E-Commerce Packaging Market Key Insights:

Get More Information on E-Commerce Packaging Market - Request Sample Report

The E-Commerce Packaging Market size was USD 70 billion in 2023 and is expected to Reach USD 162.37 billion by 2032 and grow at a CAGR of 9.8 % over the forecast period of 2024-2032.

The industry is expected to grow as a result of factors like rising internet and smartphone penetration, economic expansion, and rising online spending. However, the lack of first-hand product experience prior to purchase and the low penetration of online businesses in rural areas of the world are likely to be significant growth inhibitors for the sector. The U.S after China is the world's largest e-commerce market. During the anticipated years, the country is expected to experience consistent and significant growth. The rising dependence of consumers on online shopping, the high level of consumer spending power, and the growing use of smartphones and the internet in the nation are some of the factors boosting the growth of this industry. An expanding market in the U.S is food e-commerce.

In 2023, the global industry was dominated by the corrugated box product segment, which brought in more than 35 % of the total revenue. The high share was primarily attributed to the rise in demand for green packaging products with high strength and sustainability, like corrugated boxes. Additionally, consumers' increasing reliance on online delivery of goods is probably going to increase demand for corrugated box packaging.

MARKET DYNAMICS

KEY DRIVERS:

-

The e-commerce sector is seeing an increase in demand for Sustainable Plastic Packaging.

In the coming years, the e-commerce sector's rising need for plastic-based packaging is anticipated to fuel market expansion. This is because of the e-commerce industry's dependency on plastic-based packaging. When compared to paper, wood, and corrugated board, this material is widely accessible, inexpensive, and lightweight. Additionally, the increased sales of grocery items with a doorstep delivery strategy boosted the demand for plastic-based packaging.

-

Increasing e-commerce platform demand for food and drinks.

RESTRAIN:

-

Strict Regulations against the use of plastic packaging.

Due to the widespread use of non-biodegradable plastic and the introduction of strict government regulations by various governments, the market size for e-commerce packaging has been negatively impacted. These limitations are the main obstacles to market expansion.

OPPORTUNITY:

-

Growing demand in the e-commerce industry for eco-friendly packaging.

The market is expected to see new opportunities as a result of the rising demand for eco-friendly packaging in e-commerce. The demand for e-commerce packaging during the forecast period would increase by initiatives taken by major players.

-

The market will be expanded by the growing number of smartphone users.

CHALLENGES:

-

The lack of recycling facilities will hinder growth.

The lack of recycling facilities is the main challenge in the growth of the e-commerce packaging market. Recyclable packaging contributes to environmental preservation and smart infrastructure development, both of which are crucial for the market. Thus, during the forecast period, this will restrain the growth of the e-commerce market.

IMPACT OF RUSSIAN UKRAINE WAR

Food and grocery costs tend to go up for eCommerce customers. Businesses might also fail to offer customers the discounts they want. This is due to the fact that Russia, which even outsells the US in terms of export volume, is a significant global supplier of wheat. Along with this, Russia and Ukraine are referred to as the "BreadBasket" of Europe because they provide 25% of the continent's maize and 35% of its wheat. Fewer exports during the War affected the e-commerce packaging market, due to less production and availability of fewer resources. The cost of food packaging material also increased which affected the food and beverage packaging.

Russia is also one of the leading exporters of metals such as aluminium, and steel. The shortage of the export of this material affected the e-commerce industry.

The production and marketing of cosmetics and other personal care products took a severe hit as a result of the rise in crude oil prices and the scarcity of petrochemicals due to the war. Renowned cosmetic companies may even decide to stop producing their entire product lines and eliminate promotions as a result of the rising costs of packaging materials.

IMPACT OF ONGOING RECESSION

In times of economic downturn, brands frequently reduce spending and supply costs. As a result, it may be tempting to buy packaging from foreign producers that is "one size fits all.". These options include plain brown boxes or envelope mailers made of low-quality printing materials. The financial performance of a brand may ultimately suffer if this course of action is taken.

Imported packaging of poor quality increases the possibility of product damage, as well as returns and disgruntled customers. Furthermore, void-filling techniques are frequently needed with these one-size-fits-all solutions, which raises the price. Buying imported boxes may initially save brand money, but in the long run, they will probably end up spending more on reverse logistics and returns processing.

KEY MARKET SEGMENTS

By Raw Material

-

Plastic

-

Wood

-

Corrugated Board

By Product Type

-

Corrugated Box

-

Tapes

-

Mailers

-

Poly Bags

-

Protective Packaging

-

Others

By Application

-

Personal Care

-

Pharmaceutical

-

Household

-

Electronics & Electrical

-

Food & Beverages

-

Others

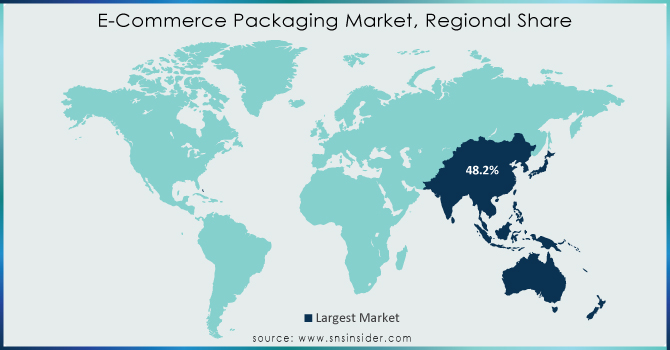

REGIONAL ANALYSIS

The market was dominated by Asia Pacific, which in 2023 had a revenue share of over 48.2%. Due to rising mobile internet usage and shifting lifestyles, the region is anticipated to experience rapid growth over the forecast period. Asians are embracing urban lifestyles and a culture that is more focused on work, so the availability of free time is less. As a result, consumers are slowly moving their shopping to e-commerce platforms. As a result, the demand for shipping supplies is rising along with the Asia Pacific region's increasing reliance on e-commerce.

In addition, the Asia Pacific region is seeing an increase in the adoption of technologies like blockchain, AIML, IoT, and 5G wireless systems, which are reshaping the online business landscape by, among other things, lower costs, and improving Advertisements. The market is predicted to grow significantly as a result of improved technologies combined with an e-commerce platform, which will also lead to an increase in the demand for packaging materials for product shipping.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin American

Key Players

Some major key players in the E-commerce packaging market are Alpha Packaging, Amcor Plc, Transcontinental Inc, WINPAK Ltd, ALPLA, CCL Industries, Mondi, Coveris, Constantia Flexibles, Berry Global Group Inc, and other players.

RECENT DEVELOPMENTS

-

Europe, New legislation, which will be unveiled by the European Commission soon, will for the first time include restrictions on packaging size and the amount of "empty space" in boxes that online retailers ship across Europe.

-

Smurfit Kappa, A new online retail "boutique" for the packaging industry has been opened by Smurfit Kappa in the Dominican Republic.

| Report Attributes | Details |

| Market Size in 2023 | US$ 70 Bn |

| Market Size by 2032 | US$ 162.37 Bn |

| CAGR | CAGR of 9.8 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Plastic, Paper & Paperboards, Wood, Corrugated Board) • By Product Type (Corrugated Box, Tapes, Mailers, Poly Bags, Protective Packaging, Others) • By Application (Personal Care, Pharmaceutical, Household, Electronics & Electrical, Food & Beverages, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Alpha Packaging, Amcor Plc, Transcontinental Inc, WINPAK Ltd, ALPLA, CCL Industries, Mondi, Coveris, Constantia Flexibles, Berry Global Group Inc |

| Key Drivers | • The e-commerce sector is seeing an increase in demand for plastic-based packaging. |

| Market Opportunities | • Growing demand in the e-commerce industry for eco-friendly packaging. |