Neural Processor Market Report Scope & Overview:

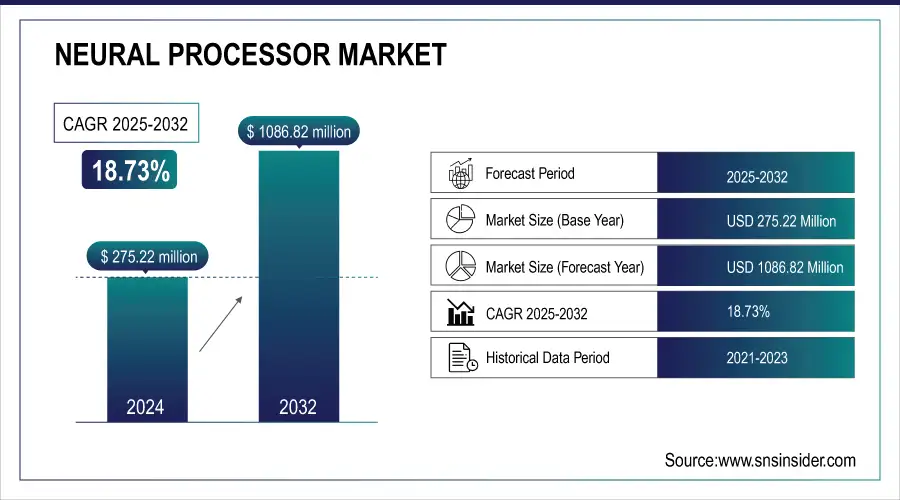

The Neural Processor Market was valued at USD 275.22 Million in 2024 and is expected to reach USD 1086.82 Million by 2032, growing at a CAGR of 18.73% from 2025-2032.

The neural processor market is experiencing rapid expansion, driven by the increasing demand for AI and machine learning applications across diverse industries. Neural processing units (NPUs) are specialized chips designed to accelerate AI tasks such as deep learning, natural language processing, and computer vision. These chips play a crucial role in efficiently managing large datasets and complex computations, sparking advancements in autonomous vehicles, robotics, and smart devices. One significant factor driving market growth is the growing incorporation of AI in consumer electronics, particularly smartphones. In 2023, over 90% of smartphones featured AI capabilities, with many high-end devices equipped with NPUs to enhance functionalities like facial recognition, voice assistants, and advanced photography. Leading companies like Apple, Huawei, and Qualcomm have integrated NPUs into their flagship models, highlighting the importance of this technology in the consumer market.

Get More Information on Neural Processor Market - Request Sample Report

Additionally, the rise of autonomous vehicles is fueling demand for neural processors. These vehicles depend on NPUs for real-time decision-making and object detection. Tesla, for instance, integrates neural processors into its Full Self-Driving (FSD) computers, which can process up to 72 trillion operations per second (TOPS), enabling sophisticated decision-making in autonomous driving. As the industry advances toward fully autonomous systems, the need for powerful NPUs is expected to surge. In data centers, NPUs are revolutionizing AI workload processing. Google’s Tensor Processing Units (TPUs), deployed in their data centers, significantly enhance AI model performance in services like Google Search, Translate, and Photos. With TPUs, Google processes over 1 billion photos daily, improving both speed and efficiency.

Neural Processor Market Highlights:

-

The growth of self-driving cars is driving demand for high-performance neural processing units (NPUs) capable of real-time object detection and decision-making. NPUs are critical for managing data from cameras, sensors, and LiDAR systems, enabling autonomous vehicles to process information rapidly and make accurate driving decisions.

-

Advanced NPUs are essential for enhancing the safety and accuracy of autonomous driving systems. For example, Tesla’s Full Self-Driving system utilizes NPUs capable of 72 TOPs to process data from multiple sensors, demonstrating the increasing reliance on neural processors for autonomous technology.

-

The rapid adoption of NPUs in data centers accelerates AI workloads and large-scale AI applications. Companies like Google employ NPUs to optimize search, image recognition, and data management, improving operational efficiency and enabling real-time processing of billions of data points daily.

-

Organizations increasingly recognize the benefits of NPUs in improving performance and enabling innovative AI solutions, making neural processors a crucial element in the evolution of AI technologies and data center operations.

-

A key restraint is the limited availability of compatible software and development tools for NPUs, which can hinder their adoption. While some companies, such as NVIDIA, provide optimized software frameworks, many NPUs lack robust third-party support, slowing integration across industries like automotive, healthcare, and cloud services.

-

Addressing the software ecosystem gap is essential to fully realize the potential of NPUs and promote broader adoption across sectors reliant on high-performance AI processing.

Neural Processor Market Drivers:

-

The rise of self-driving cars requires high-performance NPUs for real-time object detection and decision-making.

The rapid development of self-driving technology is a key driving factor for the expansion of the growth of the neural processor market. One of the critical premises for self-driving is real-time data processing that will help ensure the safety of all participants of the road and facilitate their optimal functioning. This data management is possible only with the help of neural processors, which are created to control the immense streams of data from a car’s cameras, sensors, as well as LiDAR systems, necessary for object detection, lane tracking, navigation decisions, and many other vital processes through AI-supported amelioration. NPUs enhance the capability of autonomous vehicles to process data rapidly and make accurate driving decisions. As a current example, the Full Self-Driving system by Tesla develops neural processors that can perform up to 72 TOPs while overseeing and organizing data from eight cameras and various sensors to see both close obstacles, such as road signs and signals, other cars, and pedestrians, as well as safely plan the car’s driving path. Therefore, the further development of self-driving technology is dependent on the further evolution of NPUs.

The enhancement of self-driving technology and the processes around it foster the expansion of the neural processor market. The further development of the safety and accuracy of self-driving technology is impossible without advanced NPUs and their rapidly increasing processors’ ability. Thus, the importance and value of NPUs as one of the leading facets of the self-driving future are evermore reinforced by this tendency.

The rapid growth of neural processors in data centers contributes to the significant increase in the efficiency of AI workloads as well as the implementation of large AI applications. As a specially designed processor to accelerate the performance of complex AI algorithms, neural processors perform significantly better in the area of computations required to implement cloud services. For example, Google uses NPUs to speed up computations in Google Search and Google Photos. Therefore, Google can accelerate the search for data in various sources and ensure that pictures are analyzed and provided to users in real-time. This technology allows the company to manage more than a billion photos daily while enhancing image search and recommendation options for the users.

Considering that the number of organizations that realize the benefits of the use of NPUs in data centers is rising, soon, their use becomes a common trend. This agent of change improves the operational performance of multiple organizations and enhances it by developing innovative solutions in the area of AI. Thus, currently, NPUs become crucial to the progression of data center and neural process market technologies.

Neural Processor Market Restraints:

-

The availability of compatible software and tools for neural processors may be insufficient, hindering their adoption in various applications.

The availability of compatible software and tools for neural processors (NPUs) is a critical factor influencing their adoption across various applications. Despite the rapid advancements in neural processing technology, many developers and organizations face challenges due to a lack of optimized software that can fully leverage the capabilities of NPUs. This limitation can hinder the effective implementation of NPUs in real-world applications, slowing down innovation and adoption rates. For instance, companies like NVIDIA have developed powerful NPUs, but the effectiveness of these processors often depends on the availability of suitable software frameworks and development environments. While NVIDIA provides software tools like TensorRT and CUDA to optimize AI workloads on their GPUs, a similar comprehensive ecosystem for NPUs is not always present. This disparity can create barriers for developers who want to integrate NPUs into their applications, leading to a reliance on traditional processors that have more mature software support.

A real-time example can be seen in the automotive industry, where companies are increasingly utilizing NPUs for autonomous vehicle applications. However, the absence of robust software frameworks that specifically cater to the unique requirements of NPUs can complicate the deployment of advanced driver assistance systems (ADAS). For instance, Tesla's Full Self-Driving (FSD) system relies heavily on its in-house software, but its neural processing capabilities could be further enhanced if more third-party software tools were available that are tailored for NPUs.

In summary, the insufficient availability of compatible software and tools for neural processors poses a significant challenge in the market. Addressing this gap is essential for fostering broader adoption and maximizing the potential of NPUs across various sectors, including automotive, healthcare, and data centers.

Neural Processor Market Segment Analysis:

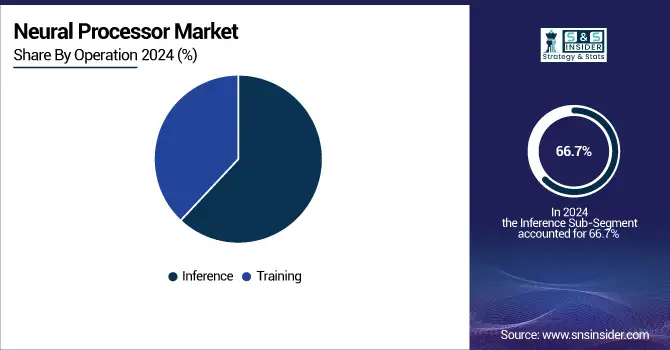

By Operation

The inference segment dominated the market and accounted for 66.7% of global revenue in 2024. One of the central factors underlying this trend is an increasing demand for real-time AI decision-making. As such, inference operations represent one of the driving forces behind the growth of neural processors on the market. This process involves the application of trained AI models to new data, allowing devices to make instant predictions or actions. With more and more AI-driven applications becoming widespread, such as advanced speech recognition, facial recognition, or completely autonomous systems of various kinds, the need for improved inference capabilities keeps increasing. Neural processors are a perfect match for this scenario as they are specifically designed for these purposes, providing better performance and lower power consumption rates compared to ordinary hardware. Such features make these devices crucial to AI technologies across several industries.

Meanwhile, the training segment is expected to register substantial growth in CAGR during the forecast period, which is also based on several factors. One such is the emergence of increasingly complex and detailed AI models, which implies new ways to train these systems. This concept determines the purpose of training, which may be defined as teaching AI models to identify patterns and make predictions based on vast data sets. These processes require substantial computational power, and with more industries, such as healthcare, finance, or autonomous vehicles, investing in AI, specialized hardware demand keeps rising. Neural processors are specifically engineered to manage these tasks more effectively, thus becoming a crucial factor in the training of complicated models.

By Application

The smartphones and tablets segment had the largest share of market revenue in 2024. More manufacturers are implementing AI in these devices, and their use of neural processors is rapidly increasing as greater demands are put on these applications. Neural processors are used to provide significant enhancement in performance for applications such as facial recognition, voice assistance, and real-time translation of spoken language. With the rise of AI-driven applications like augmented reality and enhanced photography, manufacturers are rapidly adapting their devices to take advantage of neural processors. As more and more companies compete in producing better AI mobile devices, the smartphones and tablets segment has secured its position as the driving force in the use of neural processors.

Autonomous vehicles segment is anticipated to witness significant growth during the forecast period. Recent applications of AI and new technology such as sensor systems and, in the present case, neural processors, have helped to develop a new type of vehicle requiring no human intervention. With neural processors, AI systems can make rapid decisions about the environment, and the most frequently imagined of these is autonomous vehicle object recognition, route planning, and collision avoidance systems.

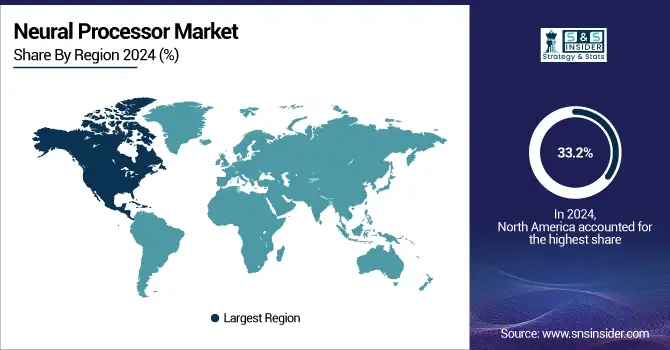

Neural Processor Market Regional Analysis:

North America Neural Processor Market Trends

North America dominated the market with a 33.2% share in 2024. The region's neural processor market is experiencing robust growth, fueled by the increasing demand for sophisticated artificial intelligence applications. The rise of cloud computing and edge devices is accelerating the adoption of neural processors across multiple sectors, including healthcare, automotive, and finance. Moreover, major players in the region are investing heavily in research and development to enhance the capabilities and performance of neural processors.

The U.S. market is marked by rapid technological advancements, especially in deep learning and natural language processing. Leading tech companies are launching new models of neural processors that improve both computational power and energy efficiency. Additionally, the growing emphasis on smart devices and the Internet of Things (IoT) is driving market expansion, as these applications necessitate strong processing capabilities.

Need Any Customization Research On Neural Processor Market - Inquiry Now

Europe Neural Processor Market Trends

Europe holds a substantial share in the neural processor market, driven by the adoption of AI solutions in automotive, healthcare, and industrial automation sectors. Countries like Germany, France, and the UK are investing in AI research and AI-enabled edge computing solutions. The emphasis on energy-efficient and secure AI technologies, coupled with strong government support for digital transformation, is fostering market growth. European companies are focusing on developing neural processors optimized for local industrial and automotive applications.

Asia-Pacific Neural Processor Market Trends

Asia-Pacific is witnessing rapid growth in the neural processor market due to the expansion of AI adoption in countries such as China, Japan, South Korea, and India. Key drivers include the increasing use of autonomous vehicles, smart manufacturing, and AI-powered consumer electronics. Government initiatives promoting AI development, combined with high investments by tech giants, are accelerating market expansion. The region is also focusing on edge AI deployment and energy-efficient neural processors to meet the growing demand across industries.

Latin America Neural Processor Market Trends

Latin America is witnessing gradual growth in the neural processor market, driven by increasing adoption of AI technologies in sectors such as finance, healthcare, and industrial automation. Countries like Brazil, Mexico, and Argentina are investing in digital transformation initiatives and AI research. The rising use of smart devices, cloud computing, and edge AI applications is boosting demand for high-performance neural processors, while government support for technology adoption further fosters market expansion.

Middle East & Africa (MEA) Neural Processor Market Trends

The MEA region is experiencing steady growth in the neural processor market, fueled by AI adoption in sectors like healthcare, finance, and smart city initiatives. Countries including the UAE, Saudi Arabia, and South Africa are investing in AI infrastructure and promoting innovation in digital technologies. Increased interest in AI-enabled industrial automation, edge computing, and IoT applications is driving demand for advanced neural processors, while strategic partnerships and government-backed programs support market development.

Neural Processor Market Key Players:

Companies along with one of their manufacturers

-

NVIDIA Corporation - Tesla GPUs

-

Intel Corporation - Xeon Scalable Processors

-

Google LLC - Tensor Processing Units (TPUs)

-

Amazon Web Services, Inc. - Graviton Processors

-

Qualcomm Incorporated - Snapdragon Processors

-

IBM Corporation - IBM POWER Processors

-

Microsoft Corporation - Azure Sphere

-

AMD (Advanced Micro Devices, Inc.) - EPYC Processors

-

Graphcore Limited - Intelligence Processing Unit (IPU)

-

Apple Inc. - Apple M1 Chip

-

Baidu, Inc. - Kunlun AI Chip

-

Huawei Technologies Co., Ltd. - Ascend AI Processors

-

Micron Technology, Inc. - GDDR6 Memory

-

Xilinx, Inc. - Versal ACAP

-

Arm Holdings Limited - Cortex-A Series Processors

-

Synaptics Incorporated - ClearView AI Processors

-

Tenstorrent Inc. - Grayskull AI Processor

-

MediaTek Inc. - Dimensity Processors

-

Marvell Technology Group Ltd. - ThunderX Processors

-

Achronix Semiconductor Corporation - Speedster FPGAs

Major suppliers:

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Micron Technology

-

Foxconn Technology Group

-

Seagate Technology

-

ASE Group

-

GlobalFoundries

-

Pegatron Corporation

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Falanx (contract manufacturer)

-

Foxconn Technology Group

-

SMIC (Semiconductor Manufacturing International Corporation)

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

ON Semiconductor

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

SoftBank Group (parent company)

-

Ams AG

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

GlobalFoundries

-

TSMC (Taiwan Semiconductor Manufacturing Company)

Neural Processor Market Competitive Landscape:

Intel Corporation Founded in 1968, Intel Corporation is a global leader in semiconductor technology, specializing in the design and manufacturing of microprocessors, chipsets, and data-centric solutions. The company drives innovation across computing, AI, and cloud infrastructure, enabling high-performance, energy-efficient technologies for consumer, enterprise, and industrial applications worldwide.

-

In September 2024, Intel Corporation launched its Core Ultra 200V processors, featuring a neural processing unit that is four times faster than the previous generation, enhancing power efficiency and computational capability for laptops.

Advanced Micro Devices (AMD)Founded in 1969, Advanced Micro Devices (AMD) is a multinational semiconductor company known for its high-performance processors, graphics cards, and data center solutions. AMD delivers cutting-edge computing and visualization technologies for PCs, gaming, and enterprise applications, driving innovation in AI, cloud computing, and next-generation processing platforms globally.

-

In June 2024, Advanced Micro Devices Inc. unveiled its AI processors, including the MI325X accelerator, at the Computex technology trade show, highlighting new neural processing units designed for on-device AI tasks in AI PCs. The MI350 series is expected to deliver 35 times better inference capabilities compared to earlier models, reflecting AMD's commitment to significant performance improvements.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 275.22 Million |

| Market Size by 2032 | USD 1086.82 Million |

| CAGR | CAGR of 18.73% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Operation (Training, Inference) • By Application (Smartphones and Tablets, Autonomous Vehicles, Robotics and Drones, Healthcare and Medical Devices, Smart Home Devices and IoT, Cloud and Data Center AI, Industrial Automation and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA Corporation, Intel Corporation, Google LLC, Amazon Web Services, Inc., Qualcomm Incorporated, IBM Corporation, Microsoft Corporation, AMD (Advanced Micro Devices, Inc.), Graphcore Limited, Apple Inc., Baidu, Inc., Huawei Technologies Co., Ltd., Micron Technology, Inc., Xilinx, Inc., Arm Holdings Limited, Synaptics Incorporated, Tenstorrent Inc., MediaTek Inc., Marvell Technology Group Ltd., Achronix Semiconductor Corporation |