Nano Calcium Carbonate Market Analysis & Overview

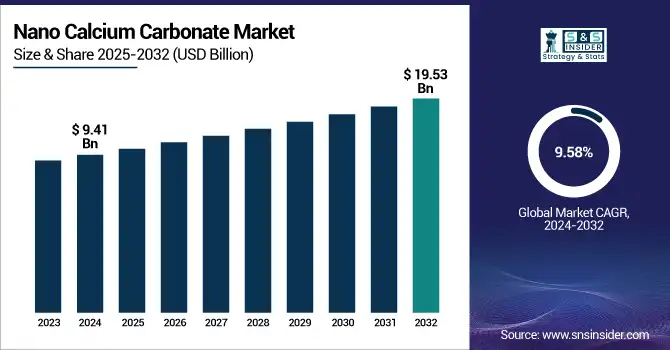

The Nano Calcium Carbonate Market size was USD 9.41billion in 2024 and is expected to reach USD 19.53 billion by 2032 and grow at a CAGR of 9.58% over the forecast period of 2025-2032.

To Get more information on Nano Calcium Carbonate Market - Request Free Sample Report

This report provides in-depth insights into the Chemicals and Materials sector, covering production capacity and utilization by country and type in 2023, along with feedstock price trends. It analyzes regulatory impacts across regions, emphasizing environmental metrics such as emissions data, waste management, and sustainability initiatives. The report highlights innovation and R&D advancements by type, shaping future market trends. Additionally, it examines the adoption rates of Chemicals and Materials Software by region, evaluates key features, and assesses regulatory adherence to ensure compliance. These insights offer a comprehensive understanding of market dynamics, technological advancements, and regulatory frameworks, enabling strategic decision-making for industry stakeholders.

The U.S. held the largest market share in the Nano Calcium Carbonate Market, valued at USD 1.98 billion in 2023, and is projected to reach USD 4.22 billion by 2032, growing at a CAGR of 8.79% during the forecast period. This dominance is driven by the strong presence of well-established end-use industries such as plastics, rubber, and paints & coatings, which extensively utilize nano calcium carbonate for its superior properties like enhanced mechanical strength and improved durability. Additionally, the U.S. benefits from advanced research and development initiatives, facilitating innovation in nano-materials and boosting product adoption in high-performance applications. Favorable regulatory frameworks, coupled with rising demand for lightweight automotive and sustainable packaging solutions, further contribute to market growth. The presence of key manufacturers and increased investment in nanotechnology advancements position the U.S. as a leading market for nano calcium carbonate.

Nano Calcium Carbonate Market Dynamics

Drivers

-

Rising demand for nano calcium carbonate in plastics and rubber industry drives market expansion.

The increasing adoption of nano calcium carbonate in plastics and rubber applications is a key driver propelling market growth. This compound enhances mechanical properties, improves impact resistance, and increases the durability of end products, making it a preferred additive in packaging, automotive components, and construction materials. Additionally, stringent regulations on reducing carbon footprints have encouraged industries to utilize nano calcium carbonate as a sustainable filler, further driving demand. With technological advancements, manufacturers are developing modified nano calcium carbonate grades with superior dispersion and compatibility, boosting its application scope. The expanding automotive and consumer goods industries, coupled with growing infrastructure projects worldwide, further contribute to market growth. As industries continue to seek lightweight, cost-effective, and high-performance materials, the demand for nano calcium carbonate is expected to surge significantly over the forecast period.

Restrain

-

High production costs and complex manufacturing processes restrain market growth.

One of the primary restraints in the nano calcium carbonate market is the high production cost and the complexity of the manufacturing process. The synthesis of nano calcium carbonate requires specialized equipment, precise control over particle size, and high-purity raw materials, which significantly increase operational expenses. Additionally, energy-intensive processing methods, such as carbonation and precipitation techniques, add to the overall cost burden. Manufacturers also face challenges in maintaining product consistency and ensuring uniform dispersion in various applications, leading to increased R&D expenditures. Furthermore, the presence of cheaper alternatives like conventional calcium carbonate and other mineral fillers poses competition, making it difficult for companies to achieve widespread adoption. These factors collectively hinder the growth potential of nano calcium carbonate, particularly in price-sensitive markets, limiting its expansion in emerging economies.

Opportunity

-

Growing applications in biodegradable plastics and sustainable packaging create market opportunities.

The increasing focus on sustainable materials and biodegradable plastics presents a lucrative opportunity for the nano calcium carbonate market. With global regulations emphasizing eco-friendly solutions, industries are shifting toward bio-based polymers, where nano calcium carbonate plays a crucial role in enhancing mechanical strength and reducing carbon footprints. The packaging industry, in particular, is witnessing a surge in demand for sustainable alternatives, driving the incorporation of nano calcium carbonate as a functional additive. Additionally, advancements in nanotechnology have enabled the development of surface-modified nano calcium carbonate, improving its compatibility with biodegradable polymers. This trend is expected to accelerate market expansion, with key manufacturers investing in research to cater to the evolving needs of environmentally conscious industries. As a result, nano calcium carbonate is poised to gain traction in green manufacturing applications.

Challenge

-

Stringent environmental regulations on nanomaterials pose compliance challenges for manufacturers.

The nano calcium carbonate market faces significant challenges due to stringent environmental regulations on nanomaterials. Regulatory bodies such as the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) impose strict guidelines on the production, usage, and disposal of nanomaterials to mitigate potential health and environmental risks. Compliance with these regulations requires extensive testing, safety assessments, and certifications, increasing operational costs for manufacturers. Additionally, concerns regarding the potential toxicity of nanoparticles have led to increased scrutiny, further complicating market entry for new players. The evolving regulatory landscape demands continuous adaptation by industry participants, making it crucial for companies to invest in sustainable production practices and transparent safety standards. Overcoming these regulatory hurdles is essential for long-term market growth and widespread acceptance of nano calcium carbonate in various applications.

Nano Calcium Carbonate Market Segmentation Analysis

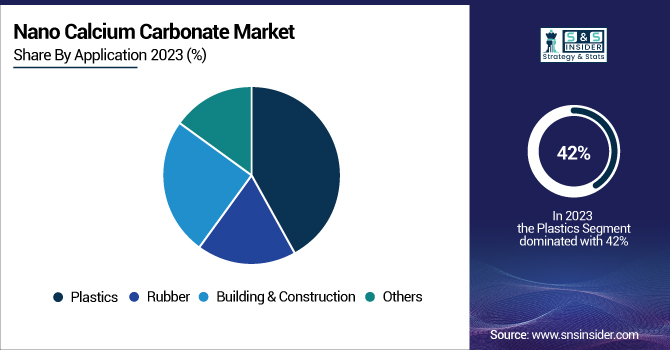

By Application

Plastics held the largest market share, around 42% in 2023 in the nano calcium carbonate market. Nano calcium carbonate improves the strength, impact resistance, and thermal stability of plastics and reduces production costs by partially or entirely replacing costlier resins. It is favored as an additive in industries such as packaging, automotive, construction, and consumer goods due to its superior dispersion and melt intercalation characteristics in polymer matrices. Its usage had been further fuelled by the increasing demand for more lightweight and durable plastic materials, in particular in the automotive and electronics sectors. This, coupled with regulatory pressures advocating for reductions in the use of synthetic polymers and for the adoption of biodegradable plastics, has prompted producers to implement nano calcium carbonate into biodegradable polymer formulations, thus, proliferating its demand. However, with industries continuing the road to finding cost-effective, high-performing materials, it can be expected that plastics will still play a major role in the market.

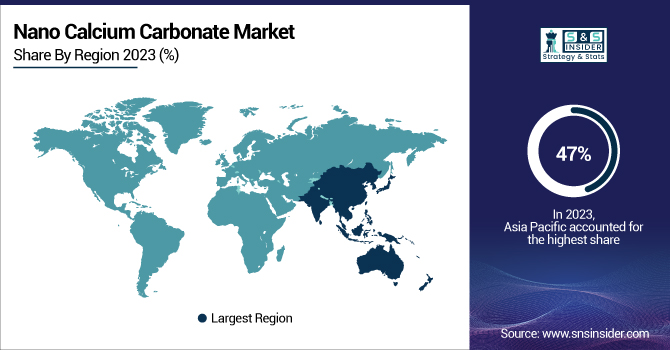

Nano Calcium Carbonate Market Regional Analysis

Asia Pacific held the largest market share, around 47%, in 2023. This rapid growth of the region is majorly attributed to the surging demand in countries including China, India, and South-East Asian Countries, due to their extensive usage of nano calcium carbonate to improve the performance and cost-efficiency of their products. The growth in automobile and packaging industries in these countries has led to a rise in demand for high-performance fillers such as nano calcium carbonate. The high availability of raw materials, manufacturing cost advantages, and favorable government policies allow for large production capacities in the region. high with both the largest production and consumption of nano calcium carbonate in the world, China occupies a vital position in market development. Asia Pacific will continue to lead in the global market whenever there is industrialization and infrastructure expansion.

North America held a significant market share. As the regional manufacturing environment has become increasingly advanced over the last decade, demand in the U.S.- and Canada-based high-performance additive markets has followed suit, with a strong focus on product life-cycle sustainability and energy efficiency. Furthermore, strict environmental regulations favoring sustainable and lightweight materials have driven the demand for nano calcium carbonate in automotive and packaging applications. North America is another region with a significant market share due to increasing emphasis on R&D and hefty investments in the nanotechnology sector. Additionally, the presence of key players in the industry and an established supply chain network ensures a consistent supply of quality nano calcium carbonate increasing the market share in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Omya AG (Omyacarb, Omyalite)

-

Minerals Technologies Inc. (NanoPCC, Opacarb)

-

Imerys S.A. (Filmlink, Carbital)

-

Huber Engineered Materials (Hubercarb, Hubercarb Q Series)

-

Solvay S.A. (Acticarb, Solvay PCC)

-

NanoMaterials Technology Pte Ltd (NMT NanoCaCO3, UltraFine CaCO3)

-

Maruo Calcium Co., Ltd. (Maruomite, Maruo UltraFine)

-

Shiraishi Kogyo Kaisha, Ltd. (Hakuenka, Shiraishi PCC)

-

Fimatec Ltd. (Fimatec PCC, FineCal)

-

Guangdong Qiangda New Materials Technology Co., Ltd. (Qiangda PCC, NanoCal)

-

Zhenghe Company Ltd. (Zhenghe UltraFine, CaCoNano)

-

Changzhou Calcium Carbonate Co., Ltd. (ChangCal, NanoPure)

-

Jiawei Chemical Group (Jiawei PCC, Ultrafine NanoCaCO3)

-

Yuncheng Chemical Industrial Co., Ltd. (YC PCC, Yuncheng NanoCaCO3)

-

Weifang Santi Chemical Co., Ltd. (Santi PCC, UltraWhite)

-

Nitto Funka Kogyo K.K. (NF Calcium, Nitto PCC)

-

Columbia River Carbonates (CalEssence, NanoCCol)

-

Kunal Calcium Limited (Kunal PCC, UltraCal)

-

Anhui Chaodong Cement Co., Ltd. (CD NanoCaCO3, Chaodong PCC)

-

DongNan New Materials Co., Ltd. (DongNan PCC, NanoMate)

Recent Development:

-

In April 2023, Omya revealed plans to invest in the establishment of calcium carbonate manufacturing facilities across seven locations in the Asia Pacific region, enhancing support for long-term partners in the paper and board industry.

-

In April 2023, Minerals Technologies Inc. signed three long-term agreements to supply precipitated calcium carbonate (PCC) in China and India, strengthening its Specialty Additives product portfolio in these markets.

-

In October 2023, Imerys opened a new greenfield facility in Wuhu, China, dedicated to manufacturing high-quality talc for lightweight polymers, with a focus on automotive applications, including electric vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.41 Billion |

| Market Size by 2032 | USD 19.53 Billion |

| CAGR | CAGR of 9.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Plastics, Rubber, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Omya AG, Minerals Technologies Inc., Imerys S.A., Huber Engineered Materials, Solvay S.A., NanoMaterials Technology Pte Ltd, Maruo Calcium Co., Ltd., Shiraishi Kogyo Kaisha, Ltd., Fimatec Ltd., Guangdong Qiangda New Materials Technology Co., Ltd., Zhenghe Company Ltd., Changzhou Calcium Carbonate Co., Ltd., Jiawei Chemical Group, Yuncheng Chemical Industrial Co., Ltd., Weifang Santi Chemical Co., Ltd., Nitto Funka Kogyo K.K., Columbia River Carbonates, Kunal Calcium Limited, Anhui Chaodong Cement Co., Ltd., DongNan New Materials Co., Ltd. |