Mycotoxin Testing Market Report Scope & Overview:

Get More Information on Mycotoxin Testing Market - Request Sample Report

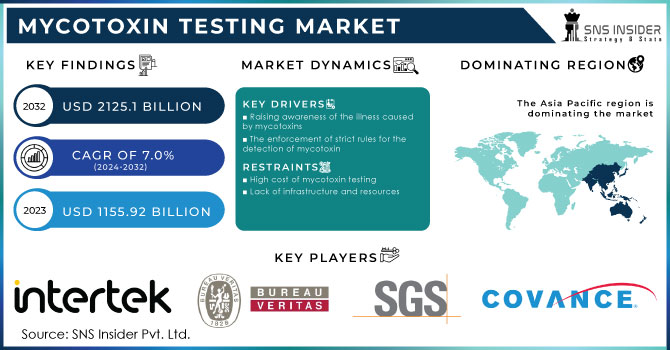

The Mycotoxin Testing Market size was USD 1155.92 billion in 2023 and is expected to Reach USD 2125.1 billion by 2032 and grow at a CAGR of 7.0 % over the forecast period of 2024-2032.

Mycotoxins are toxic secondary metabolites produced by molds that can contaminate food and feed. They can cause a variety of health problems in humans and animals, including cancer, immune suppression, and reproductive problems. Mycotoxin testing is the process of detecting and measuring the levels of mycotoxins in a food or feed sample.

Based on Type, Aflatoxin is the fastest-growing segment. Aflatoxin intoxication of agricultural products poses a significant risk to human and animal health, as well as significant economic losses. Aflatoxin exposure in humans causes a variety of health problems, including acute and chronic aflatoxicosis, immunological suppression, liver cancer, liver cirrhosis, stunted growth in children, and many others. Aflatoxins have been found in a variety of crops, most notably groundnuts and maize.

Based on technology, spectroscopy and chromatography-based technology is expected to increase rapidly and account for the lion's share of the market. This technology yields faster results than older methods while maintaining precision in the mycotoxins testing and other markets.

MARKET DYNAMICS

KEY DRIVERS

-

Raising awareness of the illness caused by mycotoxins

-

The enforcement of strict rules for the detection of mycotoxin

Governments and food safety organizations all over the world are enforcing higher limits on the number of mycotoxins permitted in food and feed. The Food and Drug Administration (FDA) of the United States has also established maximum limits for many mycotoxins in food. These restrictions are increasing demand for mycotoxin testing services to verify that food and feed products are complying.

The Codex Alimentarius Commission, a joint FAO/WHO food standards authority, has also established maximum levels for numerous mycotoxins in food. Several mycotoxins in food and feed have maximum limits imposed by the European Union (EU). These restrictions are outlined in the Regulation on food pollutants. The legislation was modified to incorporate new maximum limits for ochratoxin A and deoxynivalenol (DON) in cereals and cereal products, as well as maize and maize products.

RESTRAIN

-

High cost of mycotoxin testing

-

Lack of infrastructure and resources

In developing countries, effective food control infrastructures are frequently lacking. This increases the danger of mycotoxin contamination in food and feed. This can comprise laboratories equipped with the appropriate technology and experience to conduct mycotoxin testing, as well as a network of transportation and storage facilities to guarantee that samples are delivered to laboratories in a timely and safe manner. It also includes technologies for creating more sensitive and specific mycotoxin detection methods, swiftly screening food and feed samples for mycotoxins, and measuring mycotoxin levels in food and feed.

OPPORTUNITY

-

Technological advancement in testing

-

Increasing exports of food and feed

Growing outbreaks of mycotoxin disorders in developing countries such as African and Asian countries provide new prospects for testing in these locations. Increased trade across borders of emerging markets increases the possibility of the spread of foodborne illnesses, and poor sanitation and processing conditions in Indonesian factories necessitate the need for mycotoxin testing for food. Many governments in developing nations are establishing legislation requiring mycotoxins to be evaluated in food and feed products. Contamination with mycotoxin can harm a country's food industry's reputation and result in economic losses.

CHALLENGES

-

Inappropriate collection and standardization of the samples

Improper sample collection can result in erroneous, negative test results. For example, if a sample is not correctly collected, it may not contain all of the mycotoxins found in the food or feed. Furthermore, there is no single, globally acknowledged method for evaluating mycotoxin. This can make comparing results from different laboratories challenging. Furthermore, the absence of standardization can make developing new mycotoxin testing procedures challenging.

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine war has hampered food production and transport, increasing the risk of mycotoxin contamination in food and feed products. This is because mycotoxins are created by molds that flourish in warm, humid conditions, such as those found in badly preserved food. It has also resulted in a scarcity of testing laboratories in Ukraine. Because they were damaged or destroyed during the war, obtaining the required equipment and resources to resume testing operations has been challenging. According to research conducted by the Food and Agriculture Organization of the United Nations (FAO), the danger of mycotoxin contamination in Ukrainian food and feed products has increased by 50% since the beginning of the war. The WHO issued a warning in June 2022 that the conflict in Ukraine would cause a rise in mycotoxin-related foodborne diseases.

IMPACT OF ONGOING RECESSION

The mycotoxin testing market can be significantly impacted by recessions. The FAO issued a warning in May 2022 that the conflict in Ukraine would increase mycotoxin contamination worldwide. The food supply system has been disrupted by the pandemic and war, which has caused food inflation. Additionally, shipping and storage fees are very expensive. The cost of non-essential things, such as mycotoxin testing, may be reduced by producers. This might result in fewer people needing mycotoxin testing services. Additionally, food exports from developing nations have reduced during the recession, reducing the need for mycotoxin testing. Testing increases along with a growth in exports.

MARKET SEGMENTATION

By Pathogen Type

-

Aflatoxins

-

Ochratoxin A

-

Patulin

-

Fusarium Toxins

-

Other Mycotoxins

By Technology

-

HPLC-based

-

LC-MS/MS-based

-

Immunoassay-based

-

Other Technologies

By Application

-

Feed

-

Food

REGIONAL ANALYSIS

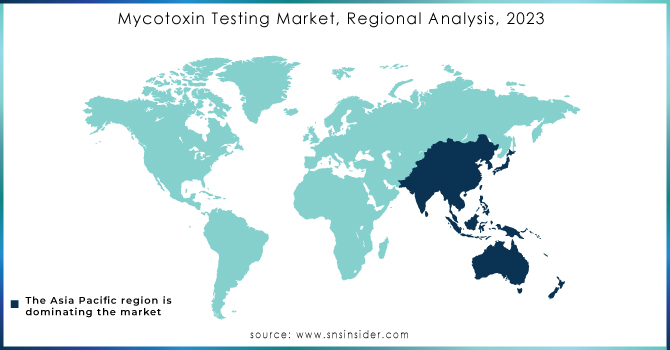

The Asia Pacific region is expected to be the fastest-growing market for mycotoxin testing in the forecast period. This is due to the growing population, increasing disposable income, and increased food demand in the region. Asia Pacific is the major producer of agricultural products. Since Covid-19 the demand for testing has increased as COVID-19 originated in China, and the products exported from this country have increased demand for mycotoxin testing.

Mycotoxin Testing Market in Europe is growing at a faster rate. Due to increased demand for food safety and the tight restrictions set by the European Union (EU), Europe is likely to be a prominent market for mycotoxin testing. The European Union (EU) issued a warning in April 2022 regarding the heightened danger of mycotoxin contamination in Ukrainian food and feed products. Aflatoxin is the most serious pollutant on the European Union's Rapid Alert System for Food and Feed (RASFF).

North America is expected to have a rapidly growing market for mycotoxin testing in the forecast period. North America is the major producer, consumer, and exporter of agricultural products. The demand for mycotoxin testing is increasing due to the high awareness of food safety among consumers and the stringent regulations imposed by the US Food and Drug Administration (FDA).

Need any customization research on Mycotoxin Testing Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

SGS S.A., Als Limited, Bureau Veritas S.A., Romer Labs Diagnostic GmbH, Intertek Group Plc, Covance Inc., Eurofins Scientific, Dts Laboratories, Microbac Laboratories, Ils Limited, Silliker, Inc., Asurequality Limited, and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

In 2023 ImagoAI Inc. introduced a novel, affordable fast mycotoxin test for corn mycotoxins and corn silage that offers results in 30 seconds. This novel test uses advanced hyperspectral imaging and artificial intelligence to detect numerous mycotoxins in a single examination.

In 2023 Romer Labs held the conference on Advancement in Mycotoxin Detection Technology and Mitigation of and Study the Challenges and Solutions for Researchers, Industry, and Farmers, which was successfully held at Fico Eataly World in Italy.

| Report Attributes | Details |

| Market Size in 2023 | USD 1155.92 Billion |

| Market Size by 2032 | USD 2125.1 Billion |

| CAGR | CAGR of 7.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Pathogen Type (Aflatoxins, Ochratoxin A, Patulin, Fusarium Toxins, Other Mycotoxins) • By Technology (HPLC-based, LC-MS/MS-based, Immunoassay-based, Other Technologies) • By Application (Feed, Food) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | SGS S.A., Als Limited, Bureau Veritas S.A., Romer Labs Diagnostic GmbH, Intertek Group Plc, Covance Inc., Eurofins Scientific, Dts Laboratories, Microbac Laboratories, Ils Limited, Silliker, Inc., Asurequality Limited |

| Key Drivers | • Raising awareness of the illness caused by mycotoxins • The enforcement of strict rules for the detection of mycotoxin |

| Market Opportunity | • Technological advancement in testing • Increasing exports of food and feed |