Marine Lubricants Market Report Scope & Overview:

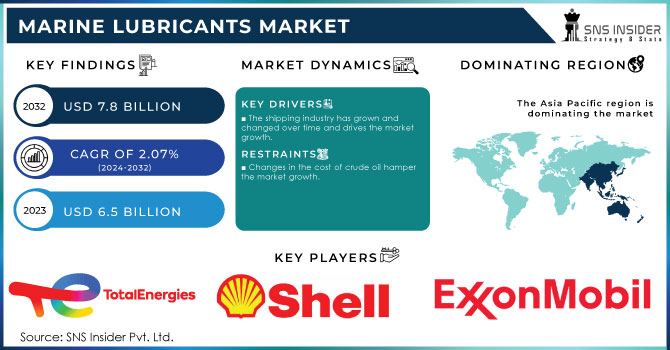

The Marine Lubricants Market Size was valued at USD 6.5 Billion in 2023 and is expected to reach USD 7.8 Billion by 2032 and grow at a CAGR of 2.07% over the forecast period 2024-2032.

Get E-PDF Sample Report on Marine Lubricants Market - Request Sample Report

Marine Lubricant is a high-performance oil that breaks down easily and is used to protect marine equipment and make engines run more efficiently. The marine lubricants market is mostly driven by new technologies to reduce emissions, the growth of maritime tourism, and improvements to infrastructure that are making the shipping industry stronger.

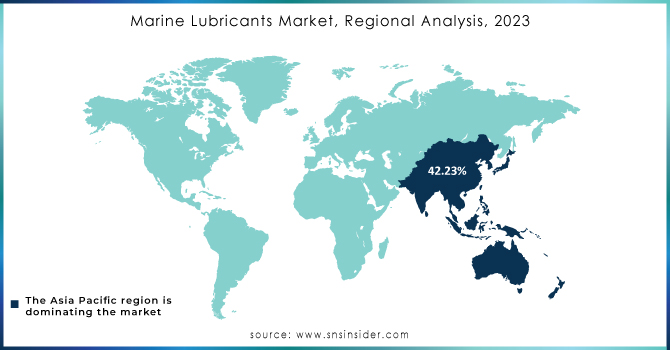

But the growing demand for bio-based marine lubricants gives the companies that make them a chance to grow. In terms of value, Asia Pacific is the most important market for marine lubricants around the world. It is also the area where the marine lubricants market is growing the fastest.

Marine lubricants are becoming increasingly more interested in using synthetic products due to their efficient applications under high pressure and intense heating and cooling conditions. As a result, such lubricants provide high wear and corrosion protection, ensuring extended equipment service life and reduced maintenance costs for both military and commercial vessels. In 2023, ExxonMobil developed and commercially launched its new synthetic marine lubricant, and particularly Mobilgard 540 AC. The products have been engineered to improve engine performance and fuel combustion and it compliant with the International Maritime Organization 2023 requirements.

This lubricant is characterized by high thermal stability and oxidation resistance, which is critical in modern engines as they begin to operate under environmentally stringent performance standards. Furthermore, the new product extends ExxonMobil’s lineup of modern advanced marine lubricants. Shell Alexia 140 lubricant introduces their position on the trends in ship fuels as now LNG-based fuels are used by some ships and require new synthetical lubricants.

The marine lubricants industry is under pressure to comply with the principles of sustainability and the circular economy, which will minimize the environmental impact. For that reason, many lubricant manufacturers aim to reduce the amount of waste generated during their production and distribution, by producing more recyclable and reusable means of packaging. For instance, Castrol and TotalEnergies have undertaken several sustainable packaging initiatives and now make their lubricants available in environmentally friendly containers and refillable systems that eliminate the use of virtually any disposable plastics. Furthermore, the idea of a circular economy applies to production as well, so manufacturers attempt to reduce energy consumption, reuse industrial by-products, and incorporate recycled materials in their formulations.

The European Green Deal, for instance, aims to make shipping more sustainable by 2050, encouraging the adoption of environmentally acceptable lubricants (EALs) and promoting practices that support waste reduction in the supply chain.

Marine Lubricants Market Dynamics:

Drivers

-

The shipping industry has grown and changed over time and drives the market growth.

The emergence of the shipping sector, initially a common means of transportation, has experienced a series of transformations that have steered the development of the marine lubricants market. Noteworthy, emerging globalization, dependence on international trade, as well as technological advancements, have played a vital role in raising the growth of the sector. With the global maritime trade continuing to grow, predominantly in regions of Asia-Pacific, the use of advanced high-quality performance lubricants required for numerous superior fleets has increased. The developments were apparent in 2022 when Maersk announced the inclusion of 12 large container vessels powered by methanol. Such announcements are associated with the increased need for innovative lubricants that will be able to operate diverse fuel types and support efficient engines. Additionally, Cargill was not left behind and began its first shipment that was fuelled by biofuel.

In line with the United Nations Conference on Trade and Development, future global maritime trade volumes will present annual growth of 2.4% through 2030. This means that the number of ships and, hence, the demand for marine lubricants will continue to increase. Moreover, governmental regulations and initiatives such as the IMO 2020 specifying the necessity to reduce sulfur emissions in maritime fuel have facilitated the emergence of new types of marine lubricants that can comply both with performance and environmental standards. Thus, due to the ongoing regulatory and technological shifts, the shipping industry has changed in a significant way and the market for marine lubricants has experienced considerable growth and innovation.

Restrain

- Changes in the cost of crude oil hamper the market growth.

The primary factor hindering the growth of the marine lubricants market is the fluctuation of crude oil cost. Since crude oil is regarded the primary raw product in the manufacturing of lubricants, its market price largely impacts oil cost prices. Therefore, if the cost of crude oil grows, the cost price of producing and refining lubricants grows as well; such a situation implies that the end consumers in the maritime field receive the products at elevated prices. In some instances, the fuel and lubricant needs of shipping companies are high, thus the operation budget might be strained. As a result, lubricant production manufacturers may witness more delays in fleet maintenance since they cannot afford the expensive resupply and lubricants. Alternatively, companies may seek cheaper alternatives thus declining the lucrative demand for premium marine lubricants. Moreover, crude oil cost fluctuations also impact lubricant production manufacturers since the volatility can impact the uncertainties of suppliers’ markets.

-

Using industrial lubricants could make the time between drains longer.

Marine Lubricants Market Segmentation

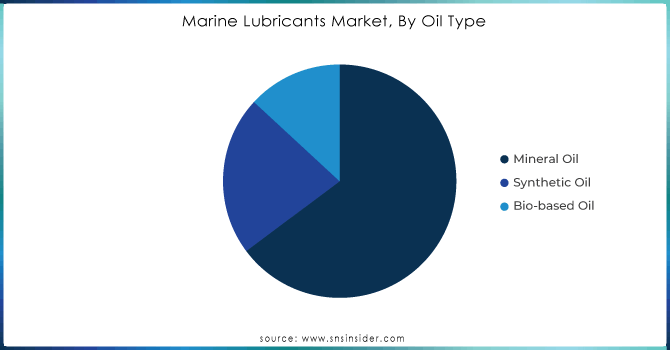

By Oil Type

Mineral Oil is projected that the mineral oil had the biggest share of around 42.95% in 2023. This is because they are widely available, cost-effective, and have been used for different gradients in maritime access. Furthermore, mineral oils are derived from refined crude oil, making them relatively cheaper than their synthetic and bio-based counterparts. Additionally, most shipping companies, especially those with a high number of fleets, use mineral oil because it is a relatively affordable and convenient range of brands. They are also commonly used in the maritime industry, given that they have a longer history of a variety of marine engines and equipment, proofing them of their dominant percentage.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Product Type

The engine oil market share is around 48.23% in 2023. it is essential for maintaining the performance and longevity of marine engines, which are critical to the operation of any vessel. Large ships and vessels have relatively High temperatures, filthy loads, the biggest running hours, and other conditions that prove that engine oil will always be needed. Engine oils prevent friction, corrosion, and wear and tear, and engines run smoothly and with arguable performance with no trouble. Furthermore, with the introduction of new and flagship vessel types, engines must have more power and deliver more performance, therefore advanced engine oils are developed which are especially good with lower-sulfur fuels, and due to IMO 2020, sulfur cap use of such type of engine oil is even strongly recommended.

By Ship Type

Bulk carriers held the largest market share around 39.54% in 2023. This dominance is largely due to their significant presence in global maritime trade and their high engine and machinery usage. As bulk carriers are responsible for transporting large volumes of commodities like coal, grain, iron ore, and other raw materials, they are some of the most frequently utilized vessels in the shipping industry. This intensive use, often on long voyages across international waters, requires continuous maintenance and lubrication of their engines, hydraulics, and other critical machinery to ensure efficient operation and prevent breakdowns. As a result, bulk carriers account for a substantial share of the demand for marine lubricants.

Marine Lubricants Market Regional Outlook:

Asia Pacific held the largest market share around 42.23% in 2023. The marine industries in China, India, and Singapore are expected to continue on a healthy growth path over the forecast period, which is expected to drive the consumption of marine lubricants in the region. Many industries are opening their manufacturing units in Asia Pacific due to the availability of cheap labor and raw materials in the region. This is expected to provide a huge push to the market in Asia Pacific. Also, the region has been experiencing a significant rise in investments made into the manufacturing sector, mainly due to the increasing trade activities that are happening in China. As aforementioned China is playing a major role in the consumption of products as well as the production of these products. The Singapore shipping sector is largely based on Singapore’s core business of container. Singapore aims to expand its port to become a premier global hub port and an international maritime centre over the forecast period. Also, to make sure that Singapore retains its edge in terms of quality, the Maritime and Port Authority are also involved in the promotion of maritime R&D in off-shore and marine engineering, port, and shipping.

Key Players:

-

ExxonMobil Corporation (Mobilgard 540 AC, Mobil SHC Aware, Mobilgard ADL)

-

Shell plc (Shell Alexia 140, Shell Argina)

-

TotalEnergies SE (Talusia Universal, Total Carter XEP)

-

Chevron (Clarity Synthetic EA Gear Oil, Delo 400, Taro Ultra Advanced)

-

BP plc (Castrol Cyltech, Castrol Hyspin AWH)

-

Royal Dutch Shell plc (Shell Mysella, Shell Corena)

-

LUKOIL Marine Lubricants (NAVIGO MCL, LUKOIL OLOA 48001)

-

Lubmarine (Total Group) (Talusia Universal, Lubmarine 340)

-

PetroChina Company Limited (Kunlun Marine Oil, Kunlun Hydraulic Oil, Kunlun Cylinder Oil)

-

FUCHS Petrolub SE (RENOLIN MR, TITAN MARINE, FUCHS Renolin HVI)

-

Gulf Oil Marine Ltd. (GulfSea Cylcare EHP, GulfSea Superbear, GulfSea Hydra)

-

Indian Oil Corporation Ltd. (Servo Marine 707, Servo Cylinder 400, Servo Steerol EP)

-

China Petrochemical Corporation (Sinopec) (Sinopec Marine Cylinder Oil 50100, Sinopec Marine Gear Oil, Sinopec Tulux T700)

-

BP Marine (Energol Cyltech, BP Vanellus, BP Transcal N)

-

Valvoline Inc. (Valvoline Premium Blue, Valvoline All Fleet, Valvoline Marine Pro)

-

JXTG Nippon Oil & Energy Corporation (ENEOS Marine, , ENEOS Gear Oil)

-

SK Lubricants Co. Ltd. (ZIC Marine, SK Solvent Marine, SK Enersave Marine)

-

Repsol S.A. (Repsol Marine Cylinder Oil, Repsol Nautico, Repsol Marine Synth)

-

Klüber Lubrication (Klüberbio RM, Klüberplex BEM, Klüberbio AG 39-602)

-

BASF SE (BASF Irganox, BASF Irgafos, BASF Synthetic Ester-based Oils)

Recent Development:

-

2023: TotalEnergies launched Talusia Optima; a new marine cylinder oil designed to meet the requirements of engines operating on low-sulfur fuels. This product aims to enhance engine performance and compliance with IMO 2020 regulations.

-

2023: Idemitsu introduced Idemitsu Marine HDX, a new high-definition marine lubricant that provides superior protection and performance for a wide range of marine engines and operational conditions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.5 Billion |

| Market Size by 2032 | US$ 7.8 Billion |

| CAGR | CAGR of 2.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Oil type (Mineral Oil, Synthetic Oil, Bio-based Oil) • By Product Type (Engine Oil, Hydraulic Fluid, Compressor Oil, Others) • By Ship type (Bulk Carriers, Tankers, Container Ships, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Castrol, Lubmarine (Total Group), Sinopec Corporation, Lukoil Marine Lubricants., Gulf Marine and Industrial Supplies Inc., Quepet Lubricants, Chevron, ExxonMobil Corporation, BP Marine, Royal Dutch Shell Plc, JX Nippon Oil & Energy Corporation, and Other players |

| Drivers | • The shipping industry has grown and changed over time and drives the market growth. • New technologies to reduce emissions |

| Restraints | • Using synthetic lubricants could make the time between drains longer. • Changes in the cost of crude oil hamper the market growth. |