Paints & Coatings Market Report Scope & Overview:

Get PDF Sample Copy of Paints & Coatings Market - Request Sample Report

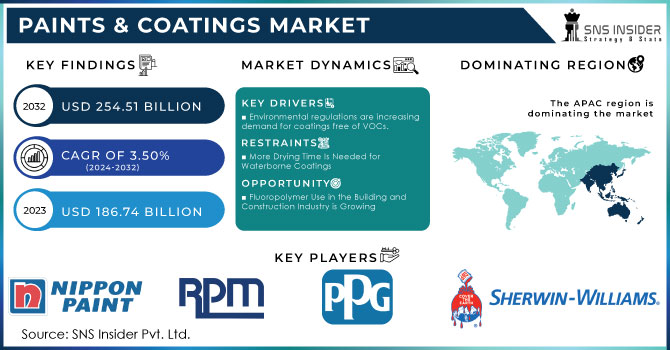

The Paints and Coatings Market Size was valued at USD 186.74 billion in 2023, and is expected to reach USD 254.51 billion by 2032, and grow at a CAGR of 3.50% over the forecast period 2024-2032.

The Paints & Coatings Market has experienced significant growth, driven by several key factors such as increasing demand for eco-friendly coatings, technological advancements, and expansion in emerging markets. Innovations in waterborne, powder, and UV coatings are becoming more prominent due to their environmental benefits and enhanced durability. Moreover, the growing construction and automotive sectors have contributed to the steady rise in demand for high-quality and sustainable coatings. Companies are actively integrating cutting-edge technologies like nanocoatings to create superior-performance products. A surge in premium product demand is also driving growth in the architectural coatings sector. Emerging markets, particularly in India and China, are seeing a sharp increase in construction activities, further boosting the demand for both decorative and industrial coatings. The automotive coatings sector, emphasizing aesthetic appeal and durability, is expanding rapidly as automakers focus on higher-quality finishes and environmental sustainability.

Several companies have recently made strategic moves to capitalize on these market dynamics. AkzoNobel India, in July 2023, outlined its expectations for the Indian paints and coatings sector to reach INR 1 lakh crore in the next five years, citing rapid urbanization and growing demand for premium products. The company also emphasized its commitment to sustainable manufacturing practices to align with India's stricter environmental regulations. In September 2024, Asian Paints, alongside Indigo Paints and Kansai, saw stock price increases due to falling oil prices, which reduced production costs, offering a positive market outlook. This shift reflects the broader industry trend of benefiting from cost reductions in raw materials. In November 2024, Nippon Paint made a significant acquisition by purchasing AOC for EUR 2.1 billion, marking a key step in expanding its reach in the global coatings market. The acquisition aligns with Nippon's strategy to strengthen its position in both the automotive and industrial coatings sectors. In June 2024, a report highlighted the growth of top players such as Sherwin-Williams and PPG Industries, whose sales benefited from the growing demand for high-performance industrial coatings. Meanwhile, Kamdhenu Paints, in September 2024, expanded its offerings by launching a new wood coatings range and ramping up production capacity to meet the growing needs of both residential and commercial customers. These recent developments showcase the competitive nature of the market, with companies continually innovating and expanding their operations to maintain their leadership positions.

Paints and Coatings Market Dynamics:

Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts the Paints & Coatings Market Growth

The increasing demand for environmentally friendly coatings is a significant driver of the Paints & Coatings Market. Rising concerns over environmental sustainability and stricter regulations are encouraging manufacturers to develop eco-friendly products. Water-based, powder, and UV coatings are gaining popularity due to their low levels of volatile organic compounds (VOCs), reducing air pollution and health hazards. Many industries, including automotive, construction, and consumer electronics, are opting for these coatings to meet sustainability goals and adhere to government regulations. The architectural sector is also increasingly adopting eco-friendly coatings due to consumer preference for green building materials. Companies that invest in developing such products stand to gain a competitive edge by catering to the rising demand for sustainable solutions. For instance, manufacturers are focusing on enhancing the durability, functionality, and aesthetic appeal of eco-friendly coatings, ensuring they do not compromise on quality while meeting environmental requirements. This shift is poised to continue as more industries align with sustainable practices.

-

Technological Advancements in Coatings Technology Fuel Growth in Paints & Coatings Market

-

Increasing Demand for Premium and Decorative Coatings Drives Market Expansion

-

Expansion of Construction Activities in Emerging Economies Supports Paints & Coatings Market Growth

-

Growth of Automotive Industry Drives Demand for High-Performance Coatings in Paints & Coatings Market

Restraint:

-

Fluctuating Raw Material Prices and Supply Chain Disruptions Hamper Paints & Coatings Market Growth

Opportunity:

-

Growing Trend Toward Sustainable Coatings Creates Market Opportunities in Emerging Regions

The growing global emphasis on sustainability presents significant opportunities for the Paints & Coatings Market, particularly in emerging regions. As environmental awareness increases, consumers and industries in these regions are seeking eco-friendly and sustainable coatings to reduce their carbon footprints. This growing demand for green solutions in construction, automotive, and industrial applications offers companies the chance to introduce innovative, environmentally friendly products. Manufacturers can capitalize on this trend by investing in research and development of sustainable coatings, such as those that use renewable resources or have low VOC content, aligning their products with both consumer preferences and governmental regulations.

-

Adoption of Smart Coatings Presents New Growth Prospects for Paints & Coatings Industry

-

Increase in Renovation and Retrofitting Activities Creates Demand for Paints & Coatings in Developed Markets

Challenge:

-

Environmental Regulations and Compliance Challenges for Paints & Coatings Manufacturers

Paints & Coatings manufacturers face the challenge of complying with stringent environmental regulations across various regions. The growing global push for sustainability has led to tighter regulations on the production and use of coatings, particularly in terms of VOC emissions, waste management, and the use of harmful chemicals. Meeting these regulatory standards can be costly and time-consuming, requiring significant investment in new technologies, testing, and certification processes. Manufacturers must constantly innovate to develop eco-friendly products that adhere to these regulations without compromising performance. The increasing complexity of these requirements adds to the operational burden, particularly for small and medium-sized manufacturers that may struggle to keep up with evolving environmental standards.

| Segment | Contribution (%) | Key Roles |

|---|---|---|

| Raw Material Suppliers | 0.25 | Provide pigments, resins, solvents, and additives |

| Manufacturers | 0.3 | Produce paints and coatings for various applications |

| Distributors/Wholesalers | 0.2 | Facilitate bulk distribution to retailers/industries |

| Retailers | 0.15 | Connect products to end consumers |

| End Users | 0.1 | Use products in construction, automotive, etc. |

The supply chain for the Paints & Coatings Market involves multiple interconnected stages, each playing a critical role in ensuring efficient product delivery. Raw material suppliers provide essential inputs such as pigments, resins, solvents, and additives, which are foundational to manufacturing paints and coatings. Manufacturers transform these materials into a wide range of products, including architectural, industrial, and specialty coatings. The products are then distributed through distributors and wholesalers, who ensure bulk delivery to various regions, facilitating a smooth supply to retailers or industrial clients. Retailers play a pivotal role in connecting products to end consumers, including DIY enthusiasts and small-scale contractors. Finally, the end users consist of industries like construction, automotive, aerospace, and marine, where paints and coatings are used for functional and decorative purposes. Technological advancements and sustainability trends are influencing each segment, with increased emphasis on reducing VOC emissions and introducing eco-friendly alternatives.

Paints and Coatings Market Segments Analysis

By Product Type

In 2023, the architectural coatings segment dominated the Paints & Coatings Market, holding a market share of approximately 45%. This dominance can be attributed to the rapid growth in the construction industry, particularly in residential and commercial projects. As urbanization continues to rise, especially in emerging economies, the demand for decorative and protective coatings in buildings has surged. Architectural coatings not only enhance the aesthetic appeal of structures but also provide essential protective qualities, such as weather resistance and durability. For example, the increasing popularity of green buildings has driven demand for eco-friendly architectural coatings that meet sustainability standards, further solidifying this segment's leading position in the market.

By Technology

In 2023, the waterborne coatings segment dominated the Paints & Coatings Market, accounting for a market share of around 50%. This dominance is primarily due to the growing awareness of environmental concerns and stringent regulations aimed at reducing volatile organic compound (VOC) emissions. Waterborne coatings are favored for their low environmental impact, making them suitable for various applications across industries. The automotive and architectural sectors, in particular, have seen a significant shift towards waterborne products. Companies are investing in the development of advanced waterborne formulations that provide excellent performance without compromising on durability or aesthetic quality. For instance, leading manufacturers like Sherwin-Williams and PPG Industries have expanded their portfolios to include a wide range of waterborne coatings that cater to both industrial and consumer markets.

By Resin

In 2023, the acrylic resin segment dominated the Paints & Coatings Market, with a market share of approximately 40%. The versatility and superior performance characteristics of acrylic resins, such as excellent adhesion, durability, and resistance to weathering, have made them a popular choice across various applications. These resins are widely used in architectural and decorative coatings due to their vibrant colors and gloss retention. Additionally, the rising demand for environmentally friendly products has further propelled the use of acrylics, as they are typically water-based and have lower VOC emissions compared to traditional solvent-based resins. Major companies like AkzoNobel and Asian Paints have emphasized acrylic-based formulations in their product lines to meet market demand.

By End-Use Industry

In 2023, the construction industry dominated the end-use segment in the Paints & Coatings Market, capturing a market share of around 50%. This dominance reflects the substantial growth in construction activities globally, driven by urbanization, infrastructural development, and rising disposable incomes. Architectural coatings are essential in new construction and renovation projects, contributing to the segment's leading position. Furthermore, the construction industry's focus on sustainable building practices has spurred the demand for eco-friendly coatings that comply with environmental regulations. Companies such as Nippon Paint and Berger Paints have been actively developing innovative coatings tailored for the construction sector, offering solutions that enhance durability, aesthetics, and environmental compliance.

Paints and Coatings Market Regional Overview

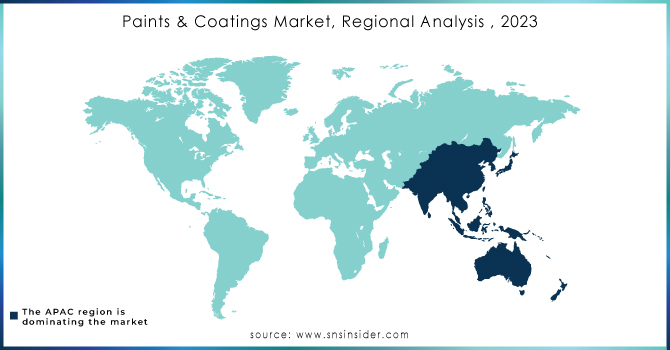

In 2023, the Asia-Pacific region dominated the Paints & Coatings Market, accounting for a market share of approximately 45%. This dominance can be attributed to rapid industrialization, urbanization, and growing construction activities across major economies in the region, including China and India. For instance, China's ongoing infrastructure development initiatives, such as the Belt and Road Initiative, have significantly boosted demand for construction materials, including paints and coatings. The country’s extensive construction sector is expected to continue growing, with investments in residential and commercial buildings. Additionally, India’s real estate market is flourishing due to government initiatives like Housing for All, which promotes affordable housing and drives the demand for decorative and protective coatings. Japan also plays a crucial role in the region, particularly in automotive coatings, as it is home to major automotive manufacturers. The growing focus on sustainable and eco-friendly coatings has further accelerated market growth in Asia-Pacific, with companies like Asian Paints and Nippon Paint leading the charge by innovating products that meet the increasing regulatory standards for VOC emissions. The demand for architectural coatings in this region is bolstered by rising consumer preferences for aesthetically pleasing and durable paint solutions, reflecting the dynamic nature of the paints and coatings market in Asia-Pacific.

Get Customised Report as per Your Business Requirement - Enquiry Now

Key Players in Paints and Coatings Market

-

AkzoNobel N.V. (Dulux, International)

-

Alcoatec (Alcoa Paints, Alcoabond)

-

Asian Paints Limited (Apcolite, Royale)

-

Axalta Coating Systems (Corlar, Imron)

-

BASF SE (R-M, Glasurit)

-

Berger Paints India Limited (Luxol, Weathercoat)

-

Covestro AG (Bayhydrol, Baybond)

-

Hempel A/S (Hempel's Marine, Hempadur)

-

Jotun A/S (Jotashield, Jotun Marine)

-

Kansai Paint Co., Ltd. (Prestige, Kansai)

-

Nippon Paint Holdings Co., Ltd. (Dulux, Nippon Paint)

-

PPG Industries, Inc. (Pittsburgh Paints, Dulux)

-

RPM International Inc. (Rust-Oleum, Zinsser)

-

Sherwin-Williams Company (Emerald, SuperPaint)

-

Sika AG (Sikagard, Sikafloor)

-

Tikkurila Oyj (Tikkurila, Temal)

-

Valspar Corporation (Cabot, Valspar Wood Coatings)

-

The Dow Chemical Company (Dow Coating Materials, Dow Corning)

-

The Sherwin-Williams Company (Sherwin-Williams, Minwax)

-

Benjamin Moore & Co. (Aura, Regal)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 186.74 Billion |

| Market Size by 2032 | US$ 254.51 Billion |

| CAGR | CAGR of 3.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Architectural Coatings, Industrial Coatings, Protective Coatings, Specialty Coatings) • By Technology (Waterborne, Solvent-borne, Powder Coatings, Others) • By Resin (Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, Vinyl, Fluoropolymer, Others) • By End Use Industry (Construction, Automotive, Aerospace, Marine, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AkzoNobel N.V., BASF SE, PPG Industries, Inc., Sherwin-Williams Company, Asian Paints Limited, RPM International Inc., Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, Valspar Corporation (a subsidiary of Sherwin-Williams), Berger Paints India Limited and other key players |

| Key Drivers | • Expansion of Construction Activities in Emerging Economies Supports Paints & Coatings Market Growth • Growth of Automotive Industry Drives Demand for High-Performance Coatings in Paints & Coatings Market |

| RESTRAINTS | • Fluctuating Raw Material Prices and Supply Chain Disruptions Hamper Paints & Coatings Market Growth |