Packaging Automation Market Report Size and Analysis:

The Packaging Automation Market size was valued at USD 70.94 billion in 2023 and is expected to reach USD 136.98 billion by 2032, growing at a CAGR of 7.59% over the forecast period of 2024-2032

Packaging that does not require human assistance is called packaging automation. It is a sensible strategy to remove unnecessary work, allowing manufacturers and packaging companies to make more use of fewer resources. The introduction of packaging automation reduces labor dependency and increases packaging efficiency and reproducibility. In addition, overall packaging costs are reduced and packaging quality is improved. Due to automated devices, production processes have become more productive and efficient. Manufacturers are increasingly using automated machines to pack their goods and products as they are efficient and can reduce labor costs and time. Automation is used in the manufacturing industry for many advantages such as increased flexibility, safe working conditions, strict quality, reduced waste, and affordability. In addition, the introduction of programming capabilities into these machines, based on product labeling and presentation needs, allows for versatility and non-repetitiveness of tasks and activities.

Market Size and Forecast:

-

Market Size in 2023: USD 70.94 Billion

-

Market Size by 2032: USD 136.98 Billion

-

CAGR: 7.59% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

Get More Information on Packaging Automation Market - Request Sample Report

The rise in demand for productivity, industrialization, manufacturing process improvements and increasing utilization of automation in multiple industries including food & beverage, pharmaceutical, and cosmetics are believed to drive the growth of this market. However, the introduction of packaging automation solutions in the industrial sector is hampered by the high initial costs associated with setting up an automation system. Increased demand for customized packages and government measures to support digital transformation in APAC should also provide great potential for market participants. However, one of the biggest obstacles to the expansion of this market is the lack of trained personnel to operate automation equipment.

Rising disposable incomes and developing living standards have increased the demand for robust packaging solutions that ensure the resilience and durability of goods in transit. These considerations have led manufacturers in the healthcare, e-commerce packaging and logistics, and food and beverage industries to adopt sophisticated packaging solutions to accelerate production and embrace mass production concepts.

Packaging Automation Market Trends:

-

Increasing demand for high-speed, efficient, and error-free packaging solutions across food & beverage, pharmaceuticals, and e-commerce sectors is driving automation adoption.

-

Rising labor costs and workforce shortages are accelerating the shift toward robotic and automated packaging systems.

-

Growing emphasis on sustainable packaging and reduced material wastage is boosting demand for advanced automated solutions.

-

Rapid expansion of e-commerce and logistics industries is increasing the need for smart labeling, sorting, and palletizing technologies.

-

Integration of AI, IoT, and Industry 4.0 technologies is enhancing real-time monitoring, predictive maintenance, and operational efficiency.

-

Investments in flexible and modular packaging systems are enabling manufacturers to handle diverse product formats and improve production agility.

Packaging Automation Market Key Drivers

-

An efficient and automated packaging solution is needed as a result of the increasing e-commerce industry

E-commerce is one of the growing markets around the world that are looking to online shopping. Emerging countries such as India and China are experiencing significant growth in online shopping. The growth of the e-commerce sector has greatly increased the need for packaging equipment at all stages of e-commerce manufacturing, including primary and secondary packaging, labeling, product identification and marking. In addition, product packaging has a significant impact on customer purchasing decisions as it helps keep your goods safe and differentiate your business through eye-catching and creative imagery.

-

Awareness of the integration of supply chains continues to grow.

Packaging Automation Market Restraints

-

As compared to conventional packing, packaging automation is costly.

Packaging Automation Market Opportunities

-

Technological advancements in this sector are driving the market.

With this cutting-edge technology, you can easily monitor your packaging machines from anywhere using your desktop computer, mobile device, or laptop. These cutting-edge technologies have made it easier for production workers to assess the effectiveness and consistency of such automated systems. The remote control can also send key policies that remotely enable or disable machine features, helping to identify and troubleshoot faults.

-

Significant growth opportunities are being seen in the pharmaceutical industry.

Packaging Automation Market Challenges

-

In the field of automation, there is a shortage of qualified workers.

Impact of Russia-Ukraine War

Exports of packaging machinery from Russia amounted to 53 units, from 28 Russian exporters to 25 buyers, according to Volza's Russian export data. In particular, Moldova, India and Turkey are among the main export markets of Russian packaging machinery. India is the largest exporting country of packaging machinery with 120,600 units followed by China with 90,000 and Germany with 54,800.

As far as Russian import data are concerned, 882 consignments of packaging machines imported into Russia were imported by 211 Russian importers from 154 suppliers according to Volza. In particular, Turkish, Indian, and Brazilian packaging machinery is imported by Russia. Vietnam's 129,500 units have been the top 3 importers for packaging machinery followed by the United States with 99,100 and India with 90,600.

Due to trade disruptions export and imports were affected due to the war. There was a downfall in shipments and production was affected.

Impact of Ongoing Recession

Recession decreases the packaging needs which will affect the market for packaging automation. During a recession, general economic uncertainty may make companies reluctant to invest in new packaging automation machinery. This could reduce demand for packaging. Market research shows that the industry's spending could fall by 45% during a recession. This will have a major impact on the packaging market.

In 2022, the supply and demand for packaging materials decreased. This is due to lower consumer spending due to the looming recession and rising interest rates.

Key Market Segmentation

By Automation Type

-

Tertiary & Palletizing Automation

-

Secondary Packaging Automation

-

Automated Conveyer & Sorting Systems

By Offering

-

Solution

-

Services

By Function

-

Labeling

-

Capping

-

Bagging

-

Filling

-

Palletizing

-

Others

By Industry Application

-

Healthcare

-

Food & Beverages

-

Personal Care & Cosmetics

-

Aerospace & Defence

-

Automotive

-

Others

Regional Analysis

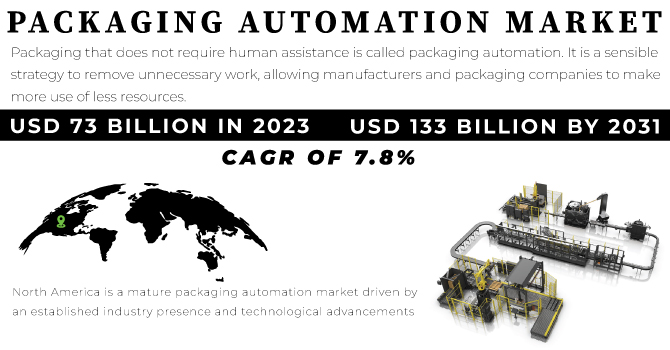

North America is a mature packaging automation market driven by an established industry presence and technological advancements. The region's focus on efficiency, sustainability and reduced labor costs has led to widespread acceptance of automated packaging solutions. Major countries contributing to the market include the United States and Canada.

Europe is a major packaging automation market characterized by strict regulations and a focus on sustainability. The region has a strong presence in pharmaceuticals, food and beverages, and e-commerce, driving demand for automated packaging solutions. Countries such as Germany, UK, and France contribute significantly to the market.

Asia Pacific is undergoing rapid industrialization and urbanization, resulting in increased demand for automated packaging solutions. China, Japan, India and South Korea are major market players, driven by the burgeoning e-commerce sector and the need for efficient packaging processes. The region has great growth potential due to its large consumer base and expanding manufacturing activity.

In Latin America, the market for packaging automation is growing due to increasing industrialization and urbanization in countries such as Brazil and Mexico. The food and beverage industry and expanding e-commerce sector are key drivers of automated packaging solutions in the region.

The Middle East and Africa packaging automation market continues to evolve with increasing investments in areas such as food processing, pharmaceuticals, and logistics. Countries such as Saudi Arabia, South Africa and the United Arab Emirates are seeing growth in automated packaging solutions due to the need for increased productivity and efficiency.

To Get a Customized Report as per your Business Requirement - Request For Customized Report

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Packaging Automation market are Rockwell Automation, Mitsubishi Electric Corporation, Automated Packaging Systems, Emerson Electric Company, Linkx Packaging, SATO Holdings, Multivac Group, ULMA Packaging, ABB Limited, Ranpak, and other players.

Automated Packaging Systems-Company Financial Analysis

Recent Developments

-

The Numina Group has launched a Pakt, which the company says is an entirely finished productized pack and ship automation solution specially built for fulfillment operations.

-

RanPak, a provider of paperboard packaging solutions for online and industrial supply chains, has launched "Flapit!", which is a highly effective machine to pack many small products at once.

-

Osaro's working with Sealed Air to demonstrate the robot bagging system.

| Report Attributes | Details |

| Market Size in 2023 | USD 73 Bn |

| Market Size by 2031 | USD 133 Bn |

| CAGR | CAGR of 7.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Automation Type (Packaging Robots, Tertiary & Palletizing Automation, Secondary Packaging Automation, Automated Conveyer & Sorting Systems) • By Offering (Solution, Services) • By Function (Labelling, Capping, Bagging, Filling, Palletizing, Others) • By Industry Application (Healthcare, Food & Beverages, Personal Care & Cosmetics, Aerospace & Defence, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Rockwell Automation, Mitsubishi Electric Corporation, Automated Packaging Systems, Emerson Electric Company, Linkx Packaging, SATO Holdings, Multivac Group, ULMA Packaging, ABB Limited, Ranpak |

| Key Drivers | • An efficient and automated packaging solution is needed as a result of the increasing e-commerce industry • Awareness of the integration of supply chains continues to grow. |

| Market Restraints | • As compared to conventional packing, packaging automation is costly. |

Frequently Asked Questions

Ans. Growth of e-commerce sector is driving the market.

Ans. Technological advancements in this sector are driving the market.

Ans. North American region is the leading market of Packaging automation.

Ans. The Packaging Automation Market size was USD 73 billion in 2023.

Ans. The Packaging Automation market will grow at a CAGR of 7.8%.