Palm Oil Market Report Scope & Overview:

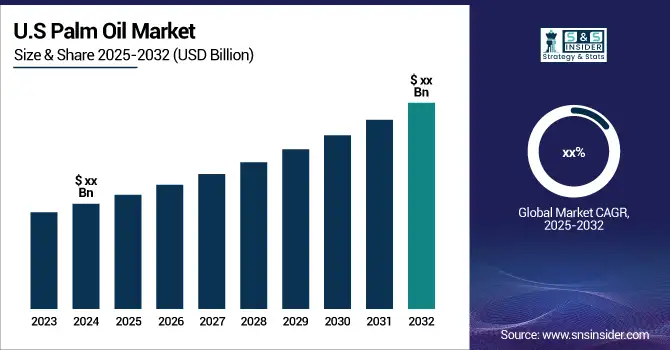

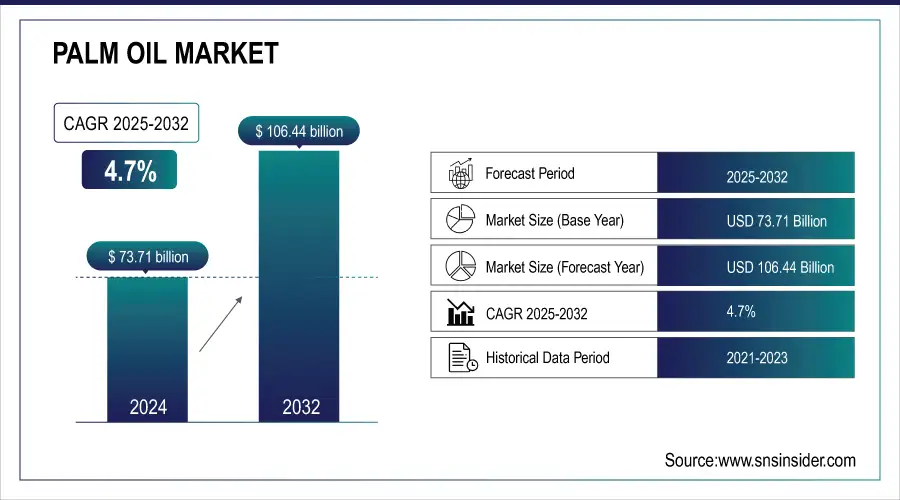

The Palm Oil Market Size was valued at USD 73.71 billion in 2024, and is expected to reach USD 106.44 billion by 2032, at a CAGR of 4.7% from 2025 to 2032.

The palm oil market is shaped by rising global demand, sustainability efforts, and geopolitical factors. Key players like Wilmar International, Sime Darby Plantation, IOI Corporation, and Golden Agri-Resources adapt to evolving conditions. Latin American exports surged to record levels in May 2024, led by Colombia. Global production increased 2% in March 2024 compared to the previous year. Major producers in Indonesia and Malaysia, including Musim Mas and Bumitama Agri, are expanding capacity, while sustainability initiatives and certifications support continued market growth.

Palm Oil Market Size and Forecast:

-

Market Size in 2024: USD 73.71 Billion

-

Market Size by 2032: USD 106.44 Billion

-

CAGR: 4.7% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Get More Information on Palm Oil Market - Request Sample Report

Palm Oil Market Highlights:

-

Rising consumer demand for sustainable palm oil in food, cosmetics, and biofuel industries driving market expansion

-

Palm oil preferred by manufacturers for high yield, versatility, stability, and cost-effectiveness

-

Growth of the biofuel industry using palm oil as a key feedstock for biodiesel increasing overall demand

-

Environmental challenges such as deforestation, habitat loss, and biodiversity concerns restraining market growth

-

Regulatory and consumer pressure encouraging producers to adopt more sustainable practices

-

Advancements in sustainable production technologies, precision agriculture, and certification initiatives creating opportunities for market growth and environmental benefits

Palm Oil Market Drivers:

-

Increasing Consumer Demand for Sustainable Palm Oil Products Across Food, Cosmetics, and Biofuel Industries Propel Market Expansion

The move toward sustainability has given the palm oil market an immense boost, especially in the food and cosmetics sectors. With growing environmental concerns, consumers demand ingredients that are sustainably sourced. Palm oil produces much higher yields per hectare than other vegetable oils and has become the first choice for those manufacturers who want to be sustainable without sacrificing too much in costs. Major food and cosmetics brands now promise to use only certified palm oil from suppliers ranked under the Roundtable on Sustainable Palm Oil (RSPO).

Such a commitment not only will help keep up the sustainability of the supply chain but also enhance their reputation with environmentally conscious consumers. Given the versatility, stability, and not too steep a price, compared to other oils, palm oil, increasing demand for this item in products as varied as baked goods to cosmetic care underlined its course. This, from a biological perspective, meant the market would also experience pretty dramatic growth along the palm oil market trends wherein consumers will also be leaving room for production based on sustainability by producers.

-

Growing Biofuel Industry Increasingly Utilizes Palm Oil as a Key Feedstock for Biodiesel Production, Further Augmenting Market Growth

The growing biofuel industry will therefore be a significant driver for the palm oil market moving forward. In many countries, the governments have focused on reducing the amount of greenhouse gas emissions as well as energy dependence on fossil fuels by replacing these with renewable sources of energy. Biofuels have therefore emerged rapidly as an alternative form of energy from fossil fuels with growing usage of palm oil feedstock for the production of biodiesel whose physical attributes are considered to be favorable.

Indonesia and Malaysia, the largest producers of palm oil globally, have established blending mandates for biodiesel to support their renewable energy policies. Growing demand for biodiesel increases total palm oil usage but provides economic incentives for producing palm oil. Improved technology will further facilitate the introduction of palm oil to the biofuel industry with the creation of more efficient ways of producing biofuel. Increased investment and innovation in optimizing palm oil use in biofuels will, in the near future, be attributed to the increasing need for renewable energy globally.

Palm Oil Market Restraints:

-

Environmental Impact of Palm Oil Production Including Deforestation, Habitat Loss, and Biodiversity Concerns

Despite palm oil’s advantages, the palm oil industry has critical issues with environmental challenges such as deforestation and biodiversity loss. At the beginning of expansion for palm oil plantations, it is well-documented that they typically take over tropical rainforests, which further leads to the loss of other precious ecosystems. Apart from direct threats to wildlife habitats, these causes of deforestation also contribute to rising levels of carbon dioxide in the atmosphere from stored carbon dioxide. Furthermore, the biodiversity lost in palm oil plantation activity results in potential risks to the stability and resilience of ecosystems.

Due to growing awareness among the people regarding these matters, consumers and activists are now demanding that there be sustainable practices related to the production of palm oil. This has been met with pressure from regulatory authorities on producers them to adopt more environment-friendly practices, thereby putting added cost pressures on producers and affecting profit margins accordingly. As a result, companies producing palm oil will feel the pressure to satisfy the demand of consumers but at the same time address the environmental implications in sourcing. Growth in the market and sustainability might have a great restraint on the palm oil industry in the future.

Palm Oil Market Opportunities:

-

Advancements in Sustainable Palm Oil Production Practices Creating Pathways for Market Growth and Environmental Benefits

Innovations in sustainable production practices may present opportunities for palm oil market development and adoption as consumers continue to ask for more responsibly sourced products, and increasing the sustainability of palm oil cultivation is important. Several initiatives-agroforestry, precision agriculture, cover crops-would enhance the environmental performance of palm oil plantations. The above practices reduce deforestation, improve soil quality, and also enhance biodiversity.

For instance, new technologies, such as remote sensing and data analytics, are now enabling farmers to increase their yields while minimizing harm to the environment. Lastly, combining the efforts of the farmers, NGOs, and government institutions can start certification schemes to promote such sustainable practices. This shift toward innovation benefits producers with both economic advantages-open increasing markets and consumer trust-and sustainable production in the long run, as is the case with palm oil becoming an important agriculture commodity. Sustainability can focus on positioning palm oil as a flagship in responsible sourcing and environmental stewardship.

Palm Oil Market Segment Analysis:

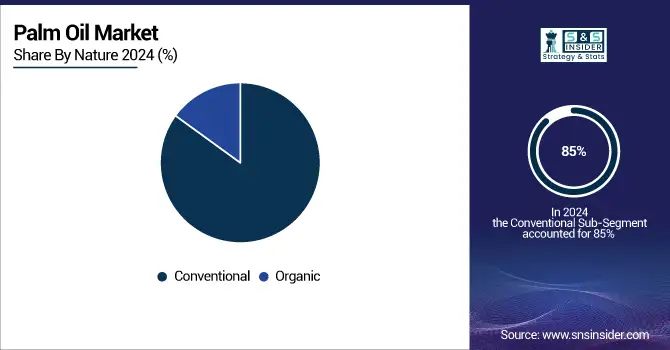

By Nature

In 2024, the conventional segment dominated capturing an estimated palm oil market share of approximately 85%. Conventional palm oil accounts for the largest share of the total production since it is readily available and has a lower production cost compared to organic palm oil. Production of conventional palm oil occurs through traditional farming practices that often involve the use of chemical fertilizers and pesticides, which enhance yield and profitability by very high margins for the farmer.

For instance, Indonesia and Malaysia, producers of the majority of the palm oil globally, rely considerably on traditions and this will enable them to provide big chunks of global appetite in food, cosmetics, and the fast-growing biofuel markets. Cost is also another aspect on the side of conventional palm oil as cheaper palm oil can be sourced by most manufacturers in most price-sensitive markets. Despite growing adoption by health-conscious consumers and environmentally conscious brands, organic palm oil remains scarce, and it tends to have a premium price. Large producers Unilever and Nestlé are starting to introduce more sustainable options into their products; still, conventional sources account for far more of total production.

By Product Type

In 2024, Crude Palm Oil (CPO) dominated the Palm Oil Market, holding an estimated market share of approximately 48%. The dominant base for Crude Palm Oil is its versatility nature and wide application in industries. CPO is widely used in food applications, such as different cooking oils, margarines, and processed foods, and is thus very commonly found in households and food manufacturing processes. The major palm oil producers include countries like Indonesia and Malaysia. It exports most of its CPO to global markets. Global markets further refine it into products, such as Refined Bleached Deodorized (RBD) Palm Oil and Palm Kernel Oil.

High yield CPO, along with relatively lower cost in comparison to refined products, makes it an attractive choice for manufacturers in need of keeping their cost of goods sold competitive. Also, the rising demand of biodiesels is helping the positive aspect of the CPO segment due to its increased use as feedstock in the production of biodiesel, thereby further expanding the market. Other types of products produced in addition to CPO, for instance, RBD Palm Oil, and the Palm Kernel Oil, enhance the market, but CPO is the largest due to its extensive application and cost-effective properties.

By End-Use

In 2024, the Food & Beverage segment dominated the Palm Oil Market, accounting for an estimated market share of approximately 60%. The main promoter of dominance for the Food & Beverage segment is the fact that palm oil is widely used as a component in cooking oils, margarine, and other processed foods. Palm oil has exceptional properties, fitting extremely well with high-heat stability and extended shelf life, making it a preference for manufacturers within the food space.

For instance, large food companies including Nestlé and Unilever utilize this ingredient in a broad product portfolio, ranging from snack foods to baked products in a bid to fulfill consumers' demands for cheap, multi-purpose ingredients.

Moreover, the rising demand for palm oil in emerging markets is attributed to the fact that it is cheaper than other oils in many markets, and this development has further solidified the market position of the segment. With the increasing health consciousness of consumers, the food industry too is headed toward sustainably sourcing palm oil coupled with initiatives for responsible sourcing practices, thereby enhancing the appeal for that segment. While there is a share of other end-use applications, such as Biofuel & Energy, Personal Care & Cosmetics, and Food & Beverage is the largest and most influencing of all so far and has thus led the market concerning overall consumption of palm oil.

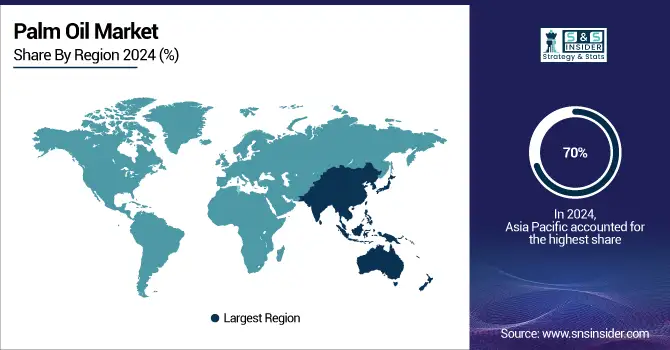

Palm Oil Market Regional Analysis:

Asia-Pacific Palm Oil Market Trends:

In 2024, Asia Pacific dominated the palm oil market with approximately 70% market share. Major producers and consumers such as Indonesia and Malaysia, producing over 85% of global palm oil, benefit from favorable climate, extensive plantations, and supportive policies. High urban population growth and rising demand in food, cosmetics, and biofuels continue to drive consumption.

Need any customization research on Palm Oil Market - Enquiry Now

Africa Palm Oil Market Trends:

Africa emerged as the fastest-growing region in 2024 with a CAGR of 8%. Investments in plantations and processing facilities, especially in Nigeria and Ghana, are enhancing production to meet local and international demand. Efforts to reduce imports, improve infrastructure, and expand applications in food, personal care, and biofuels support market growth.

North America Palm Oil Market Trends:

North America relies heavily on imports for its palm oil supply, primarily for processed foods, snacks, and industrial applications. Increasing consumer awareness of health and sustainability issues is prompting a shift toward certified sustainable palm oil. The U.S. and Canada remain key markets for both edible and industrial uses, with steady demand growth expected.

Europe Palm Oil Market Trends:

Europe’s palm oil market is influenced by stringent sustainability regulations and environmental policies. Countries like Germany, the Netherlands, and Italy import palm oil mainly for food processing, cosmetics, and biodiesel production. Growing demand for sustainable and certified palm oil is driving adoption of RSPO-certified products while reducing environmental impact.

Latin America Palm Oil Market Trends:

Latin America, led by Brazil and Colombia, is gradually expanding palm oil cultivation and processing to meet domestic demand and export opportunities. Investments in mechanized plantations and modernization of processing units are enhancing production efficiency. Rising use of palm oil in food, cosmetics, and biodiesel supports regional market growth.

Middle East Palm Oil Market Trends:

In the Middle East, palm oil is primarily imported to meet demand in cooking oils, processed foods, and bakery products. Countries such as Saudi Arabia and the UAE are major importers. Growing population, rising disposable income, and industrial food processing are driving market growth. In Africa, local production is expanding alongside rising consumption and export potential.

Palm Oil Market Key Players:

-

Wilmar International Ltd.

-

Sime Darby Plantation Berhad

-

IOI Corporation Berhad

-

Kuala Lumpur Kepong Berhad

-

Golden Agri-Resources Ltd.

-

PT Astra Agro Lestari Tbk

-

United Plantations Berhad

-

IJM Corporation Berhad

-

Bumitama Agri Ltd.

-

Sampoerna Agro Tbk

-

Genting Plantations Berhad

-

Okomu Oil Palm Company Plc

-

Sarawak Oil Palms Berhad

-

First Resources Ltd.

-

Indofood Agri Resources Ltd.

-

PP London Sumatra Indonesia Tbk

-

Kulim Berhad

-

Godrej Agrovet Ltd.

-

Adani Wilmar Ltd.

-

Anglo-Eastern Plantations plc

Palm Oil Market Competitive Landscape:

Wilmar International Ltd., Established in 1991, is a leading agribusiness group involved in palm oil cultivation, processing, and trading. The company operates across the entire value chain, including edible oils, oleochemicals, and biodiesel. It has a global presence and focuses on sustainable practices and expanding food and nutrition markets.

-

In June 2025, Wilmar International is acquiring the remaining 50% stake in PZ Wilmar from PZ Cussons for USD70 million, gaining full ownership of the Nigerian palm oil business. The move aims to expand into Nigeria’s food and nutrition market, tapping opportunities in a country with over 200 million consumers.

Sime Darby Plantation Berhad, Established in 1910, is one of the world’s largest palm oil producers by acreage. The company engages in plantation management, palm oil cultivation, and downstream processing. It focuses on sustainability, renewable energy initiatives, and diversification into green industrial projects to enhance long-term revenue and environmental stewardship.

-

In May 2024, Sime Darby Plantation is co-developing the 1,000-acre Kerian Integrated Green Industrial Park with PNB in Perak, converting less productive plantation land into solar farms and exploring data centre developments to create new sustainable revenue streams and support green E&E investments.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 73.71 Billion |

| Market Size by 2032 | USD 106.44 Billion |

| CAGR | CAGR of 4.7% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Nature (Organic, Conventional) • By Product Type (CPO, RBD Palm Oil, Palm Kernel Oil, Fractionated Palm Oil) • By End-use (Food & Beverage, Personal Care & Cosmetics, Biofuel & Energy, Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Wilmar International Ltd., Sime Darby Plantation Berhad, IOI Corporation Berhad, Golden Agri-Resources Ltd., Felda Global Ventures Holdings Berhad, Musim Mas Holdings, Cargill Inc., Bumitama Agri Ltd., Kuala Lumpur Kepong Berhad (KLK), First Resources Ltd. and other key players |