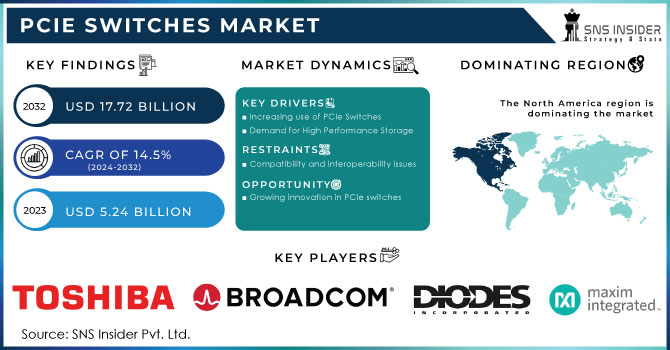

PCIe Switches Market Size & Overview:

The PCIe Switches Market was valued at USD 1.78 billion in 2023 and is expected to reach USD 4.80 billion by 2032, growing at a CAGR of 11.70% over the forecast period 2024-2032. The PCIe Switches market is propelled by rising adoption in data centers, automotive and industrial applications, and growing deployment in artificial intelligence, cloud computing, and high-performance computing. On the technology front, ever-growing PCIe Gen4 and Gen5 functions help in all categories of bandwidth, latency, and scale giving rise to lower latency in working with a huge amount of data. The production of semiconductors influences supply chain dynamics, with availability fluctuations affecting the deployment timeline. Expected growth is coupled with increasing demand from applications including autonomous vehicles, 5G, and IoT, as PCIe switches become indispensable for seamless connectivity for high bandwidth processing across numerous end-user-specific applications spanning AI workloads to real-time industrial automation.

Get more information on PCIe Switches Market - Request Sample Report

Market Dynamics

Key Drivers:

-

Rising Demand for PCIe Switches Driven by AI Cloud Computing Data Centers and Automotive Innovations

PCIe Switches are key components that facilitate data exchange between devices within a PCIe network. The PCIe Switches are being driven within high-performance computing applications due to the larger demand for large-scale data processing and faster interconnection in the data centers. In addition, the quick adoption of cloud computing, AI, and ML technologies is also driving demand for more high-end interconnects, such as PCIe. In automotive, the increase in electric vehicle (EVs) power supply and the development of autonomous driving technology that needs to process/communicate large data amounts among sensors is pushing the need for advanced PCIe Switches.

Restrain:

-

Challenges in PCIe Switches Market Due to Backward Compatibility Complexity and Performance Bottlenecks in Applications

The PCIe Switches market finds one of the major restraining factors in the complexity and backward compatibility limitations. In the Gen3 to Gen4 market environment, legacy devices will have difficulties migrating to the latest standards because their programmable interconnect is based on older generations (e.g., Gen1 or Gen2). This gap in compatibility hinders the applications of newer PCIe standards in industries. Moreover, although PCIe Switches can transfer data very quickly, the performance may drop significantly when the number of devices connected increases, leading to bottlenecks in mega applications.

Opportunity:

-

Automotive Sector and 5G Drive Growth Opportunities for PCIe Switches in EVs IoT and Automation

The growing automotive sector is a big opportunity in the PCIe Switches market, especially with the transition towards electric vehicles (EVs) as well as increasing vehicle system complexity. Supporting high bandwidth applications such as ADAS, infotainment, and autonomous vehicle technologies which will become mainstream, PCIe Switches enable designers to architect more flexible, modular, and integrated solutions. Expect 5G to add even more opportunities with communication infrastructure, where high-speed, low-latency transfer of data is critical. PCIe Switches are witnessing high adoption on the back of massive investments in industrial automation, IoT, and smart manufacturing, opening new growth horizons for companies.

Challenges:

-

Challenges in PCIe Switches Market Include System Integration Performance Power Balance and Ongoing Architecture Innovation

Another big problem is how PCIe Switches fit within heterogeneous infrastructure systems. As interconnectivity plays a pivotal role between PCIe technologies concerning systems, the complexities of interconnected devices, mostly in applications such as data centers and industrial end-machines, make tools and methodologies critical in designing connected systems exploiting complete PCIe Switch capabilities. Another constant challenge involves balancing performance, power consumption, and system stability. In addition, with the increasing demand for more advanced features that is, higher bandwidth and speed PCIe switch architecture innovation is an ongoing requirement that may need further specialized knowledge and lengthy design cycles. This can potentially slow down the speed of adoption in specific markets.

Segment Analysis

By Type

Gen3 dominated with 56.5% of the market share in 2023 and is expected to continue to grow with the fastest CAGR between 2024 and 2032. The dominance is due to the growing need for high-speed data transfer and low-latency communication in general in various industries such as data centers, automotive, and healthcare. PCIe Gen3 has come a long way from its predecessor and is capable of handling higher data throughput for advanced applications such as cloud computing, artificial intelligence, and high-performance computing. The Gen3 segment is also growing because of the rapid growth of cloud infrastructure, 5G networks, and autonomous vehicles. Gen3 has a substantial growth opportunity ahead, particularly driven by the need for speed and efficiency in data processing as the automotive sector moves to Electric Vehicles (EVs) and autonomous solutions. These technologies will continue to grow well into the future, creating higher-performance interconnects such as PCIe Gen3 which will likely be the fastest-growing segment of the overall market in the years ahead.

By Application

Data Center held the largest market share of 59.6% in 2023 and is anticipated to witness the fastest CAGR from 2024 to 2032. This growth is mainly driven by increasing demands for cloud computing, data storage, and high-performance computing. With more businesses and industries leaning towards data-driven solutions, data centers are emerging as core processing and information storage areas that deal with large volumes of data. The high throughput of data needs high-speed interconnects where PCIe Switches play a significant role in providing maximum performance and scalability. Increasing artificial intelligence (AI) and machine learning along with the implementation of 5G also drives the necessity of next-generation data center equipment. PCIe Gen3 switches PCIe Gen3 switches offer efficient, high-bandwidth data transfer solutions needed by these technologies. Furthermore, the implementation of the edge computing scenario and the increased need for low-latency data processing are other reasons driving the PCIe Switches market in data centers with the fastest growing segment.

By Industry

Chemical & Petrochemical had the largest share of the market 24.7% in 2023, due to the high demand for high-performance computing and data transfer in process control, monitoring, and automation systems within this sector. Real-time monitoring of industrial chemical processes and petrochemical production depends upon effective, robust data communication for analytical measurements. PCIe Switches help support efficient data handling as well as integration of advanced technologies such as IoT and machine learning which play an increasingly important role in the industry to optimize operations and effectively reduce downtime, therefore improving productivity in this sector. As the chemical and petrochemical industry has a considerable market share, PCIe Switches will still be in demand, particularly in energy-oriented regions that have put infrastructure development at the forefront.

The automotive sector will exhibit the highest CAGR from 2024-2032, owing to the rising need for advanced data processing and connectivity solutions used in electric vehicles (EVs) and autonomous driving technologies. Point-to-point PCIe Switches also facilitate traditional PCIe use by managing the dispersed systems characterizing modern vehicles, such as advanced driver assistance systems (ADAS), infotainment systems, and real-time sensor data processing. The proliferation of electric and autonomous vehicles will result in an increasing demand for high-speed low-latency data communication which will drive the need for PCIe Switches in the automotive sector. The digitalization of the automotive industry, which continues unabated, is another catalyst for this growth opportunity.

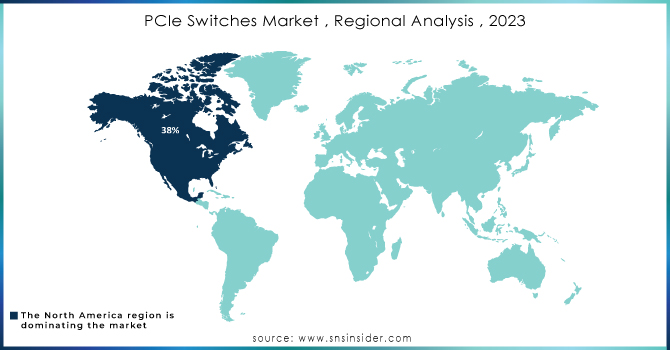

Regional Analysis

The market was led by North America, with a 35.1% share, in 2023, as a result of the growing requirement for the development of data centers, high-performance computing systems, and automotive applications. Countries with larger data centers, like those owned by Google, Amazon, and Microsoft, which want high-speed, low-latency interconnects such as PCIe Switches to support their operations, are in the U.S. Tesla and General Motors are bringing electric and autonomous vehicles to market, and both will present significant challenges that the industry will rely on PCIe Switches to meet — massive volumes of sensor data and high data rates that need to be processed almost in real-time. Continuous technological breakthroughs and infrastructure development in North America remain a driving factor in keeping this market at the top globally.

Asia Pacific is anticipated to grow at the fastest CAGR throughout the anticipated time frame 2024 to 2032, owing to an upsurge in the penetration of 5G, AI, and IoT technology coupled with the growing automotive and manufacturing industry in the region. China and Japan are two of the largest automotive hubs, but companies such as BYD and Toyota, which both have a focus on electric vehicle development, need advanced data communication. Also, there are a considerable number of semiconductor manufacturers in the Asia Pacific, such as TSMC, for the production of advanced chips that power the PCIe Switches. Technological Developments & Investments in Infrastructure in the Asia Pacific Region to Boost Growth of PCIe Switches Market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key players

Some of the major players in the PCIe Switches Market are:

-

Broadcom (Broadcom PEX88000, Broadcom PEX9700 Series)

-

Intel (Intel Ethernet 800 Series, Intel FPGA PCIe Switch)

-

Microchip Technology (Microchip PCIe Switch, Microchip 8-Port PCIe Switch)

-

NXP Semiconductors (NXP PCIe Switch, NXP Switch Matrix)

-

Qualcomm (Qualcomm QCA6390, Qualcomm 6600 PCIe Switch)

-

Mellanox Technologies (now part of NVIDIA) (Mellanox PCIe Switch, ConnectX-6)

-

IDT (Integrated Device Technology, now part of Renesas) (IDT PCIe Switch, IDT 9DBL100)

-

Xilinx (now part of AMD) (Xilinx Versal, Xilinx Alveo PCIe Switch)

-

Texas Instruments (Texas Instruments TSW1400, PCIe-based switch solutions)

-

Pericom Semiconductor (now part of Diodes Incorporated) (Pericom PCIe Switch, Pericom PI7C9X)

-

Analog Devices (Analog Devices ADM1166, Analog Devices ADP1048)

-

Keysight Technologies (Keysight PCIe Test Solutions, Keysight PathWave)

-

Inphi Corporation (now part of Marvell Technology) (Inphi PCIe Switch, Inphi 400G PCIe)

-

ASMedia Technology (ASMedia ASM1061, ASMedia ASM1480)

-

Vitesse Semiconductor (now part of Microsemi) (Vitesse PCIe Switch, Vitesse 10G/25G Switch)

Recent Trends

-

In March 2024, Broadcom launched the industry's first 5nm PCIe Gen5/Gen6 retimers, enhancing AI workload scalability with extended reach and lower power consumption.

-

In January 2025, Microchip Technology introduced the Switchtec PCIe Gen 4.0 16-lane switches, enhancing data transfer for automotive and embedded computing. The PCI100x family offers scalable, high-performance connectivity for AI, data centers, and advanced computing applications.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.78 Billion |

| Market Size by 2032 | USD 4.80 Billion |

| CAGR | CAGR of 11.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Gen1, Gen2, Gen3) • By Application (Data Center, Communication Industry, Industrial Application, Others) • By Industry (Chemical & Petrochemical, Oil & Gas, Energy & Power, Automotive, Food & Beverages, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Broadcom, Intel, Microchip Technology, NXP Semiconductors, Qualcomm, Mellanox Technologies (now part of NVIDIA), IDT (now part of Renesas), Xilinx (now part of AMD), Texas Instruments, Pericom Semiconductor (now part of Diodes Incorporated), Analog Devices, Keysight Technologies, Inphi Corporation (now part of Marvell Technology), ASMedia Technology, Vitesse Semiconductor (now part of Microsemi) |