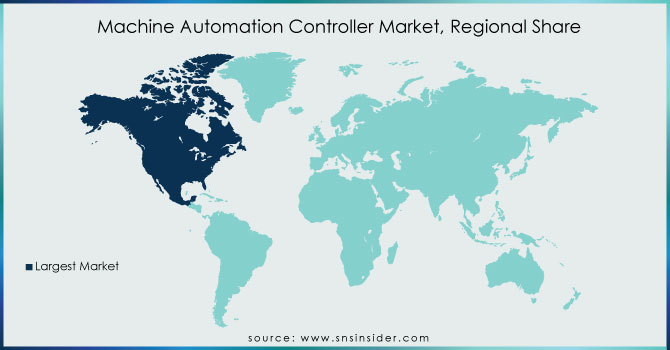

Regional Analysis

In 2023, North America held the largest share, at 37.7%, of the Machine Automation Controller Market. This is due to the region's well-developed manufacturing infrastructure, rapid adoption of Industry 4.0 technologies, and the concentration of major automation companies including Rockwell Automation and Emerson Electric. Automotive, energy, and food & beverages are the hottest sectors where automation controllers are in high demand. Example Plc A perfect example of this is the Gigafactories of Tesla, where the company uses advanced PLCs and DCS systems in its highly automated production lines. General Motors also utilizes automation controllers for smart manufacturing and quality control on its North American plants.

The Asia Pacific region is projected to witness the highest CAGR during the forecast period between 2024 and 2032, owing to industrialization, a boost in smart factories investments, and booming manufacturing sectors like electronics and automotive. Countries like China, Japan, and South Korea are at the forefront of automation adoption. Highly automated production systems like the ones Toyota employs to improve production line efficiency require sophisticated automation controllers. Meanwhile, in China, automakers like BYD and battery giant CATL are pouring money into automation to boost EV cell production. The rising manufacturing sector in Southeast Asian countries is another driving factor for the machine automation controllers market in this region.

Need any customization research on Machine Automation Controller Market - Enquiry Now

Key players

Some of the major players in the Machine Automation Controller Market are:

-

Siemens (SIMATIC S7-1500, SIMATIC S7-1200)

-

FANUC (Series 30i/31i/32i-MODEL B CNCs, Power Motion i-MODEL A)

-

B&R Industrial Automation (X20 System, ACOPOSmulti)

-

Mitsubishi Electric (MELSEC iQ-R Series, MELSEC iQ-F Series)

-

Rockwell Automation (ControlLogix, CompactLogix)

-

Omron (NJ Series Machine Automation Controllers, NX1P Series)

-

Schneider Electric (Modicon M580, Modicon M340)

-

Yokogawa Electric (FA-M3V, STARDOM)

-

Bosch Rexroth (IndraControl XM, IndraMotion MLC)

-

ABB (AC500 PLC, Freelance DCS)

-

Delta Electronics (AS Series PLC, AH500 Series)

-

Panasonic (FP-XH Series, FP7 Series)

-

Keyence (KV-8000 Series, KV Nano Series)

-

Hitachi (EH-150 Series, Micro-EH Series)

-

Beckhoff Automation (CX Series Embedded PCs, C6015 Industrial PC)

Recent Trends

-

In April 2024, Siemens announced the new Simatic S7-1200 G2 controller as part of its Xcelerator portfolio, debuting at Hannover Messe 2024. The controller offers enhanced motion control, safety, and scalability, with availability expected in winter 2024.

-

In March 2024, FANUC America showcased its new Power Motion i-MODEL A Plus motion controller at MODEX 2024, integrating PLC and CNC functionalities for precise multi-axis control

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 42.08 Billion |

| Market Size by 2032 | USD 61.66 Billion |

| CAGR | CAGR of 4.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Controller Type (Distributed Control System (DCS), Programmable Logic Controller (PLC), Industrial PC (IPC)) • By Form Factor (IP65, IP20, Others (P40, IP67, and IP69K)) • By Application (Semiconductor & Electronics, Oil & Gas, Energy & Power, Food & Beverages, Chemicals, Pharmaceuticals, Automotive, Medical Devices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, FANUC, B&R Industrial Automation, Mitsubishi Electric, Rockwell Automation, Omron, Schneider Electric, Yokogawa Electric, Bosch Rexroth, ABB, Delta Electronics, Panasonic, Keyence, Hitachi, Beckhoff Automation. |