Peptide Microarray Market Report Scope & Overview:

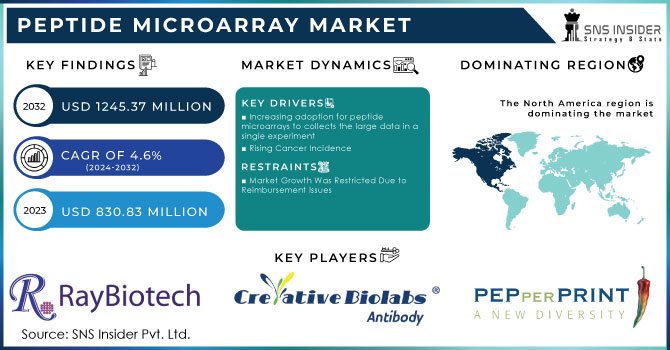

The Peptide Microarray Market size was estimated at USD 830.83 million in 2023 and is expected to reach USD 1245.37 million by 2032 with a growing CAGR of 4.6% during the forecast period of 2024-2032.

To Get More Information on Peptide Microarray Market - Request Sample Report

Peptide microarrays are a reliable tool for tracking binding activity, histone-modifying enzymes, and protein linkage function on a wide scale in proteomics and clinical assays. The increased incidence of cancer and technological advancements are the key elements driving the industry's global expansion. Because of the development in chronic diseases, there has been a surge in the demand for molecular diagnostic tools in recent years. Furthermore, peptide microarray diagnostic techniques are inexpensive, which encourages industrial growth.

MARKET DYNAMICS

DRIVERS

-

Increasing adoption for peptide microarrays to collects the large data in a single experiment

Rising usage of peptide microarrays to collect massive amounts of data in a single experiment is one of the key drivers of the peptide microarrays market. Furthermore, peptide microarrays are cost-effective, which is an advantage for low and middle-income countries. Peptide microarrays can be used to profile a patient's immune response to altering humoral during illness progression.

-

Rising Cancer Incidence

The key forces driving the global market under research are the rising prevalence of cancer and technological advancement. Furthermore, the rising prevalence of chronic diseases will drive the peptide microarray market.

RESTRAIN

-

Market Growth Was Restricted Due to Reimbursement Issues

However, payment issues are expected to stymie business growth. Understanding COVID-19's role in the SARS-CoV-2 infection pathway is critical for developing effective therapies. Proteomics is well-equipped with the methodologies required to handle this problem.

OPPORTUNITY

-

Less in economy

The peptide microarray is less prevalent in the economy, and there is a growing awareness of personalized medicine, which may serve as a driving force in the expansion of the worldwide peptide microarray market.

CHALLENGES

-

The lack of healthcare coverage, as well as the technological complexity involved with peptide microarray technology

IMPACT OF RUSSIA-UKRAINE WAR

Between Russia and Ukraine, global pharma and medtech sales are less than 3%, thus the impact on enterprises globally is not particularly severe. The difficulties stem from being able to fly items above airspace, for example. There is the higher expense of doing so, as well as the macroeconomic inflation caused by the war. Furthermore, some raw resources from Russia, ranging from natural gas to precious metals, are used in the production process, particularly on the device side. We must consider alternatives to those materials as well as the economic implications of doing so. Aluminum, titanium, nickel, iron, and gas are all important components in surgical and orthopedic devices and implants. If the supply base of those commodities is substantially disrupted, which it will be, that creates a difficulty in an environment already constricted by the epidemic.

IMPACT OF ONGOING RECESSION

The ongoing recession has reduced the available hospitals’ funds, including reimbursement rates, donations, and income. Furthermore, hospitals' patient care losses grew as a result of less ambulatory care and elective procedures. Furthermore, income from non-patient care activities fell following the economic downturn. All of these variables contributed to an increase in out-of-pocket and informal payments. Hospital closures, admitting fewer patients with acute diseases, limiting drug prescription, and forcing patients to source consumables and drugs from outside the hospital have all resulted in an indirect rise in patients' financial burden.

KEY MARKET SEGMENTATION

By Type

-

Instruments

-

Reagents

-

Services

The Services segment dominated during the forecast period due to a number of specialized companies provide microarray service options. Outsourcing this application may reduce time and effort while also providing access to specialist technical skills and facilities for diversifying microarray-based research. Researchers can benefit from specialized screening of a wide number of diverse targets and indicators using these services.

By Application

-

Disease Diagnostics

-

Protein Functional Analysis

-

Antibody Characterization

-

Drug discovery

In 2022, the Disease Diagnostics segment is expected to dominate the market growth of 54.8% during the forecast period owing to the increasing complexity of chronic diseases is expected to increase the demand for early disease diagnosis in hospitals, resulting in a greater usage of diagnostic capabilities, including peptide microarrays. According to the American Cancer Society, the expected prevalence of new cancer cases in 2022 was 1.9 million, with 609,360 cancer-related deaths in the United States. The most common cancers in the United States were breast, lung, prostate, and colon cancer.

By End User

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Clinics

-

Diagnostic Centers

-

Others

In 2022, the pharmaceutical & biotechnology companies segment is expected to dominate the market growth of 55.9% during the forecast period due to many big corporations are investing in research and development to produce products and services for the early detection and management of chronic diseases. As a result, enterprises are adopting enhanced microarray technologies, boosting the global microarray market.

REGIONAL ANALYSIS

North America held a significant market share of 47.9% in 2022. The region's substantial contribution can be attributed mostly to enhanced healthcare facilities and increasing R&D spending. There is also a greater understanding among healthcare professionals and the general public regarding the early detection and treatment of chronic diseases, which improves diagnostic accuracy. The majority of the industry's key competitors are headquartered in North America, which drives market expansion even further.

Asia-Pacific is witness to expand fastest CAGR rate during the forecast period because of growing government backing in the healthcare business, increased awareness of antibody-based research, and the expansion of proteomics in the region. The frequency of chronic diseases has increased in Indonesia, and the rising demand for fast and precise diagnosis can be met by microarrays, driving market expansion in the Asia Pacific region even further.

Do You Need any Customization Research on Peptide Microarray Market - Enquire Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major players are PEPperPRINT GmbH, RayBiotech Life, Inc., Creative Biolabs, Aurora Instruments Ltd., Kinexus Bioinformatics Corp., Pfizer Inc., Microarrays Inc., Bio-Rad Laboratories, JPT Peptide Technologies, Merck KGaA, Innopsys, and Others.

RECENT DEVELOPMENTS

In June 2022, Ariceum Therapeutics raised EUR 25 million in Series A funding to advance its principal asset, Satoreotide, for the diagnosis of low- and high-risk neuroendocrine tumors.

In May 2022, Pfizer Inc. and Biohaven Pharmaceutical Holding Company Ltd announced a definitive agreement under which Pfizer will acquire Biohaven, the maker of NURTEC ODT, an innovative dual-acting migraine therapy approved for both acute treatment and episodic migraine prevention in adults.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 830.83 million |

|

Market Size by 2032 |

US$ 1245.37 million |

|

CAGR |

CAGR of 4.6% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

By Type (Instruments, Reagents, Services), By Application (Disease Diagnostics, Protein Functional Analysis, Antibody Characterization, Drug discovery), By End User (Pharmaceutical & Biotechnology Companies, Hospitals & Clinics, Diagnostic Centers, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

|

Company Profiles |

PEPperPRINT GmbH, RayBiotech Life, Inc., Creative Biolabs, Aurora Instruments Ltd., Kinexus Bioinformatics Corp., Pfizer Inc., Microarrays Inc., Bio-Rad Laboratories, JPT Peptide Technologies, Merck KGaA, Innopsys |

|

Key Drivers |

•Increasing adoption for peptide microarrays to collects the large data in a single experiment •Rising Cancer Incidence |

|

Market Challenges |

•The lack of healthcare coverage, as well as the technological complexity involved with peptide microarray technology |