Organic Fruits & Vegetables Market Report Scope & Overview:

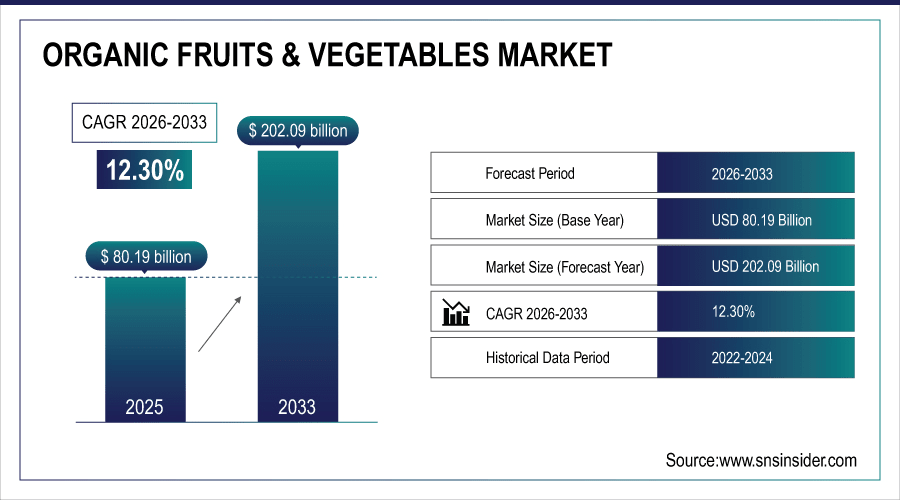

The Organic Fruits & Vegetables Market size was valued at USD 80.19 Billion in 2025E and is projected to reach USD 202.09 Billion by 2033, growing at a CAGR of 12.30% during 2026-2033.

The global market growth is driven by rising health consciousness, increasing demand for chemical-free and nutrient-rich produce, and awareness of sustainable farming practices. Expanding retail penetration, innovative organic offerings, and consumer preference for fresh, natural foods are further fueling demand. These factors position organic fruits and vegetables as a key focus in both developed and emerging markets, supporting steady growth and widespread adoption globally.

Around 60% of health-conscious consumers actively include organic fruits and vegetables in plant-based or clean-eating diets.

To Get More Information On Organic Fruits & Vegetables Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 80.19 Billion

-

Market Size by 2033: USD 202.09 Billion

-

CAGR: 12.30% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Organic Fruits & Vegetables Market Trends

-

Growing health awareness is driving consumer preference for fresh, natural, and chemical-free fruits and vegetables.

-

Concerns over pesticide residues, foodborne illnesses, and chronic health conditions are increasing demand for organic produce.

-

Organic products are perceived as more nutritious, safer, and environmentally friendly, boosting global market growth.

-

Retailers and food service providers are expanding organic offerings and promoting health benefits through marketing campaigns.

-

E-commerce, direct-to-consumer models, and subscription services are improving accessibility to organic fruits and vegetables.

-

Online platforms enhance supply chain efficiency, consumer trust through certifications, and market penetration in urban and semi-urban regions.

U.S. Organic Fruits & Vegetables Market Insights

The U.S. Organic Fruits & Vegetables Market size was valued at USD 20.85 Billion in 2025E and is projected to reach USD 43.90 Billion by 2033, growing at a CAGR of 9.74% during 2026-2033. The U.S. market growth is fueled by consumer demand for healthier, safer food options, rising disposable incomes, and strong government support for organic farming. Greater availability through supermarkets, specialty stores, and online platforms, combined with growing awareness of environmental sustainability and reduced pesticide usage, is driving adoption. These factors are encouraging widespread consumption of organic fruits and vegetables, strengthening market presence, and supporting steady growth across the country.

Organic Fruits & Vegetables Market Growth Drivers:

-

Rising Consumer Preference for Healthy and Chemical-Free Food Leading to Increased Organic Product Demand

Consumers are increasingly seeking fresh, natural, and chemical-free fruits and vegetables due to growing health awareness. Concerns over pesticide residues, foodborne illnesses, and chronic health conditions are driving preference for organic produce. Organic products are perceived as more nutritious, safer, and environmentally friendly, leading to higher demand. Retailers and food service providers are responding by expanding organic offerings, while marketing campaigns emphasize health benefits. This shift in consumption behavior ensures sustained growth, supporting market expansion globally and creating opportunities for organic fruit and vegetable producers to capture a health-conscious customer base.

Over 70% of consumers prefer fruits and vegetables labeled as organic or chemical-free.

Organic Fruits & Vegetables Market Restraints:

-

High Production Costs and Limited Yield Restricting Market Growth Potential

Organic farming involves higher labor, certification, and input costs compared to conventional agriculture. Limited crop yield due to the avoidance of synthetic fertilizers and pesticides increases production expenses. These higher costs translate to premium pricing, which can restrict adoption among price-sensitive consumers. Seasonal availability and logistical challenges further exacerbate supply limitations. Additionally, organic certification processes are time-consuming and costly, deterring small-scale farmers. These factors collectively constrain market expansion, limiting overall growth despite rising demand, and create challenges for producers and retailers in meeting consistent supply requirements globally.

Organic Fruits & Vegetables Market Opportunities:

-

Expansion of Online Retail and Direct-to-Consumer Channels Enhancing Organic Product Reach

The increasing popularity of e-commerce and home delivery services provides new avenues for organic fruit and vegetable sales. Direct-to-consumer models, subscription boxes, and online marketplaces enable consumers to access fresh organic produce conveniently. This growth in digital retail improves supply chain efficiency, reduces intermediaries, and strengthens customer engagement. Additionally, online platforms allow producers to showcase certifications, traceability, and health benefits, increasing consumer confidence. Leveraging digital channels opens opportunities for market penetration, wider audience reach, and enhanced profitability, fostering the expansion of organic fruits and vegetables in both urban and semi-urban regions globally.

Over 60% of consumers now purchase fresh fruits and vegetables online at least once a month.

Organic Fruits & Vegetables Market Segmentation Analysis

-

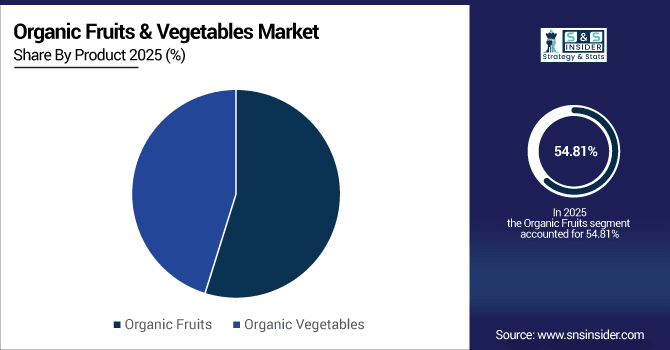

By Product, Organic Fruits led the Organic Fruits & Vegetables Market with a 54.81% share in 2025E, while Organic Vegetables is the fastest-growing segment with a CAGR of 13.46%.

-

By Form, the Fresh sector dominated the market with 38.46% share in 2025E, whereas the Frozen segment is expected to grow fastest with a CAGR of 18.18%.

-

By Category, Citrus Fruits led the market with 28.47% share in 2025E, whereas Berries is registering the fastest growth with a CAGR of 15.93%.

-

By Distribution Channel, Supermarkets/Hypermarkets held 38.62% share in 2025E, whereas Online Retail sector is growing the fastest with a CAGR of 16.59%.

By Product, Organic Fruits Leads Market While Organic Vegetables Registers Fastest Growth

Organic Fruits segment dominated the Organic Fruits & Vegetables Market with the highest revenue share of about 54.81% in 2025E due to strong consumer preference for fresh, naturally grown fruits that provide essential vitamins, antioxidants, and better taste. Companies such as Earthbound Farm have strengthened this segment by offering a wide range of certified organic fruits across retail channels. The Organic Vegetables segment is expected to grow at the fastest CAGR of about 13.46% during 2026-2033, fueled by increasing health awareness, adoption of plant-based diets, and growing consumption of leafy greens and vegetables in both households and restaurants.

By Form, Fresh Dominate While Frozen Shows Rapid Growth

Fresh segment dominated the Organic Fruits & Vegetables Market with the highest revenue share of about 38.46% in 2025E due to high consumer preference for minimally processed produce that retains nutrients and flavor. Organic Valley has expanded its fresh produce offerings, enhancing accessibility and visibility. Frozen segment is expected to grow at the fastest CAGR of about 18.18% during 2026-2033, driven by convenience, longer shelf life, and increasing demand for ready-to-cook organic vegetables, enabling consumers to maintain a healthy diet with minimal spoilage and food waste.

By Category Citrus Fruits Lead While Berries Registers Fastest Growth

Citrus Fruits segment dominated the Organic Fruits & Vegetables Market with the highest revenue share of about 28.47% in 2025E due to high demand for vitamin C-rich fruits, immune-boosting properties, and year-round availability. Driscoll’s has contributed to the growth by supplying high-quality citrus fruits with strong brand recognition. Berries segment is expected to grow at the fastest CAGR of about 15.93% during 2026-2033, supported by their antioxidant content, rising use in smoothies, desserts, and health foods, and growing popularity as a superfood among millennials and health-conscious consumers globally.

By Distribution Channel, Supermarkets/Hypermarkets Leads While Online Retail Sector Grows Fastest

Supermarkets/Hypermarkets segment dominated the Organic Fruits & Vegetables Market with the highest revenue share of about 38.62% in 2025E due to widespread availability, organized retail infrastructure, and trust in quality assurance and organic certifications. Whole Foods Market has been instrumental in this dominance by offering extensive organic selections. Online Retail segment is expected to grow at the fastest CAGR of about 16.59% during 2026-2033, as e-commerce platforms, mobile apps, and subscription-based delivery services provide convenient access to fresh organic produce, particularly in urban areas, expanding the market reach and enhancing consumer purchasing behavior through digital platforms.

Organic Fruits & Vegetables Market Regional Analysis:

North America Organic Fruits & Vegetables Market Insights

North America dominated the Organic Fruits & Vegetables Market with the highest revenue share of about 36.47% in 2025E. This is driven by high consumer awareness of health and nutrition, well-established organic certification systems, strong retail and distribution networks, and widespread adoption of sustainable and chemical-free produce, making organic fruits and vegetables a preferred choice among consumers across the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Organic Fruits & Vegetables Market Insights

The U.S. dominates North America due to high consumer awareness, well-established organic certification systems, strong retail networks, government support for organic farming, and widespread adoption of health-conscious and sustainable food practices, driving consistent demand for organic fruits and vegetables.

Asia-Pacific Organic Fruits & Vegetables Market Insights

The Asia Pacific segment is expected to grow at the fastest CAGR of about 17.04% during 2026-2033. Growth is fueled by rising disposable incomes, increasing urbanization, and greater health consciousness. Government initiatives promoting organic farming, coupled with expanding retail and e-commerce channels, are accelerating the adoption of organic fruits and vegetables, particularly in developing countries such as China and India.

China Organic Fruits & Vegetables Market Insights

China leads the Asia Pacific market due to growing urban populations, rising disposable incomes, increasing health awareness, government initiatives promoting organic agriculture, and expanding retail and e-commerce channels, resulting in higher adoption of organic fruits and vegetables across the country.

Europe Organic Fruits & Vegetables Market Insights

Europe holds a significant share in the Organic Fruits & Vegetables Market due to strong consumer awareness of health and sustainability, well-established organic certification standards, and widespread availability through supermarkets and specialty stores. Increasing demand for chemical-free, nutritious produce, coupled with government support for organic farming and eco-friendly practices, is driving market growth and encouraging higher adoption of organic fruits and vegetables across the region.

Germany Organic Fruits & Vegetables Market Insights

Germany dominates Europe’s organic fruits and vegetables market due to strong consumer preference for chemical-free, nutritious produce, well-established certification systems, widespread retail availability, and supportive government policies promoting sustainable farming, driving consistent demand and adoption across the country.

Latin America (LATAM) and Middle East & Africa (MEA) Organic Fruits & Vegetables Market Insights

The Middle East & Africa organic fruits and vegetables market is led by the UAE, driven by rising health awareness, disposable incomes, and expanding retail networks. In Latin America, Brazil dominates due to favorable farming conditions, growing consumer preference for pesticide-free produce, and increasing adoption through supermarkets and e-commerce channels.

Organic Fruits & Vegetables Market Competitive Landscape:

Danone S.A. is a global leader in the food and beverage industry, committed to health, nutrition, and sustainability. Through its subsidiary Earthbound Farm, the company provides high-quality organic produce. Its Organic Baby Spinach is rich in vitamins and antioxidants, while Organic Mixed Berries offer a flavorful, nutrient-dense option for consumers seeking chemical-free, naturally grown fruits. Both products highlight Danone’s focus on delivering safe, nutritious, and environmentally responsible organic offerings globally.

-

In July 2024, Earthbound Farm introduced an innovative plant-based tray made from recycled plant fibers, reducing plastic use by 95%. This eco-friendly packaging aligns with growing consumer demand for sustainable products. The move reflects Danone's commitment to sustainability and consumer preferences for environmentally responsible packaging.

Dole Food Company, Inc. is one of the world’s largest producers and marketers of fresh fruits and vegetables, emphasizing quality and sustainability. Its Organic Bananas are grown without synthetic pesticides, offering a healthy and convenient snack, while Organic Strawberries are carefully cultivated to ensure freshness, taste, and high nutritional value. Dole’s extensive distribution network and commitment to eco-friendly farming practices strengthen its leadership in supplying premium organic fruits to global consumers.

-

In September 2024, Dole launched its "Go Organic!" range across Ireland, featuring 30 organic product lines, including organic bananas and pineapples. The initiative aims to make organic produce more accessible and appealing to a broader consumer base. Dole's focus is on engaging younger shoppers and expanding the organic market presence.

Driscoll’s, Inc. is a leading supplier of premium berries with a strong focus on organic and sustainable farming practices. Its Organic Blueberries are known for superior taste, antioxidant content, and chemical-free cultivation, while Organic Raspberries provide a nutrient-rich, fresh, and flavorful option. Driscoll’s dedication to quality, environmental responsibility, and health-conscious products ensures that its organic fruits consistently meet consumer expectations for safety, freshness, and nutritional benefits globally.

-

In July 2025, Driscoll’s Sweetest Batch blackberries won Good Housekeeping’s 2025 Snack Awards, highlighting the company's dedication to quality and innovation. Additionally, in 2024, Driscoll’s was named to Fast Company's list of the World's Most Innovative Companies, underscoring its leadership in berry innovation and sustainable practices.

Organic Fruits & Vegetables Market Key Players:

Some of the Organic Fruits & Vegetables Market Companies are:

-

Danone S.A.

-

General Mills, Inc.

-

The Hain Celestial Group, Inc.

-

Organic Valley

-

United Natural Foods, Inc. (UNFI)

-

Greenyard NV

-

Dole Food Company, Inc.

-

Grimmway Farms

-

Fresh Del Monte Produce Inc.

-

Zespri International Ltd.

-

Amy’s Kitchen, Inc.

-

SunOpta Inc.

-

Driscoll’s, Inc.

-

Nature’s Path Foods, Inc.

-

Earthbound Farm (a subsidiary of Danone)

-

Cal-Organic Farms

-

Fruitable Fresh

-

DMH Ingredients, Inc.

-

Windmill Organics Ltd.

-

Jaivik Foods

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 80.19 Billion |

| Market Size by 2033 | USD 202.29 Billion |

| CAGR | CAGR of 12.3% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Seaweed, Legume Protein, Plant-based omega-3, Soy Protein, Pea Protein, Others [quinoa, oats, beans, and seeds]) • By Product Type (Breaded Vegan Shrimp, Crunchy Coconut Shrimp, Crispy Vegan Shrimp, Raw Vegan Shrimp) • By Distribution Channel (B2B, B2C [Store-based Retailing, Online Retailing]) • By End-Use (Food Service Industry, Household, Retail) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Danone S.A., General Mills, Inc., The Hain Celestial Group, Inc., Organic Valley, United Natural Foods, Inc. (UNFI), Greenyard NV, Dole Food Company, Inc., Grimmway Farms, Fresh Del Monte Produce Inc., Zespri International Ltd., Amy’s Kitchen, Inc., SunOpta Inc., Driscoll’s, Inc., Nature’s Path Foods, Inc., Earthbound Farm (a subsidiary of Danone), Cal-Organic Farms, Fruitable Fresh, DMH Ingredients, Inc., Windmill Organics Ltd., Jaivik Foods. |